November 2024 Developer Sales Report: New Home Sales Skyrocket Amid Year-End Launch Frenzy

- By ERA Singapore

- 5 mins read

- Private Residential (Non-Landed)

- 16 Dec 2024

In total, November saw 2,557 new private homes (excluding ECs) sold, representing a 246.5% month-on-month (m-o-m) uptick over October’s performance (738 units sold). Year-on-year (y-o-y), new private home sales were also up 226.1% in November, compared to the 784 units sold over the same period in 2023. This is the highest new home sales in a month since September 2012 which saw 2,621 new homes sold.

The substantial spike in developer sales was fuelled by six new projects (of which, includes one EC), striking a strong contrast to the first ten months of 2024, which were characterised by a relative lack of new launches.

Notable projects that made their debut in November include Chuan Park (OCR, 916 units), Union Square Residences (RCR, 366 units), The Collective at One Sophia (CCR, 367 units), Emerald of Katong (RCR, 846 units), Nava Grove (RCR, 552 units) and Novo Place (EC, 504 units).

This year’s strong showing is also noteworthy, with even more projects launched to capture buyer interest before the festive season. For instance, in November last year, developers had only launched three new projects – namely J’den, Hillock Green, and Watten House.

The flurry of the new home launches can be attributed to several factors. Developers were rushing to launch their projects as soon as they have their sales licenses ahead of the Dec-Jan festivities. At the same time, we have seen buyer sentiment has also improved following the Federal Reserve’s interest rate cut in September and November which have eased mortgage rates and borrowing costs.

In total, developers had launched 2,871 new private homes (excluding ECs) in November, marking a 437.6%, or four-fold from the 534 units in October. On the year, this figure represents a 196% increase over the 970 units launched for sale in November 2023.

Meanwhile, the EC market too witnessed a sharp pick-up in sales volume following Novo Place’s debut, with transaction numbers of new units increasing twelve-fold on a m-o-m basis. Of the 334 new EC transactions recorded, approximately 85.8% can be attributed to Novo Place, thus showcasing its role in boosting market activity.

Best-Performing New Launches

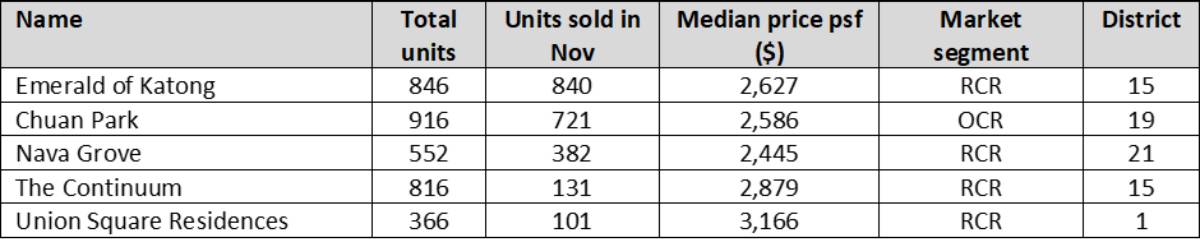

Table 1: Top five performing new launch projects (excluding EC) in November 2024

Source: URA, ERA Research and Market Intelligence

By order of most units sold, November’s best-sellers were respectively Emerald of Katong (840 units sold), Chuan Park (721 units sold), Nava Grove (382 units sold), The Continuum (131 units sold), and Union Square Residences (101 units sold).

Emerald of Katong had set a new benchmark for new private homes in the area, with a median price of $2,627 psf. Helmed by developer Sim Lian Group, the project had a take-up rate of 99% during its launch weekend, making it by far the best-selling project of the year with 840 out of 846 units sold. Factors contributing to the launch’s success include its location within the desirable District 15, as well as its proximity to key commercial and recreational nodes, such as Paya Lebar Central and East Coast. The success of the Emerald of Katong could be attributed to the sweet spot in the price quantum of its units, despite its higher median price of $2,626 compared to other new launches in the vicinity. Notably, approximately 59% of the transactions were below $2.5 million.

