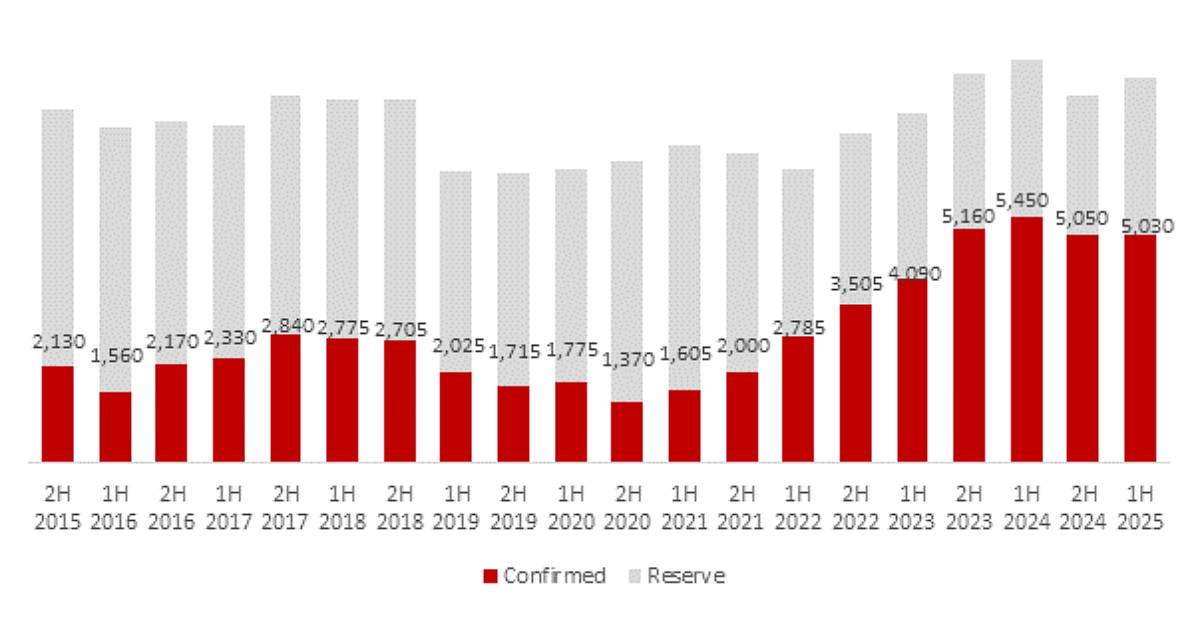

The 1H 2025 Government Land Sales (GLS) program saw an increase in the overall private home supply to 8,505 units, up from 8,140 units in 2H 2024. A total of ten sites were placed on the Confirmed List, comprising six private residential sites, one Commercial & Residential site, and three EC sites.

Collectively, the 1H 2025 GLS Confirmed List includes 5,030 private homes, comprising 980 Executive Condominium (EC) units, while the Reserve List will offer an additional 3,475 residential units. Overall, the private home supply slated for 1H 2025 fell marginally by 0.4% compared to 2H 2024 but remains 7.7% lower than the supply in 1H 2024.

“We believe the steady supply of private homes may help to address the recent pick-up in new home demand, giving homebuyers the overview of a strong pipeline of upcoming launches. Separately, the 1H 2025 GLS sites on the Confirmed List presents aplenty of land-banking opportunities for developers in established HDB estates that tend to attract strong interest from HDB upgraders.”

Chart 1: Residential GLS Sites (No. of Units)

Source: URA, ERA Research and Market Intelligence

Where are the promising sites?

We believe the Telok Blangah and Dunearn Road sites will present first-mover opportunities for developers of the upcoming new residential precincts.

The Dunearn Road site will be the first private residential development launched following the announcement of Bukit Timah Turf City’s redevelopment plans earlier this year. The private residential site is nestled among the first upcoming HDB flats in Bukit Timah, and we expect the future residents to benefit from ample amenities as the area undergoes transformation.

Kickstarting the Greater Southern Waterfront transformation is the launch of this Telok Blangah Road site, where the former Keppel Golf Course used to be. Like Bukit Timah Turf City, this site will be an exciting prospect due to its central location, as well as being new estates, offering first movers’ advantage.

Within walking distance of Telok Blangah MRT, residents would be able to conveniently access work nodes at one-north, Buona Vista and the National University of Singapore. HarbourFront station, one stop away will also offer an interchange option into the CBD in under 10 minutes. Not to mention, this is the largest site in this GLS launch, offering a large, 740 units in high rise towers with a 4.7 plot ratio.

Next would be the sites located just adjacent to MRT station which includes Hougang Central and Lakeside Drive. The Hougang Central is likely to be developed as an integrated development located just next to the Hougang MRT station, which will also be servicing the Cross Island line when it is completed by 2030. This is also the first launch in Hougang since 2011.

Similarly, the Lakeside Drive site is adjacent to the Lakeside MRT station, making it a choice residential location in the heart of the Jurong Lake District development.

The GLS site at Dorset Road is within the city centre, and can yield around 430 units. The area largely see boutique developments and could see the pent-up demand for larger residential projects. Furthermore, it is within walking distance of Farrer Park MRT, as well as within 1km of Farrer Park Primary School, we should see a fairly competitive bidding process for this site.

Lastly, the three EC sites at Senja Close, Woodlands Drive 17 and Sembawang Road will also be on the radar for developers. Both Senja Close and Woodlands Drive 17 were on the 2H 2024 Reserve List and have been shifted to the 1H 2025 Confirmed list.

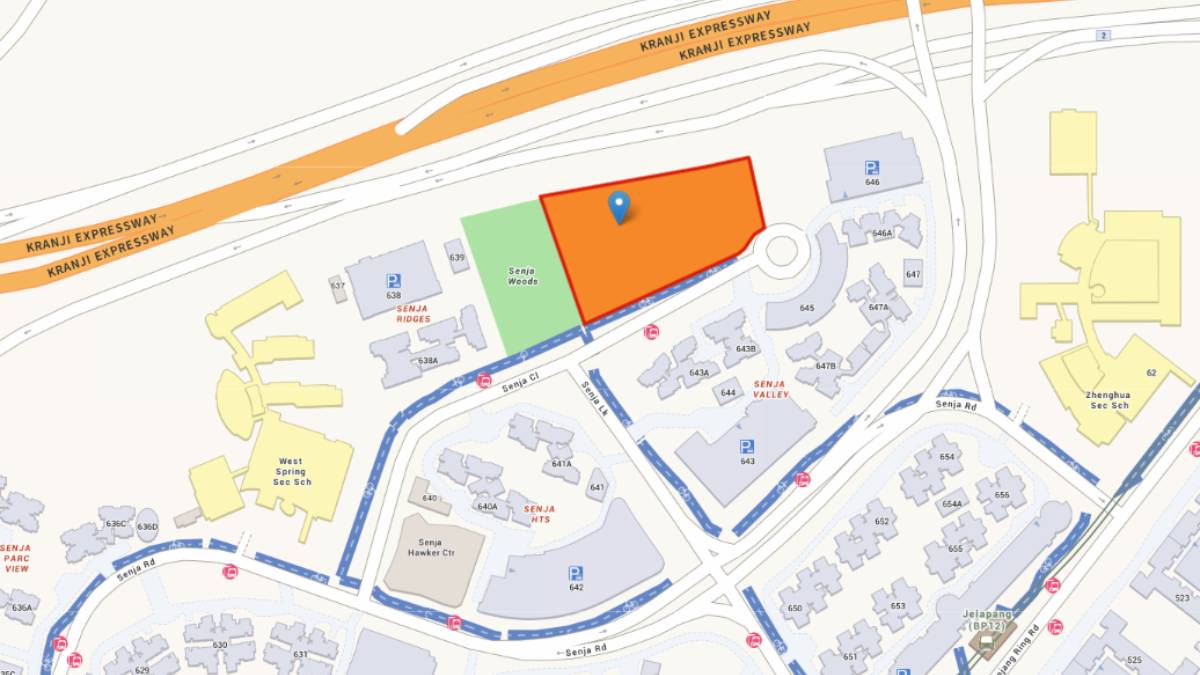

Senja Close (EC) – 295 units

Source: URA

Initially announced under the Reserve List in 2H 2024’s GLS programme before being moved to the Confirmed List in the current round of GLS announcements, Senja Close is one of three sites designated for EC development.

