One-off Property Tax Rebate for Owner-occupied Residential Properties in 2025

- By administrator

- 2 mins read

- 29 Nov 2024

SINGAPORE, 29 November 2024 – The Ministry of Finance and Inland Revenue Authority of Singapore have jointly issued a press release announcing a one-off property tax rebate for all owner-occupied residential properties in 2025.

The one-off property tax rebate of 20% for Owner-Occupied HDB flats, and 15%, capped at $1,000, for owner-occupied private residential properties in 2025. The rebate will automatically offset any property tax payable. The adjustment of all Annual Value Bands of the Owner-Occupied Residential Property Tax Rates would be adjusted from 1 January 2025 to account for significant increases in residential Annual Value (AV) over the last two years.

While this is a one-off property tax rebate in 2025 for owner-occupied residential properties, any assistance from the government to help defray costs is always welcome. Since this is a one-off rebate with a cap of S$1,000, the impact is not expected to be significant.

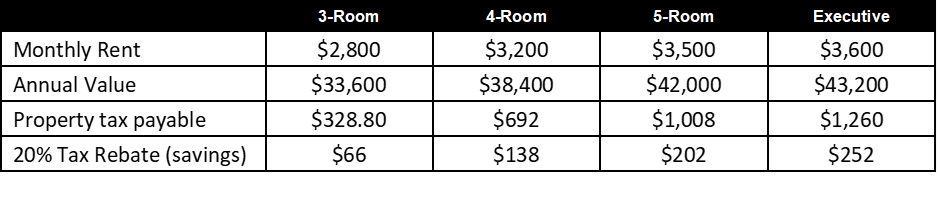

With the revision of the first AV band from $8,000 to $12,000, all one- and two-room HDB flats will continue not to pay Property Tax in 2025.

Assuming there is no change in their Annual Values; with the one-off property tax rebate and the revised Annual Value bands, all Owner-Occupied HDB flats and over 90% of Owner-Occupied private residential properties, may be paying lower property taxes in 2025.

How much property tax savings can Singaporeans expect?

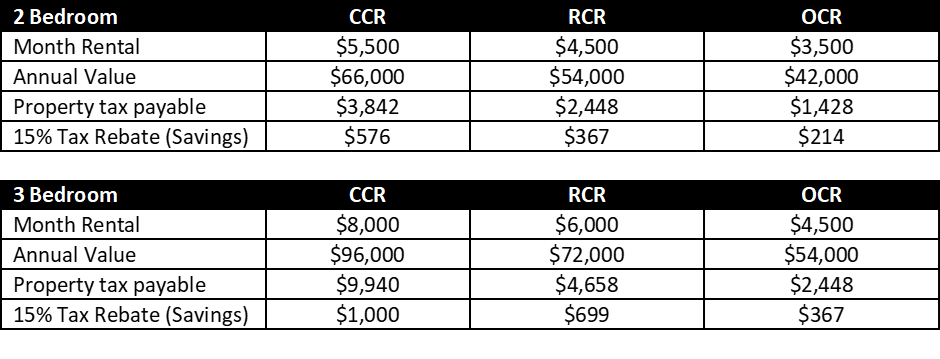

The median annual rent for a 3-bedroom RCR condo is approximately $72,000 and the homeowner will need to pay $4,658 in property taxes. In 2025, the homeowner can enjoy a one-off property tax rebate of $699.

But not all private property owners will benefit from the full 15% tax rebate due to the $1,000 cap. For example, a homeowner of a 3-bedroom unit in CCR with a property tax liability of $9,940. Instead of receiving a 15% tax rebate that amounts to $1,491, they will only be entitled to $1,000.

Table 1: Annual Value and Property Tax for Private Properties

Source: IRAS and URA as of 29 Nov 2024, ERA Research and Market intelligence

*AV band based on 2024 tiers

Table 2: Annual Value and Property Tax for HDB

Source: IRAS and HDB as of 29 Nov 2024, ERA Research and Market intelligence

AV is based on IRAS’s annual assessment of the annual rent of the property; it is not based on the actual rent of the property. While the rental index of private residential properties is 4.0% lower y-o-y, rents still have not bottomed out.

Hence, this 15% to 20% rebate may be a quicker stop-gap measure to help Singaporeans mitigate cost-of-living concerns. Even though the rebate amount is not significant, it is part of the government’s continued commitment to help Singaporeans cope with the higher cost of living.

END OF PRESS RELEASE

For media enquiries, please contact:

Eugene Lim, Key Executive Officer, ERA Singapore

Email: [email protected]