HDB Resale Prices Peaked Amid Sustained Demand in 2024

- By ERA Singapore

- 4 mins read

- HDB

- 22 Dec 2024

2024 was a bumper year for the HDB resale market

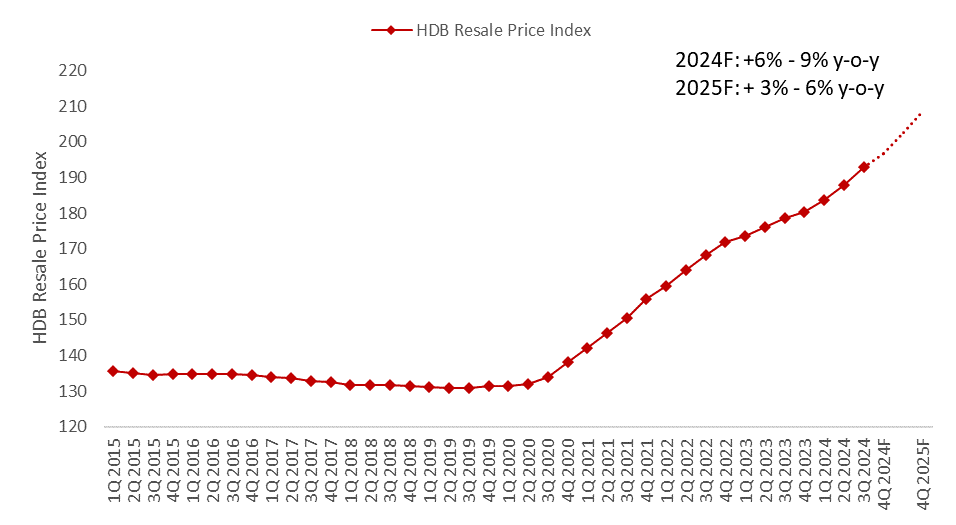

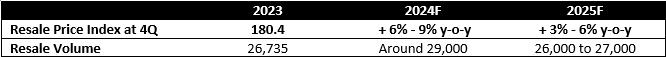

The Housing and Development Board (HDB) resale market saw continued price growth, reaching an all-time high, driven by a healthy resale volume. Over the first nine months of 2024, the HDB Resale Price Index (RPI) rose by 6.9% and is projected to follow a similar growth trajectory, potentially bringing the full-year increase to between 6% and 9%.

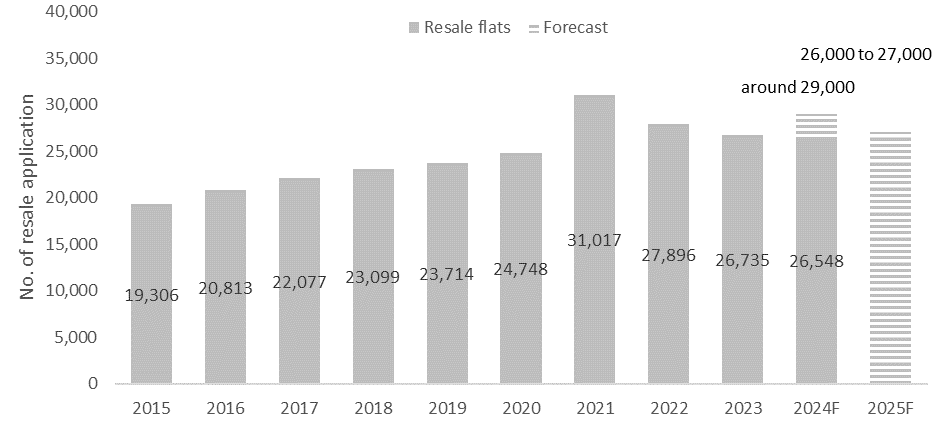

In the first 11 months of 2024, resale applications totalled 26,548 and are projected to reach between 28,500 and 29,000 units by year-end—a significant increase from the 26,735 units for the full year 2023.