Expected to yield approximately 295 units, the future EC project at Senja Close will join Blossom Residences, another EC in the area which was completed in 2014. Nearby amenities include Senja Hawker Centre and Jelapang LRT station, promising future residents some measure of convenience.

Developers may show moderate interest in Senja Close, given limited competition due to the scarcity of fresh EC supply in the immediate vicinity. However, the site’s fair, but uninspiring location may limit its appeal.

Woodlands Drive 17 (EC) – 420 units

Source: URA

Among the trio of EC sites announced in this round’s GLS programme, Woodlands Drive stands out for its remarkably better locational attributes compared to other EC offerings. Traditionally, ECs are located in less-prime areas relative to private developments, making them a more budget-friendly option in exchange for further distances from key amenities.

However, the future EC at Woodlands Drive will be situated between two prominent facilities in the North, namely Singapore Sports School and Woodlands Health Campus. Additionally, the site is conveniently close to Woodlands South MRT station, which enhances its connectivity to other locations on the Thomson-East Coast Line. Consequently, developers could be drawn to Woodlands Drive, owing to its uniqueness and strong potential.

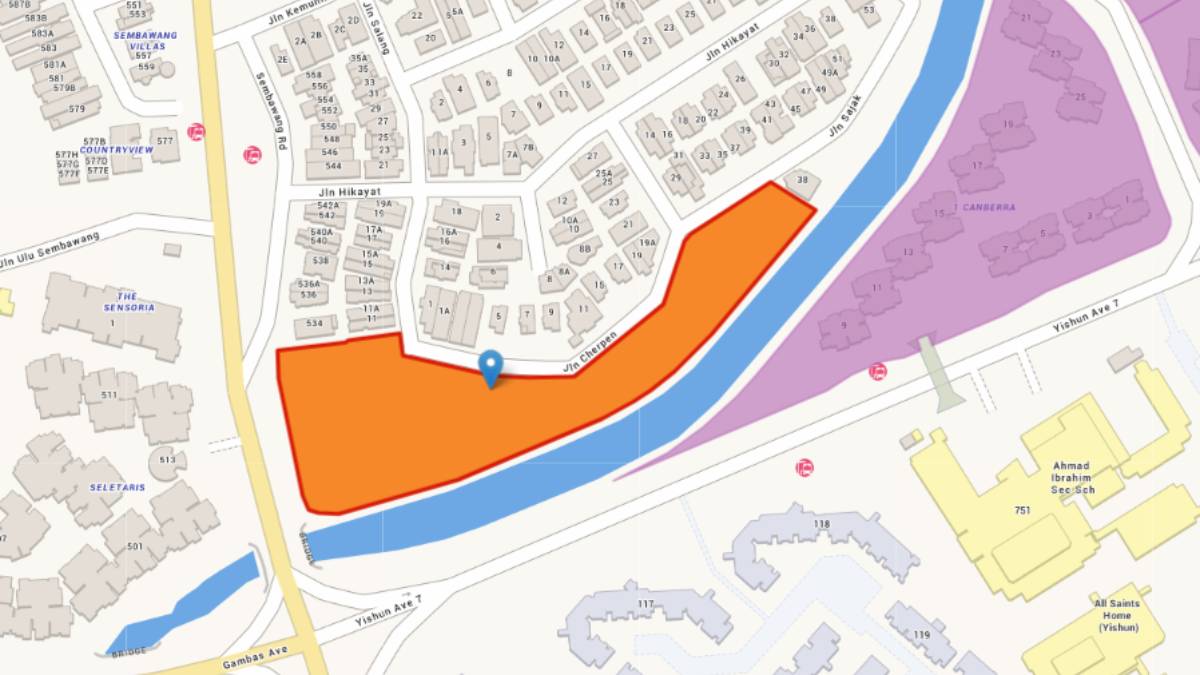

Sembawang Road (EC) – 265 units

Source: URA

Adjoining a pair of landed residential enclaves, the Sembawang Road site is nestled between the intersection of Yishun Avenue 7 and its namesake road. This relatively distant location places it a good distance away from the nearest MRT station (Canberra Station), as well as other amenities such as Sembawang Shopping Centre and Canberra Plaza. Traveling along Sembawang Road, future residents will also have access to Chong Pang Market and Food Centre.

We expect to see a fair degree of interest from developers for this site, given the tight EC supply in the area, as the latest past EC projects in Canberra (e.g. Parc Canberra and Provence Residence) are already sold out.

Lakeside Drive – 575 units

Source: URA

This site at Lakeside Drive follows the launches of two private condo developments, the LakeGarden Residences and Sora. These launches were relatively well received, due to the large growth potential from the adjacent Jurong Lake District. Furthermore, it stands out in terms of location, as it is a shorter distance from the MRT and primary schools.

We expect competitive bids for this site, as it is a site in a HDB estate within walking distance from an MRT, and within 1km priority enrolment distance of Rulang and Lakeside Primary Schools. Projects like these are normally well received by HDB upgraders within the same, and nearby estates.

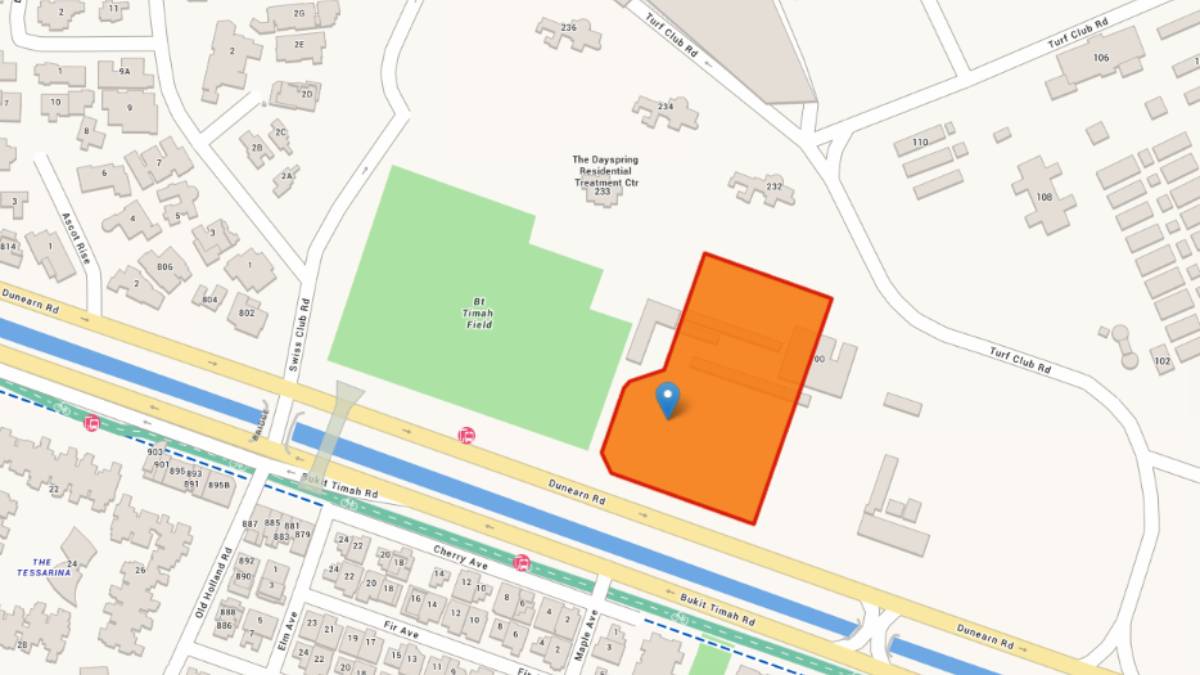

Dunearn Road – 370 units

Source: URA

As the pilot GLS plot from the former Bukit Timah Turf City site, this 370-unit project will be flanked by the various landed neighbourhoods of Bukit Timah. Future residents of this site will be served by the existing Sixth Avenue Downtown Line station and an upcoming Cross Island Line station. It is likely that the pricing and future development of the project will be that of a premium development, marketed for existing residents in the surrounding landed estates.