Similarly, Chuan Park had set a new benchmark price of $2,586 psf in Lorong Chuan, following its successful launch in mid-November. Occupying the same site as the former Chuan Park Residences, the development is just a stone’s throw away from Lorong Chuan MRT station, thus giving future residents easy access to the Circle Line. Additionally, Chuan Park is the first new launch in the neighbourhood since 2010, enabling it to capitalise on years of pent-up demand from potential upgraders living nearby.

Nava Grove, which likewise made its debut on the same weekend, provides future residents with the opportunity to live within a natural enclave nestled between Clementi and Dover Forests. Despite the harmonisation rule, which tend to see higher psf pricing, Nava Grove was offered at a very attractive price point for an RCR project. 67% of the units sold were transacted at $2,500 psf and below.

The Continuum climbed the charts to become the fourth best-performing development in November 2024, benefitting from the spilt-over demand from Emerald of Katong. Several units were sold at a price psf similar to or just marginally higher than that of the Emerald of Katong, despite its freehold status.

Meanwhile, new private homes at Union Square Residences achieved a median price of $3,166 psf, following an encouraging launch weekend that saw 75 units sold. The development is conveniently located near key destinations along Singapore River’s vibrant dining and entertainment scene, including Clarke Quay and Boat Quay. Moreover, its proximity to the downtown area also offers live-work-play opportunities for future owners.

Emerald of Katong Revives New Private Home Sales in RCR and District 15

Leading the three regions by far, the Rest of Central Region (RCR) recorded the highest number of new home sales in November, with 1,570 units sold. On the other hand, the Core Central Region (CCR) and Outside Central Region (OCR) saw 98 and 885 units sold.

Compared to October (247 units sold), November’s new private home sales in the RCR represent a dramatic 535.6% increase, or a five-fold jump over the previous month.

This dramatic rise in new private home sales in the RCR is largely attributable to the revitalising effect of Emerald of Katong on earlier launches in District 15. Examples include Tembusu Grand and The Continuum – both of which saw a rebound in sales numbers as Emerald of Katong renewed consumer interest in the area.

Tembusu Grand, which launched in April 2023, sold 53 units in November—doubling the 26 units sold in October. Similarly, sales at The Continuum skyrocketed to 131 units in November, a significant rise from the 8 units sold in October.

This outcome was also likely driven by oversubscription at Emerald of Katong. Buyers who were unable to secure favourable ballot numbers or desired units may have ended up shifting their attention to other developments in District 15.

Executive Condominium

In the Executive Condominium (EC) segment, sales of EC likewise soared to 334 units in November up from 28 units in October, with the launch of Novo Place, which provided EC buyers with a fresh option since the launch of Lumina Grand in January this year.

On its launch weekend, Novo Place achieved a take-up rate of 57%, selling 291 units out of a total of 504. This strong performance is partly attributable to Novo Place’s convenience. Unlike other EC launches with remaining stock, Novo Place will be within walking distance from the future Tengah Park MRT station – a rare convenience for EC developments, which are often located in more outlying areas. The second-timer quota was met at launch and will reopen for ballot in December which is expected to boost sales at Novo Place.

Additionally, Novo Place’s strong showing also drummed up interest in similar offerings, leading to a boost in sales at earlier EC projects. For example, Lumina Grand and North Gaia both recorded 19 units sold respectively in November compared to the 11 and 13 units sold in October.

