Singapore’s New Private Home Market Sees Rising Demand from Young Singaporeans

- By ERA Singapore

- 6 mins read

- Private Residential (Non-Landed)

- 18 Jan 2024

The market share of new private home buyers, aged 26 to 35 years old, more than tripled between 2015 to 2022.

Even in the face of recent headwinds, including higher interest rates, moderating economic activity, and the implementation of market cooling measures in April 2023, the demand for new private homes among Singaporeans has stayed steadfastly strong.

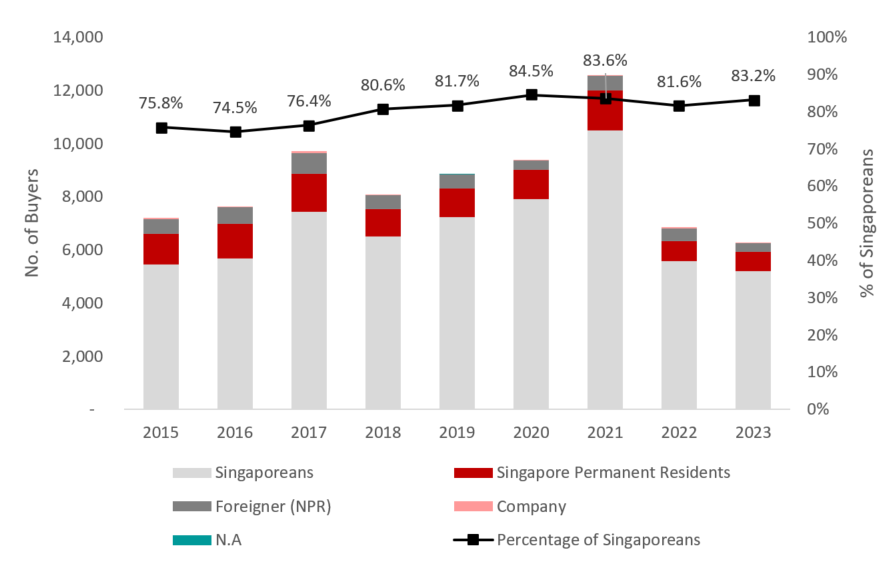

Singaporeans have consistently held sway in Singapore’s new private home market, capturing the lion’s share of yearly new home purchases. In 2015, Singaporeans accounted for approximately 75.8% of new private home sales; this percentage has risen steadily across the years, reaching a peak of 84.5% in 2020 and has remained at similar levels since.

Chart 1: New Private Home Buyers by Nationality and Residential Status (2015 to 2023)

Source: URA as of 18 Jan 2024, ERA Research and Market Intelligence

This upswing in Singapore buyers follows a steady growth in demand for new private residential homes, particularly amongst young Singaporeans, whom we define as Singaporeans aged between 26 to 35 years old.

Between 2015 to 2022, the cohort of local adults comprising the aforementioned age group of new private home buyers has more than tripled – a finding that tallies with mainstream media observations about the homeownership aspirations of Singaporean millennials and Gen-Zers.

The changing face of Singaporean new private home buyers

Based on proprietary industry data from ERA Singapore, covering a sample size of 37,000 Singaporean new home buyers, we have identified three prominent demographic trends pertaining to new private home buyers in Singapore.

1. A rising proportion of young Singaporeans are buying new private homes

Mirroring housing markets worldwide, older Singaporeans have traditionally dominated the domestic market for new private homes, but there are now compelling signs supporting a noticeable shift in this widely-held narrative.

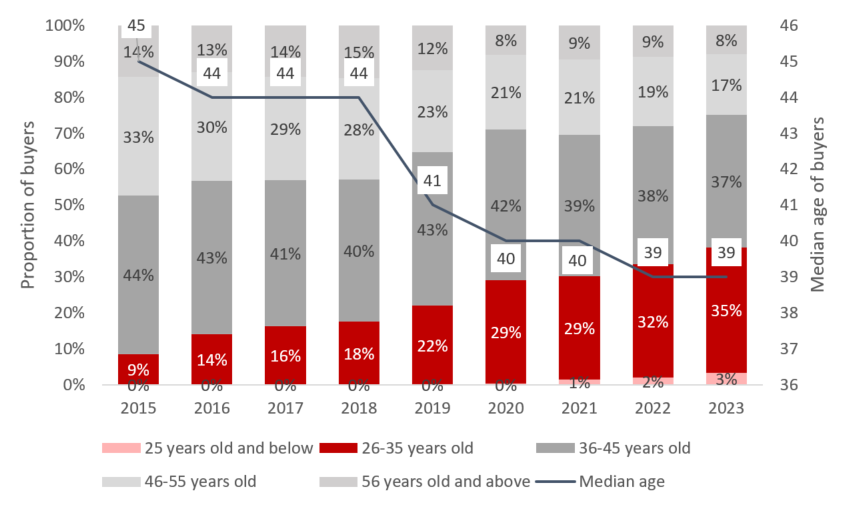

Across the past nine years, the share of young Singaporean buyers of new private homes has climbed steadily. In 2015, this demographic group accounted for just 9% of new private home sales in the country; this figure has since surged by 26 percentage points to 35% in 2023.