This site should draw the attention of bidders, who are likely to be drawn in by first movers’ advantage, following the attention drawn to the announcement of transformation plans of Bukit Timah Turf City earlier in the year.

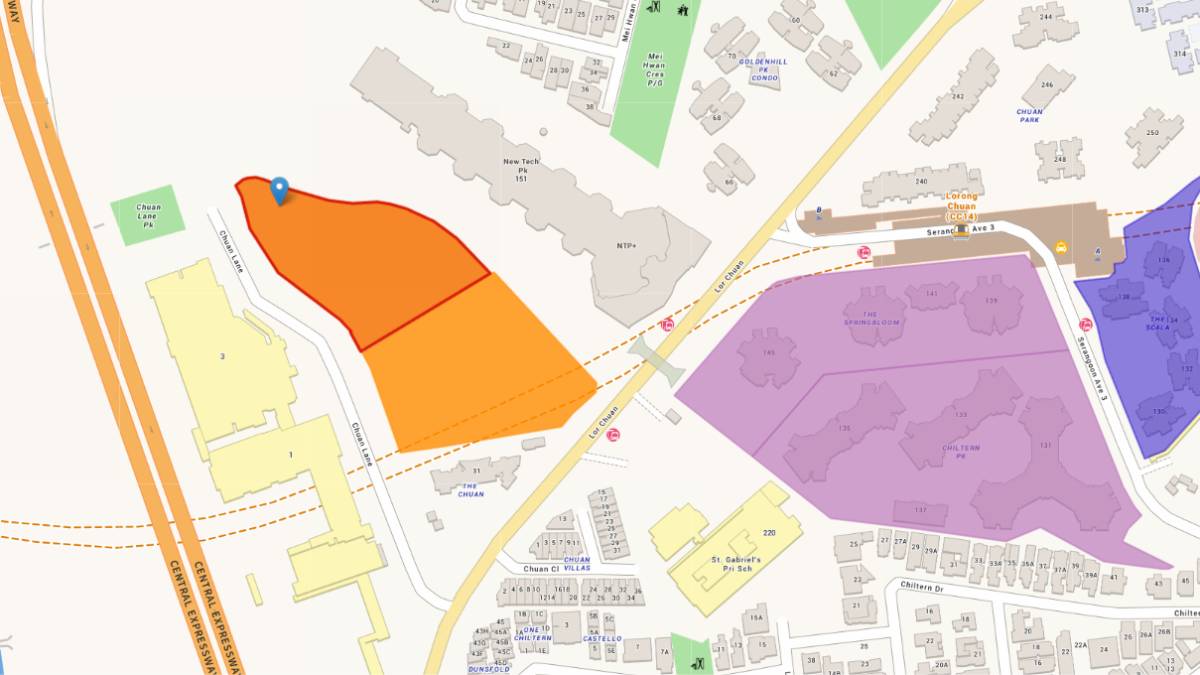

Chuan Grove – 505 units

Source: URA

This GLS site at Chuan Grove will be part of the 1H 2025 GLS confirmed list, after its neighbouring site was announced as part of the confirmed list in 2H 2024. The site will see connectivity via nearby Lorong Chuan MRT, and priority enrolment to St. Gabriel’s Primary School. It should see strong upgrader interest from HDB owners at Bishan, Toa Payoh, and Serangoon, with strong rental potential due to its proximity to the nearby Australian International School.

The site, which can potentially yield 505 homes in high-rise tower blocks should see mixed interest, due to the presence of a neighbouring site with more units and an earlier completion timeline.

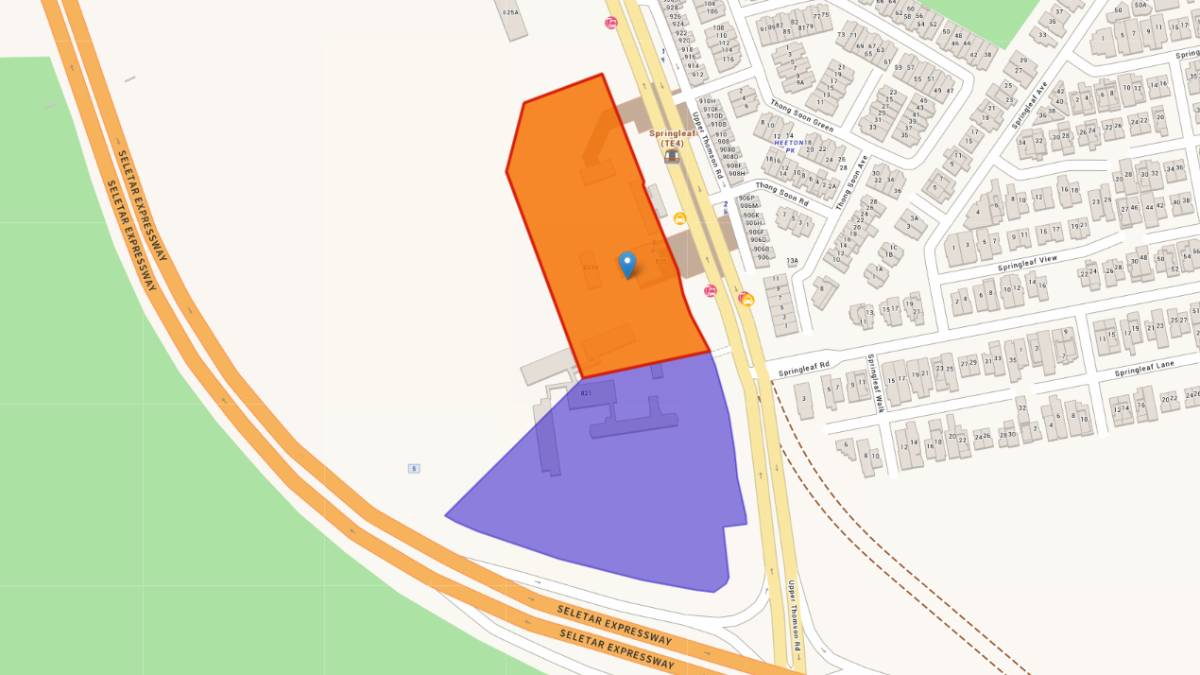

Upper Thomson Road (Parcel A) – 595 units

Source: URA

Adjacent to Parcel B, which tendered in 2H 2024, this Upper Thomson GLS site will be located next to Springleaf MRT, and its nearby landed estate.

Given that there is a lack of amenities, as well as a supply glut in this Upper Thomson and nearby Lentor area, we do not anticipate much bidding activity for this site.

