Senja Close (EC) – Government Land Sale (GLS) Site Analysis

- Egan Mah Jixiang

- 8 min read

- Research

- 27 Mar 2025

The tender for the Government Land Sale (GLS) site at Senja Close closed on 5 August 2025. In total, the site drew interest from five bidders, with the top bid of $352.9 million (or $771 psf ppr) being put in by CDL Constellation Pte. Ltd. (City Developments Limited).

Site Details

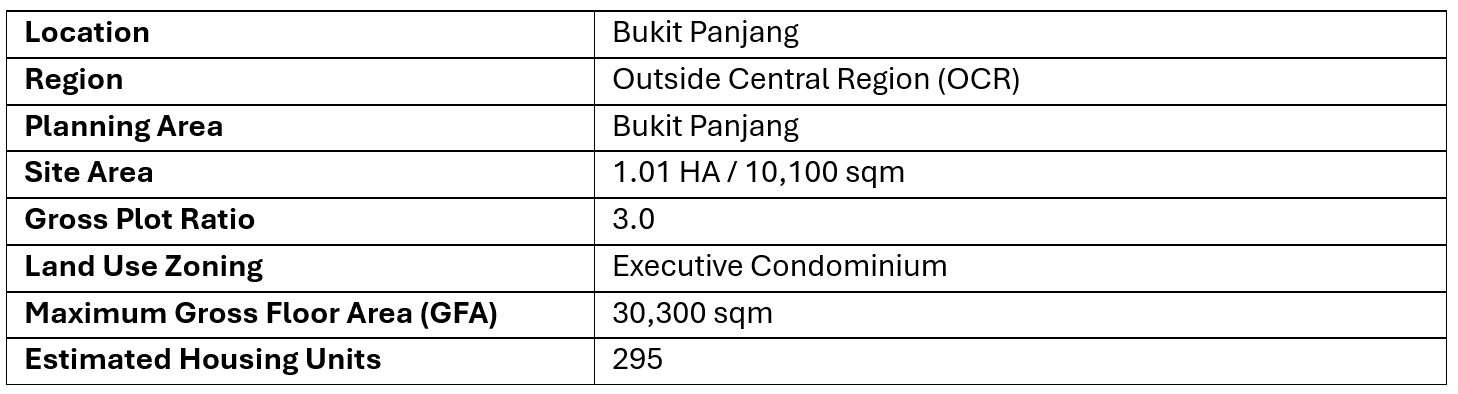

Table 1: Details of Senja Close EC GLS Site

Source: URA

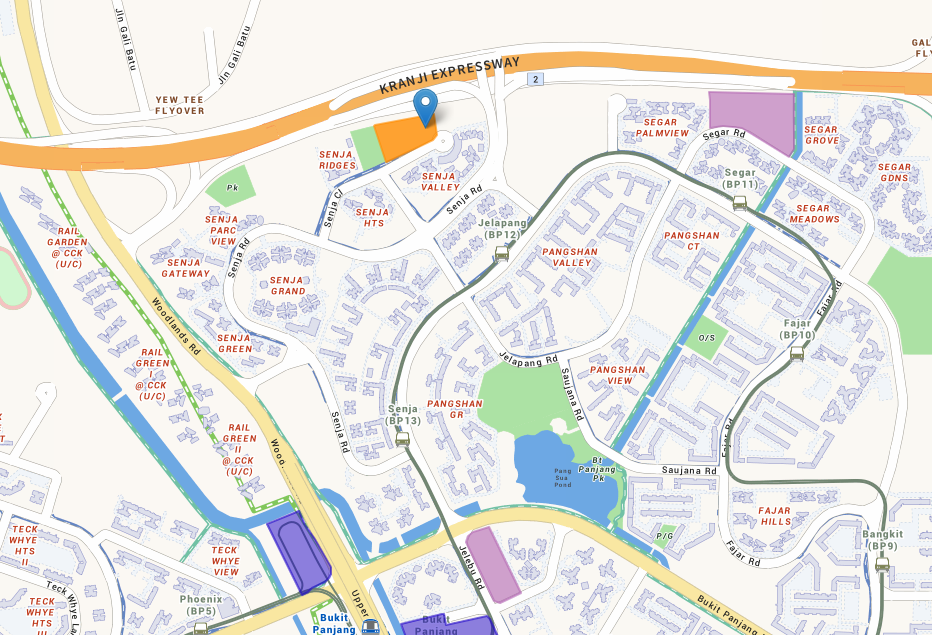

Map of the Senja Close EC site

Source: URA

Locational Attributes

The Senja Close site is within a 10-minute walk to Jelapang LRT station, which is two LRT stops away from Bukit Panjang Station on the Downtown Line (DTL). The DTL connects to Singapore’s downtown and eastern regions. Located a few stops away from Jelapang LRT Station is also Choa Chu Kang MRT and Bus Interchange on the North South Line (NSL).

