3Q 2024 Rental Report: Private Property Rents Recover, But Future Growth Uncertain as Completions Rise and Tenants Turn Cautious

- By Stanley Lim

- 4 mins read

- HDB, Private Residential (Landed), Private Residential (Non-Landed), Rental

- 13 Nov 2024

Private home rents rose marginally in 3Q 2024, along with rental transaction volumes. However, it remains to be seen if rental growth will sustain amid more completions and rising vacancies.

Overview

Following three consecutive quarters of decline, private home rents in Singapore reported a marginal recovery in 3Q 2024. This surprising reversal comes on the tail of a seasonal quarterly increase in rental contracts.

Tenants were also more likely to lean towards private home rentals, seeking greater value in properties with in-house amenities. This shift comes as the gap between private home and HDB flat rents narrowed over the past quarters.

Meanwhile, in the HDB market, demand held firm despite an increase in median rents and a slight dip in approved rent applications over the quarter. These shifts can be seen as the result of both increased upgrader activity and a declining number of HDB flats fulfilling their Minimum Occupation Period (MOP) in 2024, resulting in fewer HDB flats being put up for rent.

Employment

As at June 2024, the total foreign workforce (excluding domestic workers and workers in the construction, marine shipyard and process) stood at 807,400, up from the 798,000 in December 2023. That being said, rental demand from foreigners could be tempered by the recent spate of high-profile layoffs in the tech, manufacturing and banking sectors.

Private Residential Rental Market

Rental Index

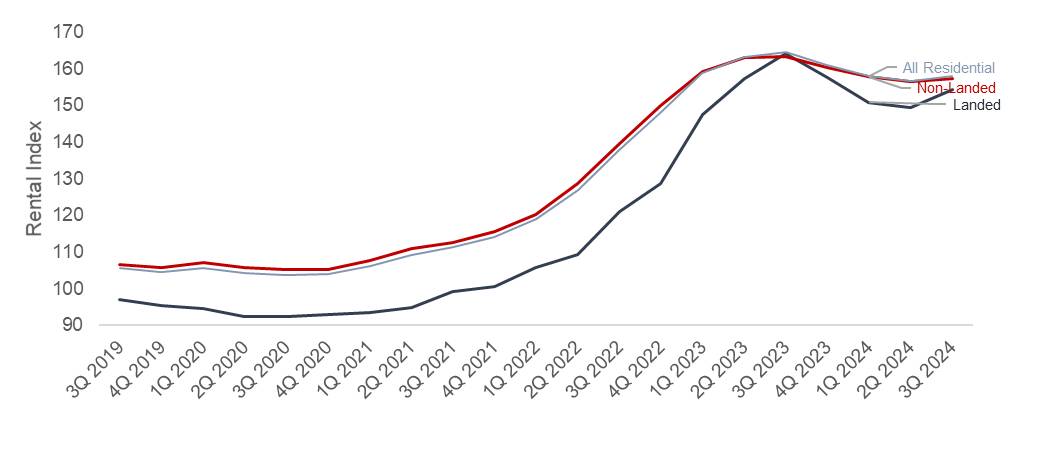

In 3Q 2024, rents for all private residential properties recovered slightly by 0.8% quarter-on-quarter (q-o-q), breaking the streak of three consecutive quarters of decline.

This subtle uptick was consistent across the board, with non-landed and landed private properties alike experiencing marginal rental growth. Overall rents for non-landed properties rose 0.5% q-o-q in 3Q 2024, compared to the 0.8% q-o-q decrease registered the previous quarter. The landed segment registered a similar movement in overall rental growth, rising 3.2% q-o-q and offsetting the 0.9% q-o-q dip in 2Q 2024.

Among the various regions, the Core Central Region (CCR) was the only residential sub-market that experienced further correction as non-landed private property rents shrank 1.6% q-o-q in 3Q 2024. Conversely, the Rest of Central Region (RCR) and Outside Central Region (OCR) respectively saw small quarterly gains of 1.7% and 2.2% for non-landed properties.

