Private residential hotspots for 2017

- By administrator

- 4 mins read

- Press Room

- 11 Jan 2017

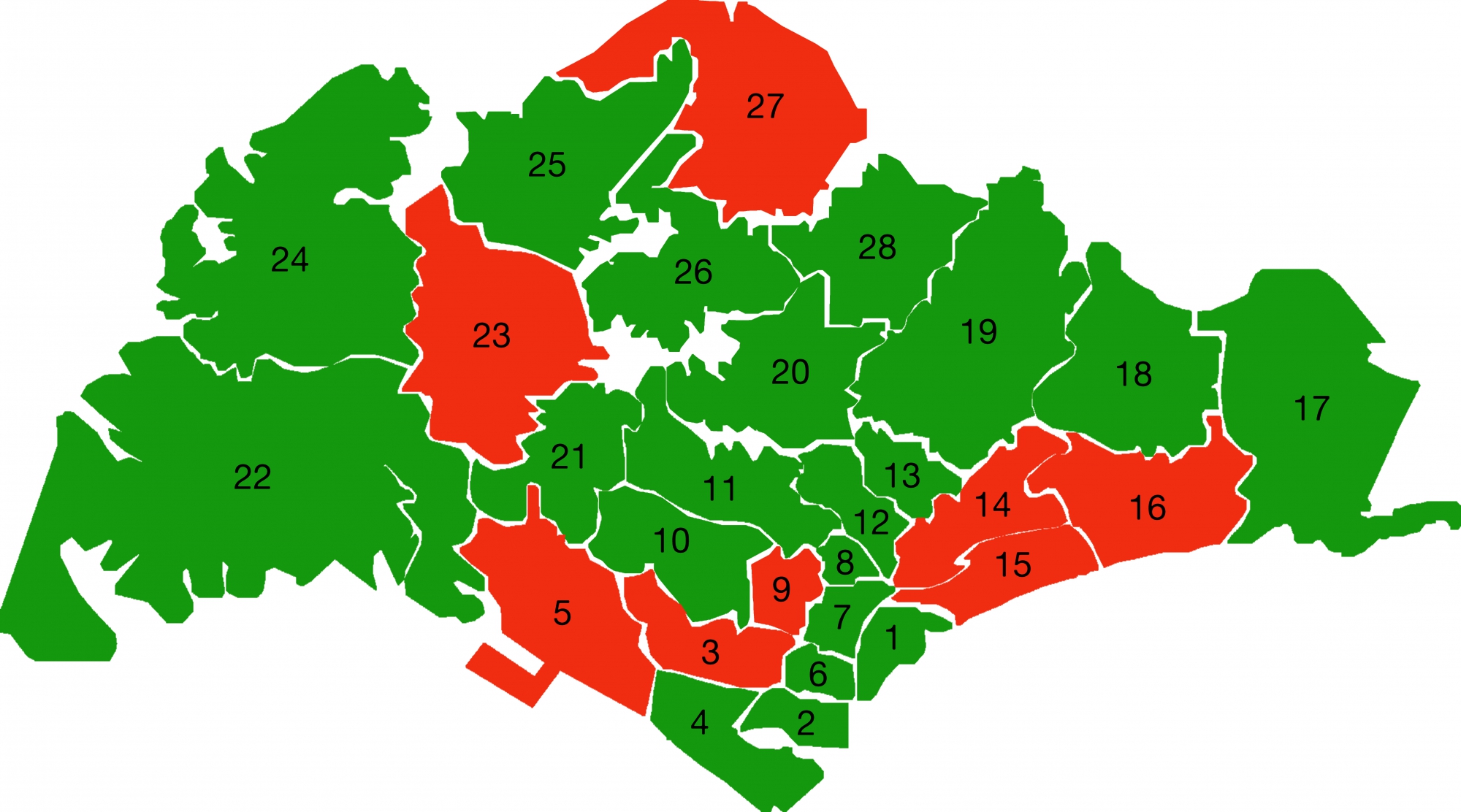

Singapore, 11 Jan 2017 – Looking back, 2016 did not turn out to be a bad year for the private residential property market, as some had feared. Transaction volume improved, with developers already selling more units in the first 11 months of the year than the entire 2015. In the resale market, buyers have been active as well, with volume transacted in the first 3 quarters being 27% higher than the corresponding period in 2015.While buyers have been picking up properties all over the island, some locations saw more activity than others. We observe that areas with new projects launches tend to be hotspots. In particular, the three most popular locations with buyers were Districts 19, 9 and 18 in descending order. All of them are home to at least one new launch in 2016, Forest Woods and Stars of Kovan in District 19, Cairnhill Nine in District 9 and The Alps Residences in District 18.

New launches have typically been the focal point of buying activity. Often, newly launched projects will turn out to be the best sellers in the month which they are launched. This is largely due to the intense marketing activities which start a few weeks prior to their launch. This results in increased buyer attention in the locality of the new project. Surrounding projects may get a boost from the heightened buyer interest in the area as well. For example, when The Alps Residences was launched in October this year, sales at neighbouring The Santorini was doubled in the same month.

As such, we expect transaction activity in the coming year to be driven by new launches. Hotspots will likely be the areas where new condominium projects are due to be launched.