Major roads and expressways serving the site include the Kranji Expressway (KJE), Woodlands Road, and the Bukit Timah Expressway (BKE). Additionally, Woodlands Regional Centre and the Jurong Lake District are 20 minutes away from the site.

Despite being located within a residential enclave, Senja Close is surrounded by three primary schools, all within a 1km radius. Residents can also experience the convenience of living near a suite of amenities. These include Senja Hawker Centre, Senja Woods (neighbourhood park) and Greenridge shopping centre (neighbourhood mall).

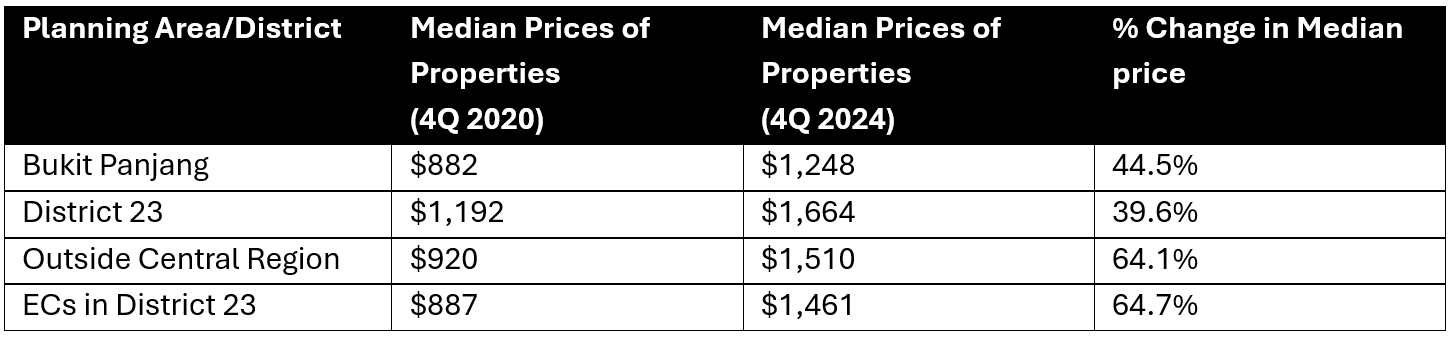

Price and Market Trends

Between 4Q 2020 and 4Q 2024, the median price psf of ECs in Bukit Panjang, District 23, and OCR have increased across the board. Over this period, median prices in Bukit Panjang and District 23 saw a big increase of 44.5% and 64.7% respectively. Additionally, OCR ECs recorded a significant 64.1% jump. For ECs in District 23, median prices have also risen 64.7% from $887 psf in 4Q 2020 to $1,461 psf in 4Q 2024.

Table 2: Prices of All Non-Landed Private Homes in the Vicinity

Source: URA as of 24 February 2024, ERA Research and Market Intelligence

ECs are a popular choice amongst HDB upgraders

ECs have consistently been a popular choice among HDB upgraders. This is due to their more accessible pricing compared to private condos. Last year, new homes sized between 900 to 1,000 sqft in the OCR saw a 42% difference in median prices between ECs ($1.48M) and private condos ($2.10M). This gap highlights the value proposition of ECs, particularly for HDB upgraders who meet the income ceiling of $16K. Hence, buyers, particularly HDB upgraders, see value in ECs.

Apart from commanding lower prices than new private condos in the OCR, homebuyers have the additional flexibility of not needing to dispose of their existing home, prior to purchasing an EC. This is on top of the added benefit of ABSD remission for Singaporean purchasers.

Moreover, EC buyers may opt for the Deferred Payment Scheme (DPS), whereby they will only need to pay a deposit and defer their EC loan till after it has been completed. In this way, the buyers will not need to service two mortgages while waiting for their new home.

With no ABSD payable and the availability of the DPS, HDB owners will find it easier to upgrade to new ECs.

This widespread appeal is reflected by the over-50% take up rates observed at the last four EC launches, including the latest Otto Place in Tengah. These figures could be even higher if not for the second-timer quota of 30% at launch. This is despite Otto Place selling units at its launch at an average of $1,700 psf.

