Can You Afford a Singapore Condo Based on Your Salary Today?

- By Stanley Lim

- 4 mins read

- Private Residential (Non-Landed)

- 28 Nov 2024

Keep scrolling, because we’ve done the math for you!

It’s often said that location is the most important factor when buying a new home. While that is almost always the gospel truth, price is undeniably the next-most crucial point of consideration for any aspiring homeowner.

Amidst the current market where prices for private properties are on the uptrend, it’s more important than ever to carefully evaluate what you’re able to afford. Naturally, this process warrants checking out the sticker prices for condos (both new and resale), however you’ll also need to account for other considerations – not least your current financial commitments, interest rates, and borrowing limits.

To paint a complete picture, we break down the key factors that’ll determine whether your household income can afford you a condo in 2024, be it from the primary or secondary market.

How much does a condo cost in Singapore today?

Before delving deeper into the numbers, it’s important to note that condo prices can differ significantly across Singapore. This variance hinges on a whole slew of factors: a condo’s size, its proximity to amenities (think schools, malls, and public transport hubs), and of course, a development’s age which will affect the balance lease.

That said, location – or more specifically, the region where a condo is situated – is one of the strongest indicators of how much it’ll cost.

Broadly-speaking, condos in the Core Central Region (CCR) tend to command a higher price than their similarly-sized counterparts in the Rest of Central Region (RCR) and Outside Central Region (OCR); this is mainly due to the proximity of CCR homes to the prime business district, which increases their appeal and market value.

Likewise, RCR properties usually come with a bigger price tag than those in the OCR, as they are more centralised compared to OCR homes.

So, with that in mind, here’s an overview of how much new and resale condos could cost in 2024, based on official median price data from the Urban Redevelopment Authority (URA):

Table 1: Median price of new and resale condominiums by region*

| Region |

Median Price (New Condo) |

Median Price (Resale Condo) |

| Core Central Region |

$1,999,000 |

$2,486,000 |

| Rest of Central Region |

$2,373,000 |

$1,710,000 |

| Outside Central Region |

$1,958,000 |

$1,400,000 |

Source: URA, ERA Research and Market Intelligence (*Based on URA data from Jul to Dec 2024)

For purpose of the study, the numbers are rounded up to the nearest thousands.

Based on these figures—plus a few assumptions— you’ll get an approximate idea of whether one of these homes fits within your budget, given your current salary.

How much do you need to make to afford a condo purchase in Singapore?

With the latest prices listed above, determining the salary you’ll need to afford a condo would be a clear-cut process, right? But not quite.

Before diving into the numbers, it’s important to note that there are other considerations at play – and not just the price of your dream condo. For instance, condo buyers must consider the Total Debt Servicing Ratio (TDSR) and Loan-to-Value (LTV) ratio, which will certainly impact their affordability as well as the size of their downpayment.

Hence for simplicity’s sake, here are some assumptions that we’ll be using to guide our calculations and estimates:

- The buyer(s) has no existing loan obligations, be it a mortgage, car loan or credit loan; this is so that they will be able to maximise the TDSR of 55% for their future home mortgage.

- The current stress test rate of 4% is applied when determining the maximum loan quantum.

- Other home-related and/or miscellaneous costs are not factored into the calculation (e.g. stamp duties, legal fees, home renovation/furnishing costs).

Based on median price data of transactions in each region and the pointers above, here’s what you’ll need to earn to afford a new/resale condo in Singapore today…

Table 2a: Approx. income needed to afford a new condo in each Singapore region*

| Region | Median Price (New Condo) | Corresponding Size (Sqft) | Approx. Household Income Needed | Approx. Monthly Repayment |

| Core Central Region |

$1,999,000 |

732 |

$13,100 |

$7,200 |

| Rest of Central Region |

$2,373,000 |

904 |

$15,500 |

$8,500 |

| Outside Central Region |

$1,958,000 |

743 – 1,012 |

$12,800 |

$7,100 |

Source: URA, ERA Research and Market Intelligence (*Based on URA data from Jul to Dec 2024)

For purpose of the study, the numbers are rounded up to the nearest thousands.

