A recap of the Singapore residential market in 2023 and what lies ahead in 2024

- By Wong Shanting

- 6 mins read

- Private Residential (Landed), Private Residential (Non-Landed)

- 26 Dec 2023

Rising cost and the elevated interest rates have moderated residential property demand across the board in 2023. Residential demand tapered further with the Additional Buyer Stamp Duty (ABSD) hike in April that curtailed demand from investors and foreigner buyers. The roundup of money laundering cases in August involving several high-value residential property transactions, has further led to the heightening of anti-money laundering checks. What’s next for the Singapore residential market?

But recent new sales performance seems to paint a different picture. J’den and Watten House, launched in November, have reported exceptional sales amid achieving benchmark prices. The residential market looks to have turned the corner with returning buyers’ confidence.

Projected economic expansion, low unemployment rates and healthy household balance sheet to support homebuying activities in 2024

Despite the global slowdown, Singapore has emerged as the bright spot in Asia Pacific. Its economic growth is forecasted to expand by 2.3% in 2023. The labour force is largely stable with overall unemployment rate projected to stay low, even as retrenchment increases. Both headline and core inflation could begin abating and are projected to average 3.0%-4.0% and 2.5%–3.5% respectively in 2024. For now, the Singapore household balance sheet remains healthy. All of these factors will help support homebuying activities.

Analysts are hopeful that the Federal Reserve of United States could cut interest rate by up to 75 basis point in 2024 in the second half of 2024. This could further boost the residential market and bolster transaction volume in 2024.

Residential home prices

The All-residential property price index reported a modest increase in 2023, registering a 3.9% growth in 3Q 2023 since the beginning of the year. CCR non-landed home prices, the laggard among the regions, fell by 2.0% over the first nine months of 2023. By contrast, RCR and OCR saw non-landed home prices rise 4.0% and 8.8% in the first nine months of 2023, largely attributed to higher new home prices in the areas.

Landed home prices have held steady, rising only 3.9% over the last nine months of 2023. This is in contrast to the last two years where the COVID-led boom sent landed prices soaring by 13.3% and 9.6% y-o-y in 2021 and 2022 respectively.

The all residential property price index is forecasted to grow between 4%-5% y-o-y in 2023, and another 5%-6% y-o-y in 2024. Meanwhile, landed home prices are anticipated to stay relatively stable and could see a potential growth of up to 2% by end 2024.

Chart 1: Singapore residential price index

Source: URA, ERA Research and Market Intelligence

Non-landed new homes

According to caveats as at 15 Dec 2023, the islandwide average new home price in 4Q 2023 reached $2,550 psf (per square feet), registering 8.9% growth y-o-y. After a dearth of new home launches since August, November new home launches such as J’den and Watten House, have reported exceptional sales performance amid achieving benchmark prices. J’den sold at a median price of $2,475 per square feet (psf) while Watten House reached a median price of $3,198 psf.

Despite an increase in new home launches this year, sales volume has moderated. In 2023, the new home market welcomed 22 new launches and one Executive Condominium (EC) launch. An estimated of 7,600 new homes (excluding EC) is launched in 2023, which is 52% higher than in 2022 (4,987 units).

The top five best-selling projects by units in 2023 are as follow: The Reserve Residences, Grand Dunman, Lentor Hills Residences, Tembusu Grand and J’den.

ERA projects total new home sale could reach between 6,500 and 7,000 in 2023, just a shade lower than 2022 where 7,099 new homes were sold.

Chart 2: New sale transactions and average price

Source: URA as at 15 Dec, ERA Research and Market Intelligence

Table 1: Top five Best-selling projects (excluding EC) in 2023

|

Project name |

Total units |

Tenure | Market Segment | Total units sold in 2023 | Average price

($psf) |

Percentage Sold |

|

THE RESERVE RESIDENCES |

732 |

99 Years | RCR | 676 | 2,470 |

92% |

|

GRAND DUNMAN |

1,008 |

99 Years | RCR | 622 | 2,522 |

62% |

|

LENTOR HILLS RESIDENCES |

598 |

99 Years | OCR | 436 | 2,084 |

73% |

|

TEMBUSU GRAND |

638 |

99 Years | RCR | 376 | 2,463 |

59% |

|

J’DEN |

368 |

99 Years | OCR | 329 | 2,457 |

89% |

Source: ERApro, URA as at 15 Dec, ERA Research and Market Intelligence

Buyer profile for new homes

The ABSD hike in April 2023, which included the doubling of ABSD for foreign buyers, has curtailed demand from foreign buyers across the board.

