3Q 2024 Industrial Property Market: All Factory Prices Rose Despite Fewer Transactions

- By Egan Mah Jixiang

- 3 mins read

- Industrial

- 27 Nov 2024

Economic Overview

Based on advance estimates, the Ministry of Trade and Industry (MTI) announced that the Singapore economy grew by 4.1% year-on-year (y-o-y) in 3Q 2024. The growth is led by the manufacturing sector which expanded 7.5% y-o-y. All manufacturing sectors recorded expansions apart from the biomedical manufacturing cluster. On a quarter-on-quarter (q-o-q) seasonally-adjusted basis, the sector grew by 9.9 per cent, a sharp turnaround from the 1.2 per cent contraction in the second quarter.

The Economic Development Board (EDB) also expects that business sentiments in the manufacturing sector remain positive, despite continuing geopolitical and macroeconomic headwinds. Similarly, all clusters barring biomedical manufacturing, anticipates improved business prospects till March 2025. The transport engineering (including aerospace and marine & offshore engineering segments) expects the most favourable business environment. This is followed by the general manufacturing cluster.

The Singapore Manufacturing PMI decreased slightly month-on-month (m-o-m) by 0.4% to 50.80 points from 51.00 points in October 2024. However, despite this small blip, manufacturing is still in an expansion mode.

However, there may be potential headwinds in the longer run. US under President-elect Donald Trump may impose higher import tariffs that will disrupt China, and the larger global arena. This may have a knock-on impact on the manufacturing supply chains in Asia and Singapore.

Price and Sales Transaction Volume

On 18 September, the U.S. Federal Reserve (Fed) announced that it was finally cutting interest rates after keeping them elevated over the past four years. The cut of 50 basis points lowers the Fed’s target rate range to 4.75% to 5.00%, down from the previous range of 5.25% to 5.50%. The rate was cut by a further 25 basis points to between 4.50% – 4.75% on 7 November 2024.

This cut gave buyers the confidence to enter the market. For investors, the higher rental yield of industrial properties are also more attractive than those of residential leasehold properties. Moreover, industrial properties also comes without the punitive Additional Buyers’ Stamp Duty (ABSD). These factors may have provided both local and foreign investors the impetus to enter the market now.

Moreover, improved market sentiments and business environment brought about by the Fed rate cuts have led to higher manufacturing output. Industrialists, being more optimistic with the market conditions, are ramping up production when demand for goods and services are driven up. The manufacturing sector has picked up steam and businesses are moving forward ahead in business expansion. The lower financing cost could translate to lower operating costs.

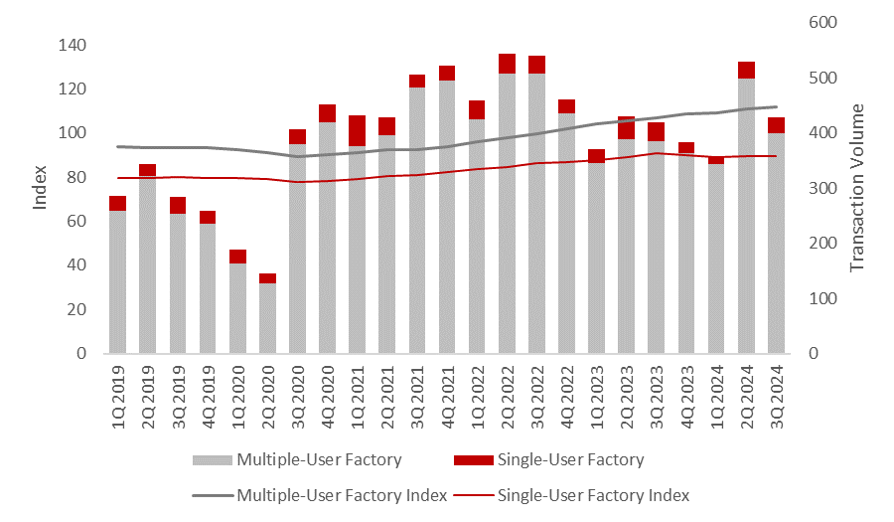

Chart 1: Price Index and Transaction Volume

Source: URA, ERA Research and Market Intelligence

Prices of multiple-user factories and single-user factories rose 0.7% and 0.2% quarter-on-quarter despite fewer transactions. This is despite transactions falling for both sub-markets. While multi-user factory space saw 19.9% q-o-q fewer transactions, it was still 3.6% higher y-o-y. There was still strong demand for these units by both investors and end-users.