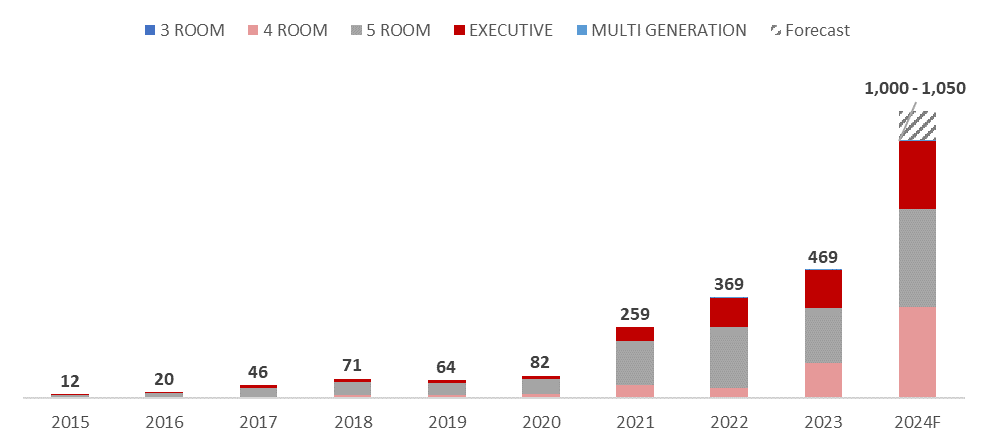

This robust demand has also led to a surge in million-dollar flats, with more than double the number of such sales recorded compared to 2023, with 944 of such transactions as of 3rd December, projected to exceed 1000 by year end.

In the Build-to-Order (BTO) segment, the reclassification of flats rolled out 2H 2024, introducing the new “Standard,” “Plus,” and “Prime” flats in the October BTO sales launch. While the “Standard” flats saw the same resale criteria as before, “Plus” and “Prime” flats came with stricter requirements, including a 10-year Minimum Occupation Period (MOP) and subsidy clawback conditions among other conditions. Collective, HDB had launched 21,225 new flats, comprising 19,637 BTO flats and 1,588 flats under the Sale of Balance Flats exercise in 2024 to meet the housing demand.

2024 Homebuying Activities Underpinned by Firm Economic Fundamentals

Singapore’s economy gained momentum in 3Q 2024, recording a 5.4% year-on-year (y-o-y) expansion compared to a 3.0% growth in 2Q 2024[1]. The growth was primarily driven by robust performances in the manufacturing, wholesale trade, and finance & insurance sectors. With a continued recovery in global electronics demand and stronger-than-expected economic activity, MTI revised its full-year GDP growth forecast to approximately 3.5%, up from the earlier range of 2.0% to 3.0%.

Amid the economic expansion, hiring in the labour market has similarly picked up in 3Q 2024. According to the Labour market report[2], Singapore saw a sharp uptick in employment numbers alongside a decline in retrenchments. Hiring in 3Q 2024 expanded, rising by 22,300 compared to 16,000 in 1H 2024. Retrenchment numbers in the first nine months of 2024 has declined by 15.6% to 9,350, compared to the 11,130 in the same period last year. Overall unemployment rate continued to remain at a low of 1.9% in 3Q 2024.

Singapore continued to see easing inflationary pressures in 3Q 2024, falling to 2.2% which is the lowest seen since 2Q 2021[3]. Among which, accommodation inflation has likewise moderated 2.9% in 3Q 2024,

a sharp contrast to the peak of 4.9% in 1Q 2023. As inflation eased, Singapore’s real income rebounded in 2024 compared to 2023.

Singapore households remained financially resilient despite concerns over growing household debt. The Monetary Authority of Singapore remains confident in households’ financial resilience, citing higher wages and robust financial assets that will continue to support households in meeting their loan obligations. Furthermore, the recent Fed interest rate cuts have offered additional relief to home owners. The 3-month compounded SORA fell from 3.70% in January to 3.24% in November, easing pressure on mortgage payments.

The number of Resident Population increased by some 31,600 which helped to fuel demand for HDB flats in 2024. In short, the better-than-expected economic outlook, firm economic fundamentals and grown resident population had bolstered stronger HDB resale activities in the second half of 2024.

HDB Resale Price Index Growth to Moderate In 2025

The HDB RPI has shown consistent growth throughout the year, reaching 192.9 in 3Q 2024, registering 6.9% increase over the last nine months, with a projected 6% – 9% increase by end 2024.

By 2025, the HDB RPI is expected to grow at a measured pace, reflecting the higher price base in 2024 and a reduced supply of MOP flats in 2025, which have been a key driver of price growth in recent years.

Chart 1: HDB Resale Price Index (RPI) Time Series

Source: data.gov.sg, ERA Research and Market Intelligence

HDB resale transactions soared in 2024, highest seen since 2021

In the first 11 months of 2024, resale applications totalled 26,548 and are projected to reach around 29,000 units by year-end—a significant increase from the 26,735 units for the full year 2023. What could have contributed to this surge? Firstly, some HDB upgraders are being priced out of the private home market, leading them to opt for larger or more centrally located flats instead. Next, with the reclassification of BTO flats since Oct 2024, some buyers saw better value in centrally located resale flats. These flats are exempt from the extended 10-year MOP and other restrictive resale restrictions, making them more appealing to these buyers.