Among the market segments, CCR was the most impacted. Prior to the pandemic, foreign buyers accounted for close to one quarter of the buyers for homes in CCR, but this proportion has trended between 12% and 14% since 2020. RCR and OCR have seen similar declines, even as they reported a marginal decline in the proportion of foreign buyers.

Chart 3: Buyers profile by residential status (new homes)

Source: URA as at 15 Dec, ERA Research and Market Intelligence

Government Land Sales Programme

A total of eight residential and two EC sites were awarded in 2023. Some Government Land Sale sites have attracted up to six bids this year, and more developers have partnered up and put in joint bids. Both of the EC sites received nine bids.

Developers have been eager to replenish their land bank in 2023 as the unsold residential stock fell to only 17,576 (including ECs) units in 3Q 2023. Land costs have inflated and this paves way for higher new home prices in the near term. For instance, the Toa Payoh Lor 1 site closed in Nov, achieved a bid of $968 million, which worked out to a land rate of $1,360 per square feet per plot ratio.

New home outlook

In 2024, there could be as many as 32 new home launches and one EC launch scheduled in the pipeline. This could contribute to a total of more than 11,000 new homes.

The 2023 land sale performance suggests prices of new homes in 2024 will continue to grow at a more measured pace. ERA forecasts prices of new homes to grow between 3%-4% by end-2024 while demand for new homes in 2024 will remain largely similar to 2023, falling in the range of 7,000 to 8,000 units.

