SINGAPORE, 5 March 2025 – ERA Realty Network (“ERA”) is pleased to announce its appointment as the sole and exclusive marketing agent for the collective sale Elias Green Condominium located at 1, 3, 5, 7, 9, 11, 13 & 15 Elias Green, Singapore 519959 to 519966 (“Elias Green”). Elias Green will be launched for sale by public tender on 6 March 2025 at a guide price of SGD928 million.

Elias Green condominium, with a remaining lease tenure of approximately 65 years, sits on a land area of 48,019.0 sq m (516,871 sq ft approximately). Under the Master Plan 2019, it is zoned for Residential use at a gross plot ratio of 1.4.

Elias Green Condominium consists of 419 apartment units across several blocks, including a part-6/7-storey block, an 8-storey block, two 13-storey blocks, a 14-storey block, a 15-storey block and a 16-storey block. Unit sizes range from 127 sq m to 152 sq m.

At the guide price of SGD928 million, the land rate translates to SGD1,355 per square foot per plot ratio (psf ppr), after factoring 10% bonus gross floor area and inclusive of an estimated Land Betterment Charge of SGD 150.8 million for intensification and upgrading to a fresh 99-year lease.

The owners are in the process of submitting an Outline Application to URA for a residential development at a Gross Plot Ratio of 1.8. If the application is approved, the land rate would be approximately SGD 1,245 psf ppr.

Strategically situated in a residential neighbourhood, Elias Green offers seamless access to a diverse range of retail, dining, and entertainment options. Residents can enjoy shopping and dining at Pasir Ris Mall, White Sands, and Elias Mall, while Tampines Retail Park—home to Courts Megastore, IKEA Tampines, and Giant Hypermart—provides additional lifestyle conveniences.

For leisure and recreation, Downtown East offers family-friendly attractions, while major landmarks such as Singapore Expo, Changi Airport, and Jewel Changi Airport are just a short drive away, ensuring unparalleled connectivity for both work and travel.

The property is also close to an array of green spaces and recreational areas, including Tampines Eco Green Park, Pasir Ris Park, and the beautiful Pasir Ris Beach, offering ample opportunities for outdoor activities, picnics, jogging, and cycling.

The development enjoys excellent connectivity via a well-established network of major roads and expressways, including Elias Road, Pasir Ris Drive 1, and Pasir Ris Drive 8. The nearby Tampines Expressway (TPE) ensures easy access to the Central Business District (CBD) and Changi Airport, offering residents seamless access to the rest of Singapore.

Families with school-going children will benefit from the property’s close proximity to several well-established educational institutions. Within a 1km radius, residents will find Angsana Primary School, Elias Park Primary School, and Park View Primary School, making it convenient for younger children to attend school nearby. Other primary schools within a 1-2km radius, including Poi Ching School and Gongshang Primary School, among others. Beyond primary education, educational institutions such as Tampines-Meridian Junior College and the Overseas Family School are also located within the vicinity, offering quality education for students of different age groups.

Mr. Tay Liam Hiap, Managing Director of Capital Markets and Investment Sales at ERA Singapore, commented, “ Elias Green Condominium is situated within Pasir Ris town, which is undergoing significant transformations under HDB’s “Remaking Our Heartland” initiative. With new housing developments and a recently constructed retail mall, Pasir Ris is set to become a more vibrant and well-connected residential hub. ”

He added, “As part of this transformation, the new Pasir Ris Bus Interchange is expected to be completed by 2025. This will integrate with the future Pasir Ris Integrated Transportation Hub, which will also include the Cross Island Line (CRL) slated to be operational by 2030, to further enhance connectivity across Singapore.”

If the collective sale is successfully concluded at the minimum price, owners can expect to receive approximate gross sale proceeds ranging between SGD2.04 million and SGD2.31 million per unit. This is the second attempt following the previous attempt in 2018.

The tender closes on Tuesday, 22 April 2025 at 2pm Singapore time.

For media enquiries, please contact:

Yue Kai Xin, Press Relations, ERA Singapore

Email: [email protected]

Singapore, 19 February 2025 –

1. Over 50,000 new homes to be launched over the next three years

While not a new announcement, the government reaffirms its intentions to ramp up its Build-to-Order (BTO) supply over the next three years to meet housing demand. This will be driven by new developments in Woodlands, Bayshore and Mount Pleasant.

In 2025, 3,800 flats, some 20% of the total supply, will feature shorter wait times of three years or less. Additionally, there are plans to hold a second Sale of Balance Flats (SBF) exercise later this year.

“The ramp-up in BTO supply could help ease housing demand in Singapore, but it will take some time for HDB price growth to slow to a more sustainable price.

We believe many buyers will be drawn to attractive sites like Bayshore and Mount Pleasant. For instance, Mount Pleasant may be seen as an extension of the Toa Payoh housing estate, providing more options for buyers interested in that area. This could also help alleviate housing demand in Toa Payoh, which is home to many million-dollar flats.

While these initiatives are welcome, this ramp in BTO supply may not be able to meet immediate housing needs. Since January, 163 million-dollar flats have been transacted, with 94% located in mature estates. These flats are also likely to be launched in phases, which adds to the construction timeline. Moreover, buyers who have more urgent needs for a HDB flat in these locations still look towards resale flats.” said Eugene Lim, KEO, ERA Singapore

2. Fresh Start Housing Scheme

To better support vulnerable, lower-income families in achieving stability and upward mobility, the Fresh Start Housing Scheme will be further enhanced to aid second-timer families with children in transitioning from public rental flats to homeownership.

Moving forward, the current grant amount for eligible families to buy a new Standard two-room Flexi or Standard three-room flat on a shorter lease will be increased from $50,000 to $75,000. Additionally, the Fresh Start scheme will be extended to first-timer families living in public rental flats, allowing them to purchase shorter-leased subsidised flats.

“The Fresh Start Housing Scheme is a great initiative to promote greater equitability for low-income Singaporeans to achieve homeownership. The greater subsidy and the lower cost of shorter-leased homes will make homeownership more accessible to low-income Singaporeans.”

For media enquiries, please contact:

Yue Kai Xin, Press Relations, ERA Singapore

Email: [email protected]

SINGAPORE, 17 February 2025 – HDB’s February 2025 (Build-to-Order) BTO exercise, coupled with the annual Sale of Balance (SBF) exercise concludes today. In total, 10,622 HDB homes were available for application island wide.

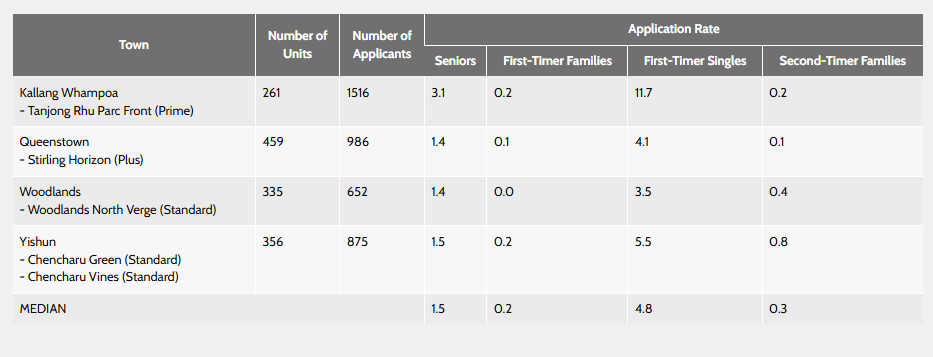

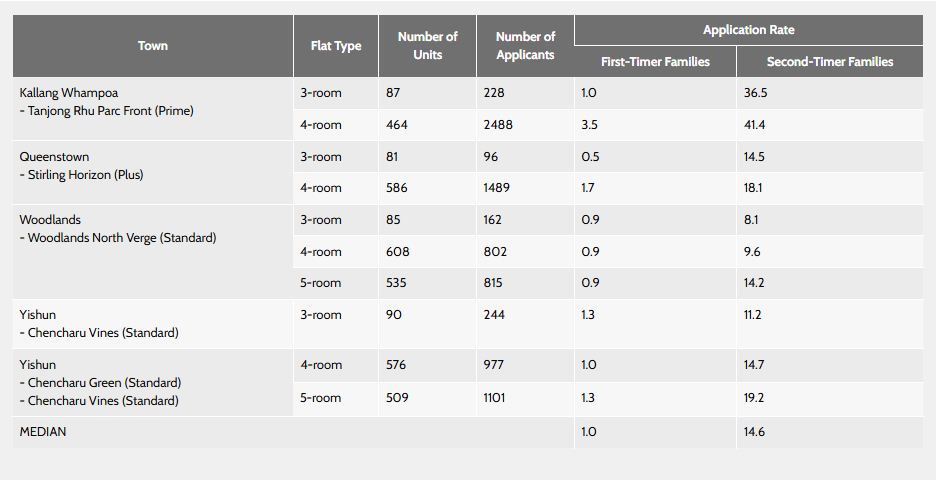

We saw a moderate 1.0 median first-timer application rate for 3-room and larger flat types across all the BTO projects, with a further 4.8 median first-timer application rate for 2-room flexi BTO flats.