Potential Demand

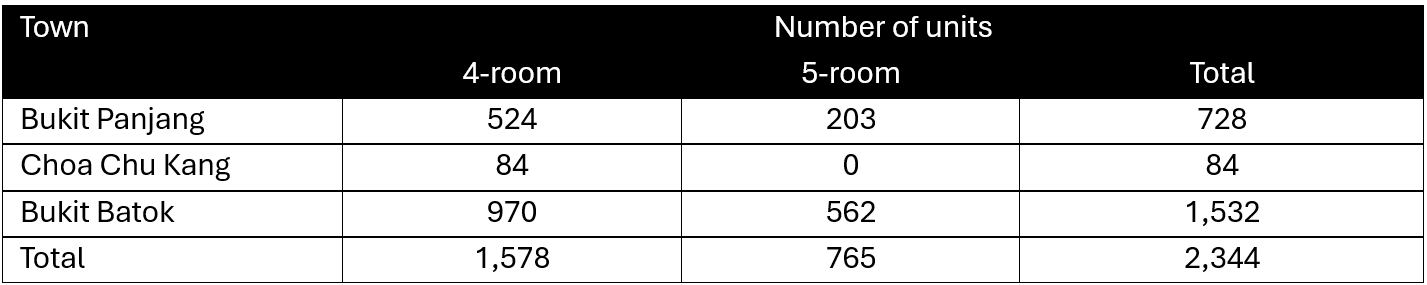

Demand for this site will come from primarily from HDB upgraders living in the western and northern regions of Singapore. Between 2024 and 2027, an estimated number 2,344 flats (4-room and larger) in Bukit Panjang, Choa Chu Kang and Bukit Batok will fulfil their Minimum Occupation Period (MOP).

Given the scarcity of fresh EC supply in the immediate vicinity, we may see competitive bidding activity for this site. Likewise, the presence of an LRT station nearby and amenities like Senja Hawker Centre and Greenridge Shopping Centre could further boost the site’s attractiveness to developers and potential buyers alike.

Currently, the median transaction price of 5-room flats in 2024 at Bukit Panjang, Choa Chu Kang and Bukit Batok are $658,000, $618,000 and $758,500 respectively.

Additionally, this is the third Executive Condominium development in Bukit Panjang, which will further increase demand due to the limited supply of ECs in the Bukit Panjang planning area. This could also fuel buyers’ available cash on-hand, further boosting demand from HDB upgraders.

Table 3: HDB flats reaching MOP between 2024 to 2027

Source: Singstat, ERA Research and Market Intelligence

The last Bukit Panjang EC site tender (now Blossom Residences) dates back to December 2010, resulting in five bidders and a land cost of $271 psf ppr. Furthermore, with Blossom Residences being the last EC launch in Bukit Panjang since 2011, the Senja Close site could see some pent-up demand from HDB upgraders in the vicinity.