Buyer Profile

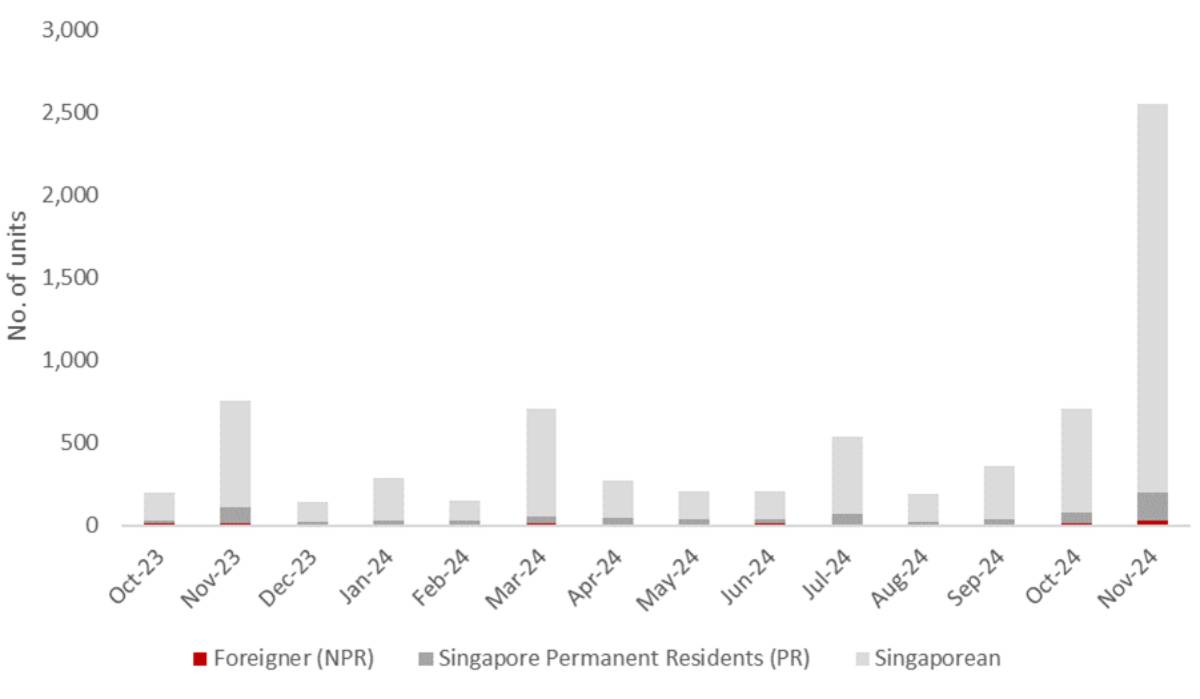

Chart 1: Buyer profile for all new non-landed homes excluding ECs

Source: URA, ERA Research and Market Intelligence

Despite the significant jump in overall new non-landed private home sales (excluding ECs), foreigner demand continued to remain flat largely due to the punitive Additional Buyer’s Stamp Duty. Foreign buyers accounted for only 25 transactions.

On the other hand, Singapore Permanent Residents (PR) exhibited significantly higher buyer activity. The number of PR buyers surged from 62 in October to 175 in November, representing a more than twofold increase in absolute terms.

Meanwhile, Singapore residents continued to dominate the market in November, accounting for 2,353 buyers, or 92.2% of all transactions for the month.

Luxury Properties (Non-Landed Homes $5 Mil and Above)