As of 5pm on 17 Feb 2025, publicly available HDB data shows that there were 8,402 applicants for the 3,621 units (3-room and bigger BTO units) across four residential towns – Queenstown, Kallang-Whampoa, Yishun, and Woodlands. The 2-room Flexi units saw 4,029 applicants for 1,411 units.

“We observed a lower median application rate for Feb 2025 BTO projects compared to the June and October 2024 launches. The concurrent SBF exercise, which offered 5,590 flats with shorter wait times and a wider range of locations, have diverted demand away from the BTO exercise.” said Eugene Lim, KEO, ERA Singapore.

Under the SBF exercise, flats in mature estates that were launched prior to October 2024, will adhere to the standard HDB resale restrictions such as 5-year MOP instead of the 10-year MOP under Plus or Prime categories. This makes them appealing to buyers who do not want to be restricted by the longer MOP.

Under the BTO sales launch, the 2-room Flexi flats saw 4,029 applicants for 1,411 units. This is due to the concurrent SBF exercise offering 1,348 2-room Flexi flats, which drew in a staggering 7,602 applicants and helped ease pressure on the BTO launch.

“Tanjong Rhu Parc Front’s 3- and 4-room flats respectively saw first-timer family application rates of 1.0 and 3.5. This surpasses the corresponding rates recorded for June 2024’s Tanjong Rhu BTO project (Tanjong Rhu Riverfront I and II), which were 0.9 for 3-room flats and 2.1 for 4-room flats.

The strong interest in Tanjong Rhu Parc Front is due to its marginally closer location to Tanjong Katong MRT station compared to June 2024’s projects, as well as the Kallang Alive Master Plan announcement in August.”

“Stirling Horizon, a Plus project located in Queenstown, was less popular compared to other BTO sales launched in Queenstown. In particular, 4-room flats saw moderately slower interest from first-timer families, with an application rate of 1.7.

Besides being a Plus project that saw more stringent resale requirements, Stirling Horizon is relatively far away from the nearest Queenstown MRT station and has a longer wait time of 55-month.”

“The two Standard projects under Yishun township, Chencharu Vines and Chencharu Green saw application rates of 1.3 for 3-room flats, 1.0 for 4-room flats, and 1.3 for 5-room flats respectively.

While both Chencharu projects saw shorter wait time of between 37 and 38 months, buyers may be concerned that there will be a shortage of amenities in the still-developing Chencharu area when they are ready to move it. This may have held back interest in both projects. Some homebuyers may opt for resale flats instead, drawn by their location with more amenities, and the reasonable price gap between BTO and resale options.”

“Overall, application rates for Woodlands North Verge fell short of expectations, seeing a 0.9 application rate across 3-room, 4-room, and 5-room flats. This can be in large part due to the lack of amenities surrounding Woodlands North now.

While the project would feature access to the nearby Woodlands North MRT station across the Thomson-East Coast line, the surrounding area is largely undeveloped in terms of amenities and housing projects.”

“Overall, we also saw strong interest for the SBF for 3-room and bigger, with first-timer application rates upwards of 5.0 for popular housing towns such as Bishan, Serangoon, Pasir Ris, Queenstown, Sengkang, Hougang, Bedok, and Tampines.

HDB towns with few flats available such as Pasir Ris (11 units), Serangoon (8 units) and Hougang (70 units) all saw significantly high application rates.

For the SBF exercise, 2-room Flexi flats attracted 7,602 applications in total. Additionally, first-timer single applicants for 2-room Flexi flats in Bedok, Geylang, Hougang, and Tampines saw application rates exceeding 200.”

SBF flats have been popular as they offer a wider variety of projects as compared to those in the BTO exercises. SBF flats that saw high application rates were in towns not featured in this current BTO exercise, such as Clementi, Tampines, Pasir Ris, Sengkang, and Hougang.

“Majority of these SBF flats in mature estates, will follow the standard 5-year MOP, unless they were previously launched under the Plus or Prime classifications, making them attractive to buyers which explains their high oversubscription rate. Furthermore, some of the SBF flats are already completed, with others offering shorter waiting times compared to BTO flats, they could meet the demands of homebuyers with urgent housing needs.”

As the sole SBF exercise of the year concludes, all demand will fall back onto the BTO market for the remaining two launches of the year. We should see increased application rates for the upcoming BTO projects this year, as they feature homes in sought-after locations like Bukit Merah and Toa Payoh.

Table 1: Number of Applications Received for 2-room Flexi BTO as at 5pm, 17 Feb 2025

Source: HDB

Table 2: Number of Applications Received for 3-room and bigger BTO flats as at 5pm, 17 Feb 2025

Source: HDB

For media enquiries, please contact:

Yue Kai Xin, Press Relations, ERA Singapore

Email: [email protected]

SINGAPORE, 17 February 2025 – URA has released the January Developer Sales report. Compared to the lukewarm performance in December, which saw only 203 new homes sold, January saw new home sales momentum pick up again following the launches of two projects- The Orie and Bagnall Haus.

In total, 1,083 new homes were sold in January, marking more than fourfold increase month-on-month and 256% change year-on-year (y-o-y). The staggering increase was due to the December seasonal lull and strong buyer activity seen at The Orie and Bagnall Hause.

The three top performing projects, as mentioned were The Orie (RCR, 680 units sold), One Bernam (CCR, 99 units sold), and Bagnall Haus (OCR, 75 units sold) – one for each market segment.

“The Orie, being the first Toa Payoh launch since 2016, sold 680, or 88% of its units in the month, for a median price of $2,731 psf, with some 1 and 2-bedroom units on higher floor breaking through the $3,000 psf price point. The strong performance was expected due to pent-up demand in Toa Payoh, coupled with the limited availability of plots in the area. Majority of the buyers were Singaporeans who grew up in this area and were look for their next home.” said Marcus Chu, CEO, ERA Singapore.

“One Bernam saw some 99 units sold in January. The median sale price of $2,521 psf was just a notch higher than the project’s launched price in May 2021 (median $2,471 psf), providing an attractive entry price point for a CCR project. With recent RCR launches like The Orie reaching a median price of $2,731 psf, One Bernam stood out as an undervalued CCR project. Its competitive pricing attracted investors, positioning it as an appealing CCR value buy amid the narrowing CCR-RCR price gap.”

“Bagnall Haus, a small freehold condo in D16, which sold 75 of its 113 units for a median price of $2,494 psf within its launch month. Some 52 units were transacted below the $2.5m price quantum, making it an attractive product for homebuyers seeking a FH property. On top of that, its prime location near Sungei Bedok MRT adds to its appeal, checking many boxes for discerning buyers.”

“January clocked in just 21 Executive Condo (EC) sales, with no new EC launches. As at Jan, there are only some 148 units of EC units remain unsold and buyers are slowly snapping up the balance stock.”

Continuing the trend from December, Hillock Green also performed well, transacting 21 units at $2,253 psf. It has consistently performed as a best-seller in 2024, with its attractive pricing compared to the benchmark prices being set islandwide by recent new launches, and its family friendly layouts. Lentor’s supply of new home has been dwindling but the launch of Lentor Central Residences is set to inject fresh options into the market.

“In the primary market, luxury properties priced at $5 million and above saw just two transactions in January. Notably, both deals were from Park Nova, a luxury freehold development on Orchard Boulevard, and were above the $15 million mark. According to caveats, the 2,906 sqft four-bedroom unit was sold to a foreigner at $16.6M ($5,708 psf), which will likely incur an ABSD of 60%. Meanwhile the 5,898 sqft penthouse acquired by a PR for a remarkable $38.9M ($6,593 psf).”

In the latter half of 2024, we saw interest rate cuts and more positive economic sentiment revitalising the new home market. Collectively, with Singapore’s firm economic fundamentals, buyers remain confident in the resilience of the residential market, which could help weather global headwinds and bolster new home sales in recent months.

In February, we are likely to see the launch of more highly anticipated projects such as Aurea, ELTA, and Parktown Residence. In particular, projects like ELTA and Parktown Residence are within popular housing estates like Clementi and Tampines and will draw strong interest from HDB upgraders in the vicinity. We can expect to see a continued sales momentum of the primary market. With this, ERA projects new home sales possibly reaching between 7,000 and 8,000 units in 2025.