The proportion of Singaporeans under 25 in the new private home sales market, though still small, also grew to 3% in 2023.

After the COVID-led demand surge seen in 2021, we saw the Singapore residential market transiting into a different realm largely characterised by rising home prices amid supply chain disruption and elevated interest rates. The Additional Buyer Stamp Duty implemented in April 2023 further dampened new home demand across the board in 2023. New private home sales reached some 13,027 units in 2021 but have fallen to a mere 6,421 units by 2023.

Looking at the numbers of Singaporeans buying new private homes, the number of buyers between the age group of 26 to 35 has seen a gentler decline in buyer numbers in comparison to other segments.

Between 2021 to 2023, the number of buyers aged 26 to 35 shrank by 59.5%, from 1,818 to 737. But for the age groups of 36 to 45, 46 to 55, as well as 56 and above, their respective declines were more noticeable at 69%, 72.9% and 71.8% respectively across the same period.

2. Singaporeans aged 36 to 45 still form the largest segment of new private homebuyers despite decline in numbers

Despite shrinking in number, Singaporean buyers belonging to the 36 to 45-year-old cohort have retained their dominance in the new private home market. In 2015, these Singaporeans accounted for 44% of new private residential property purchases; this was followed by Singaporeans between 46 to 55 years old, whose share of new private home transactions was 33% in the same year.

Fast forward to 2023, and the size of both buyer groups has dipped. Singaporeans belonging to the 36 to 45 age group now account for 37% of transactions, a 7-percentage point drop compared to eight years ago.

The shift is even more apparent for Singaporean buyers in the 46 to 55 age range, whose share of new private home transactions has fallen to 17% in 2023, marking a 16-percentage point decline.

3. The profile of new private homebuyers is skewing younger

In light of the latest changes in buyer demographics, the median age of Singaporean new private home buyers has distinctly exhibited a downward trend, possibly indicating that younger generations of locals will be playing a bigger role in Singapore’s new private residential market.

Chart 2: Proportion New Private Home Buyers by Age (2015 to 2023) and median age of buyers

Source: ERA Research and Market Intelligence

In 2015, the median age of new private home buyers was 45. Since then, it has traced downwards year on year over the last eight years, before reaching the current low of 39 years in 2023.

What is driving these shifts in new private homeownership?

1. Rising incomes are enabling young Singaporeans to achieve their private homeownership aspirations

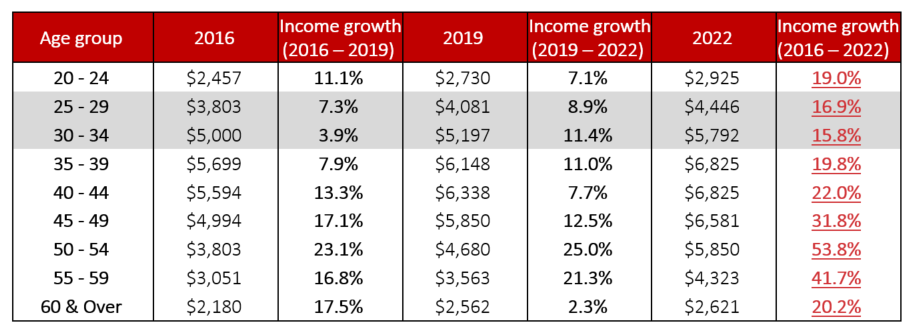

According to official figures by the Ministry of Manpower, the median income for full-time employed residents increased for all age groups from 2016 to 2022.

In 2022, the median gross monthly income for full-time employed residents between the ages of 25 and 29 reached $4,446 years old, while those between 30 and 34 earned $5,792. Compared to the corresponding figures in 2016, this represents a 16.9% increase (up from $3,803) and a 15.8% increase (up from $5,000) for local residents in the respective age groups.

