What Does URA’s Extension of the CBDI and SDI Schemes Mean for Singapore’s Urban Rejuvenation?

- By Wong Shanting

- 4 mins read

- Commercial, Private Residential (Non-Landed)

- 13 Feb 2025

This article was written in collaboration with Tay Liam Hiap, Managing Director of Capital Markets and Investment Sales.

The Central Business District Incentive (CBDI) and the Strategic Development Incentive (SDI) schemes were first launched in 2019 by URA to encourage the redevelopment of older buildings in the CBD and strategic areas. One may ask: why is there the need for such schemes?

Singapore’s landscape is always changing. The CBD’s skyline, despite its modernity is still dotted with clusters of older commercial buildings that have since outlived their glory days. These developments may be less relevant to modern-day needs and may be in stark contrast to the sleeker, more modern commercial buildings. As these commercial buildings age, maintenance costs can get increasingly expensive, and poor ventilation or air quality could contribute to the sick building syndrome, impacting the well-being of occupants. All of these factors are driving the ongoing flight-to-quality trend as tenants seeks prime spaces which offer a better, more comfortable working environment.

Why the need for these schemes?

To address this, the CBDI scheme and the SDI scheme were introduced in 2019 to encourage owners to redevelop older buildings into mixed-use developments aimed at transforming the CBD into a vibrant 24/7 mixed-use district.

Same motivation but different approaches

CBDI scheme

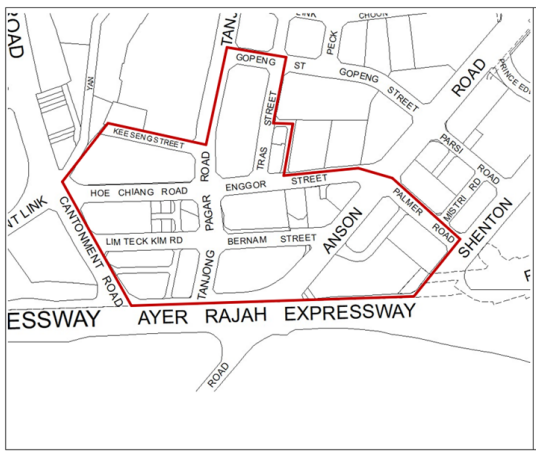

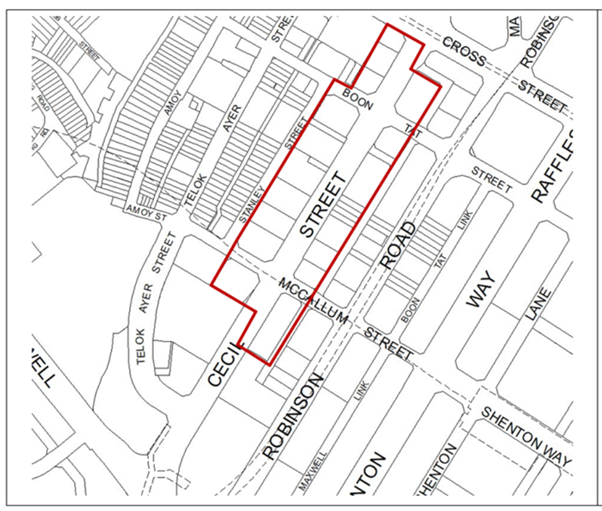

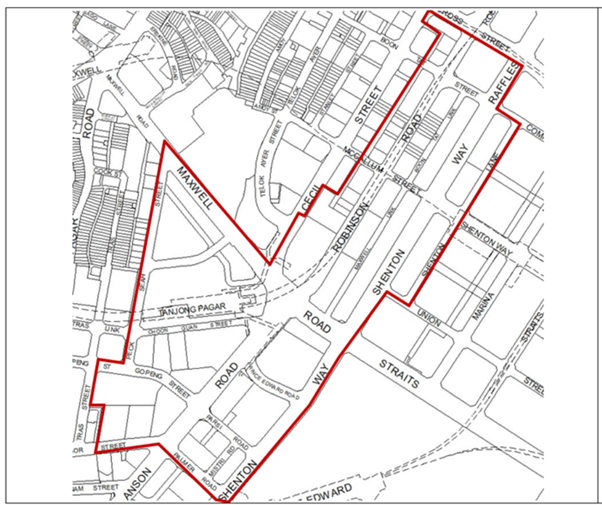

The CBDI scheme is confined to office developments, that are at least 20 years from completion, and are within the selected parts of the Anson, Cecil Street and, Robinson Road Shenton Way, Tanjong Pagar precincts. To safeguard the quality of these redevelopments, the sites are required to meet a minimum site area (1,000 to 2,000 sqm) and are not allowed to be strata subdivided. Successful proposals could be granted an additional 25% to 30% Gross Floor Area (GFA).

In 2025, the CBD incentive scheme 2.0 was updated to allow office buildings in the Anson and Cecil Street precincts the new option to include long-stay service apartments as part of their mixed-use developments.