Attention will probably on the eastern region of Singapore where three new projects are expected to be launched in the first half of 2017, Lendlease’s Park Place Residences at Paya Lebar, CEL Development’s Grandeur Park Residences at Tanah Merah and Frasers Centrepoint’s Seaside Residences at Siglap. Other key development plans in the East will likely add to the hype. For instance, Changi Airport is on track for its expansion plans, with Terminal 4 expected to be operational in 2017, while Terminal 5 is in the works, and is expected to be larger than Terminals 1, 2 and 3 combined. The additional employment generated is expected to fuel demand for homes in the eastern region of Singapore.

In the West, several condominium projects are also gearing up for launch in 2017. UOL’s The Clement Canopy at Clementi will probably be launched in the first half of 2017 while Qingjian Realty’s mixed development at Bukit Batok is expected to be launched in the latter half of the year. Together with the launch of Parc Riviera in late 2016, these projects will collectively generate interest and awareness for the area, which has not seen any new launch in a while.

In addition, with the recent signing of the bilateral agreement between Singapore and Malaysia on the implementation of the High-Speed Rail project, the western side of Singapore is expected to gain much appeal. Also, the development of the Jurong Lake District has served as a major attraction to buyers as it is envisioned to be the main commercial centre of the west.

Besides these new property hotspots, some areas have been continually seeing strong demand from buyers. These places are usually located near major commercial clusters, as the demand for employment helps drive demand for housing. To reduce travelling time, most people would choose to live near their workplace.

Districts 9 and 10 have been very popular among the well-heeled as they are the most prestigious residential areas in Singapore, and only a short drive away from the Central Business District. The multiple luxury developments also mean that wealthy buyers will be able to find one which suits their needs. Ardmore Three, Cairnhill Nine, OUE Twin Peaks and Sophia Hills were some of the projects which were popular with buyers in 2016.

The city fringe, which offers a reasonable trade-off between the distance away from the Central Business District and price, has been seeing a steady stream of buyers. Sale launches in city fringe areas have performed well, with Sturdee Residences, GEM Residences, The Poiz Residences and Thomson Impressions being favourably received by buyers.

Residential developments near secondary employment clusters have also been on buyers’ radar. For example, buyers have been active near the North Coast Innovation Corridor, which stretches from Woodlands to Seletar and Punggol. Major commercial centres along the Corridor include Seletar Aerospace Park and Woodlands Regional Centre. Seletar Aerospace Park is home to more than 60 aerospace companies, and more than 10,000 new jobs are expected to be created. Woodlands is envisioned to be developed as the next regional centre after the Jurong Lake District and will be home to an estimated 100,000 new jobs. Savvy buyers have been picking up residential units in housing estates surrounding these areas. Examples include The Wisteria and Symphony Suites in Yishun, Kingsford Waterbay in Hougang, and Riverbank @ Fernvale at Sengkang.

While we have attempted to list some of the property hotspots in 2017, the places are by no means exhaustive. If buyers prefer to take a longer term perspective, they could also consider the up and coming new towns Bidadari and Tengah. Bidadari is being actively developed into a residential town, with the government scheduled to release two plots of land intended for private housing and a retail mall along with thousands of units of public housing. Meanwhile, Tengah will be the latest residential town to be planned after Punggol. Envisioned as a “Forest Town”, it will incorporate lots of greenery and new technology, including smart homes and smart transportation such as self-driving cars.

With the good variety of new projects coming on stream this year; together with the proven popularity of selected current projects, 2017 certainly looks set to be another exciting year for home buyers!

Commercial properties: An alternative investment to consider

For investors who wish to invest in another asset class, commercial properties are a viable alternative to residential properties.

However, the purchase of commercial properties is subject to a slightly different set of regulations from residential properties and investors, before making any purchases, should carefully consider their investment objectives and weigh each available option.

Investors looking to purchase a commercial property should be aware of the following:

• Buying of commercial properties is subject to Goods and Service Tax (GST)

Individuals buying a commercial property will be required to pay the 7% GST on the purchase price. However, an investor who owns a company and purchases a commercial property through it may apply to claim back the GST amount, subject to the guidelines set by the Inland Revenue Authority of Singapore (IRAS).

• The purchase of commercial properties does not attract the Additional Buyer’s Stamp Duty (ABSD)

Any individual who purchases a second home onwards is required to pay at least a 7% ABSD on the purchase price. However, there is no such regulation for commercial properties.

• Investors can sell their commercial properties at any time

Any home owner selling their residential property within four years will be required to pay the Seller’s Stamp Duty (SSD). Depending on the holding period, the SSD payable can range from 4% to 16%. Buyers of commercial properties are not subject to this and can choose to sell off their properties and exit the market at any time.

Real estate remains a popular investment choice, even in this time where economic conditions are lacklustre. Historically, in land scarce Singapore, many property investors have seen capital gains over time. However, property investment is not risk free, as the property market is dynamic and is affected by many factors that have impact on supply, demand and therefore price. Investors have to balance their risk appetite with their objectives when selecting the appropriate property class.

By Eugene Lim, Key Executive Officer and Seah Yao Hui, Assistant Manager, Research