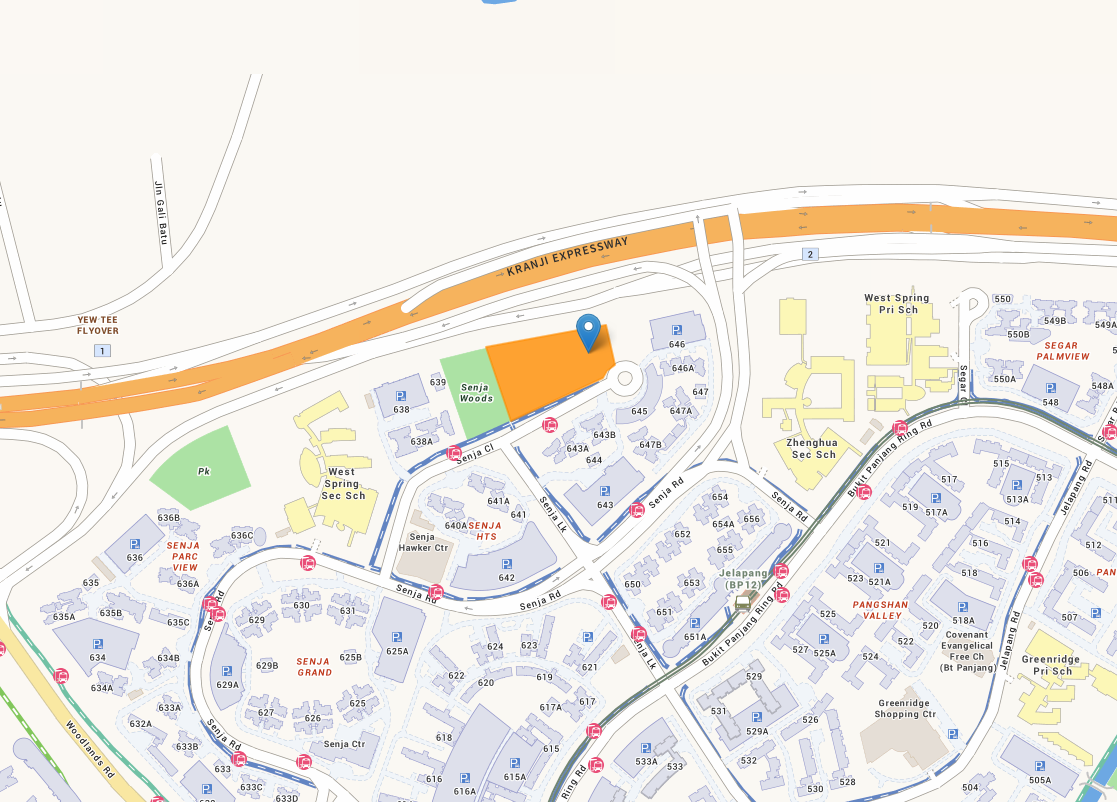

Table 2: Project launches in 2024

| No. | Private Residential Projects |

Region |

Location |

District |

Tenure |

Estimated number of units |

|

1 |

Marina View Residences |

CCR |

Marina View |

1 |

99 LH |

683 |

|

2 |

TBC (Marina Gardens Lane GLS) |

CCR |

Marina Lane |

1 |

99 LH |

790 |

|

3 |

Newport Residences |

CCR |

Anson Road |

2 |

FH |

246 |

|

4 |

Former Peace Centre |

CCR |

Sophia Road |

9 |

99 LH |

240 |

|

5 |

21 Anderson |

CCR |

Anderson Road |

10 |

FH |

18 |

|

6 |

32 Gilstead Road |

CCR |

Gilstead Road |

11 |

FH |

14 |

|

7 |

Former Kew Lodge |

CCR |

Kheam Hock Road |

11 |

FH |

TBC |

|

8 |

Former Central Mall / Central Square |

RCR |

Havelock Road |

1 |

99 LH |

366 |

|

9 |

Keppel Bay Plot 6 |

RCR |

Keppel Island |

4 |

99 LH |

86 |

|

10 |

Former Golden Mile Complex |

RCR |

Beach Road |

7 |

99 LH |

TBC |

|

11 |

The Arcady at Boon Keng |

RCR |

St Barbabas Lane |

12 |

FH |

172 |

|

12 |

TBC (Lorong 1 Toa Payoh GLS) |

RCR |

Lorong 1 Toa Payoh |

12 |

99 LH |

800 |

|

13 |

Ardon Residence |

RCR |

Haig Road |

15 |

FH |

35 |

|

14 |

Former Meyer Park |

RCR |

Meyer Road |

15 |

FH |

230 |

|

15 |

TBC (Jalan Tembusu GLS) |

RCR |

Jalan Tembusu |

15 |

99 LH |

840 |

|

16 |

The Hill @ One-North |

RCR |

Slim Barracks Rise |

5 |

99 LH |

142 |

|

17 |

The Hillshore |

RCR |

Pasir Panjang Road |

5 |

FH |

59 |

|

18 |

TBC (Bukit Timah Link GLS) |

RCR |

Bukit Timah Link |

21 |

99 LH |

160 |

|

19 |

TBC (Pine Grove GLS) |

RCR |

Pine Grove |

21 |

99 LH |

565 |

|

20 |

Former La Ville |

RCR |

Tanjong Rhu Road |

15 |

FH |

107 |

|

21 |

Former Bagnall Court |

OCR |

Upper East Coast Road |

16 |

FH |

113 |

|

22 |

Kassia |

OCR |

Flora Drive |

17 |

FH |

276 |

|

23 |

TBC (Tampines Avenue 11 GLS) |

OCR |

Tampines Avenue 11 |

18 |

99 LH |

1,190 |

|

24 |

Former Chuan Park |

OCR |

Lorong Chuan |

19 |

99 LH |

900 |

|

25 |

TBC (Champions Way GLS) |

OCR |

Champions Way |

25 |

99 LH |

350 |

|

26 |

Lentor Mansion |

OCR |

Lentor Gardens |

26 |

99 LH |

533 |

|

27 |

Lentoria |

OCR |

Lentor Hills Road |

26 |

99 LH |

267 |

|

28 |

TBC (Lentor Central GLS) |

OCR |

Lentor Central |

26 |

99 LH |

475 |

|

29 |

TBC (Clementi Avenue 1 GLS) |

OCR |

Clementi Avenue 1 |

5 |

99 LH |

501 |

|

30 |

Sora |

OCR |

Yuan Ching Road |

22 |

99 LH |

440 |

|

31 |

Hillhaven |

OCR |

Hillview Rise |

23 |

99 LH |

341 |

|

No. |

Executive Condominium Project |

Region |

Location |

District |

Tenure |

Estimated number of units |

|

1 |

Lumina Grand |

OCR |

Bukit Batok West Avenue 5 |

23 |

99 LH |

496 |

Source: ERA Research and Market Intelligence

Non-landed Resale and Sub sale market

Based on caveats lodged as at 15 Dec 2023, the islandwide average non-landed resale prices grew 5.7% in 2023 while the average non-landed sub sale prices grew 1.5% y-o-y.

