4Q 2024 URA Private Residential Flash Estimates – Faster Pace of Sales with Year-End Surge and Positive Sentiment

- ERA Singapore

- 4 min read

- PressRelease

- 2 Jan 2025

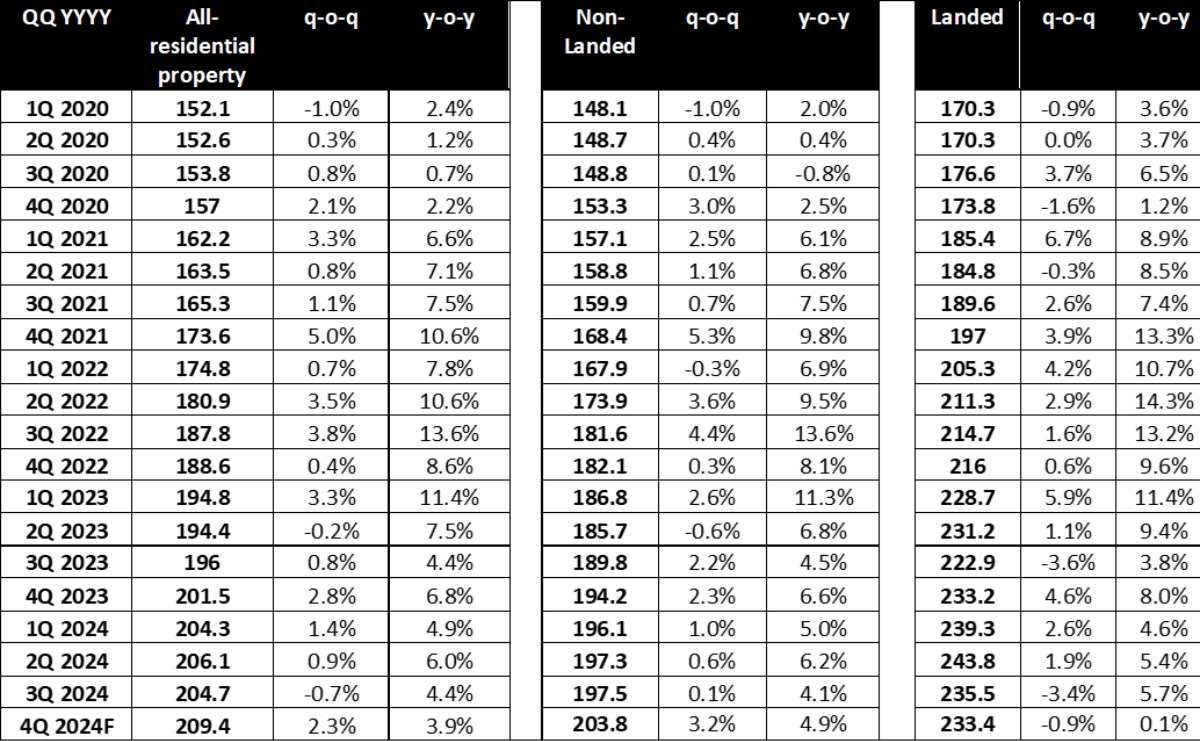

SINGAPORE, 02 January 2025 – According to URA flash estimates, the all-residential property price index registered a faster pace of growth of 2.3% quarter-on-quarter (q-o-q) in 4Q 2024, reversing the 0.7% q-o-q decline in 3Q 2024. For the whole of 2024, the all-residential property price index rose at a slower pace of 3.9% y-o-y, compared to 6.8% y-o-y growth in 2023 and 8.6% in 2022.

The faster pace of growth was largely led by the non-landed property segment, which grew by 3.2% q-o-q in 4Q 2024. Prices of non-landed properties in RCR and OCR grew by 3.4% q-o-q, supported by projects like Emerald of Katong, Chuan Park and Nava Grove which saw overwhelming demand. Meanwhile, prices of non-landed properties in CCR grew 2.4% q-o-q in 4Q 2024, reversing the 1.1% decline in 3Q 2024. Landed property prices fell at a slower pace of 0.9% q-o-q in 4Q 2024, compared to 3.4% q-o-q in 3Q 2024.