SINGAPORE, 10 February 2025 – The Housing and Development Board (HDB) announced the start of the February 2025 Build-To-Order (BTO) exercise, which will see a total of 5,032 flats brought to the market for purchase.

Overview

“This February 2025 BTO launch, which also consists of the annual SBF exercise stands out in a few key highlight areas, such as the first ever Plus project in Queenstown, as well as the largest ever SBF exercise consisting of 5,590 units.”

“Many of the homes offered under the Sale of Balance Flats (SBF) scheme have shorter remaining leases of 40 to 60 years, which may not appeal to first-time applicants, who are typically younger buyers. However, these units may attract older second-timer applicants who prioritise affordability and may not require the extensive lease.”

First Plus Project in Queenstown – Cheaper than in 2024

“The project Stirling Horizon will be the first Plus project in Queenstown. In comparison to the most recent Prime Queenstown BTO project launched in June 2024, we are observing lower starting prices for 4-room units, compared to the BTOs offered at Holland Village and Tanglin last year. There are also 3-room units, which were omitted in last year’s project.”

“Given the outstanding application rate of over 7.3 for last year’s project, we expect the same performance this time round, given the town’s reputation as a centrally located and mature estate.”

Affordable Homes in Yishun and Woodlands with a 5-year MOP

“HDB is continuing to release affordable housing in the new, or up-and-coming estates. Unsubsidised 4-room and 5-room units in Chencharu are starting from $316,000 and $447,000 respectively, making them affordable options for most Singaporeans.

Likewise, the Woodlands North Verge project, which will benefit from the revitalisation of Woodlands North will see slightly higher, but also affordable prices, with 4-room flats starting from $365,000. Overall, these two standard projects will be highly popular as they are affordable projects and will be subjected to the typical 5-year Minimum Occupation Period (MOP).”

New Chencharu BTO flats to Revitalise Yishun, Featuring Shorter Wait Times

“The shorter wait time, being close to the Khatib MRT station and in proximity to amenities of these BTO flats will appeal to homebuyers. For now, nearly 84% of the existing flats along Yishun Ring Road were built before 2000, so the BTO flats in Chencharu will open options for buyers looking to live in this area of Yishun.

In addition, future residents can look forward to a park to connect residents to Khatib MRT, an Integrated Development with a new bus interchange, hawker centre and shops.”

“For some, BTO flats are not a viable option due to the long waiting time of five to six years. In contrast, flats with shorter waiting times of less than three years offer these buyers greater flexibility. This allows them to consider temporary arrangements, such as renting a place or staying with family, while waiting for their new home to be ready.”

“Demand for resale flats is primarily driven by homeowners with immediate housing needs. The shorter wait time could potentially draw some resale buyers back to the BTO sales launches, particularly the Chencharu is an up-and-coming area in Yishun which has existing amenities and MRT access. The shorter wait time further sweeten the deal for potential homebuyers.”

Plenty of Options Available for Singles

“There will be 2,759 2-room Flexi flats available across both the BTO and SBF exercises. With the introduction of the Plus and Prime housing models, Singles are now able to apply for any 2-room Flexi flat of their choice islandwide.”

“With a greater degree of flexibility in terms of location, this will help alleviate demand for 2-room flats, which have generally been oversubscribed in BTO launches.”

Second time that Prime BTO projects are released in Tanjong Rhu

“Similar to October 2024’s BTO exercise, only one Prime project was launched, this time in Tanjong Rhu.”

“Tanjong Rhu Parc Front’s launch follows closely after Tanjong Rhu Riverfront I and II, which were also offered in June 2024’s exercise as Prime projects. Notably, 3-room flats at these projects saw more lukewarm interest and were undersubscribed. We could see a similar outcome this time round, as 3-room flats will also be offered at Queenstown resulting in more competition.”

“On the bright side, this could be a positive for applicants for 3-room flats at Tanjong Rhu, as they may have higher chances of securing a unit of their choice.”

END OF PRESS RELEASE

For media enquiries, please contact:

Eugene Lim, Key Executive Officer, ERA Singapore

Email: [email protected]

SINGAPORE, 7 February 2025 – The tender for the Government Land Sale (GLS) site at River Valley Green (Parcel B) closed on 7th February 2025.

In total, the site drew interest from five bidders, with the top bid of $627.8 million (or $1,420 psf ppr) being put in by GuocoLand Limited.

ERA’s Observations

“The highest tender price submitted at $1,420 psf ppr lies between the price submitted for two nearby sites, the River Valley Parcel A site ($1,325 psf ppr, tendered in 2024) and the Irwell Bank Road site ($1,515 psf ppr, tendered amidst peak market conditions in 2020). This could be a signal that the market could be on an upward trajectory, further exemplified by the competitive number of bidders.”

“With a land cost of $1,420 psf ppr, we could see units selling from $2,800 psf.”

“The site at River Valley Green (Parcel B) has drawn surprising interest with five bidders, contrasting the lukewarm response of Parcel A, which saw a mere two bids. The sanguine response of bidders is unexpected as the area is highly saturated with GLS sites, with three in the vicinity already sold. Including this site, the future developments could yield some 2,200 dwelling units in total.”

“When a situation like this arises, we generally see developers exercise greater caution, as they would be competing for the same pool of buyers.”

“Amongst these four sites, River Valley Green (Parcel B) site drew the most bids (5). The previous three sites in the vicinity only had an average of 1.7 bids each. Moreover, the top bid is also 7.2% higher than the neighbouring River Valley Green (Parcel A) site.”

“Key reasons why the bidding for this site drew considerably more interest and outperformed its sister site at Parcel A would be projected future demand from the planned commercial component and transport integration, and lower developmental risk due to a more palatable interest rate environment for developers.”

“Compared to the supply of other nearby sites, the Parcel B site features superior site attributes. It provides some of the finest views of the river, and a much quieter environment opposed to facing the main road. Furthermore, it will also be integrated with Great World MRT Station, providing seamless connectivity to residents.”

“Easing interest rates may have given confidence to developers, although the economic uncertainty amidst global geopolitical tensions may present risks to the developers. Compared to conditions seen through most of last year, developers have weighed these risks accordingly and decided to proceed with their bids.”

“Despite geopolitical tensions and economic risks, this has not deterred developers’ bullishness, likely drawn in from the stellar performance for new homes in the past few months. Buyers’ willingness to pay these new benchmark prices for suburban and city fringe homes could have buoyed developers’ confidence.”

For media enquiries, please contact:

Eugene Lim, Key Executive Officer, ERA Singapore

Email: [email protected]