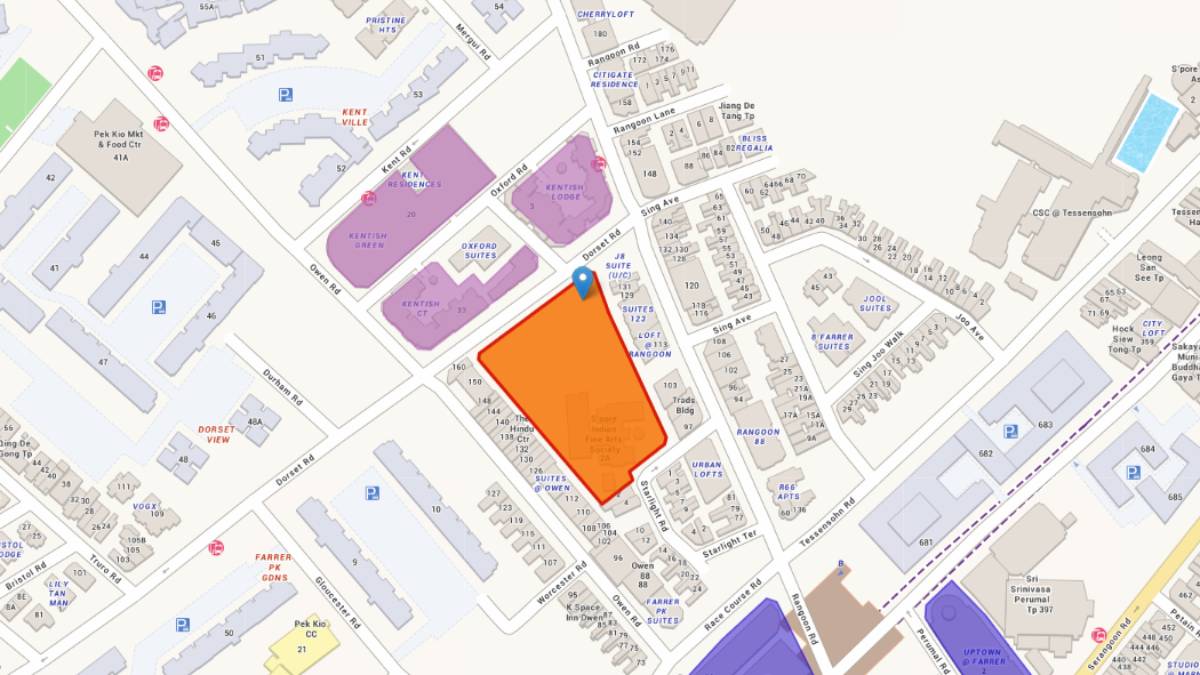

Dorset Road – 430 units

Source: URA

This GLS site at Dorset Road is within close proximity of prime districts 9 & 10 in the city centre. It is also worth noting that it offers a potential 430 units, which is rare in the area, which mainly consists of smaller or boutique developments. Given its location, it is likely that the project will be developed as a more upscale project, catering to people who idealise a lifestyle in the heart of the city.

Given it strong locational attributes, being walking distance of Farrer Park MRT, as well as within 1km of Farrer Park Primary School and a large plot ratio, we should see a fairly competitive bidding process for this site.

Telok Blangah Road – 760 units

Source: URA

Kickstarting the Greater Southern Waterfront transformation is the launch of this Telok Blangah Road site, where the former Keppel Golf Course used to lie. Like Bukit TImah Turf City, this site will be an exciting prospect due to its central location, as well as being new estates, offering first movers’ advantage.

Within walking distance of Telok Blangah MRT, residents would be able to conveniently access work nodes at one-north, Buona Vista and the National University of Singapore. Harbourfront station, one stop away will also offer an interchange option into the CBD in under 10 minutes. Not to mention, this is the largest site in this GLS launch, offering a large, 740 units in high rise towers with a 4.7 plot ratio.

Given these factors, we can expect a competitive bidding process for this Telok Blangah GLS site.

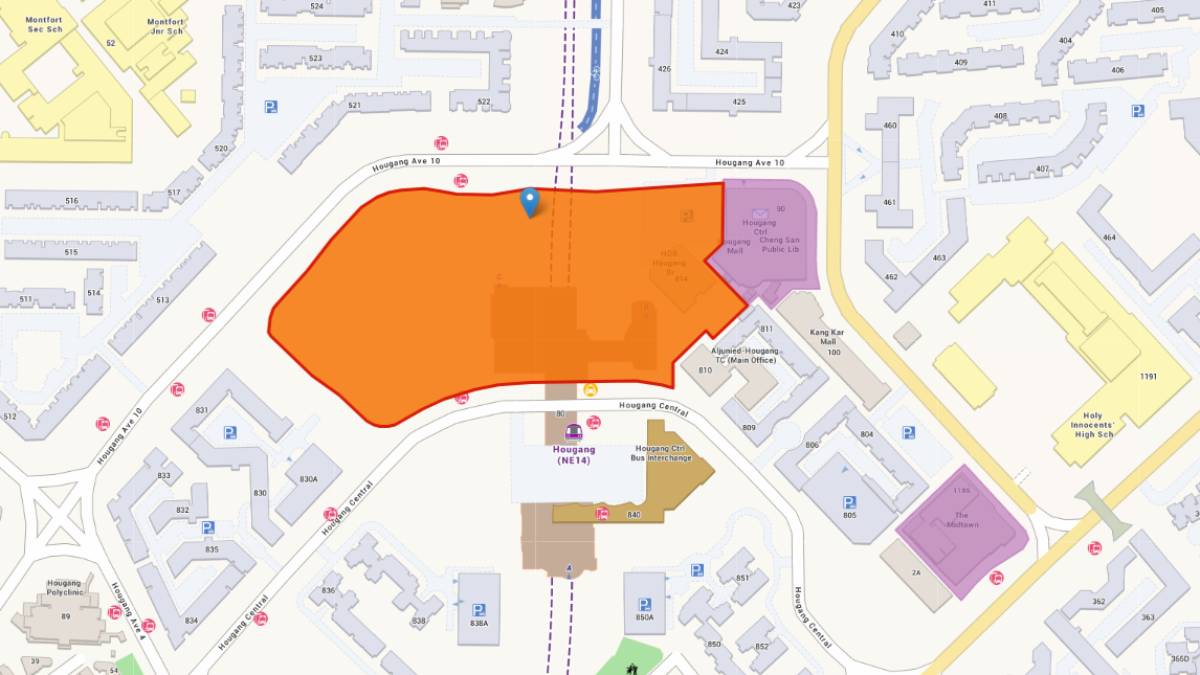

Hougang Central – 835 units

Source: URA

Among the sites announced for the Confirmed List this round, Hougang Central stands out as the only one with a commercial component, positioning it as an integrated development with the potential for approximately 835 residential units to be built. The site is also adjacent to Hougang MRT station, which is slated to become an interchange station connecting both the North East and Cross Island lines.

Strong interest from developers is anticipated for this site, thanks to its attractive features and the likely pent-up demand for private housing in the area. The most recent site sold in the vicinity was Hougang Avenue 2 in 2010, which became Terrasse, making it over a decade since a GLS site was last tendered in the neighbourhood.

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.

If you’ve been paying notice to the latest news about Singapore’s property market, you’d likely have seen headlines such as “IRAS to claw back S$60 million from buyers who used ’99-to-1’ loophole to avoid ABSD” and “Why using ’99-to-1’ is illegal in avoiding Additional Buyer’s Stamp Duty” making the rounds recently.

Naturally, these announcements have generated much buzz online, while also drawing much attention to the 99-to-1 arrangement, its legality, as well as the ongoing crackdown on Additional Buyer’s Stamp Duty (ABSD) tax avoidance by the Inland Revenue Authority of Singapore (IRAS).

But what exactly does this all mean for private homebuyers locally?

To shed light on the issue, we had Eugene Lim (Key Executive Officer) and Nicholas Poa (Senior Vice President, Legal and Compliance) explain more, as well as answer the burning question on everyone’s mind: “What exactly are the situations where IRAS has clawed back ABSD for properties that are held in a 99-to-1 shareholding arrangement?”

Can you explain what 99-to-1 shareholding arrangements are?

Eugene (E): So, before we dive into exactly what 99-to-1 shareholding arrangements are, we must first talk about property co-ownership in Singapore.

Essentially, there are two ways that property can be held. The first is joint tenancy, whereby both parties co-own a property equally – there are no distinct shares. Joint tenancy is common amongst parties who are family or between husbands and wives.

The other form of co-ownership is tenancy-in-common. Under such arrangements, each co-owner holds a prescribed number of shares in the property. In a straightforward scenario, this proportion can be equal, whereby Party A holds 50% of the property and B holds the other 50%.

However, it’s up to the owners to decide how they’d want to split the shares in a tenancy-in-common arrangement, whether it’s by a 50:50 ratio, or 99:1.