The most notable transaction in 3Q 2024 was in August. Lendlease and US private equity firm Warburg Pincus acquired $1.6 billion portfolio of assets from a Real Estate Investment Trust (REIT) portfolio owned by Blackstone and Soilbuild.

Separately, ESR-Logos REIT also purchased 51% stake in a manufacturing facility cum logistics warehouse at 20 Tuas South Avenue 14. This was part of the $772.6 million acquisition that also includes a 100% interest in a modern logistics facility in Nagoya, Japan.

More recently, Mercedes-Benz Singapore is selling the balance lease term of 16 years and 5 months of its property at 301 Jalan Ahmad Ibrahim back to JTC Corporation for $46.2 million.

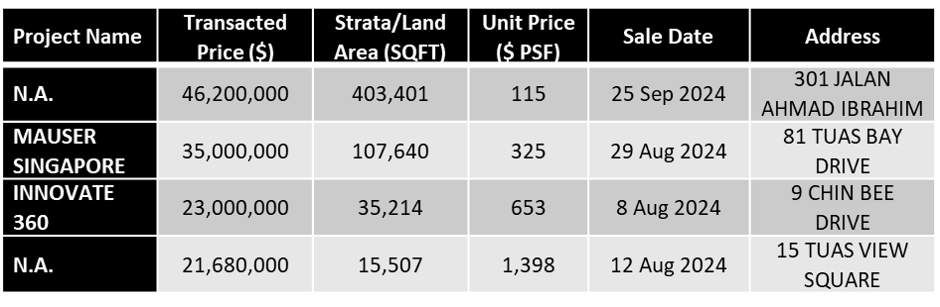

Table 1: Top five sales transactions in 3Q 2024, based on caveats lodged

Source: URA, ERA Research and Market Intelligence

As Food and Beverage (F&B) businesses attempt to keep costs low with higher commercial rents, some have opted to centralise their kitchen operations at food factories. In particular, those with multiple outlets would use this cost-effective strategy. Hence, there are more interest among end-users for such food factories. In 3Q 2024, Food Xchange @ Admiralty moved three units, while Food Vision @ Mandai moved six units and Food Ascent in Tuas South moved another 16 units respectively.

Leasing and Leasing Volume

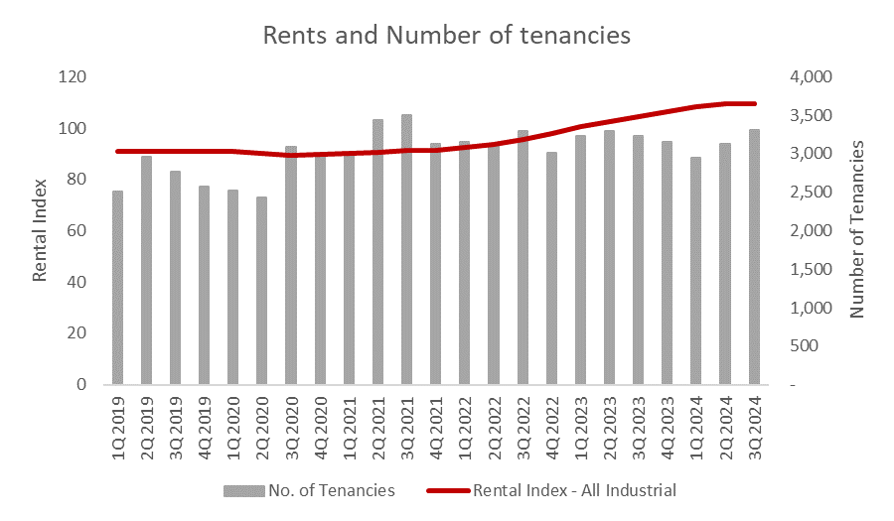

On the back of higher manufacturing output, the JTC All Industrial rental index continued its upward trend, rising for the sixteenth consecutive quarter in 3Q 2024. It climbed a further 0.3% q-o-q to 109.6, marking the highest point since 2Q 1996. However, growth has been slowing, falling from the 1.0% growth in 2Q 2024. This growth was led by Multiple-User Factory, where rents grew by 0.6% q-o-q.