Over the same period, full-time employed residents aged 35 – 54 also experienced some of the biggest increases in monthly income, ranging from 19.8% to 53.8%. This observation is a possible glimpse into the future earning potential of younger Singaporeans – and consequently more confident of their ability to invest in new private homes.

New private homes are more accessible for young Singaporeans with growing income. New private homes allow for the progressive payment scheme which support young Singaporeans who may not have the income to manage the full mortgage payment at the beginning.

Table 1: Median Gross Monthly Income from Work (Including Employer CPF) of Full-Time Employed Residents in S$

Source: MOM, ERA Research and Market Intelligence

In tandem with this trend, the macroeconomic review published by the Monetary Authority of Singapore in October 2023, indicated that nominal incomes for middle-income workers – half of whom are between 25 to 49 years old in 2021 – grew more rapidly vis-à-vis other income groups.

Equally so, the healthy overall employment rate in Singapore is a likely contributor to the growing number of young local private home buyers.

2. Elevated interest rates have impacted mortgage eligibility across the board, but older Singaporeans are affected more

Since 2H 2022, interest rates in Singapore have soared in tandem with hikes in US Federal Reserve rates – in particular, the 3-month compounded Singapore Overnight Rate Average has risen by 170 basis points since 3Q 2022.

The resulting squeeze has impacted the mortgage eligibility of all Singaporeans, though the effects are more pronounced for older borrowers than those belonging to younger age groups.

Older Singaporeans face a double whammy: In addition to shrinking mortgage approvals – which translate into steeper upfront payments and a larger initial capital outlay – they also have to contend with shorter loan tenures as well as higher interest rates that contribute to higher monthly mortgage repayments.

This confluence of factors has cause some older Singaporeans to put off their home upgrading plans indefinitely.

3. Buyers nearing the income ceiling for BTO flats may find more options in new private homes

Young Singaporean couples whose combined monthly household earnings surpasses the $14,000 income ceiling for Built-to-Order (BTO) flats, could gravitate towards purchasing an Executive Condominium (EC) or new private property over a resale HDB flat.

Case Study with Couple A:

With a combined gross monthly income of $15,000 exceeding the BTO income ceiling, Couple A is currently deciding between purchasing a resale HDB flat, an EC or a private condominium.

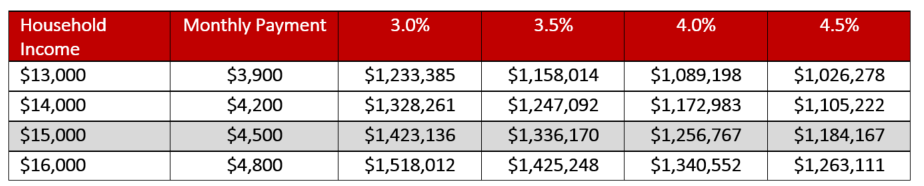

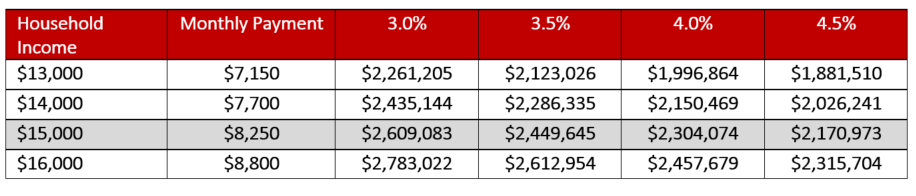

Table 2: Max purchase price for a resale HDB flat or EC by gross monthly household incomes and prevailing MSR

Source: ERA Research and Market Intelligence

Assuming a 75% Loan-to-Value (LTV) limit, 30-year loan tenure, and 4% medium-term benchmark interest rate, Couple A can afford an EC or a resale HDB flat priced up to $1.25 mil based on the prevailing Mortgage Servicing Ratio (MSR) of 30%.

Table 3: Max purchase price for a private residential unit by gross monthly household incomes and prevailing TDSR

Source: ERA Research and Market Intelligence

In comparison, with all loan assessment factors held constant and the current Total Debt Servicing Ratio (TDSR) of 55% applied, Couple A will be to afford a new private home valued near $2.3 mil.

Consequently, the larger loan quantum available for new private homes allows Couple A to explore a wider range of properties, thereby increasing their chances of finding a private residence which matches their needs and aspirations.

That said, the substantial down payment and stamp duties associated with purchasing a new private home may pose a hurdle for younger Singapore adults.