Nicholas (N): So, the bottom line that we want to highlight here is that co-owning a property in any proportion – even in a 99-to-1 structure – under tenancy-in-common isn’t illegal.

You can think of tenancy-in-common as being like a commercial joint venture, but for residential property. Each owner holds a proportionate share, often based on their financial contribution.

It’s just like partners in a business where each person’s share is separate and distinct, and they are each entitled to make independent decisions about their assets.

For example, under tenancy-in-common, each co-owner is free to pass on their share of the property to chosen beneficiaries. This is unlike joint tenancy where property ownership automatically vests in the surviving co-owner when one of them passes away.

If 99-to-1 shareholding arrangements aren’t illegal, why then did the authorities classify some cases as tax avoidance?

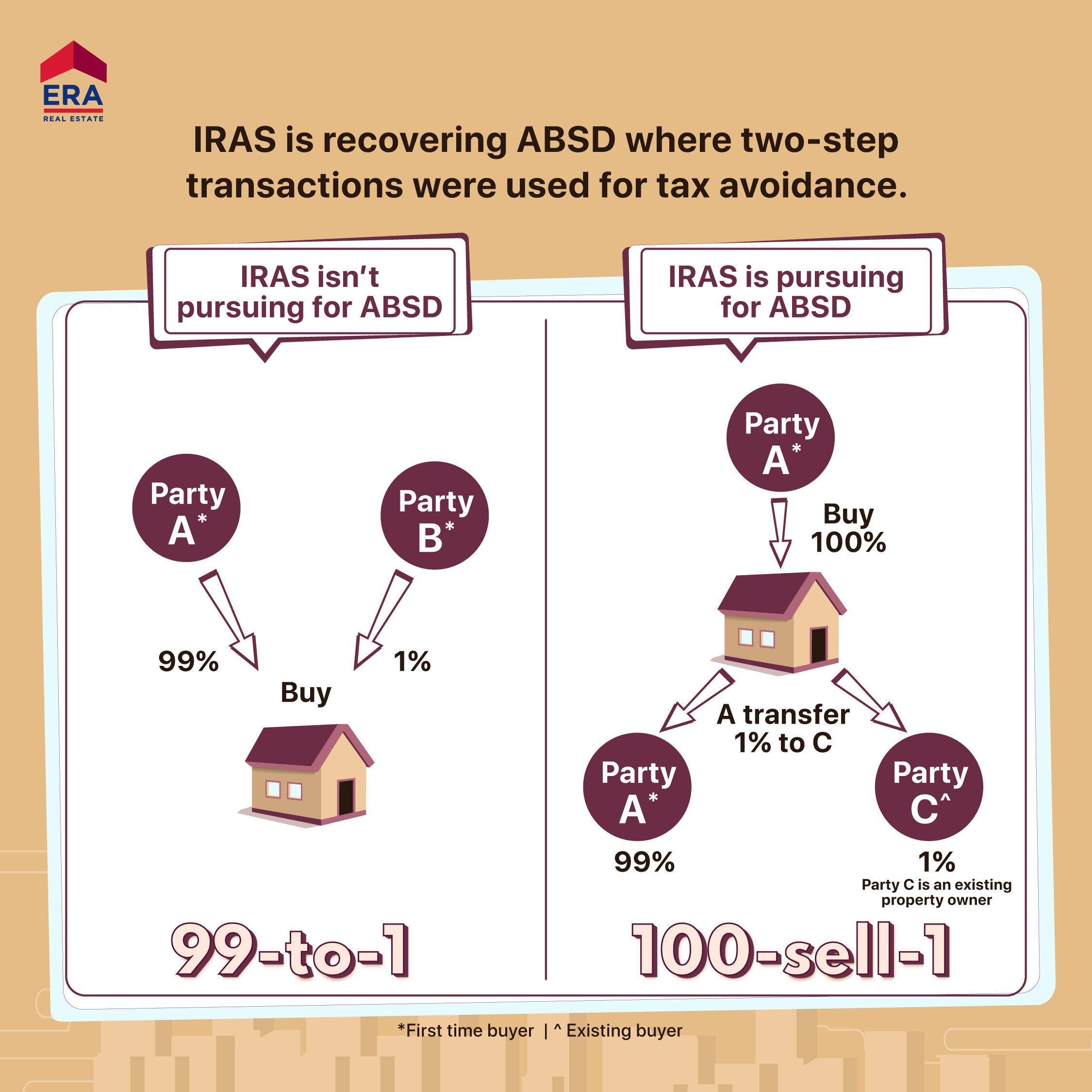

N: The type of cases that IRAS has cracked down on are ‘two-step’ transactions that are structured to avoid ABSD.

‘Two-step’ transactions work by splitting up a single purchase into two (or more) steps to reduce the amount of ABSD paid, and they involve at least one co-owner who already owns and/or has a stake in another residential property.

For instance, instead of purchasing a new house as co-owners from the outset, Party A buys 100% of the property as a first-timer, after which they will sell 1% of their share to Party B – who is an existing property owner – within a very short period.

In doing so, Party B avoids paying ABSD on the full purchase price of the new property. Instead, they pay ABSD only on the 1% share which was transferred.

E: That’s exactly how the ABSD loophole works. Considering this explanation, perhaps it’s more accurate to describe such two-step purchases as ‘100-sell-1,’ as opposed to the ’99-to-1′ phrase often used by the media to refer to schemes that exploit the ABSD loophole.

That’s because ‘100-sell-1’ more correctly illustrates the exact method that exploits the ABSD loophole, whereas ’99-to-1’ is potentially misleading since it conveys the wrong impression that all 99-to-1 holding arrangements are illegitimate.

Are there any legally valid uses of 99-to-1 shareholding arrangements?

N: Broadly speaking, there are three legitimate commercial reasons for holding a property in a designated ownership split, regardless by a 99:1 proportion or any other ratio.

The first reason would be to ensure fairness when a property is co-owned under tenancy-in-common from the start, allowing each co-owner to own a share of the property proportionate to the amount that they invested.

Second, would be to maximise loan eligibility. Using the example of Party A and B again, if Party A were to purchase a property by themselves, their loan eligibility will be evaluated solely based on Party A’s income.

However, with co-ownership, both owners’ incomes will be assessed, allowing them to secure a bigger loan while also reducing the amount of cash needed for their downpayment.

Finally, the third legitimate use of co-ownership is for future planning. If co-owners – such as married couples – wish to expand their property portfolio, they’ll be able to exit their first property more easily with a 99:1 arrangement.

This exit process is sometimes referred to as decoupling, and it usually starts off when the co-owner with a minority stake in the property transfers his share to the majority co-owner. As a result, the minority co-owner is no longer a property owner at the point that they purchase a new property, allowing them to be treated similarly as a first-time homebuyer.

I’d also want to highlight that even though decoupling makes use of the 99-to-1 shareholding structure, it’s also quite different from the ‘100-sell-1′ scheme.

For decoupling, both co-buyers don’t own any other property when purchasing their first home in a shareholding structure. In other words, they won’t have any ABSD obligations in the first place.

Furthermore, decoupling involves purchasing a property jointly with a predetermined shareholding structure from the beginning, meaning that there isn’t a second step where a minority stake is sold soon after the purchase.

Considering the recent scrutiny by IRAS, how should homebuyers approach 99-to-1 shareholding arrangements going forward?

N: It goes without saying, but homebuyers should exercise extreme caution before engaging in any 100-sell-1 arrangements going forward.

As of May 2024, the Government has made its stance clear on disregarding two-step transactions with 99-to-1 ownership structures as it will be clawing back approximately S$60 million from cases that constitute tax avoidance.

Furthermore, IRAS has also announced that it will be implementing a 50 per cent surcharge that’ll be applied on the payable ABSD amount.

E: Hence, if you’re considering buying a property using any shareholding structures, it’s important that you must consult with a qualified tax advisor or legal professional before you proceed with the transaction. Doing so will give you a better understanding of ABSD laws, and possibly save you from potential pitfalls.