ERA estimates HDB resale transactions to moderate to between 26,000 and 27,000 in 2025 on the back of fewer MOP units and higher cost of replacement homes which may lead existing owners to reconsider selling their flats.

Chart 2: HDB Resale Applications

Source: HDB, data.gov.sg as of 3 Dec 2024, ERA Research and Market Intelligence

2024 Saw A Record Number of Million-Dollar Flats

As at 3 December 2024, some 944 million-dollar flats were transacted, and the number of million-dollar flats is projected to cross 1,000 units by end-2024. This is more than double the 469 million-dollar flats minted in 2023. Nearly 91% of the million-dollar flats in 2024 were from mature estate, with 49% of these were flats that are 15 years and below. The number of million-dollar flats remains represent 3.6% of the resale application.

The highest recorded transactions came from a trio of 5-room flats in Bukit Merah, which all sold for $1.58m.

Chart 3: Million-Dollar Flat Transactions (by year)

Source: data.gov.sg as at 3 Dec 2024, ERA Research and Market Intelligence

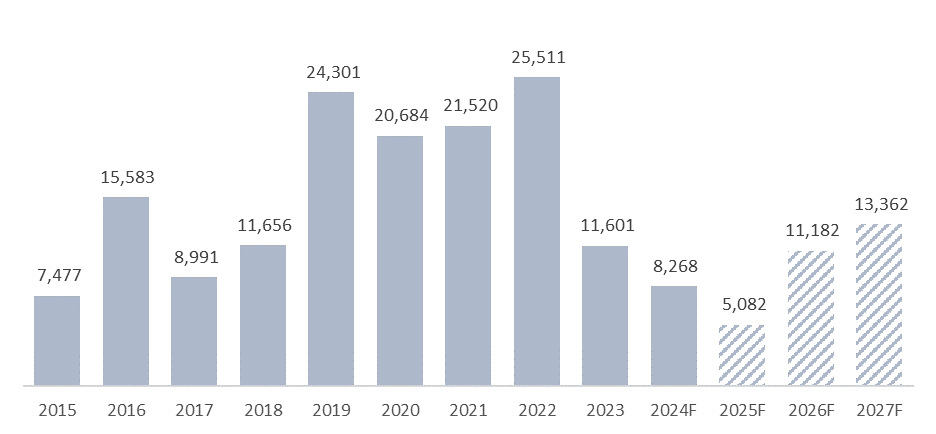

Diminished supply of Minimum Occupation Period (MOP) Flats in 2025

This year, 8,268 flats (3-room and larger) fulfilled their 5-year MOP in 2024, marking a 28.7% decrease from the 11,601 flats recorded in 2023. By 2025, the number of MOP flats is expected to decline further, falling 38.5% year-on-year to 5,082.

Chart 4: HDB flats (3-room and larger) that reach the 5-year MOP by year

Source: data.gov.sg, ERA Research and Market Intelligence

Looking at 2025, there is expected to be about 5,082 flats completing their MOP, which could lead to a corresponding decline in supply of flats being put up for sale. Notably, in 2025, we will see nearly 1,700 flats in centralised locations like Bidadari and Dawson fulfil their MOP status, which will likely contribute to more million-dollar flats.

Changes to the Build-To-Order (BTO) flat system turned buyers to resale market

Collective, HDB had launched 21,225 new flats, comprising 19,637 BTO flats and 1,588 flats under the Sale of Balance Flats exercise in 2024 to meet the housing demand.

2024 marked significant changes to the BTO system. By far, the largest change was the abolishment of the mature and non-mature classification of HDB towns. Taking its place were the new “Standard”, “Plus”, and “Prime” housing models.

While the “Standard” flats saw the same resale criteria as before, the “Plus” and “Prime” flats featured more stringent resale restrictions, such as a longer 10-year MOP, subsidy clawback and a buyer resale monthly income ceiling of $14,000. These stringent resale restrictions could deter some homebuyers, driving more to turn to existing centrally located resale flats, which remain unaffected by these changes.

What can we expect in 2025?

For 2025, ERA expects resale prices to grow at a more measured pace due to the higher price base in 2024 and a reduced supply of MOP flats in 2025, which have been a key driver of price growth in recent years. We can expect an overall 3% – 6% price growth, with 26,000 – 27,000 resale HDB units expect to move by end-2025.

Table 1: ERA forecast of HDB Resale Market

Source: URA, ERA Research and Market Intelligence

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.

[1] Ministry of Trade and Industry, Economic Survey of Singapore Third Quarter 2024

[2] Ministry of Manpower, Labour Market Third Quarter 2024

[3] Singstat, Percent Change In Consumer Price Index (CPI) Over Corresponding Period Of Previous Year, 2019 As Base Year