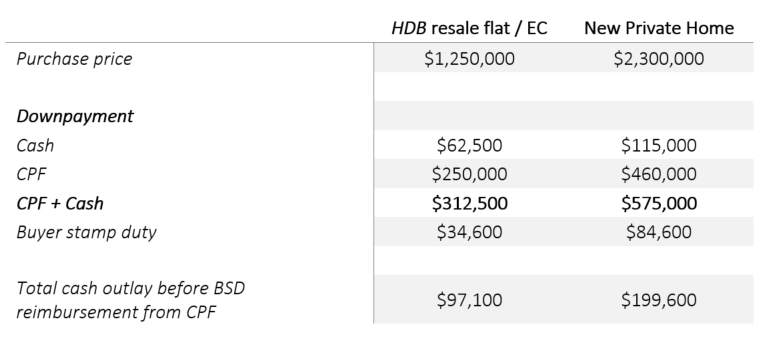

Supposing that Couple A has chosen to purchase a $1.25 mil resale HDB flat, they will need to provide a down payment amounting to $312,500, of which $62,500 has to be paid in cash for a bank loan. After accounting for the Buyer Stamp Duty (BSD) based on prevailing rates, Couple A’s initial cash outlay will amount to $97,100 but they can obtain reimbursement for the BSD from their CPF accounts.

In comparison, if Couple A were to opt for a new private home valued at $2.3 mil, they would instead be required to fork out $575,000 for their downpayment. This translates into a minimum cash amount of $115,000, and with the BSD included, Couple A’s upfront cost for a new private home comes up to $199,600.

Table 4: Comparison of cash and CPF outlay for the purchase of a HDB resale flat versus a new private home

Source: ERA Research and Market Intelligence

As a result, this initial upfront investment may put new launches out of reach for young Singaporeans aged 26 to 30 years old, but not so much for their 31 to 35-year-old peers, who could have adequate downpayment for upgrading upon selling their first home.

Anecdotal observations by our salespersons suggest a small proportion of young Singaporean homebuyers received some form of financial help from their parents for their first home purchase. But in most cases, young Singaporeans were able to pay the equity portion of the purchase price themselves.

1. Cap on HDB resale price growth over the longer term could prompt more Singaporeans to consider private homes as an investment option

The reclassification of HDB flats announced in August 2023 reaffirms the Singapore Government’s stance to ensure public housing affordability in the long run.

These include the introduction of the Plus and Prime housing models – both of which come with tighter resale and rental restrictions such as a 10-year Minimum Occupation Period, in addition to a subsidy clawback when they are sold on the resale market for the first time. Furthermore, prime flats will see resale buyers subject to income ceiling cap.

All of these conditions could have a moderating effect on resale price growth in the future. Consequently, aspiring investors may shifting their attention towards private homes which could potentially yield better returns compared to HDB flats.

2. More young Singaporeans accumulate initial downpayment for property purchase through savings and investing at a younger age

A survey published by global investment firm Franklin Templeton targeting respondents aged 18 to 35 years old, revealed that 80% of young Singaporeans are current investors. Additionally, half of the 502 respondents also agreed that they should start investing at a younger age (50%), and that doing so is key to good financial planning (51%).

By doing so, this allow younger Singaporeans to accumulate the initial downpayment and purchase their first property purchase since real estate is still widely regarded as a stable investment asset among Singaporeans. Private home offers opportunities for capital appreciation and passive incomes, which closely resonates with the young Singaporeans’ views on investing and building financial security at an early age.

Is this trend of young Singaporean private homebuyers here to stay?

Though it is a certainty that there is a growing number of Singaporeans entering the private housing market at a younger age, it remains to be seen if this will be a persistent trend in Singapore’s real estate landscape over the long term.

On one hand, a possible slowdown in economic activity and moderating income growth could dampen the appetites and purchasing power of young Singaporeans. This could lead to a reversal in the current trend, as aspiring homeowners re-evaluate their financial priorities and adjust their budgets accordingly.

Beyond just looking at macroeconomic conditions, several other factors may influence young Singaporeans to buy private homes.

The combination of premium facilities as well as the higher potential investment upside of private properties may hold greater appeal for young Singaporeans. Likewise, young aspiring investors may be drawn to private homes, owing to the moderation on HDB resale price growth over the longer term with more stringent resale restrictions for HDB flats in the future.

The appeal of private homes remains alluring and there are many compelling factors for young Singaporeans to invest into new private homes. And with some 32 upcoming new private home launches in 2024, prospective homebuyers will be spoilt for choice and have ample options to choose from. With that, we can expect to see a growing number of young Singaporeans making their foray into the dynamic realm of the new private home segment going forward.

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.