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.

By and large, February has been an eventful month for the local housing market and Singaporeans in general.

Headlining the news was an increase in rental demand, as well as the latest changes in housing policies that were announced by Deputy Prime Minister and Finance Minister Lawrence Wong during Singapore Budget 2023. Also, of note are expectations that Chinese buyers are returning to the local market.

What do these happenings bode for Singapore’s real estate scene moving forward? For answers, insights, and more, read on for a lookback at February 2023 with ERA senior management team member Eugene Lim (Key Executive Officer)!

What are your takes on the new property-related policies announced during Budget 2023?

Eugene: I think Singaporeans, especially new homeowners, will be happy about some of the new policies as they’ll end up benefitting from the changes.

During his Budget 2023 speech, Minister Lawrence Wong announced that the maximum CPF housing grant amounts would be increased for both first-timer families and singles who are buying a resale HDB flat.

With this adjustment, first-timer families can now receive up to $190,000 in CPF grants. First-timer singles, on the other hand, will get up to half the housing grants that families can receive.

Generally speaking, many first-timers will tend to favour buying a BTO flat over a resale flat due to factors like purchasing power and the lower quantum involved. So, for the man on the street, these changes will mean having a broader range of housing choices beyond BTOs.

Or in other words, with the additional support, more first-timers will have a better chance of affording a resale HDB flat. This can be advantageous for certain consumer segments, such as buyers who prefer to live in specific estates to look after their aged parents or individuals who have more urgent housing needs and are unable to bear out the waiting time of 4 to 5 years for a BTO flat.

On that note, Minister Wong also mentioned in his speech that “construction activities are back in full swing”. I believe that this too is a good sign for first-time homebuyers. A recovering construction industry is likely to translate into shorter waiting times for BTO flats as well as a bigger housing supply down the road.

Talking about Budget 2023 announcements, buyers-to-be are probably going to be concerned about the changes related to the Buyer’s Stamp Duty (BSD). Those who have been paying attention to the news are probably aware that the BSD has been raised for both residential and non-residential properties.

Before the Budget 2023 announcement, residential properties were taxed at a rate of 4% beyond $1M of their value, but that has since increased to 5% beyond $1.5M and 6% beyond $3M from 15 Feb 2023 onwards.

As for non-residential or commercial properties, the BSD rate was increased by 1 percentage point, from 3% to 4% on the value of a property above $1M and up to $1.5M. Any value exceeding the $1.5M point will be taxed at a rate of 5% from now onwards.

At first glance, these new BSD rates may come across as alarming, but when looked at in perspective, it’s unlikely that they’ll cause that much of a shift in market sentiments.

For example, if you were buying a resale HDB flat, or say, a studio apartment that’s under $1.5M, there’s no change to the amount of BSD that you’ve to pay. And even if you’ve bought a condo, if it’s not more than $2M, you’ll only have to pay $5,000 more, which is about a 0.3% increase on the property’s price.

So, will this change deter homebuyers in Singapore much? I think not, especially if they’ve a genuine need for housing or have clear intentions to invest.

Furthermore, considering that the revised BSD tax rates are scaled by property values, and also how the impact is felt more strongly at the higher tiers, one can possibly interpret this change as the Government’s effort to create a more progressive tax regime on wealth, rather than a cooling effect.

Do you have any observations to share about the current trend of rising rents in Singapore?

Eugene: One of the biggest real estate-related stories to make news since the start of this year is the trend of rising rents. Or to put it in another way, it’s undeniably a landlord’s market right now.

If we were to look at official data from HDB for Q4 2021 and Q4 2022, we’ll immediately see that median rents for 3-, 4-, and 5-room flats have risen markedly year on year in almost every town.

Median rents for 3-, 4-, and 5-room HDB flats by town (Q4 2021, Q4 2022)

| Towns | 3-room (Q4 2021) |

3-room (Q4 2022) |

4-room (Q4 2021) |

4-room (Q4 2022) |

5-room (Q4 2021) |

5-room (Q4 2022) |

| Ang Mo Kio | $1,900 | $2,300 | $2,300 | $2,900 | $2,600 | $3,150 |

| Bedok | $1,900 | $2,300 | $2,250 | $2,800 | $2,480 | $3,000 |

| Bishan | $2,100 | $2,600 | $2,400 | $3,200 | $2,650 | $3,550 |

| Bukit Batok | $1,800 | $2,200 | $2,100 | $2,650 | $2,250 | $3,200 |

| Bukit Merah | $2,000 | $2,600 | $2,670 | $3,500 | $3,000 | $3,800 |

| Bukit Panjang | $1,600 | $2,700 | $2,000 | $2,850 | $2,200 | $3,000 |

| Central | $2,300 | $2,800 | $2,800 | $3,850 | * | * |

| Choa Chu Kang | * | $2,800 | $2,000 | $2,800 | $2,100 | $3,000 |

| Clementi | $2,000 | $2,500 | $2,550 | $3,200 | $2,600 | $3,400 |

| Geylang | $1,900 | $2,350 | $2,400 | $3,000 | $2,600 | * |

| Hougang | $1,800 | $2,300 | $2,150 | $2,750 | $2,250 | $2,700 |

| Jurong East | $1,800 | $2,500 | $2,200 | $2,900 | $2,400 | $3,100 |

| Jurong West | $1,800 | $2,200 | $2,200 | $2,900 | $2,300 | $3,030 |

| Kallang/ Whampoa | $2,000 | $2,450 | $2,550 | $3,100 | $2,800 | $3,700 |

| Marine Parade | $2,000 | $2,400 | $2,480 | $3,350 | * | * |

| Pasir Ris | * | * | $2,100 | $2,700 | $2,200 | $3,000 |

| Punggol | * | $2,850 | $2,100 | $3,000 | $2,100 | $3,100 |

| Queenstown | $2,100 | $2,730 | $2,730 | $3,600 | $3,000 | $4,200 |

| Sembawang | * | * | $2,000 | $3,000 | $2,050 | $2,870 |

| Sengkang | $1,830 | $2,550 | $2,100 | $3,000 | $2,200 | $3,100 |

| Serangoon | $1,900 | $2,500 | $2,300 | $3,200 | $2,500 | $2,800 |

| Tampines | $1,850 | $2,500 | $2,200 | $2,800 | $2,400 | $3,200 |

| Toa Payoh | $2,000 | $2,400 | $2,500 | $3,450 | $2,600 | $3,200 |

| Woodlands | $1,800 | $2,200 | $2,000 | $2,650 | $2,100 | $3,100 |

| Yishun | $1,800 | $2,400 | $2,000 | $2,800 | $2,200 | $3,150 |

Source: HDB

(* denotes cases where the median rent isn’t shown due to undersized populations i.e. <20 transactions.)

In some parts of Singapore, such as the Central area, the year-on-year increase in median rent for 4-room flats was as much as $1,050 or 37.5%.

Outside of the Core Central Region, median HDB rents have grown significantly in neighbourhoods such as Bedok and Tampines. For instance, based on official HDB figures for Q4 2021 and Q4 2022, median rents for 4-room flats in Bedok and Tampines had risen by 24.4% ($2,250 to $2,800) and 27.3% ($2,200 to $2,800) respectively.

Median rents ($PSF) for non-landed private residential properties, excluding ECs (Jan 2022 to Jan 2023

Source: URA

Likewise, between January 2022 to the start of 2023, a similar trend of rent growth was observed for private residential properties in Singapore.

Nationwide data from the Urban Redevelopment Authority (URA) reflect a year-on-year hike in median PSF rental cost from $3.72 PSF to $4.90 PSF, which translates into a 31.7% increase.

The present market appetite for rentals is the result of various factors; these range from the cumulative knock-on effect of COVID-19 construction delays to last year’s cooling measures, which brought about increased rental demand because of the 15-month wait out period imposed on private property downgraders. But in the end, it all comes down to supply and demand.