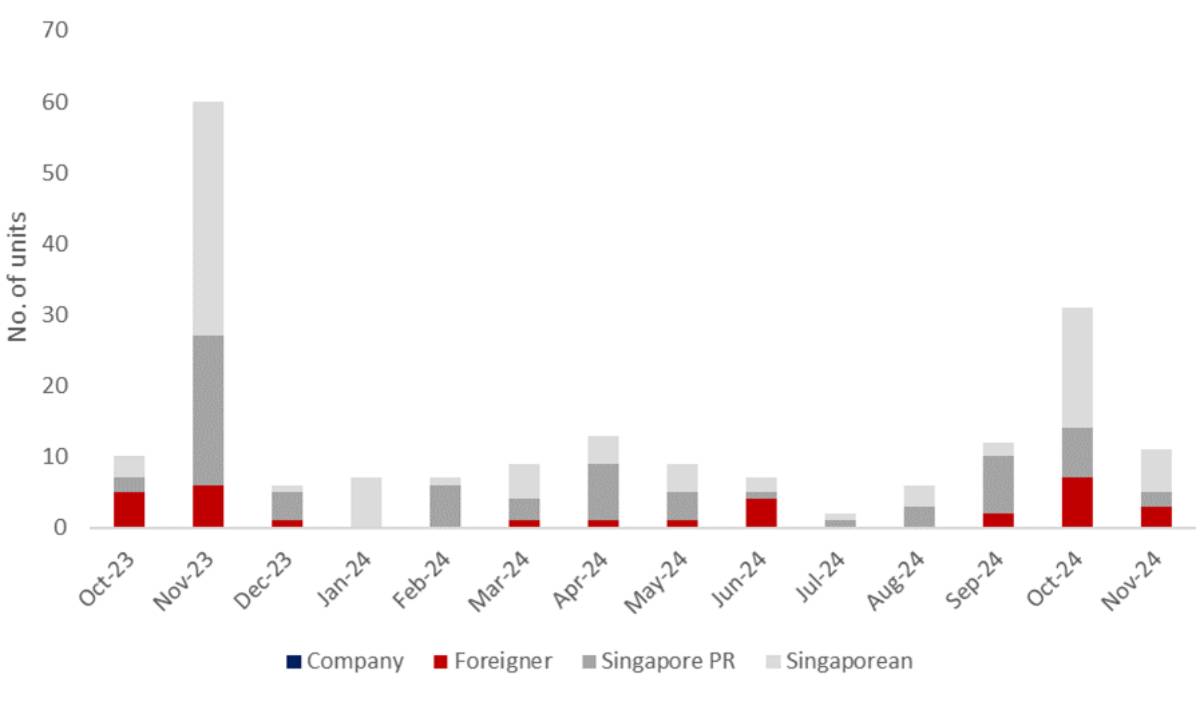

A total of 11 luxury homes, priced at $5 mil and above, were transacted in November 2024. Additionally, 63% of the luxury homes transacted in the month fell within the $5 mil – $6 mil price range. The highest-priced transaction was a 4,209 sqft unit at 32 Gilstead, which was purchased for $14.4 mil ($3,431 psf) by a Singapore PR.

Chart 2: Buyer profile for homes transacted at $5mil and more

Source: URA, ERA Research and Market Intelligence

What Lies Ahead for the New Private Home Market in the Coming Months?

Though recent interest rate cuts and a more positive economic outlook have breathed new life into the new launch market, challenges remain with an impending Trump presidency and ongoing trade tensions that could impede Singapore’s economic growth.

Nonetheless, ERA remains cautiously optimistic about Singapore’s residential market in 2025. Supported by strong macroeconomic fundamentals, Singapore is likely to strengthen its position as a ‘safe harbour’ amid potentially stormy conditions. This could, in turn, boost buyer confidence and bolster demand for new private homes even in the face of a challenging global economy.

