New ECs Still Stand Out as a Smart Choice in Today’s Market

- By Ethan Hariyono

- 4 mins read

- Executive Condominium

- 14 Nov 2024

For Singaporeans, the Executive Condominium (EC) presents an opportunity to enjoy all the benefits of a private property: owners get to enjoy all of the prestige, privacy, and facilities associated with a typical condo, but at a more accessible price point

The EC housing concept is unique to Singapore, and was introduced in 1995, to “satisfy the demands of those who aspire to own private property but cannot afford to do so”. This enables ‘sandwich-class’ Singaporeans to achieve their aspiration of owning a private home. To balance cost and affordability, many new EC projects are located in young housing estates.

That said, there are several catches. EC buyers are subject to a monthly household income cap of $16,000 and a mandatory Minimum Occupation Period (MOP) of 5 years. Even so, after fulfilling the MOP, owners can only sell their EC to Singaporeans and Singapore Permanent Residents.

ECs can eventually be sold to foreigners, but only after they become fully privatised after a 10-year period. This degree of resale flexibility is a significant reason why ECs are such a useful asset and a fantastic choice for a first home.

Given the higher price point compared to HDB flats, most EC purchasers fall within the monthly household income bracket of between $14,000 and $16,000. This group of buyers does not qualify for Build-to-Order (BTO) flats, and has to either explore resale HDB flats or private homes as alternatives.

Naturally, this makes ECs an attractive option, which may prove to be a wise move for both asset appreciation and overall liveability. For first-time HDB homebuyers, purchasing an EC also grants them greater ease of securing a unit due to priority allocation.

Given their more attractive price point compared to private homes, many EC projects witnessed a strong sales rate during their debut. Recent EC launches, such as Altura and Lumina Grand, achieved 61% and 53% sales respectively over their launch weekends.

Previous EC owners have benefited from the capital appreciation, but the landscape is changing

Over the years, EC owners have continued to reap handsome profits, benefiting from rising home prices. For EC projects completed in 2013, owners who sold after 5 years achieved a median profit of $142,000. In contrast, owners of EC projects completed in 2019 who sold at the 5-year mark saw a remarkable median profit exceeding half a million dollars. While past EC owners have clearly benefited from significant capital appreciation, the landscape is changing.

Table 1: Median EC Gross Profitability Comparison by Year of Completion and Holding Period

Source: URA, ERA Research and Market Intelligence *Grey cells indicate less than 30 transactions recorded.

Rising Land Cost and EC prices – Does buying an EC still make economic sense?

Amid rising land costs for ECs, driven by both their popularity and limited land sales where only two to three plots are released each year, developers are presented with a unique challenge.

And that is to price their offerings within an affordable range for EC’s buyers whose mortgage loan eligibility are capped by the 30% Mortgage Servicing Ratio (MSR) framework and income ceilings. When combined, both these frameworks will limit buyers’ affordability due to the caps placed on loan quantum, and subsequently, the maximum property value that buyers can finance.