Table 2b: Approx. income needed to afford a resale condo in each Singapore region*

| Region | Median Price (Resale Condo) | Corresponding Size (Sqft) | Approx. Household Income Needed | Approx. Monthly Repayment |

| Core Central Region |

$2,486,000 |

1,281 |

$16,200 |

$8,900 |

| Rest of Central Region |

$1,710,000 |

764 – 969 |

$11,200 |

$6,200 |

| Outside Central Region |

$1,400,000 |

635 – 1,421 |

$9,200 |

$5,100 |

Source: URA, ERA Research and Market Intelligence (*Based on URA data from Jul to Dec 2024)

For purpose of the study, the numbers are rounded up to the nearest thousands.

For a deeper dive, here are your options…

While the salary figures listed above are a useful starting point for condo buyers, they certainly don’t reflect the full diversity of costs and affordability for private homes in Singapore. To provide a more complete picture, here’s a breakdown of new and resale property prices across regions, paired with various salaries and home sizes.

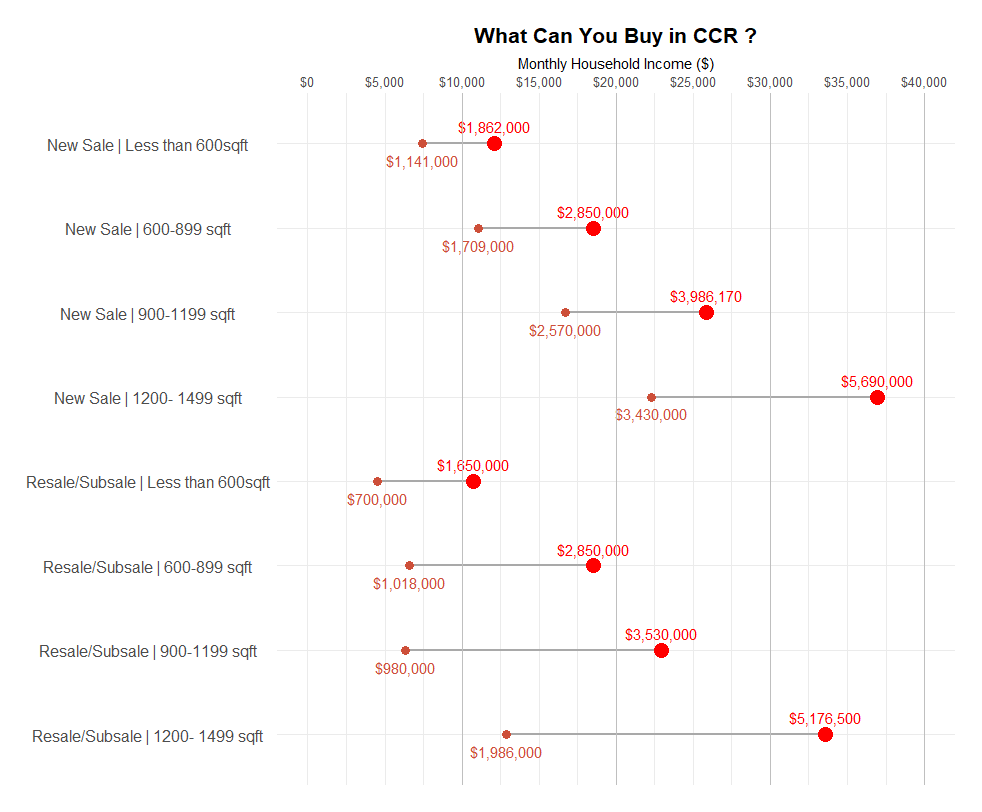

Chart 1a: New and resale property prices in CCR by size and salary levels (Jul-Dec 2024)*