Chart 1: Private Residential Rental Indexes

Source: URA, ERA Research and Market Intelligence

Rental Contracts

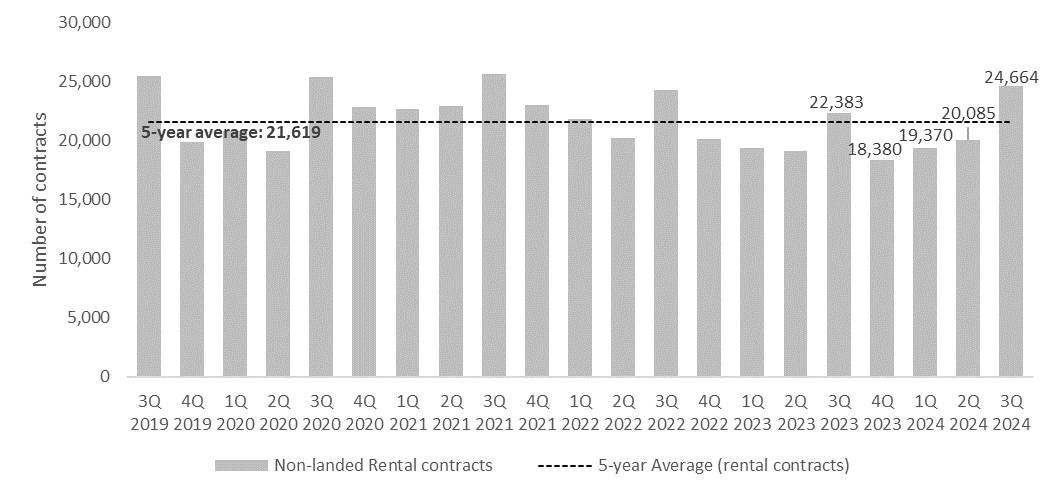

According to URA, a total of 24,664 rental contracts for non-landed private homes was recorded for 3Q 2024, marking a 22.8% q-o-q and 10.2% y-o-y increase.

In 3Q 2024, there were also 1,610 rental contracts for landed private homes. This marked a 45.9% q-o-q increase from the 1,103 contracts recorded in 2Q 2024.

Chart 2: Non-Landed Private Residential Rental Contracts

Source: URA, ERA Research and Market Intelligence

Completion and Vacancy

Across regions, vacancy rates in 3Q 2024 rose to 11.2% in the CCR and 8.1% in the RCR, while the OCR vacancy rate held steady at 4.9%.

The higher vacancy at CCR was driven by the completion of One Holland Village Residences (551 units) and The Avenir (376 units), which added nearly 1,000 completed homes to the CCR. Similarly, the RCR saw the completion of One Pearl Bank (774 units), The Reef at King’s Dock (429 units), Verticus (162 units) which added nearly 1,400 completed homes.

According to URA, 3,253 private homes were completed in 3Q 2024. This brings the total number of private homes completed in the first nine months of 2024 to 5,376 units.

Another 3,727 private homes are expected to be completed in 4Q 2024. This includes 1,222 units in the CCR, 931 units in the RCR, and 1,574 units in the OCR.

In total, 2024 expects to see nearly 9,100 new home completions, just below half of the 19,968 completions in 2023.

HDB Rental Market

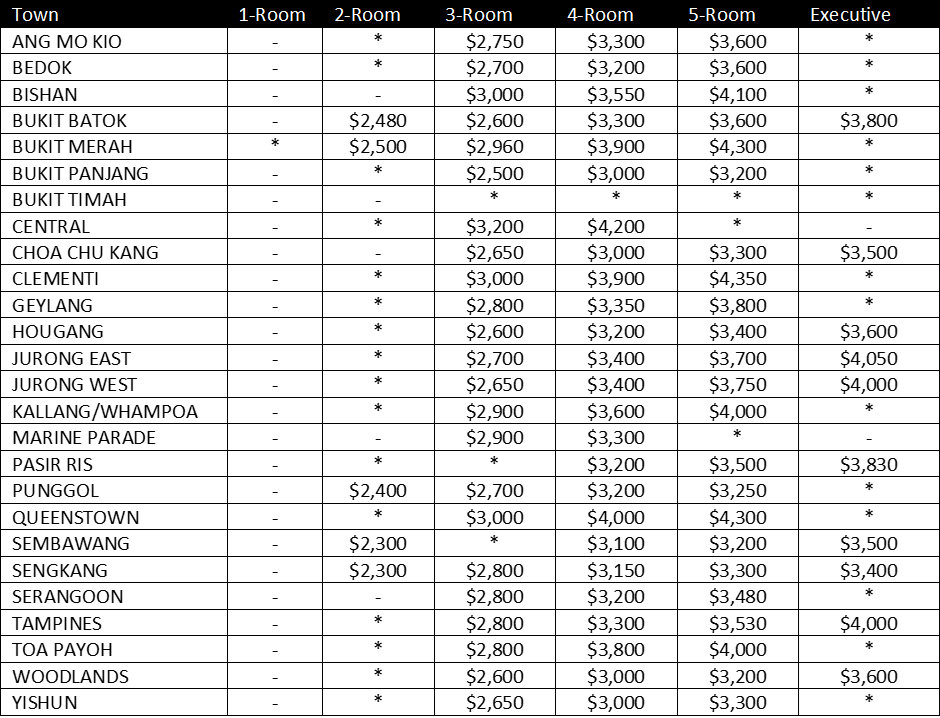

Median HDB rents of all flat types across towns

Median rents for all flat types moved upwards in 3Q 2024, rising between 0.1% and 4.5% q-o-q. Amongst towns, Jurong West reported the fastest rental growth, with rents rising q-o-q across most flat types from 3-room to executive units.