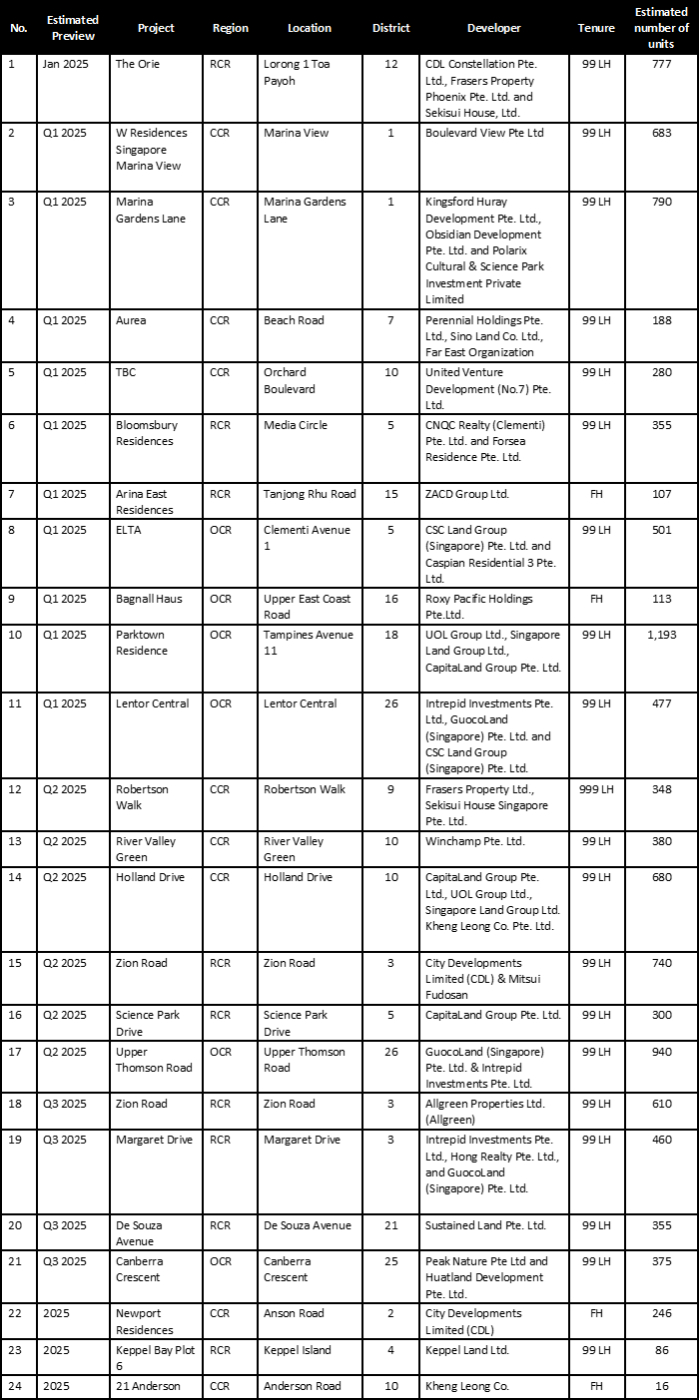

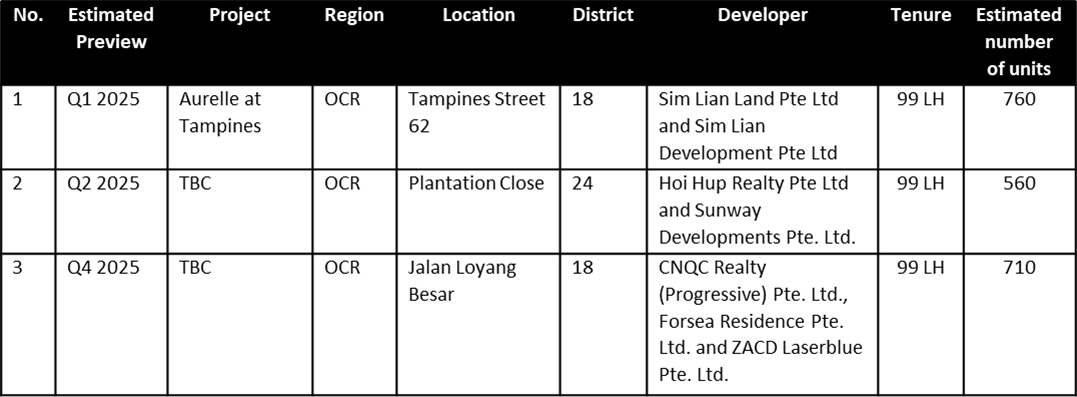

With no more new launches planned for this year, buyers will have to wait till January for more projects to enter the market. That said, there will be no lack of fresh options in 2025, with an estimated 24 private home projects and three EC launches coming next year.

The Orie, launching in January, will kick off the year as 2025’s first new launch and Toa Payoh’s first new development in almost a decade. Located at Toa Payoh Lorong 1, the project is poised to draw considerable interest due to its excellent location, the growing popularity of RCR properties, and intrinsic appeal to HDB upgraders living nearby.

Aside from The Orie, upcoming projects at Margaret Drive and Lentor Central, as well as ELTA and Parktown Residence are also expected to captivate buyers in the coming months.

However, with December’s seasonal lull in sight, we can expect new home sales to reach between 6,300 to 6,700 units by the year’s end.

Assuming stable macroeconomic conditions and the absence of unforeseen negative factors, new home price are expected to continue their upward trajectory – potentially achieving 3-5% y-o-y growth in 2025. The private residential market could see growth next year, with sales possibly reaching between 7,000 and 8,000 units in 2025

Table 2: Upcoming launches in 2025

Executive Condo

Source: ERA Project Marketing

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.