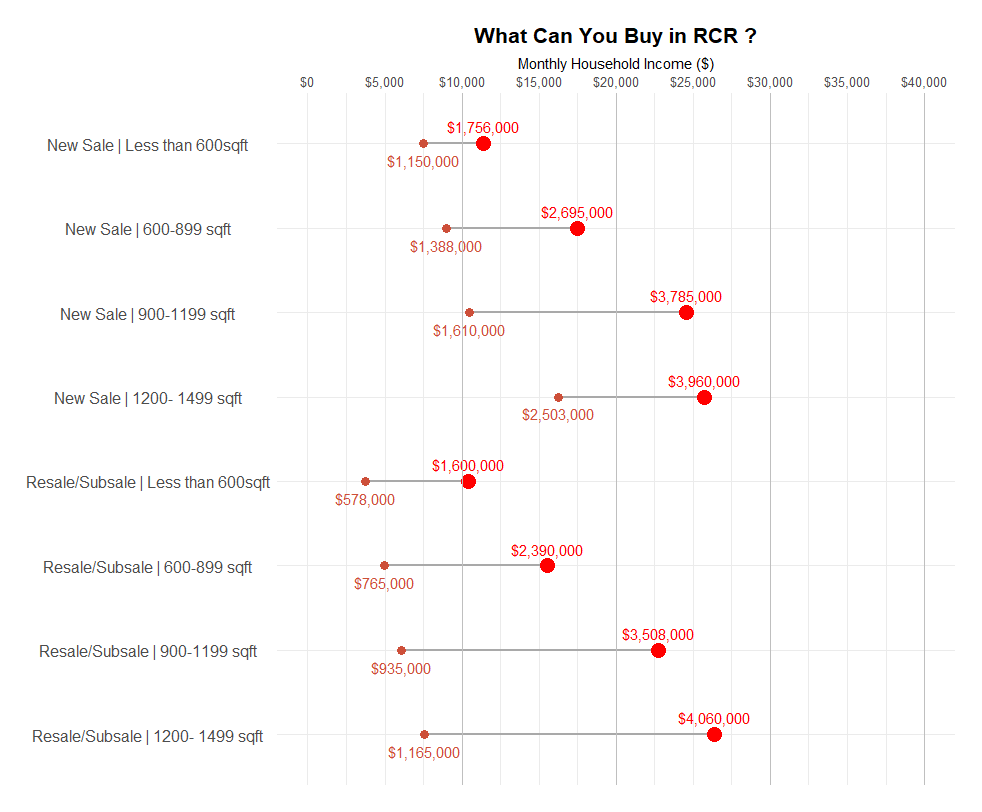

Chart 1b: New and resale property prices in RCR by size and salary levels (Jul-Dec 2024)*