Picture 1: Anson

Picture 2: Cecil Street

Picture 3: Robinson Road, Shenton Way & Tanjong Pagar

Since its launch, 14 out of the 17 CBDI applications were granted in-principle approval. This includes projects such as Newport Plaza (former Fuji Xerox Towers), The Skywaters (former AXA Tower), Realty Centre, Shenton House, 51 Anson Road and 15 Hoe Chiang Road.

Following this extension, could we see developments such as GB Building, Tong Eng Building, Cecil Court, and Springleaf Tower take advantage of the scheme and undergo redevelopment in the new future?

SDI scheme

Separately, the SDI scheme is designed to encourage redevelopment of older buildings in strategic areas including Orchard Road, wider CBD areas that fall outside the designated zones for the CBDI scheme, and Marina Centre. To qualify for the SDI scheme, a development must be at least 20 years after completion, be either a commercial or mixed-use development, and more importantly, the redevelopment must involve at least two adjacent sites.

So far, the SDI Scheme has granted seven in-principle approval for 12 applications. These include Union Square (former Central Mall & Central Square), new hotel development (former Faber House and asset enhancement of Odeon Tower), and the redevelopment of voco Hotel, The Forum Mall and HPL House.

Picture 4: Forum The Shopping Mall

The requirements for the SDI scheme are stringent, and finding an adjacent site that is willing to undergo joint redevelopment can be challenging. For that reason, the Far East Shopping Centre was unable to obtain approval to redevelop under the SDI scheme. This underscores the challenges and limitations of the SDI scheme, which can discourage some older developments from pursuing redevelopment.

Picture 5: Far East Shopping Centre

Why are there not more owners taking up the schemes?

Despite the attractive incentives, not all building owners are ready to take the plunge and participate in these schemes. There is a myriad of reasons, but the more commonly cited ones includes the high cost and inconvenience of redevelopment, the complexity of the scheme (particularly in the case of the SDI scheme), and conflicting views among stakeholders regarding redevelopments. For others, it boils down to complacency, as their older assets continue to generate attractive yields since many of them were acquired years ago.

Moreover, many of the older commercial buildings in the CBD are strata-titled and the redevelopment option will entail a lengthy collective sale process whereby 80% of owners’ consensus is required.

But with a shift in demographic trends and evolving real estate needs, it may make more sense for older developments to embark on redevelopment to avoid becoming obsolete or displaced in the medium term.

The Mandatory Energy Improvement (MEI) regime implemented in September 2024, which requires energy audits and energy efficiency improvement measures to be carried out for commercial buildings with more than 5,000 sqm of gross floor area, may also prompt owners of older commercial buildings to consider the redevelopment option, especially for buildings with short remaining lease tenures.

For now, these older buildings carve their niche by offering attractive office rental rates for smaller companies who want to stay within the CBD precinct. Likewise, older strata-titled retail malls served as a haven for mom-and-pop shops where affordable rents allow them to service their long-time customers who value familiarity.

But eventually, as the broader decentralisation strategy gains stronger traction, smaller companies may see more value in relocating to regional centres which are within a short commute to the CBD. E-commerce and shift in demographic could also see the irrelevance of mom-and-pop shops, as young shoppers are increasing purchasing items through websites and social media platforms.

Furthermore, as sustainability reporting becomes more stringent, companies may avoid leasing older buildings completely due to the negative impact on their sustainability metrics.

Over time, rental demand for older buildings may decline, impacting the overall yield. Perhaps it is time to consider redevelopment and future-proofing their assets.

Could CBD become the up-and-coming residential enclave as more are projected to participate in the CBDI scheme?

As more developments participate in the CBDI scheme, we can expect to see more residential homes within the CBD. As at end-2024, District 1 (Raffles Place, Cecil, Marina, People’s Park) and District 2 (Anson, Tanjong Pagar), has over 9,000 homes.

With the completion of Newport Plaza, The Skywaters, 15 Hoe Chiang Road and 51 Anson Road, the Anson-Tanjong Pagar area could see more than 1,000 new homes, hotels and retails offerings. At the same time, with the enhanced CBDI scheme 2.0, selected redevelopment sites can opt to redevelop as commercial spaces with long-term service apartments. These initiatives will expand the residential offerings in CBD to accommodate the growing workforce. Opportunistic investors may view this as a chance to acquire a home in CBD to capitalise on potential future growth.

Picture 5: Newport Plaza

In conclusion

The extension of the CBDI and SDI schemes reflects URA’s commitment to drive rejuvenation in key strategic areas. The transformation of CBD into a vibrant mixed-use district will further enhance its appeal as a residential enclave and present astute investors the opportunity to capitalise on potential future growth. But the success of these schemes hinges on the willingness and collaboration from these owners to drive the redevelopment. Looking beyond the inconvenience, redeveloping these buildings could help owners future-proof their assets, ensuring long-term growth while supporting sustainability efforts in the Singapore urban landscape.

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.