Some 9,455 resale units were sold, the lowest transaction volume since 2020, and another 1,095 sub sale units were sold in 2023. Compared to 2022, resale transactions have moderated by 22.0% y-o-y. On the back of more new homes approaching completion, sub sale transactions have rose substantially by 56.7% y-o-y on the back of more new homes approaching completion.

The price gap between new home and resale home have prompted some buyers to turn towards the sub sale and resale market instead. RCR and OCR saw more newly completed homes transacted in recent months and this trend is expected to persist into 2024. Newly completed homes have taken centre stage as they are increasingly popular with buyers, given their brand-new condition and readiness for immediate occupancy.

Chart 4: Resale and sub sale transactions and average price

Source: URA as of 1 Dec, ERA Research and Market Intelligence

Source: URA as of 1 Dec, ERA Research and Market Intelligence

Upcoming home completions

For the whole of 2023, some 19,000 private residential units (excluding EC) are expected to complete, marking the highest annual supply completion since 2016. Another 10,000 units are schedule to be completed in 2024.

Chart 5: Private residential completions

Source: URA as of 1 Dec, ERA Research and Market Intelligence

Resale and Sub sale Outlook

The surge in new home completions could regulate the pace of resale price growth and drive transaction volume in 2024. For the whole of 2023, ERA forecasts the average non-landed resale and sub sale price could increase by 5% y-o-y, and by another 6% y-o-y in 2024. The total non-landed resale and sub sale are estimated to reach between 11,000 and 11,500 units in 2023, and between 12,000 and 13,000 units in 2024.

Landed property

The landed property segment reported subdued sales in 2023, primarily on the back of higher home prices and a lack of inventory. Landed home owners, who have stronger holding power and are facing higher costs of replacement homes, have been inclined to set higher prices and showed little urgency to sell. The demand, on the other hand, has remained fairly stable. In light of this situation, more landed deals have fallen through as buyers and sellers reached an impasse on home prices.

Landed home prices have held steady, rising only 3.9% over the last nine months of 2023. This is in contrast to the last two years where the COVID-led boom sent landed prices soaring by 13.3% and 9.6% y-o-y in 2021 and 2022 respectively.

The total volume of landed property transactions has declined to 1,198 units, with the total transaction value reaching $6.9 billion. Compared to a year ago, both the transaction volume and transaction value have declined by 28.8% and 27.4% respectively. For the whole of 2023, the total volume of landed property transactions could reach 1,200 – 1,300 units, with the total transaction value expected to surpass $7 billion.

Looking ahead to 2024, the landed property segment is projected to see muted activities largely due to rising costs. ERA foresees total landed transaction volume could moderate to between 1,100 and 1,200 units, with total transaction value reaching between $6.0 – $6.5 billion. Landed home prices are anticipated to stay relatively stable and could see a potential growth of up to 2% by end 2024.

Chart 6: Landed property transaction volume and transaction value

Source: URA as at 15 Dec, ERA Research and Market Intelligence

Conclusion

Looking ahead to 2024, the new home segment could see as many as 32 new home launches and one EC launch scheduled in the pipeline. ERA forecasts prices of new homes could grow between 3%-6% by end-2024 largely attributed to higher land prices. Demand for new homes in 2024 could moderate to the range of 7,000 to 8,000 units.

More new home completions in 2024 could regulate the pace of non-landed resale price growth and drive transaction volume in 2024. ERA projects non-landed resale prices could increase by up to 6% y-o-y in 2024, with the total resale and sub-sale transactions ranging between 12,000 and 13,000 units in 2024.

The landed property segment is projected to see muted activities and stable price growth in 2023. ERA foresees total landed transaction volume could moderate to between 1,100 and 1,200 units, with total transaction value reaching between $6.0 – $6.5 billion. Landed home prices are anticipated to stay relatively stable and could see a potential growth of up to 2% by end 2024.

In conclusion, the private residential market appears to have turned a corner. Macroeconomic indicators are showing signs of cautious optimism in 2024, and there is quiet confidence that the residential market will recover in 2024. The second half of 2024 is projected to bring about more positive economic developments that could propel the Singapore private residential market further.

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.