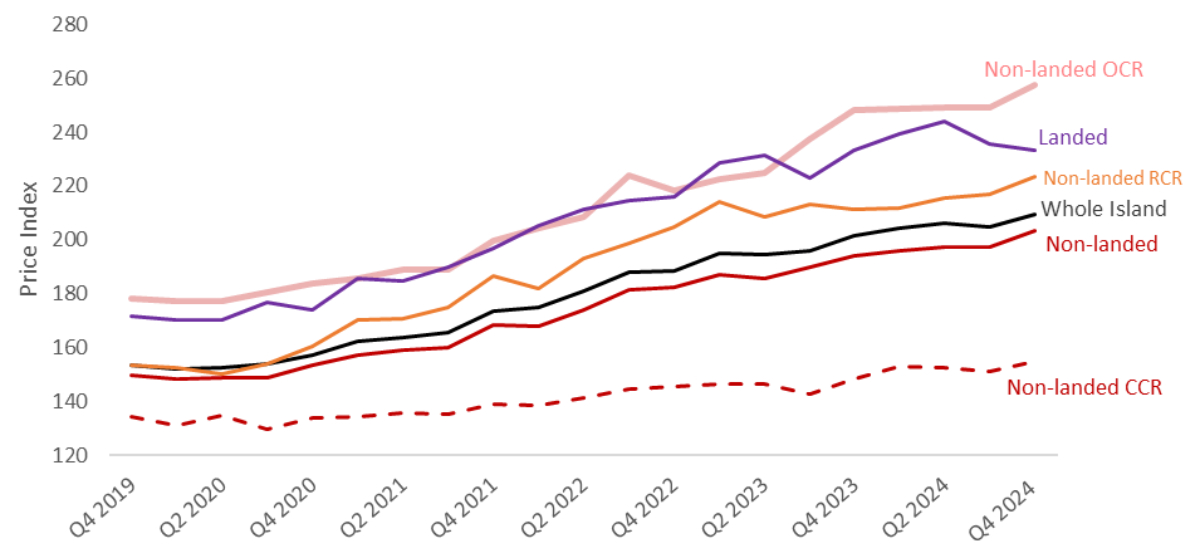

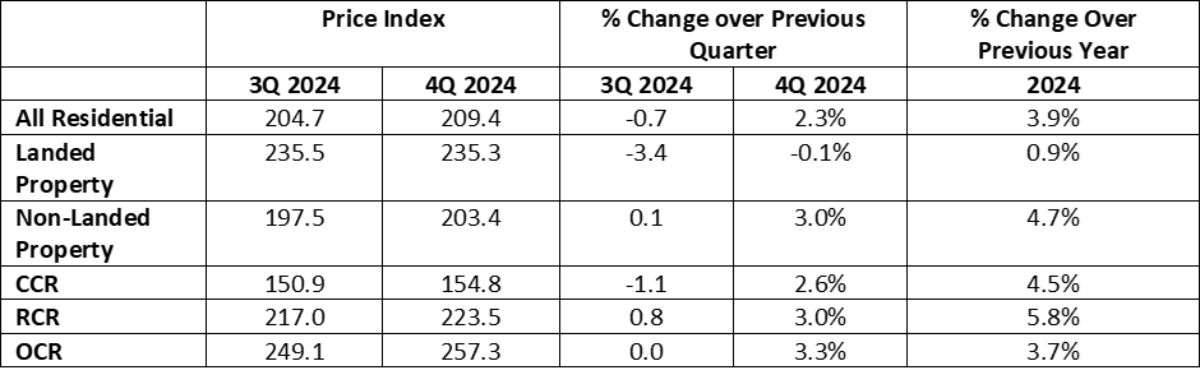

SINGAPORE, 24 January 2025 – According to the Urban Redevelopment Authority (URA)’s report for 4Q 2024, private home prices had risen 2.3% quarter-on-quarter (q-o-q), marking a reversal of the 0.7% q-o-q decline observed in 3Q 2024.

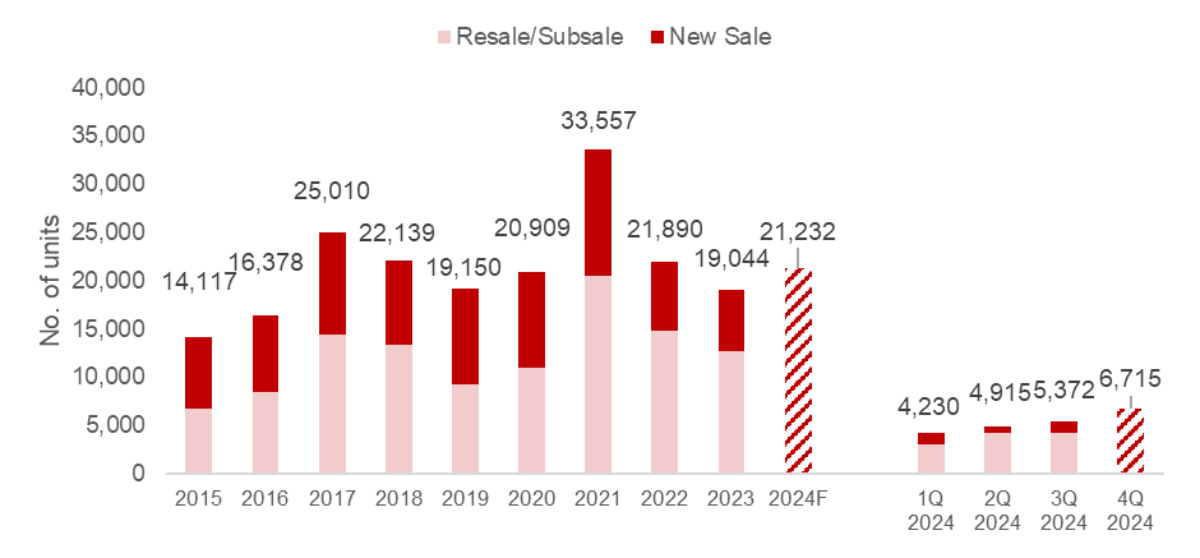

In tandem, total transaction volume of private homes also rose to 7,433 units in 4Q 2024, marking a significant increase of 38.4% from the 5,372 units recorded for 3Q 2024.

4Q 2024’s price uptick also brings full-year growth to 3.9% for private homes, reflecting a slower pace of increase compared to the 6.8% growth achieved in 2023. This is also the slowest rate of growth since 2020, when the all-private residential price index rose 2.2% y-o-y.

Comments by ERA

“The overall private residential price index experienced its slowest growth since 2020, growing at a more moderate pace in 4Q 2024. The growth was supported by new home launches such as The Collective at One Sophia, Emerald of Katong, Chuan Park and Nava Grove that have helped supported home price growth in all regions.” Said Marcus Chu, CEO, ERA Singapore.

“Since the series of Fed interest rate cuts from September 2024, we have seen a surge in buyer confidence across the board driving an uptick of market activity in 4Q 2024. 4Q 2024 new home sales accounted for just above half of the new home sold in 2024 and is the highest since 3Q 2021. Likewise, Resale and Sub-sale transactions rose 22.6% y-o-y in 2024.”

“Today’s market is reflective of genuine upgraders’ demand and the buyers welcomed the interest rate cuts as a much-needed reprieve from the higher interest rate environment since 2022. Although we are seeing higher home prices, majority of the buyers’ affordability remains constrained by the price quantum.”

“With landed homes price growing at a more moderate pace of 0.9% y-o-y in 2024, we have seen transaction volume rise by 29.9% y-o-y, from 1,286 units in 2023 to 1,671 units. The rising non-landed home prices have also helped supported more Singaporeans to move into the landed property segment.”