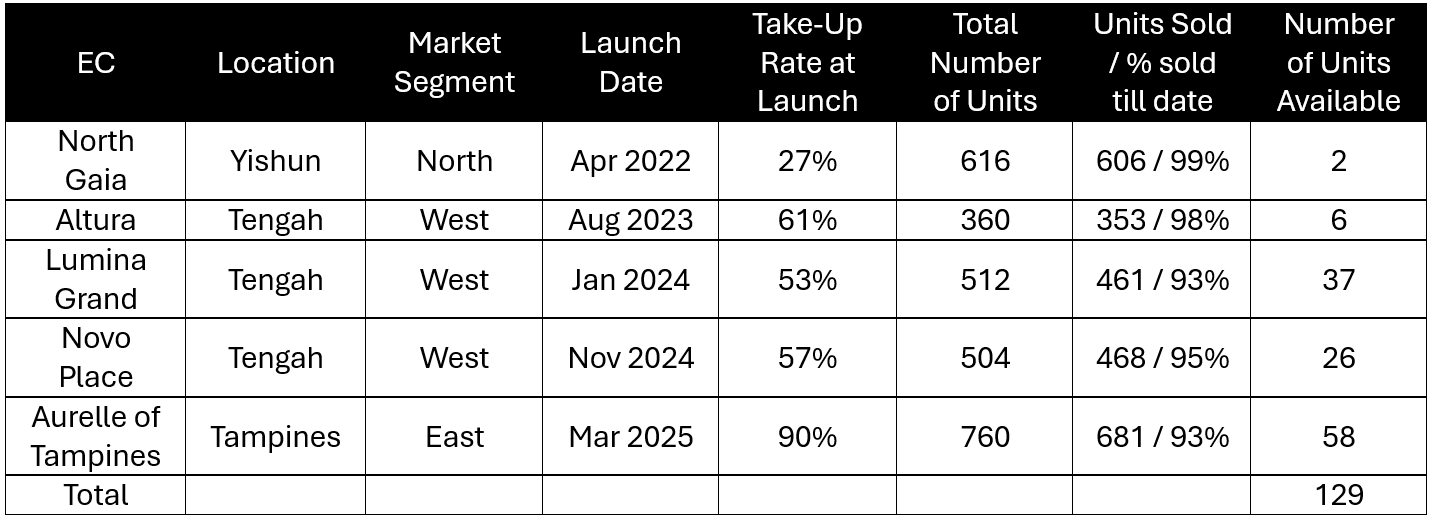

Shortage of New ECs

As of 27 March 2025, the current supply of new EC homes is fairly limited, with fewer than 130 units available across five projects island wide. Though there are another two projects at Plantation Close and Jalan Loyang Besar slated to be launched this year, this incoming supply might still fall short of demand.

Table 4: New ECs available

Source: ERApro as of 27 Mar 2025, ERA Research and Market Intelligence

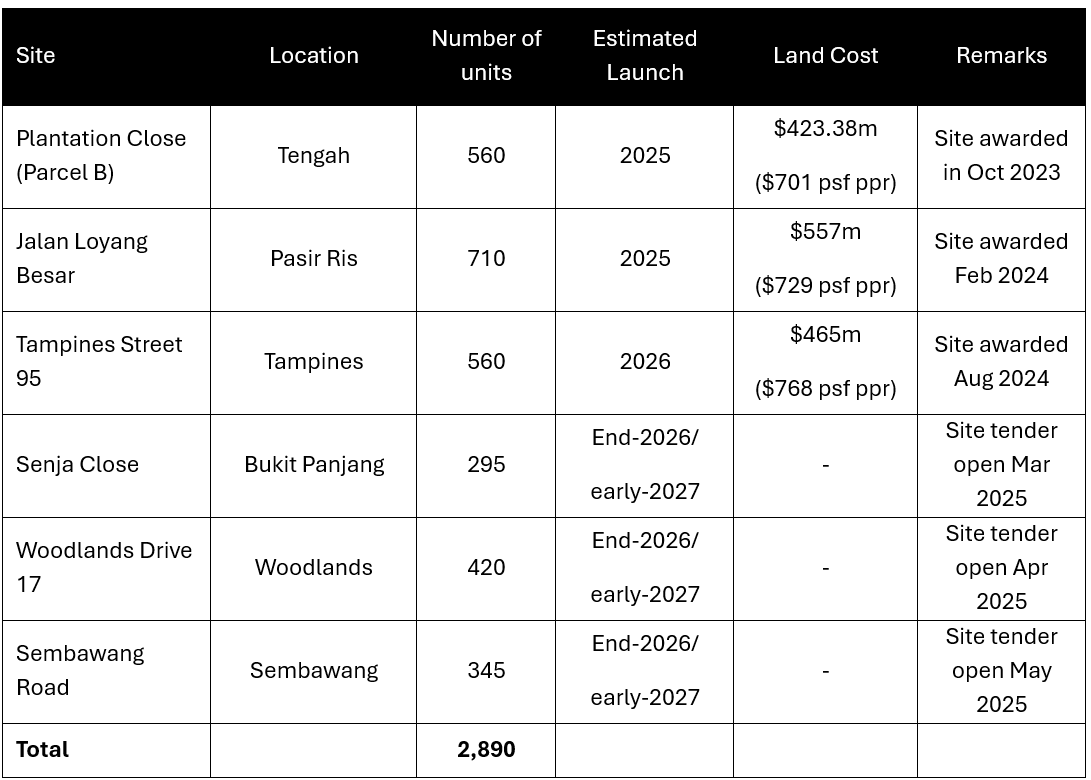

There is also a low EC supply in the pipeline. In the West, all existing new ECs are located in Tengah, which is a new estate. For those looking to stay in an estate with amenities and a transport network that is already established, they will look to this site. Moreover, the only other future launch in the West is the 560-unit Plantation Close (Parcel B) development is available.

Table 5: EC units in the pipeline

Source: URA, ERA Research and Market Intelligence

Developers have to be cautious because of buyers’ affordability

Due to the income ceiling of $16,000, as well as the Mortgage Servicing Ratio (MSR) and Total Debt Servicing Ratio (TDSR), the maximum loan a buyer can borrow is approximately $1.01 million. Amid rising EC prices, and a cap in loan quantum, EC buyers will now have to satisfy a larger initial cash outlay.

This may potentially deter upgraders to enter the EC market, instead opting for full private condominiums. Although they come with a higher price tag, buyers may only need to put a lower down payment. Moreover, they can take a larger loan as private properties are only subjected to only the TDSR, and not the MSR.