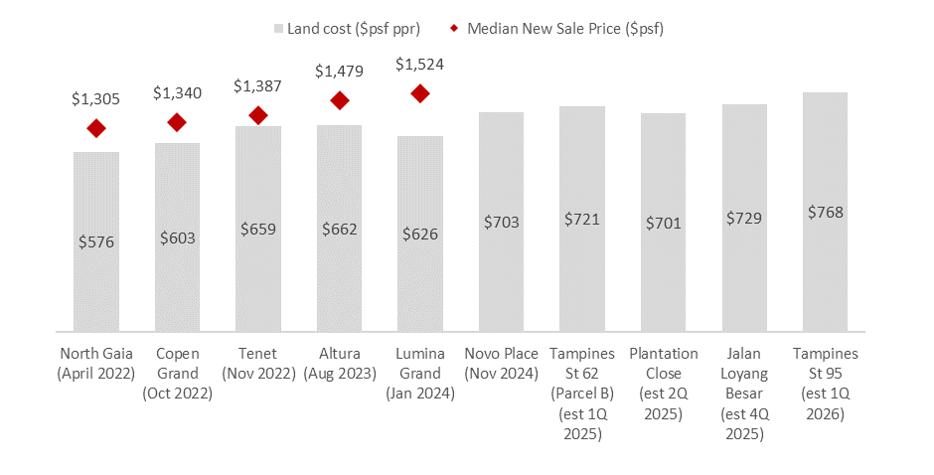

Chart 1: Land Cost vs Median Sale Prices of ECs (by launch year) since 2022

Source: URA REALIS as of 25 Oct 2024, HDB, ERA Research and Market Intelligence

EC Is Still More Attractive Amid Widening Price Gap with OCR New Homes

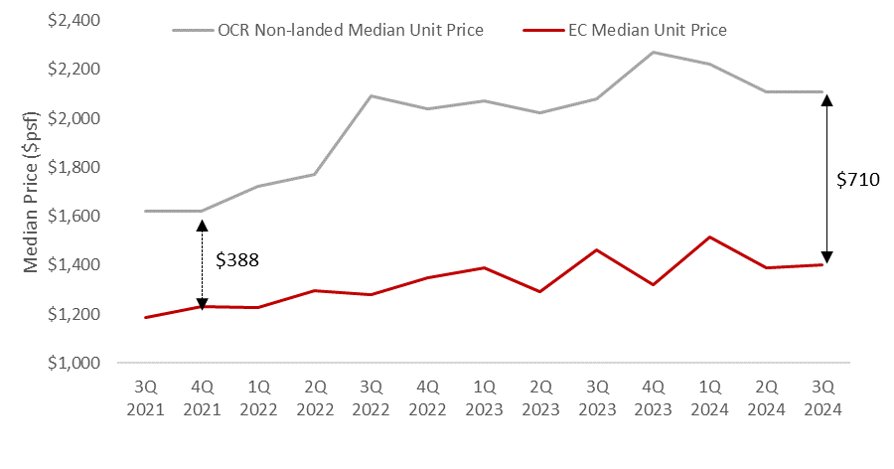

Even as EC prices continue to climb, the price gap between ECs and new non-landed private homes in the Outside Central Region (OCR) has been steadily widening over the last three years, as the latter record a faster rate of appreciation. In 4Q 2021, the price gap between a new EC and an OCR new home was $388 psf. As of 3Q 2024, this difference has soared to $710 psf.

Chart 2: Median EC and OCR new home prices

Source: URA, HDB, ERA Research and Market Intelligence

Keeping EC price quantum palatable for first timers

To keep the price quantum within an accessible range, developers have focused on offering more flexible and efficient layouts that allow homebuyers to enjoy the best use of their space. By doing so, this allows developers to keep the price quantum palatable for most buyers.

For instance, first-time buyers, who are typically young couples prefer compact unit layouts that make daily maintenance more manageable, particularly for two working adults. At the same time, they want the flexibility of space to accommodate gatherings at home. For these buyers, the trade-off of a lower price quantum for a smaller unit is often seen as worthwhile.

New ECs Make Upgrading Effortless for Second-Timers

Separately, for HDB upgraders, or second-timers, there are even more compelling reasons to consider a new EC. Firstly, upgraders are exempted from having to pay the Additional Buyer’s Stamp Duty (ABSD), since they will need to dispose of their HDB flat within six months of receiving the keys to their new EC.

Next, second-timers can also take advantage of the Deferred Payment Scheme (DPS), which, although costing 2-3% more, allows them to defer the balance of 65% until the EC achieves the Temporary Occupation Permit (TOP). The final 15% will then be payable upon the Certification of Statutory Completion. This scheme helps second-timers avoid maintaining two mortgages while waiting for the completion of the new EC.

With the ability to plough their sale proceeds from their HDB flats, second-timers are more likely to be going for the larger 4- or 5-bedroom units.

Developing Townships Provide Valuable Exit Strategies for EC Homeowners

As mentioned, ECs are usually built within developing townships, providing prospective homeowners with a viable exit strategy should they ever plan to relocate after fulfilling the MOP.

To put things into perspective, there have been five ECs launches in the Tengah and Bukit Batok planning areas, with the most recent being Novo Place. These EC projects are located in close proximity to the Jurong Lake District, which is set to transform to the largest business district outside the Central Business District over the next decade. Buyers will stand to gain a first-mover advantage benefit from growth, better connectivity and more amenities in the future.

Additionally, since these ECs are located near the new Tengah estates, there is a large captive pool of HDB upgraders once they complete their MOP.

New ECs offer affordability and deferred payment schemes, which are especially appealing for first-timers and upgraders looking to maximise space and value. However, many of these projects are locate in up and coming estates, which tend to be on the outskirts of Singapore.

So, for homebuyers who place a premium on prime locations and central convenience, resale HDB flats—despite their rising price tags—can often be the more attractive choice. This brings us to the key question: Should you opt for a million-dollar HDB flat instead of new ECs?

New EC or Million-Dollar Resale HDB: Which Is the Better Choice?

To put it simply, location is the answer. The largest advantage of resale HDB flats, and the reason that people are willing to spend upwards of a million dollars on them is due to the ability to purchase an HDB flat in centrally located areas.

Moreover, they are able to purchase larger units in these areas (5-room or executive apartments) for a similar price quantum as the typical entry price for an EC. This is a core reason why we see so many million-dollar flat transactions in city fringe areas.

On the other hand, ECs are found in locations further from Central Singapore, typically in up-and-coming housing estates. Despite so, these ECs are often located within walking distance to MRT stations and will benefit as the neighbourhood infrastructure grows and mature.

Another important consideration will be that resale flats come with shorter lease tenures that could limit the loan-to-value limits and loan tenures, whereas new ECs come with a fresh 99-year lease. Buying older flats may also come with other hidden costs from hefty renovation cost to poorly maintain external facades which are difficult and near-impossible to rectify.

So, Is Buying a New EC the Right Move?

To sum it up: ECs are a flexible private property that both the Singaporean first-time buyer and second-time upgrader should strongly consider if they meet the financial requirements.

They feature functional layouts for a variety of family sizes, are growing increasingly more convenient in location, and provide a family with privacy, exclusivity, and access to condominium facilities.

Furthermore, with many ECs situated in up-and-coming housing estates near areas poised for significant transformation, homeowners could benefit from a viable exit strategy should they need to shift in the future to match their families’ changing housing needs. Given their many positives, buying an EC is undoubtedly the right move for any savvy Singaporean property buyer.

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.