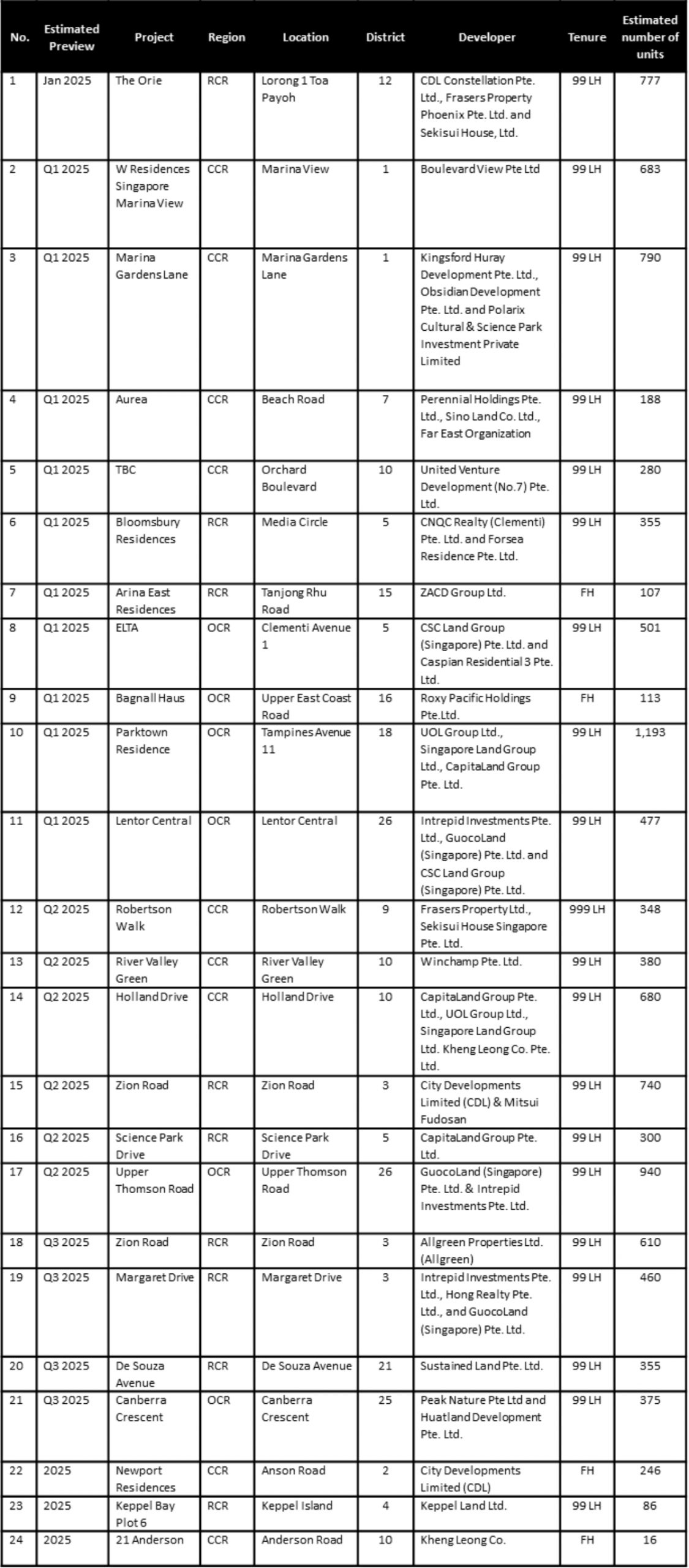

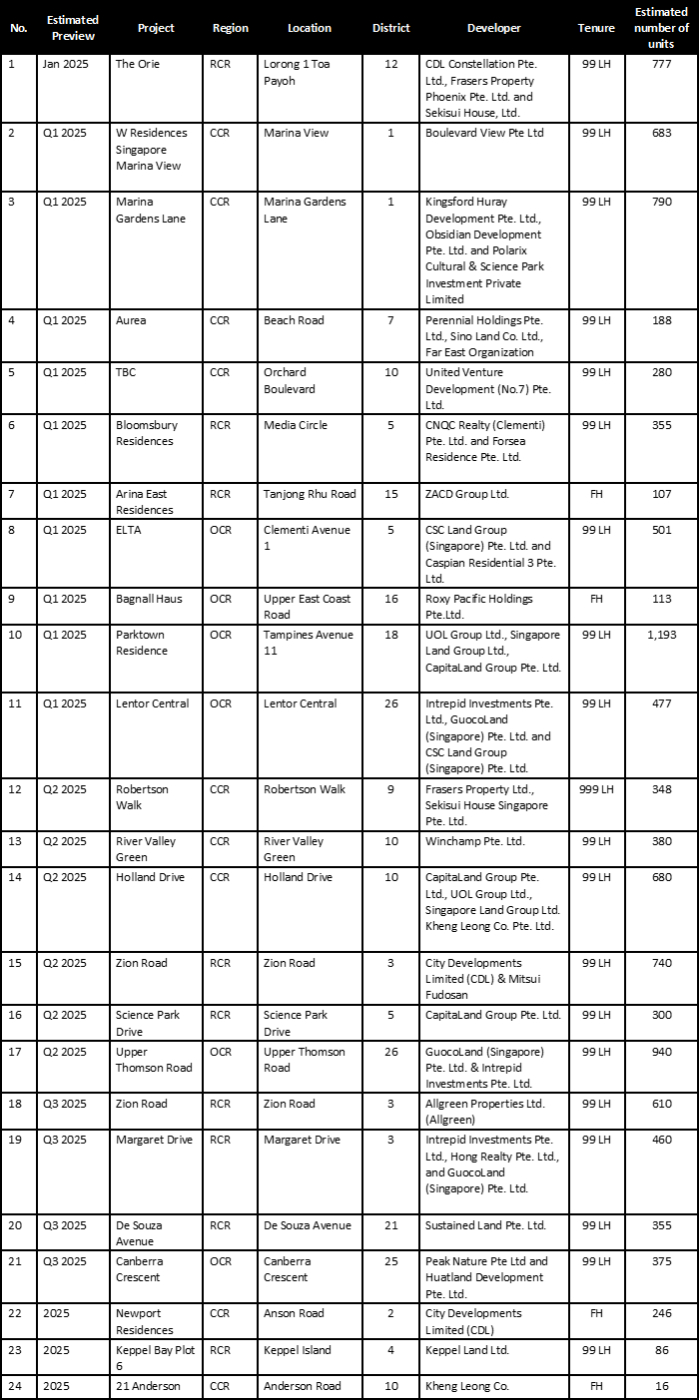

“Going forward, with fewer completions expected in 2025, we may see a supply crunch in the secondary market, prompting buyers to pivot toward the new home market instead. While unsold stock has gradually tapered to 19,606 in 4Q 2024, the upcoming 24 new home launches in 2025 will inject fresh supply of new homes.”

Nonetheless, ERA remains cautiously optimistic about Singapore’s residential market in 2025. Supported by strong macroeconomic fundamentals, Singapore is likely to strengthen its position as a ‘safe harbour’ amid looming economic uncertainties.

Assuming stable macroeconomic conditions and the absence of unforeseen negative factors, new home prices are expected to continue their upward trajectory, potentially achieving 3-5% y-o-y growth in 2025. The ample new home launches will support new home transaction volume which is projected to reach between 7,000 to 8,000 units in 2025, dependent on a favourable economic outlook.

ERA estimates that sub-sale transactions will range between 1,100 to 1,300 units, with median prices possibly growing by 7% to 9%. Resale transactions are also expected to reach between 14,000 to 15,000 units, accompanied by a median price growth of 6% to 8% by the close of 2025.

Rents have eased in 2024, on the back of higher completion since 2023 that led to strong competition for tenants. Looking ahead, with the supply of completed units tightening in both the private home and HDB markets, prices in the residential leasing market are primed for growth in 2025. Moreover, assuming no significant changes in economic conditions and foreign worker numbers, rental demand is also likely to stay consistent next year without any significant spikes or declines.

However, rental price growth is likely to diverge across the market, with newly completed homes expected to sustain stronger rent appreciation, while older properties may experience slower or flattish growth. Similarly, properties in Singapore’s outlying regions could see sharper increases in rents and stronger demand as tenants become more cost-conscious.

Come next year, ERA forecasts tempered rental price growth for private homes within a projected range of 0 to 3% y-o-y in the face of fewer completions and a more cautious economic outlook. We also anticipate the number of private home rental contracts to remain consistent, with numbers expected to reach between 80,000 and 90,000 in 2025.

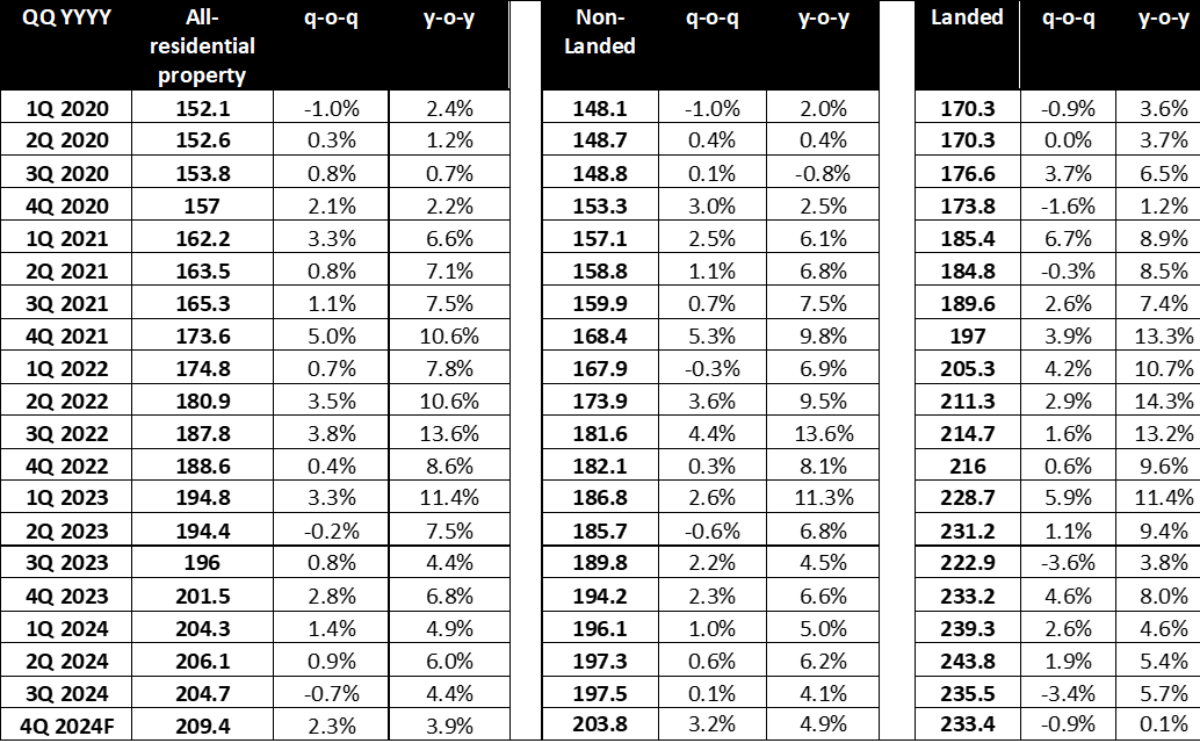

URA Private Property Index

In 4Q 2024, the All-Residential Property Price Index (PPI) rose by 2.3% quarter-on-quarter (q-o-q). This is a reversal of 3Q 2024’s performance which saw prices dipping by 0.7% q-o-q. The final print figure also aligns with the 2.3% q-o-q increase per URA flash estimates released earlier on 2 Jan 2025.

In the non-landed private home segment, prices rose 3.0% q-o-q in 4Q 2024. Notably, this is a more pronounced increase compared to the 0.1% q-o-q gain in non-landed private home prices in 3Q 2024.