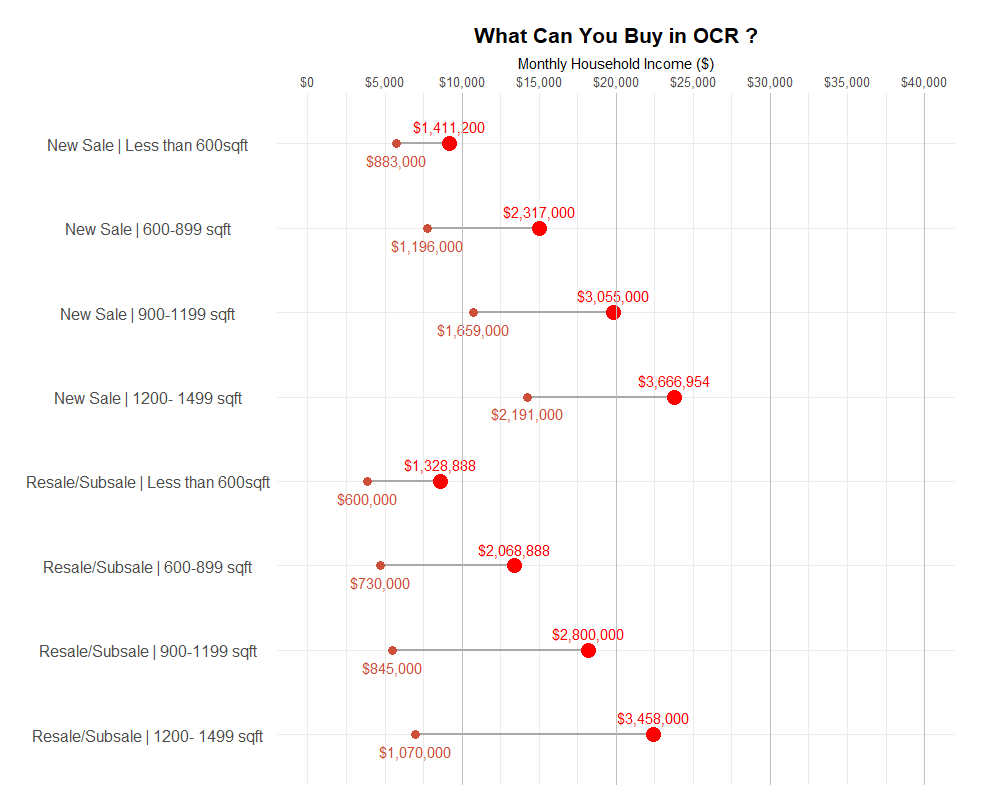

Chart 1c: New and resale property prices in OCR by size and salary levels (Jul-Dec 2024)*

(*Estimates are based on assumptions of a stress test rate of 4%, interest rate of 3%, TDSR of 55%, LTV of 75%, and a 30-year mortgage loan tenure.)

For example, referencing the chart above, the most affordable new private home under 600 sq ft (i.e. a 2-bedder or smaller unit) in the OCR would cost at least $883,000, while the priciest could reach approximately $1.4M. Correspondingly, you would need an income of about $5,800 to cover the cost of the most affordable option, while the higher-priced unit would require a salary of around $9,200.

As for the RCR, a new private home sized between 600 and 899 sqft (typically a 2-room unit) would cost between $1.38M and $2.7M. This means buyers would need a monthly income of around $9,000 to afford a smaller unit in this range, and approximately $17,600 for a larger one.

Alternatively, if you’re looking to purchase a resale or sub-sale property in the CCR between 900 and 1,199 sqft (i.e. 2- to 3-bedder units), the corresponding price range would start at around $980,000 and could go up to approximately $3.5M. As a result, the salary range needed to afford these properties would be roughly between $6,400 to $23,000.

Salary aside, what else should you take note of when budgeting for a condo?

No doubt, price tags are certainly the top concern on any prospective condo buyer’s mind, but there’s more to the picture than meets the eye when it comes to determining affordability.

As with any property purchase, aspiring condo owners will want to consider their downpayment, which determines their upfront costs. Based on the current Loan-to-Value ratio, which stands at 75%, condo buyers will have to pay up to 25% of their new property’s price initially, of which 5% must be in cash.

The starting cash outlay for condo purchases also consists of stamp duties, such as the Buyer’s Stamp Duty which is computed based on progressive rates. The Additional Buyer’s Stamp Duty may also apply depending on whether buyers intend to purchase an additional private home on top of their existing non-HDB dwelling.

So, is it possible to afford a Singapore condo with your salary?

To put it simply, the answer is a firm “yes”. With proper financial planning and a clear understanding of your affordability range, purchasing a condo in Singapore is certainly an achievable dream.

However, if you aren’t a seasoned buyer, it’s best to seek professional advice to ensure your numbers are accurate and up to date. Once again, keep in mind that while the above estimates are a useful starting point, there are also other factors at play. For instance, fluctuations in loan interest rates or adjustments to debt thresholds (i.e. TDSR) will affect the amount you can secure for a home loan, and thus, the size or type of property you can afford.

Want to get a better idea of your buying power and explore your options for private homes? Be sure to reach out to an ERA Trusted Adviser today and start your journey to condo ownership on the right foot!

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.