The public housing market will see over 20,000 HDB flats being completed in 2023 – the highest number in the past 5 years. Where the private residential market is concerned, there’ll also likely be an increase in supply in 2023 as URA estimates that 17,394 units will be completed this year. Thus, is there a chance that pressure on the rental market will ease? It’s possible.

With more Chinese property buyers returning to Singapore, what can we expect?

Eugene: It’s no secret that the Chinese are one of the largest, if not the biggest, group of foreigners buying real estate in Singapore. This popularity can be largely attributed to Singapore’s reputation as a “safe harbour” for wealthy mainlanders as well as their money.

Although there was a drop in the number of Chinese buyers at the beginning of the COVID-19 pandemic, Singapore’s property market has since felt their return. As it stands, the number of transactions made by Chinese buyers last year exceeds that of pre-pandemic levels.

Source: URA, ERA Research and Market Intelligence

In 2022 alone, Chinese mainlanders bought 1,479 residential properties, more than 2019 and 2020, which saw 1,248 and 1,150 transactions respectively. It’s possible that we could see higher, or at the minimum, similar transaction numbers in 2023 as COVID-19 travel restrictions are loosened domestically and in China.

Source: URA, ERA Research and Market Intelligence

With a new wave of Chinese buyers entering Singapore’s property market this year, what we might also see is an uptick in buyer activity in the Outside Central Region (OCR) and Rest of Central Region (RCR).

That may be the case given that in 2022, Chinese buyers made more property purchases in the OCR and RCR compared to the Core Central Region (CCR) where the majority of premium properties are located.

Hence, given the current state of population movements and purchase patterns of Chinese buyers, it would be wise for property investors and realtors to keep a watch on new launches occurring in the OCR and RCR, especially if they wish to capitalise on potential future trends.

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.

Though 2022 has come and gone, its events continue to bear weight today. For instance, the Goods and Services Tax (GST) rate hike was announced during last year’s Budget Speech, only to kick in on the first day of the new year.

This news about the GST increase from 7% to 8% on 1 Jan 2023 – and eventually, to 9% from 1 Jan 2024 onwards – saw Singaporeans finding ways to lighten the combined load of rising inflation as well as the increased cost of consumption.

While some went on a shopping spree at the turn of the year, others made the most of discounts offered by both online and physical retailers.

Which brings us to the question, with regards to the GST hike, what should Singapore property owners and buyers take note of? The facts are as follows.

1. The sale or lease of residential properties isn’t subject to GST

If you’re an interested homebuyer and/or property investor who is keen on purchasing a new dwelling in 2023, good news!

Despite the increase in the GST rate, making an addition to your real estate portfolio still won’t incur any GST on your part – but only provided that the property you’ve bought is for residential use.

As outlined within the Inland Revenue Authority of Singapore’s (IRAS) webpage pertaining to GST and real estate, the buying of either vacant residential land, residential buildings, flats, or tenements is exempt from Singapore’s (currently) 8% tax on domestic consumption.

Or put even more precisely by IRAS, what counts as a residential property includes the following:

- Houses in which people live in (e.g. bungalows)

- Workers’ quarters

- Halls of residence (i.e., student dormitories)

- Serviced apartments

- Upper floors of shophouses approved as living quarters

Additionally, homeowners renting out their dwellings for passive income will be pleased to know that the lease of residential properties is also exempt from GST.

On a related note, however, lessors should also be aware that earnings received from such leasing and/or subletting arrangements may still be subject to income tax.

2. GST will be accounted for the rental of movable furnishings and fittings

Given that the sale and rental of bare residential properties aren’t subject to GST, it stands to reason that the same ruling applies to the items contained within said dwellings, yes? Well, not so fast, because the answer isn’t what you’d expect.

Hike or no hike, per existing rules set by IRAS, GST will still be incurred on any movable furnishings and fittings supplied within a residential property that has been sold or rented out by a GST-registered owner.

So, for instance, if the upper floor of a shophouse that’s approved for residential use is leased out with a refrigerator, washing machine, and dryer, GST has to be charged on all of the aforementioned items, provided its lessor is authorised to include GST into the prices of its products and/or services.

Conversely, items within the same residential shophouse floor that can’t be moved are GST-exempt; some examples include permanent fixtures like cabinets and wardrobes, wall-mounted air conditioning units, as well as sanitaryware.

3. Which GST rate to use depends on when payment is made

Considering the new GST rate of 8% has already kicked in, one interesting fact to know is that it doesn’t apply retroactively. Which is to say: payments made before 1 Jan 2023 for transactions that are billed in phases will still adhere to the previous rate of 7%.

According to IRAS, this is generally the case for applicable goods and services provided by GST-registered businesses “where one or more or more of the following events takes place wholly or partially on/after 1 Jan 2023”.

Said events include 1) the issuance of an invoice, 2) the receipt of payment, and 3) the delivery of goods or performance of services.

In the context of real estate, this matters for the sale or lease of non-residential properties, both of which are activities that are subject to GST.

Let’s say you bought a coffeeshop where the option to purchase was exercised before 1 Jan 2023, but the date of completion is after 1 Jan 2023; the old GST rate (i.e., 7%) applies to the option money paid, whereas the new GST rate (i.e., 8%) takes effect only for all payments made after the rate change date. So, take note!

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salespersons accept no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.

Where things stand currently at the starting line of 2023, global economies – including Singapore’s – will likely continue to be occupied with three issues from 2022, namely rising interest rates (and by association, inflation as well as recession), the Russo-Ukrainian war, and not least, the still-lingering shadow of COVID-19.

The question connecting these issues is a million-dollar one: In what ways could they persist, and possibly, affect the outlook for Singapore’s property market in the coming months?

For context and insights, join us as we take a quick lookback at yesteryear’s events and their continued effects with ERA Key Executive Officer Eugene Lim.

What are your thoughts about rising interest rates, inflation, and the likelihood of a recession happening?

Eugene: Since 2019 and across the past 3 years, local banks have been gradually replacing the Singapore Interbank Offered Rate (SIBOR) and Singapore Dollar Swap Offer Rate (SOR) with Singapore Overnight Rate Average (SORA) as the main interest rate benchmark in Singapore.

During this same period, we’ve seen the 3-month SORA rise by over two-fold. Looking at historical data from the Money Authority of Singapore (MAS), we can see that the 3-month compounded SORA was approximately 1.46% p.a. on 4 Jan 2019, and as of 27 Dec 2022, it’s now at 3.14% p.a.

Source: Monetary Authority of Singapore (MAS)

If we were to look at the SORA changes through the lens of a 1-year period, this trend of rising interest rates is even more apparent. On 4 Jan 2022, the 3-month compounded SORA was roughly 0.19% p.a., so the present rate of about 3.14% p.a. represents an increase of about 3-percentage points over the past year.

Based on these trends and the expectation that we won’t be returning to near-zero interest rates any time soon, my personal advice to homeowners – especially first-time buyers and HDB upgraders – is to be prudent with financial leverage as well as the expenditure of their disposable income.

Homeowners may possibly want to take up fixed-rate home loan packages as well in order to hedge against any future hikes in interest rates.

Also, come 1Q 2023, we’ll be debuting ‘Tools’, a new feature in SALES+, our all-in-one property agent app; one of its functions will allow trusted ERA realtors to assist their clients with evaluating mortgage packages from different banks. Check it out when it’s released!

Generally speaking, a rising interest environment isn’t all a bad thing for local consumers. Yes, it’s true that the cost of borrowing goes up for them, but at the same time, it means they will see better yields on their savings as well.

In Singapore, retail financial institutions are now offering higher returns on their fixed deposit and savings accounts, and the response has been unsurprisingly positive.

However, when looking at the big picture of the world economy, our attention comes back to inflation. The present uptick in local interest rates can be traced back to ongoing efforts by the U.S. Federal Bank to curb domestic inflation and bring it down to their target rate of 2%.

Just recently on 14 Dec, the Federal Reserve raised its benchmark interest rates for what counts as the seventh consecutive time for 2022. So, with that news comes the question: Will there be a “soft landing”?