Leading these price shifts was the Outside Central Region (OCR), which saw a 3.3% q-o-q uptick for non-landed private homes. Likewise, the Core Central Region (CCR) and Rest of Central Region (RCR) both saw prices lift by 2.6% q-o-q and 3.0% q-o-q respectively.

In the landed property sub-market, prices shrank by 0.1% q-o-q in 4Q 2024. This decline is notably smaller than the 3.4% q-o-q downtick registered in the previous quarter.

Chart 1: URA Private Property Price Indexes

Source: URA, ERA Research and Market Intelligence

Table 1: Change in URA Private Property Price Indexes for 3Q 2024 and 4Q 2024

Source: URA, ERA Research and Market Intelligence

Transaction Volume

Transaction numbers for all private properties rose substantially in 4Q 2024. Based on latest figures released by URA, a total of 7,433 private homes were moved on the primary and secondary market. This surge represents a sharp increase of 38.4% q-o-q from the 5,372 units sold in 3Q 2024.

In terms of overall annual transactions for all private homes, 2024 saw full-year sales reaching 21,950 units, up 15.3% from the 19,044 units sold in 2023. This 52.9% downtick from the last high in 2021, which saw 33,557 units sold.

Notably, buyers of private homes were also largely driven to the secondary market in 2024, with the full-year figure for resale transactions rising to 14,053 units from 11,329 units in 2023.

Possible factors for this uptick in resale transactions include lower borrowing costs following the Fed’s interest rate cuts, as well as the widening price gap between new and resale non-landed private homes (excluding ECs).

Based on caveat data, the gap in median prices between the new and resale non-landed private homes (excluding ECs) widened significantly from 34.0% in 3Q 2024 to 52.5% in 4Q 2024.

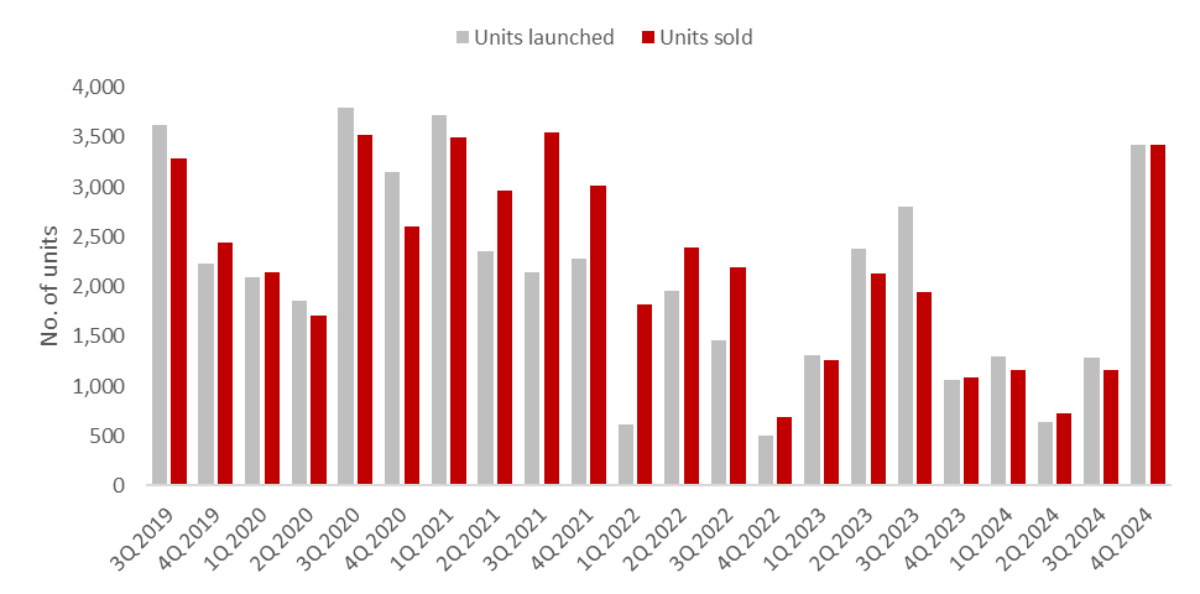

New Private Home Sales (Excluding ECs)

4Q 2024 saw a resurgence in sales of new private homes (excluding ECs), with corresponding transaction volume reaching 3,420 units over the course of the quarter. On the quarter, this represents a 194.8% q-o-q increase over the 1,160 units sold by developers in 3Q 2024.

This upturn in sales coincides with an increase in the number of private homes (excluding ECs) launched by developers. In 4Q 2024, a total of 3,425 units made their debut across several highly anticipated projects, including but not limited to Chuan Park, Union Square Residences, The Collective at One Sophia, Emerald of Katong, and Nava Grove.

The number of private residential units launched in 4Q 2024 also represents a 166.7% q-o-q increase over the 1,284 units brought to market by developers in 3Q 2024.

Correspondingly, the unsold stock of private homes (excluding ECs) contracted 2.7% q-o-q to 19,405 units in 4Q 2024, down from the 19,940 units recorded in 3Q 2024. As a result, this could lead to upward pressure on new home prices as buyers face a more competitive market.

Chart 2: New Homes Launched and Sold (Excluding ECs)

Source: URA, ERA Research and Market Intelligence

Executive Condominium

Following the debut of Novo Place in November, the number of Executive Condominium (EC) units sold by developers rose sharply to 528 units in 4Q 2024, representing a 407.7% q-o-q increase over the 104 units sold in 3Q 2024.

Additionally, a total of 504 EC units were launched by developers in 4Q 2024, contrasting the lack of fresh supply in the absence of new EC projects during 2Q and 3Q 2024.

