2Q 2024 Residential Private Property Report: Continued Slowdown in the Private Property Market One Year after ABSD implementation

- By Ethan Hariyono

- 3 mins read

- Private Residential (Landed), Private Residential (Non-Landed)

- 1 Jul 2024

Singapore’s private property market continued to slow down one year after the adjustments to Additional Buyer’s Stamp Duty (ABSD) rates were introduced in April 2023.

Furthermore, buyers have turned cautious and have pushed back their homebuying plans amid strong headwinds from slower economic growth. This has been further compounded by higher-for-longer interest rates and the higher cost of replacement homes.

Residential Home Prices

Based on flash estimates, the All-residential property price index reported a modest quarter-on-quarter (q-o-q) increase of 1.1% in 2Q 2024 compared to the 1.4% increase in 1Q 2024.

Prices of non-landed properties increased by 0.9% in 2Q 2024, compared to an increase of 1.0% in the previous quarter. Prices of non-landed properties in the Core Central Region (CCR) decreased by 0.2%, compared to the 3.4% increase in the previous quarter.

Prices of non-landed properties in the Rest of Central Region and Outside Central Region increased by 2.2% and 0.3% respectively, compared to an increase of 0.3% and 0.2% in the previous quarter respectively.

For landed properties, prices increased at a more gradual pace of 1.8% in 2Q 2024, compared to the 2.6% increase in the previous quarter.

Affordability remains a top concern for homebuyers. Despite rising prices, nearly 4 out of 5 non-landed homes sold in 2Q 2024 were priced below $2.5 million, with many buyers compromising by choosing smaller home sizes in order to keep within this price range.

Overall, 42.6% of the caveats were recorded within the sweet spot price range of between $1.5mil and $2.5mil.

Chart 1: Residential Price Indices

*Based on flash estimates

Source: URA as of 1 July 2024, ERA Research and Market Intelligence

Transaction Volume

According to URA flash estimates, sale transaction volume (up to mid-June) totalled 4,215 in 2Q 2024, compared to 4,230 in 1Q 2024.

Based on caveats lodged, islandwide non-landed private property transactions have dropped to 3,591 units, falling by 8.9% q-o-q and 29.7% y-o-y, the lowest observed since 4Q 2022.

On the back of fewer launches in 2Q 2024, new sale transaction volume fell to its lowest since 4Q 2022. New sale transaction volume fell to just 663 transactions, marking a decline of 41.8% q-o-q and 68.0% y-o-y. This is the lowest seen since 4Q 2022. In 2Q 2024, there were only six new projects launched.

Among which, two of the launches were luxury developments, Skywaters Residences and 32 Gilstead, which sold at a median price of $6,100 psf and $3,455 psf respectively.

Demand in the secondary market fell marginally by 3.7% y-o-y to 2,928 units in 2Q 2024.

Chart 2: All non-landed private residential transactions

Source: URA as of 1 July 2024, ERA Research and Market Intelligence

CCR

Non-landed private home transaction volume in the CCR fell by 41.8% q-o-q and 68.0% y-o-y to 663 units in 2Q 2024.

The CCR market, which typically sees the largest proportion of foreign buyers has remained suppressed due to the increase in ABSD rates for foreigners since last April.

The recent price adjustments at Cuscaden Reserve and The Residences at W Singapore Sentosa Cove have sparked much-needed buyer activity in the CCR market, providing value buys for investors.

RCR/OCR

The total transaction volume in Rest of Central Region (RCR) more than halved in 2Q 2024 compared to 2Q 2023 with just 1,142 transactions. The decline was attributed to fewer new homes launched in 2Q 2024 compared to a year ago.

In the Outside Central Region, the number of transactions rose 13.0% y-o-y to 1,823 in 2Q 2024 compared to 1,613 in 2Q 2023.

The RCR and OCR regions continue to be largely supported by homeowners and HDB upgraders who are attracted to locations with upcoming redevelopment, as well as areas that will see improved connectivity in the long term.

However, these buyers tend to be price sensitive and would typically buy within the sweet spot price quantum.