While rental index has climbed marginally q-o-q, leasing volume have continued to rise for the second consecutive quarter as well. There were 3,304 tenancies signed in 3Q 2024, a 5.9% increase from the previous quarter. This follows the 5.8% growth in 2Q 2024.

Chart 2: Rental Index and Number of tenancies for industrial properties

Source: JTC JSpace, ERA Research and Market Intelligence

In conclusion

With better market sentiments and another 25-basis points of interest rate cuts forecasted, we will likely continue to see more growth in rents and prices. However, the growth would be more muted in light of firms still being cautious about the global geo-political outlook and higher supply of industrial stock coming in. Moreover, Fed rate cuts forecasts may not be as bullish as initially predicted. We are likely to see more transactions in the coming quarters. Investors would look to capitalise on lower financing cost add to their portfolio, while businesses may be bullish to expand their operations. Prices and rents are still looking to increase steadily, but at a sustainable rate of between 0.5% and 1.0% in the coming quarters.

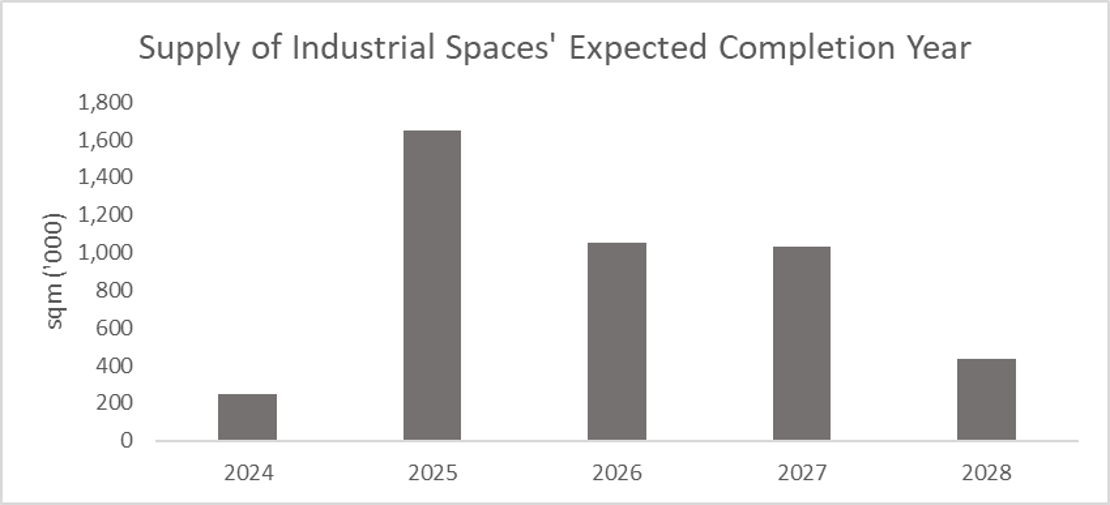

By end-2024, we do expect seven new industrial developments to attain their Temporary Occupation Permit (TOP). This will inject another 193,000 sqm of industrial spaces into the market. 2025 will see a further 1.2 million sqm of industrial space attaining TOP. Some notable developments are Bulim Square 1 and 2, a business park in Punggol Way and JTC Space @ AMK. All three developments are developed by JTC Corporation.

Industrial buildings developed by JTC Corporation are not sold. Moreover, they have started leasing out the space even before completion. Hence, the surge in supply may not have as great an impact on prices and rents even upon completion.

Chart 3: Supply of Industrial Spaces’ Expected Completion Year

Source: JTC JSpace, ERA Research and Market Intelligence

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.