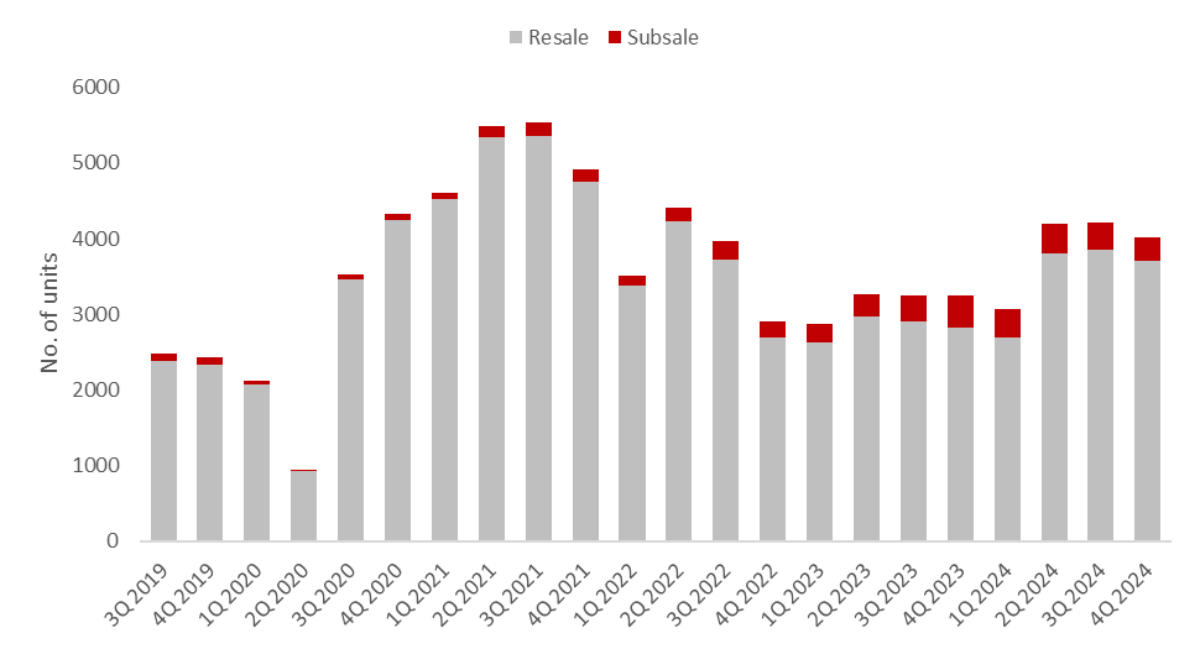

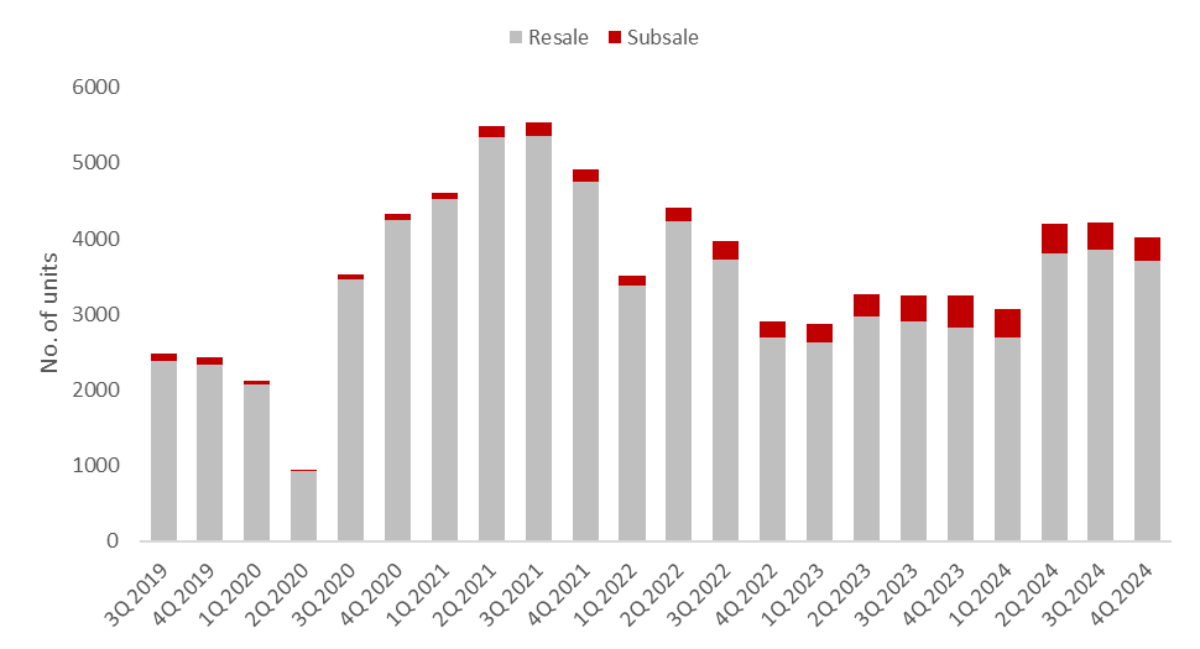

Resale and Sub-Sale (Excluding ECs)

Chart 3: Resale and Sub-sale Transaction Volume

Source: URA, ERA Research and Market Intelligence

In 4Q 2024, sales of private homes (excluding ECs) were driven equally by both resale and new sale transactions. Based on URA Realis data, new sale transactions constituted 46.0% of the quarter’s private home sales (excluding ECs), while resale transactions accounted for 49.8%.

On the quarter, sales of private homes (excluding ECs) on the resale market fell by 4.1% q-o-q, from 3,860 units in 3Q 2024 to 3,702 units in 4Q 2024.

Sub-sales of private homes (excluding ECs) also fell over the quarter. Based on latest data from URA, a total of 311 sub-sale transactions were recorded for 4Q 2024, reflecting 11.6% q-o-q decline from the 352 transactions in 3Q 2024.

Landed Homes

Chart 3: Landed homes sold in each quarter

Source: URA, ERA Research and Market Intelligence

Prices of landed homes rose 0.1% in 4Q 2024, reversing the 3.4% decrease in the previous quarter. For the whole of 2024, prices of landed homes grew at a more moderate pace of 0.9% y-o-y.

According to caveats, 441 landed homes were sold in 4Q 2024, similar to 3Q 2024. For the whole of 2024, landed property transaction volume rose by 29.9% y-o-y, from 1,286 units in 2023 to 1,671 units.

According to caveat data, the majority of landed home transactions (67.8%) in 4Q 2024 were priced between $3.5M and $7M.

Moreover, a possible factor for price increases during the quarter was the notable surge in landed home sales within the $6M to $7M range, rising from 14 units in 3Q 2024 to 45 units in 4Q 2024. In turn, this heightened demand for higher-priced homes can be traced back to the Federal Reserve’s interest rate cuts, which boosted buyer receptiveness.

Leasing

Rents for private residential properties remained unchanged in 4Q 2024, with the all-residential rental index remaining at 157.9, similar to 3Q 2024. Rents for non-landed properties also rose further by 0.2% q-o-q in 4Q 2024, continuing the positive trend observed in 3Q 2024. Rents of landed properties meanwhile fell by 1.8% q-o-q.

By region, rents for non-landed private properties rose 0.9% q-o-q in the CCR. Likewise, rents for the RCR rose by 0.3% while rents in the OCR fell by 0.8% in 4Q 2024.

According to URA Realis data, a total of 18,340 non-landed residential rental contracts were also inked in 4Q 2024, marking a 24.8% q-o-q downtick over the previous quarter.

For the whole of 2024, rentals of non-landed properties in the CCR, RCR, and OCR decreased by 2.4%, 1.3% and 1.3% respectively, a contrast from the respective increases of 5.0%, 9.0% and 7.5% in 2023

Looking ahead, rents for non-landed properties are expected to grow further in 2025. This is due to a noticeable decline in completions, which is likely to apply upward pressure on rental prices.

While completions of non-landed homes (excluding ECs) totalled 3,253 units in 3Q 2024, this dipped slightly with 3,084 private homes in 4Q 2024. Furthermore, projected full-year completions for non-landed homes (excluding ECs) currently stands at 5,846 units for 2025, which is markedly lower than the 8,460 units completed in 2024.

What Lies Ahead for the Private Home Market in the Coming Months?

Though recent interest rate cuts and a more positive economic outlook have breathed new life into the new launch market, challenges remain with the possibility of higher-for-longer interest rates, an impending Trump presidency, as well as ongoing trade tensions that could impede Singapore’s economic growth.

Nonetheless, ERA remains cautiously optimistic about Singapore’s residential market in 2025. Supported by strong macroeconomic fundamentals, Singapore is likely to strengthen its position as a ‘safe harbour’ amid potentially stormy conditions. This could, in turn, boost buyer confidence and bolster demand for new private homes even in the face of a challenging global economy.

Assuming stable macroeconomic conditions and the absence of unforeseen negative factors, new home prices are expected to continue their upward trajectory, potentially achieving 3-5% y-o-y growth in 2025. The ample new home launches will support new home transaction volume which is projected to reach between 7,000 to 8,000 units in 2025, dependent on a favourable economic outlook.

ERA estimates that sub-sale transactions will range between 1,100 to 1,300 units, with median prices possibly growing by 7% to 9%. Resale transactions are also expected to reach between 14,000 to 15,000 units, accompanied by a median price growth of 6% to 8% by the close of 2025.