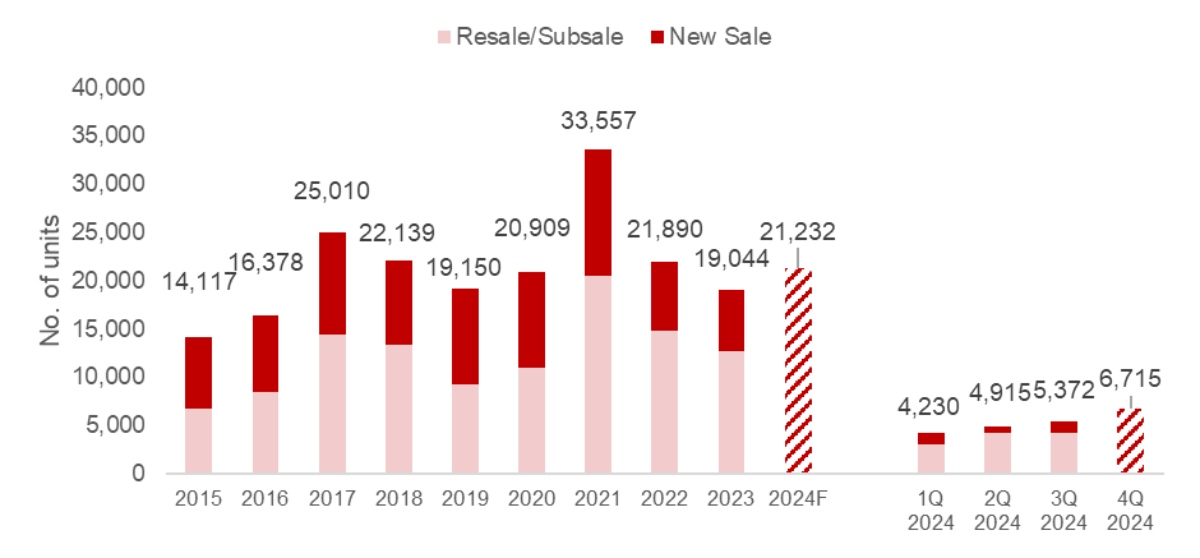

According to URA, private home sales transaction volume reached 6,715 in 4Q 2024 (as of mid-December), up from 5,372 in 3Q2024. In total, transactions reached 21,232 across 2024 (as of mid-December), an 11.5% increase y-o-y from 19,044 total transactions in 2023. However, transaction volume in 2024 is still 14% lower than the annual average of 24,830 across 2021-2023.

Based on caveats lodged, some 3,398 new homes were sold in 4Q 2024. This brings the total for 2024 to 6,447 new homes, closely mirroring the 6,421 new homes sold in 2023.

In the secondary market, some 3,313 resale and sub-sale units were transacted in 4Q 2024 compared to 4,212 in 3Q 2024. For the whole of 2024, 14,781 resale and sub-sale units were transacted compared to 12,623 units in 2023.

Comments from ERA

“The price increase in 4Q 2024 was primarily driven by the strong new home demand, some of which had achieved benchmark pricing.” said Marcus Chu, CEO, ERA Singapore.

The Singapore residential market showed some early signs of recovery as the overall transactions increased after two consecutive years of decline. Demand for private homes remained healthy underpinned by sanguine economic sentiment while the moderation of interest rates has instilled the confidence of local homebuyers.

The secondary market remained buoyed by a steady flow of new completions since 2023. Since not all homeowners choose to sell their properties upon completion, this has formed a steady pipeline of resale and sub-sale listings in 2024.

These new completions played a key role in driving resale price growth and transactions in 2024, since buyers who have an immediate need for homes appreciate ready-to-move-in options, which also come at a more attractive price point.

Separately, the new home housing segment regained its footing in the 4Q 2024, after a lacklustre nine months performance. Buyers’ confidence was reinvigorated following the successive interest rate cuts since September and the more positive economic sentiment. As a result, we have seen impressive new home sales for projects such as Emerald of Katong, Chuan Park and Norwood Grand, in 4Q 2024. The optimism may extend to January with the launch of The Orie, the first launch in Toa Payoh since 2016.