2H 2024 Government Land Sale (GLS) Programme

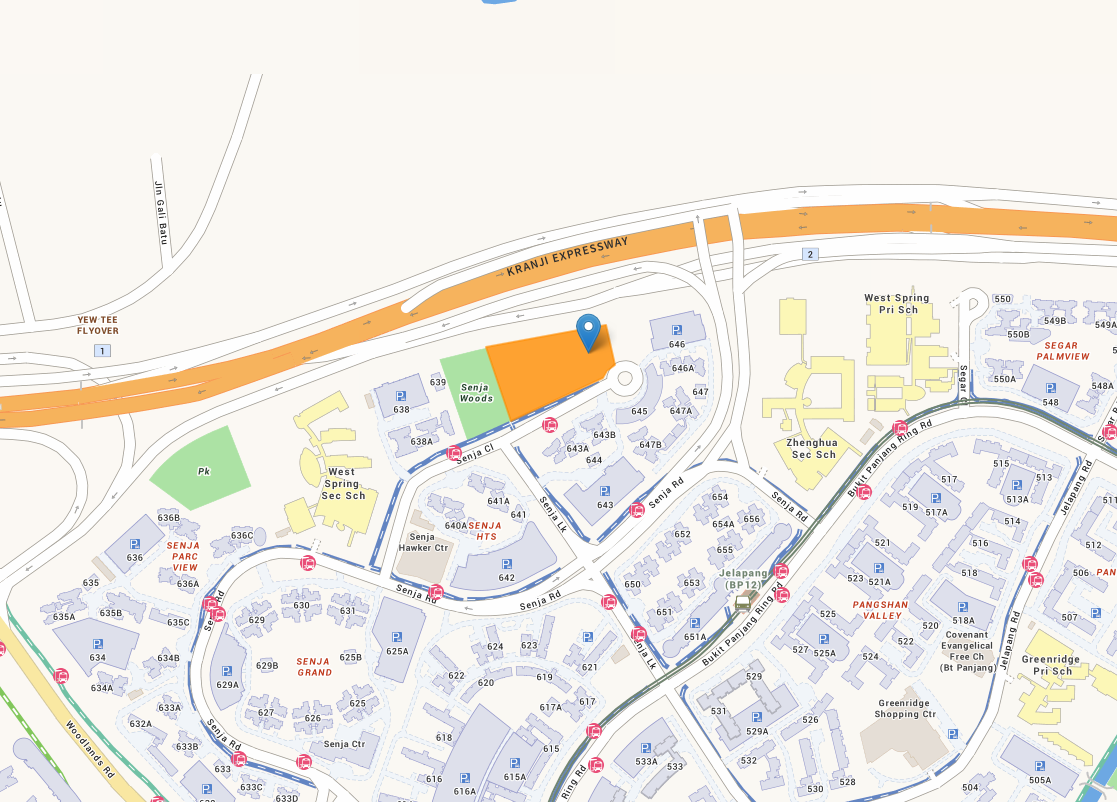

To continue to cater to housing demand and maintain market stability, the URA has ten sites on the Confirmed List and nine sites on the Reserve List in the 2H 2024 GLS program.

On the Confirmed List, there are nine residential sites, inclusive of an executive condominium (EC) plot, and a residential and commercial plot. There will be a total supply of 11,110 private residential units created via the Government Land Sales Programme in 2024 – the highest in a single year since 2013.

Outlook

Based on our observations, homebuying momentum is likely to pick up in 2H 2024 with the upcoming launch of highly anticipated new projects comprising SORA, Kassia, The Chuan Park and, Emerald of Katong.

In 2H 2024, ERA anticipates up the launch of approximately 17 new home projects, which will introduce around 8,400 new homes.

Factoring current market conditions, ERA has revised our new home forecast to between 5,500 to 6,500 units by the end-2024, down from the previous forecast 7,000 to 8,000 units. New home price growth is expected to reach between 4% and 6% y-o-y by end-2024.

In terms of the secondary market, ERA expects the CCR to continue seeing subdued demand, while RCR and OCR demand should hold with support from local buyers.

ERA holds our project the secondary market. The total resale and subsale transaction volume could reach between 26,000 and 27,000 units, with price expected to rise by 4% to 5% y-o-y in 2024.

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.