Or in other words, is it possible to lower inflation without slowing down economic activity too much and triggering a recession? The answer, together with the effects on homebuyer affordability and property investment demand, will be apparent in 2023.

Though it’s still early days, the general consensus among analysts is that Singapore could see a slowdown in economic growth, but may avoid a full-blown recession. Because of that, we can reasonably expect activity in the Singapore primary and resale property markets to remain stable next year too.

Will the continuation of the Russo-Ukrainian war affect Singapore’s property market in 2023?

Eugene: Singapore doesn’t import many essential goods from Russia and Ukraine, so the ripple effects from the conflict have mostly been felt here as inflationary cost pressures. Take for example, rising energy prices.

After the war started in Feb 2022, Brent Crude oil (a global benchmark for oil prices) saw a series of spikes, with the cost of a barrel of oil surging to as high as US$126 in Mar 2022 on fears of Russian oil sanctions.

Combined with supply chain disruptions of essential materials, like steel, and labour crunches, Singapore’s construction industry ended up facing severe challenges on cost and manpower in 2022.

The good news, thankfully, is that these issues appear to be easing as we head into the opening months of 2023 – and with enough luck, the steady output of new homes will be able to satisfy rising appetites for residential properties in Singapore.

If the Russo-Ukrainian conflict were to worsen in 2023, both the construction industry and residential property market in Singapore will likely continue to face inflationary pressures due to higher costs of production.

But even if this happens, I believe that local demand for housing in 2023 will not be dampened much by the spill-over effects and/or repercussions.

Traditionally, Singaporeans of all ages, including youths, have prioritised home ownership as one of their main life goals and this deeply-held culture has resulted in a high home ownership rate that’s one of the highest in the world.

Based on the latest figures available from the Department of Statistics Singapore, the home ownership rate in Singapore currently stands at 88.9%, up from 87.9% from the previous data period.

So, returning to the original question of “Will the continuation of the Russo-Ukrainian war affect Singapore’s property market in 2023?”

My answer is both yes and no. Yes, because on the supply side it could drive building costs upwards, and no, because the need for housing amongst locals is very much real – which we’ll likely see proof of in the form of strong market demand by consumers, plus continued property price appreciation next year.

What do the lingering effects of COVID-19 bode for Singapore’s real estate market in 2023?

Eugene: Even though it’s been nearly 4 years, COVID-19 is still a key global event that deserves to be talked about, but no longer for the same pessimistic reasons as before.

Now, more countries are loosening their travel restrictions, including China, which had locked down its cities during much of the pandemic due to its COVID-zero policy. Just as how this change in winds is likely to have a positive effect on the Singapore’s own tourism and retail sectors, it’s likely to prove beneficial for certain segments of the local property market as well.

Source: URA and ERA Research & Consultancy

For instance, with more foreigners entering the country for work and study purposes, we forecast that private home rental volumes will rise in tune with an estimated 93,000 contracts being signed in 2023.

Source: URA and ERA Research & Consultancy

Also, with Singapore’s rental market heating up due to rising demand, it’s likely that the HDB resale market will remain active next year, especially when the waiting time for BTO flats in 2023 are expected to be longer than the usual 3-year waiting time before the pandemic.

So, in short, if you’re a property investor and/or seller, it looks like 2023 is going to be an opportune time to reap benefits from your real estate assets – either in the form of passive income or proceeds earned from a profitable sale!

Need help navigating Singapore’s property market in 2023?

Whether you’re buying, selling, or renting properties, ERA is here for you.

As a global real estate brand that’s trusted by generations, our team of over 8,000 reliable advisors is always at the ready to guide you on your journey towards property ownership in Singapore.

We also offer access to a host of consumer-friendly content, ranging from regular online talk shows, to property expos – and even a Millionaire Investor Masterclass where you get to learn directly from our eminent industry experts.

To stay updated on all things property, follow us on ERA’s official Facebook, Instagram, and LinkedIn accounts!

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.

Those who have been paying attention to recent Government Land Sales (GLS) will be aware that tenders for two sites – namely Dunman Road and Pine Grove – were recently awarded by Urban Redevelopment Authority (URA) to developers on 14 June 2022.

The tender for the Dunman Road site attracted a total of 2 bids, with Sing-Haiyi Jade putting in the winning bid of $1,283,888,998 (or $1,350.50 psf ppr).

On the other hand, the GLS site tender at Pine Grove (Land Parcel A) drew 5 bids. The top bid, which was jointly submitted by UOL Group and Singapore Land Group, amounted to $671,500,800 (or $1,318.27 psf ppr).

Considering the recency of this news, it is still early days to tell what plans both developers have in store for the newest additions to their land banks, but educated guesses can be made about the effects that these purchases might have on the real estate market.

Key characteristics of the Dunman Road GLS site

Key characteristics of the Dunman Road GLS site

Spanning 25,234.3 sqm, the Dunman Road GLS site is expected to yield about 1,040 residential units; a future condominium development here is also likely to attract strong demand from homebuyers due to its proximity to nearby amenities.

What’s appealing about the Dunman Road GLS site:

- Near to Dakota MRT station, which is only 100m away.

- Close to reputable schools: Chung Cheng High School (Main) and Tanjong Katong Girls School.

- Few minutes’ walk to Old Airport Road Food Centre as well as Kallang East Fresh Market & Food Centre

Key characteristics of the Pine Grove GLS site

Located along Ulu Pandan Road, the Pine Grove GLS site (Land Parcel A) has an area size of 22,534.7 sqm and it is expected to yield an estimated 520 residential units.

What’s appealing about the Pine Grove GLS site:

-

- Within 1 km of Henry Park Primary School.

- Short drive away from Dover/Kent Ridge educational cluster, consisting Singapore Polytechnic and NUS.

- Within travelling distance of Clementi Avenue 2 Market & Food Centre.

What effects could the Dunman Road and Pine Grove GLS tenders have on the neighbourhood?

1. A possible revival in en bloc interest amongst owners of older condominiums at Pine Grove

Back in 2017, residents at Ridgewood Condo (an older development close to the Pine Grove site) had mulled an en bloc sale, which would have netted apartment owners about $2 million each and townhouse owners about $3 – $4 million.

Likewise, in 2019, owners at Pine Grove – yet another older condominium in the vicinity of the Pine Road GLS site – went up for collective sale with an asking price of $1.86 billion.

Consequently, with the top bid for the Pine Grove GLS site setting a new benchmark land price in the neighbourhood, this could encourage pro-en bloc sale owners to restart their efforts for a collective sale exercise.

2. Homebuyers can expect a benchmark price of $2,200 – $2,400 psf for future condominiums in the area

The resulting land rates from the two GLS site tenders strongly suggest that the launch prices of future condominiums in the Rest of the Central Region (RCR) could end up varying between $2,200 to $2,400 psf.

Median transacted prices for new condominium projects in the RCR

| Residential Project Name | Road Name | District | No. of units in development | Median price ($psf) |

| CanningHill Piers | Clarke Quay | 6 | 696 | $2,876 |

| Bartley Vue | Jalan Bunga Rampai | 19 | 115 | $1,922 |

| One-North Eden | Slim Barracks Rise | 5 | 165 | $2,012 |

| Liv @MB | Arthur Road | 15 | 298 | $2,402 |

| Piccadilly Grand | Northumberland Road | 8 | 407 | $2,175 |

(All median prices shown are based on transactions of 99-year leasehold condominiums from January to May 2022)

This estimate bears credence when considering recent median transacted prices of new condominium projects in the RCR, which range from $1,922 psf to $2,876 psf.

So, should homebuyers/home sellers keep a watchful eye on the Dunman Road and Pine Road GLS sites? Most definitely because of upcoming developments, including a possible Cross Island Line interchange in Clementi.

For further insights into the GLS sites at Dunman Road and Pine Road, do also check out the latest commentary by the ERA Research & Consultancy Team.

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.