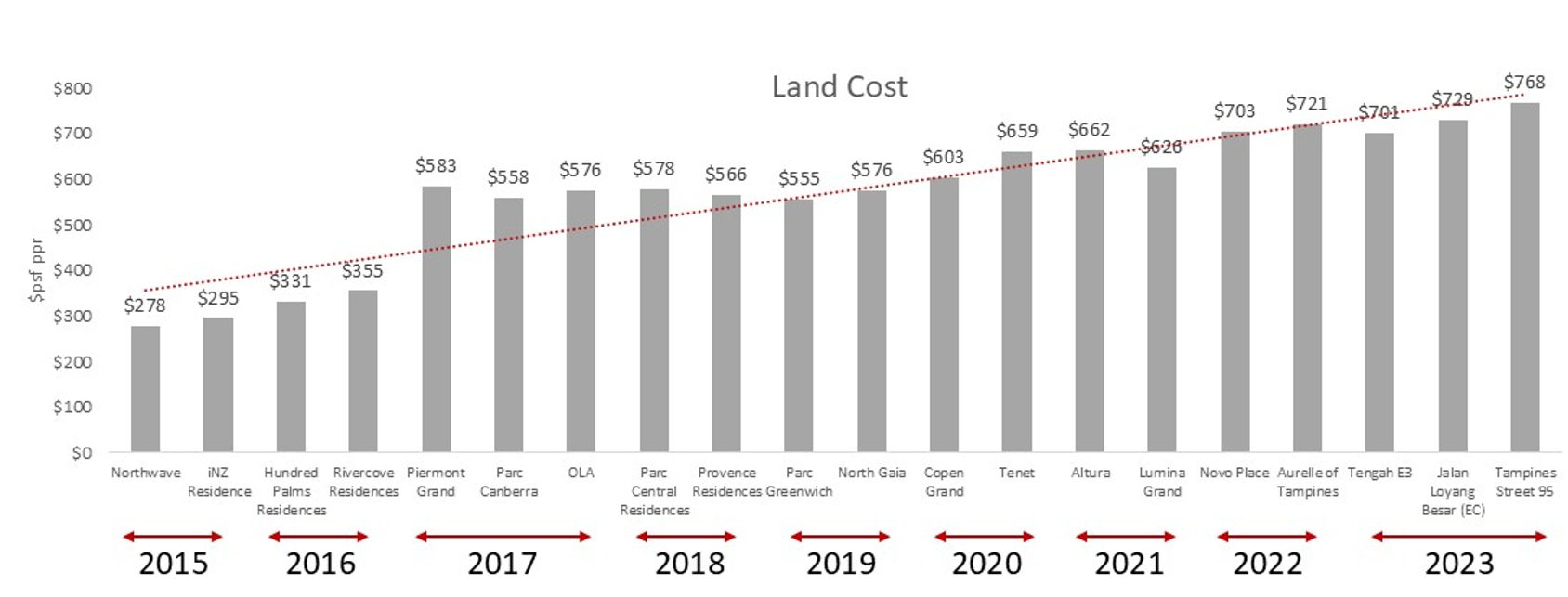

Rising EC Land Cost

The continued strong demand for new ECs has resulted in developers increasingly aggressive bidding strategy. Between 2015 and 2024, the average EC land costs have risen 164%, from $287 psf ppr to $733 psf ppr. To illustrate a more recent example, the Tengah Garden Walk EC site, subsequently launched as Copen Grand, was awarded to a joint venture between City Development Group and MCL Land, at $603 per square foot per plot ratio (psr ppr) in 2021.

As such, we could see new benchmark prices for ECs. Prices will be a far cry from the last EC sold in Bukit Panjang at Segar Road. In 2010, the site was awarded for just $271 psf ppr.

Chart 1: Land cost of ECs since 2015

Source: URA, HDB, ERA Research and Market Intelligence

Conclusion

Developers could show moderate interest in this Senja Close EC site, given limited competition due to the scarcity of fresh EC supply in the immediate vicinity. ECs also present less risk than other private sites, with a lower upfront cost and strong buyers’ demand. Developers could also take cues from the overwhelming demand at Otto Place’s launch weekend and submit bid prices accordingly.

In view of the healthy EC demand, the government has committed to releasing two EC sites for sale in 2H 2025 in Woodlands Drive 17 and Miltonia Close. This is in addition to the Sembawang Road EC site, which tender closes in September 2025. Considering the size of the site, coupled with healthy EC demand, we could see more intense bidding competition. With a new benchmark land cost for EC, we will likely see even higher launch prices seen at Otto Place.

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.