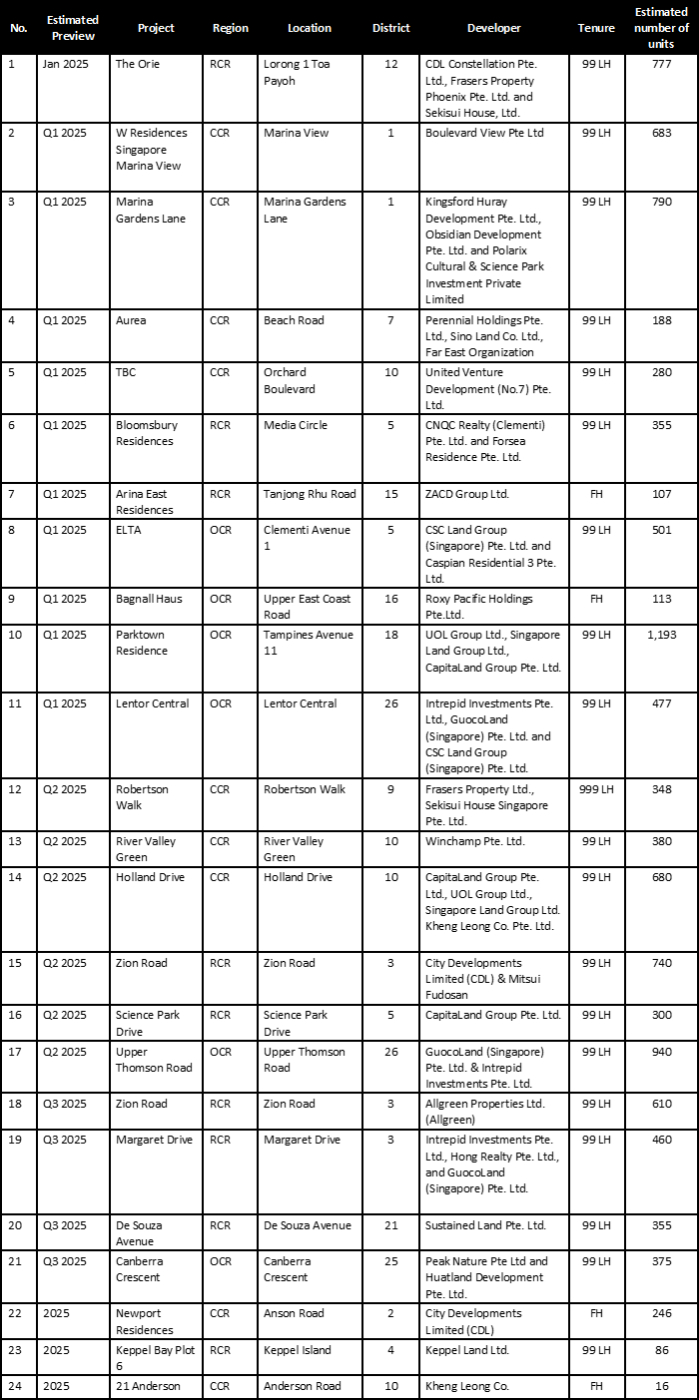

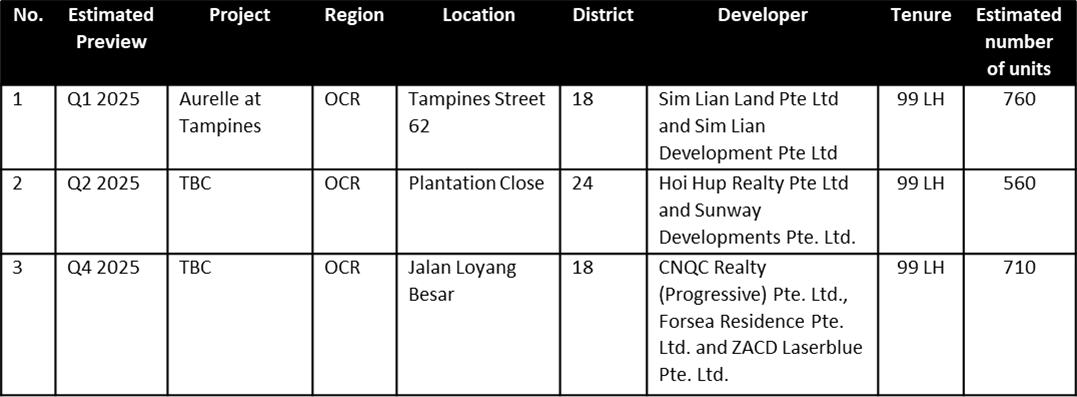

Based on estimations, 2025 could see up to 24 new private home launches and three EC launches. In total, new private home launches will yield 11,000 new homes, while the EC launches will see some 2,030 units added to the market.

Assuming stable macroeconomic conditions and the absence of unforeseen negative factors, new home prices are expected to continue their upward trajectory, potentially achieving 3-5% y-o-y growth in 2025. The ample new home launches will support new home transaction volume which is projected to reach between 7,000 to 8,000 units in 2025, dependent on a favourable economic outlook.

ERA estimates that sub-sale transactions will range between 1,100 to 1,300 units, with median prices possibly growing by 7% to 9%. Resale transactions are also expected to reach between 14,000 to 15,000 units, accompanied by a median price growth of 6% to 8% by the close of 2025.

Table 1: URA Private Residential Property Price Index

Source: HDB, ERA Research and Market Intelligence

Chart 3: New Sale and Resale/Sub-sale Transactions

*4Q2024 figures based on flash estimates Source: URA as of 01 Jan 2025, ERA Research and Market Intelligence

Table 2: Upcoming launches in 2025

Source: ERA Project Marketing

Executive Condominium

Source: ERA Project Marketing

For media enquiries, please contact:

Yue Kai Xin, Press Relations, ERA Singapore

Email: [email protected]

I confirm that I have read theprivacy policy and allow my information to be shared with this agent who may contact me later.