Table 1: HDB Median Rents in 3Q 2024

Source: HDB, ERA Research and Market Intelligence

Rental demand for HDB flats

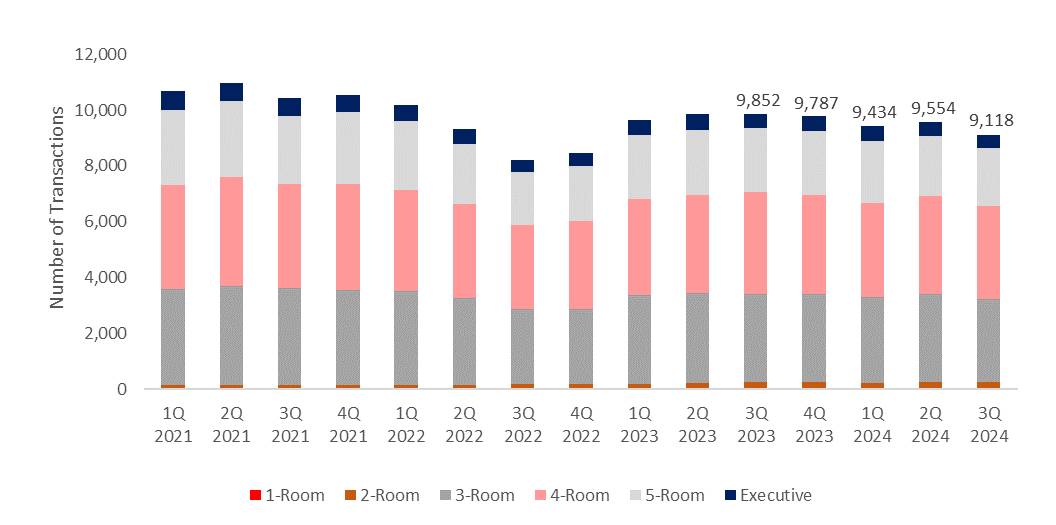

Rental demand for HDB flats remained firm in 3Q 2024, even with a smaller number of approved rental applications compared to previous periods. According to HDB, there were a total of 9,118 approved applications in 3Q 2024, or approximately 4.6% less than the previous quarter, which saw 9,554 rental cases.

This figure also brings the total number of HDB flats rented out to be 59,178 units as of 3Q 2024, which is a shade lower than the previous quarter’s count of 58,596 units.

Chart 3: Number of approved applications to rent out HDB flats by flat type

Source: HDB, ERA Research and Market Intelligence

Conclusion

Although overall rents for private residences rose slightly in 3Q 2024, this is likely to be a short-lived uptick given the current steady supply of completions.

In total, 2024 is projected to see nearly 9,100 new home completions, just under half of the 19,968 completions in 2023. This growing pool of rent-ready homes is likely to weigh on rental prices moving forward.

By region, new completions in the CCR for 4Q 2024 are expected to drive up competition for tenants among landlords, thus placing downwards pressure on rents.

Separately, given the anticipated increase in RCR and OCR completions, with most units intended for owner-occupation, we can foresee rents in these regions experiencing a marginal uptick.

On a whole, demand for private property rentals is expected to stay buoyed in the near future as more HDB tenants’ transition to private housing, driven by a shrinking price gap between the two. Separately, rental demand in the CCR could shift towards the RCR/OCR; this comes as more foreign tenants turn cautious in their housing choices, following the recent spate of high-profile job cuts in the tech, manufacturing, and banking sectors.

In consideration of these factors, ERA has adjusted our forecast, anticipating a potential easing of private home rents by 1–3% y-o-y, with the total number of rental contracts expected to range between 80,000 and 90,000 by the end-2024.

In contrast, rents for HDB flats are expected to rise further, bolstered by the tight supply of HDB flats that have fulfilled the five-year MOP. Present estimates indicate that around 12,000 MOP flats will be available in 2024, with an even smaller number of 7,000-odd units available next year. Given these insights, ERA anticipates a 5-10% uptick in rents y-o-y across all flat types, with HDB rental approvals estimated to reach between 36,000 to 38,000 contracts by the end-2024.

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.