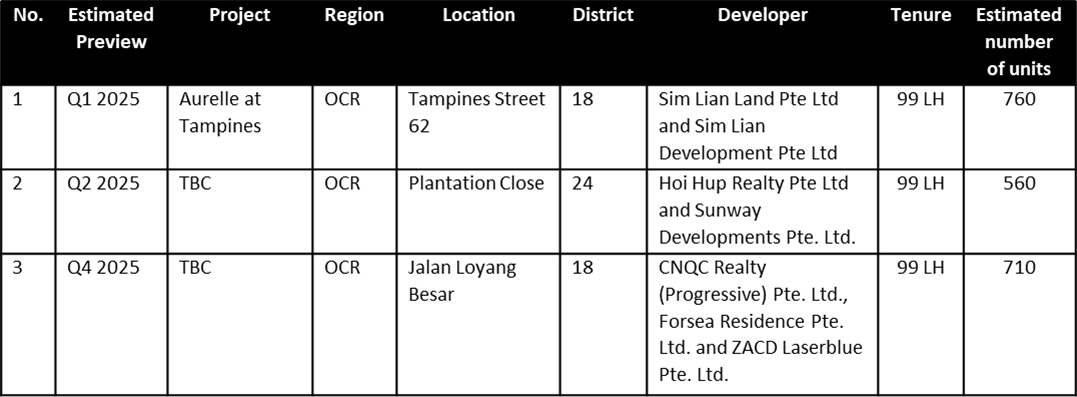

Table 2: Upcoming launches in 2025

Source: ERA Project Marketing

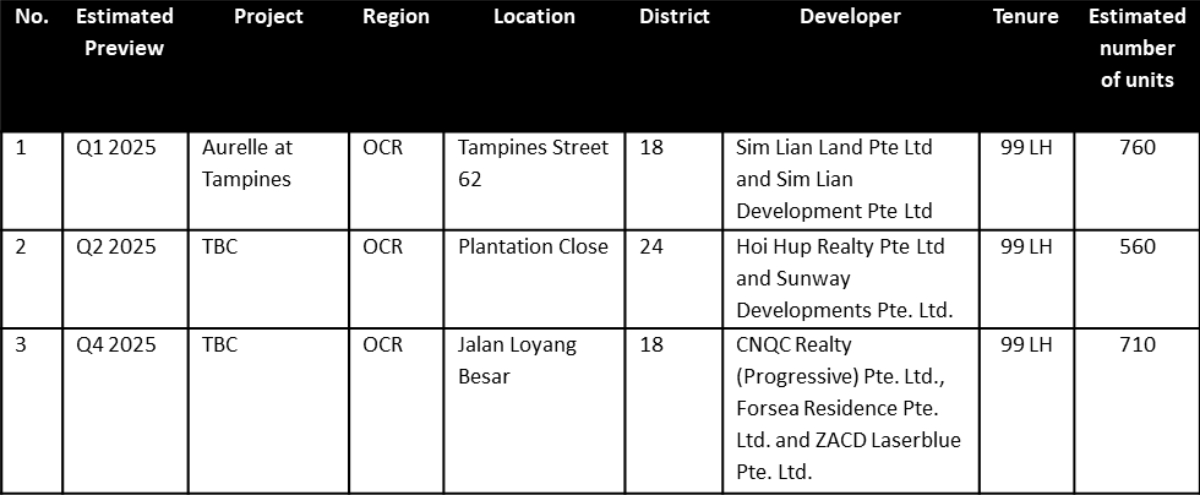

Executive Condominium

Source: ERA Project Marketing

For media enquiries, please contact:

Yue Kai Xin, Press Relations, ERA Singapore

Email: [email protected]

SINGAPORE, 24 January 2025 – According to the Housing and Development Board (HDB), the HDB resale price index rose to 197.9, a 2.6% increase quarter-on-quarter (q-o-q) in 4Q 2024. For the whole of 2024, HDB resale prices have risen at a faster pace of 9.7% y-o-y compared to 4.9% in 2023. Resale price has risen faster on the back of strong demand for HDB resale flats and fewer flats meeting the Minimum Occupation Period (MOP) in 2024 compared to 2023.

In 4Q 2024, HDB resale transactions totalled 6,424 units, a 21.1% q-o-q decrease due to the seasonal lull. This figure is 1.9% lower than in 4Q 2023. For the whole of 2024, some 28,986 HDB resale transactions were recorded, marking an 9.4% increase year-on-year (y-o-y) and the highest number of HDB resale transactions seen since 2021 (31,017 units).

Faster Price Growth Driven by Fewer MOP Flats in the Year

The growth in transaction prices observed in the quarter, as well as the entirety of 2024 can be attributed to the lower number of flats that have recently completed their Minimum Occupation Period (MOP). HDB resale buyers are often willing to pay a premium for these flats with longer balance leases, particularly if they are in mature estates with good connectivity and amenities. With a lower number of MOP flats available, sellers tend to demand higher prices for homes with these attractive attributes.

“The HDB resale market saw continued price growth, reaching an all-time high, driven by a strong demand across all flat types in 2024. Flats that have just attained their MOP status remain in high demand as they are considered new; with long unexpired lease and require no renovation.” said Eugene Lim, KEO, ERA Singapore.

“Some of these MOP flats fell within the million-dollar price range, prompting sellers across the board to raise their price expectations. This trend combined with the tight supply of resale units for sale, has driven resale price across the market. Despite this, some 76.1% of resale transactions were below $750k.

Furthermore, the new classification of Plus and Prime classification BTO flats since Oct may have driven more homebuyers to seek out HDB resale homes in central locations. These buyers are reluctant to accept the resale restrictions such as a 10-year Minimum Occupation Period, rental restrictions after MOP, subsidy clawback upon resale and resale income cap on future buyers.”

“For the whole of 2024, we have seen 1,035 million-dollar flats, amounting to 3.6% of total resale applications. More than 100 units of million-dollar flats were sold respectively in mature locations such as Kallang/Whampoa, Toa Payoh, Bukit Merah and Queenstown. Compared to 2023, where these locations saw between 40-60 million-dollar transactions each.”

“We expect MOP flats in 2025 to fall to an estimated 7,000 units. Between 2021 and 2024, we have seen nearly 81,000 MOP units and not all were immediately listed for sale upon meeting their MOP. Some of these units could still be gradually entering the market, ensuring a steady supply of resale flats for sale.”

“Alongside the supply of BTO and SBF, we expect to see the demand HDB flats stabilise in 2025. With that we can expect price for resale flats is expected to climb at a slower pace in 2025 due to the higher base seen in 2024. Much of the growth will be led by the resale homes with longer balance lease in mature estates. The February BTO sales launch is expected to draw some buyers away from the resale market”

Upgraders Turning to the HDB Market

2024 saw elevated housing interest rates across most of the year as well as notable retrenchments for the first half of the year. With private residential prices continuing to rise, some HDB owners may have chosen to upgrade within the HDB market instead; moving from smaller to larger flats; or from older to newer flats.

Such buyers could have a more comfortable budget allowing them to upgrade to larger, more centrally located homes with longer leases, which in turn helped to boost resale prices. In 4Q 2024, some 285 units million-dollar flats were transacted, bringing the total number of HDB flats surpassing the million-dollar mark in 2024 to a historical high of 1,035. This represents 3.6% of total resale transactions; compared with 1.8% in 2023.

HDB Rental Statistics

The number of approved applications to rent out HDB flats fell further by 5.6% from 9,118 cases in 3Q 2024 to 8.603 cases in 4Q 2024. Compared to 4Q 2023, the number of approved applications in 4Q 2024 was 12.1% lower. This can be attributed to the seasonal lack of demand in the fourth quarter, where tenants are normally waiting to renew their leases at the start of a new year – hence holding off on signing new rental contracts during this period.

In 2024, the total number of approved applications to rent out HDB flats decreased by 6.3% y-o-y, from 39,138 cases to 36,673 cases.

Fewer HDB units are available for rent due to the dwindling number of MOP units and more HDB upgraders in the market. With that, this could push HDB rental prices further in the coming months.

BTO Flat Supply and ERA’s Outlook for 2025

In total, 21,225 new flats were launched in 2024. This consisted of 19,637 BTO flats and 1,588 Sale of Balance Flats (SBF). 2025’s new flat supply will consist of 19,600 flats in confirmed towns such as Kallang/Whampoa, Bukit Merah, Queenstown, Mount Pleasant, Woodlands, Yishun, and Sembawang.

2025 will also see an increase in the number of Short Waiting Time (SWT) flats. These flats with a completion time of under 3 years will provide an additional option for homebuyers with more urgent housing needs, as they can consider temporary housing arrangements while waiting for their flats – an alternative to purchasing directly from the resale market.

This will kick off in February, which will offer over 10,000 units with the launch of 5,000 BTO flats in Kallang/Whampoa (Tanjong Rhu), Queenstown, Woodlands and Yishun (Chencharu), alongside the largest ever SBF exercise with more than 5,500 flats.

Except for flats launched as part of the October 2024 BTO exercise, the flats offered in the upcoming SBF exercise will not follow the new BTO classification framework. Additionally, 4 in 10 of the units in this exercise are already completed, providing applicants expedited access to a new flat. As a result, we should see a strong demand for these flats, especially for those located in prime location.

2024 closed out with a 9.7% y-o-y price growth, as well as reaching 28,986 transactions. This is close to ERA’s forecast for 2024 of 6-9% price growth and 28,000 to 29,000 transactions.

For 2025, ERA expects resale prices to grow at a more measured pace due to the higher price base in 2024 and a reduced supply of MOP flats in 2025, which have been a key driver of price growth in recent years. We anticipate an overall 3% – 6% price growth, with 26,000 – 27,000 resale HDB units expected to move by end-2025.

For media enquiries, please contact:

Yue Kai Xin, Press Relations, ERA Singapore

Email: [email protected]

SINGAPORE, 14 January 2025 – URA has just announced the closing of the tender for two residential land parcels at Dairy Farm Walk and Tengah Garden Avenue today, 14th January 2025.

Dairy Farm Walk

The tender for the Government Land Sale (GLS) site at Dairy Farm Walk closed on 14th January 2025. In total, the site drew interest from two bidders, with the top bid of $504.5 million (or $1,020 psf ppr) submitted by a consortium comprising SNC2 Realty, Apex Asia Alpha Investment Two, Soon Li Heng Civil Engineering, and Kay Lim Realty.

The two bids received for the Dairy Farm Walk site highlights the sharp fall in competition as compared to higher interest shown for previous GLS sites in the area. Previous GLS sites at Dairy Farm Walk and Dairy Farm Road received an average of seven bids across three projects, namely The Skywoods, Dairy Farm Residence and The Botany at Dairy Farm. The muted number of bids suggests that developers may now be cautious and concerned that the area’s pent-up demand in Hillview and Dairy Farm might have already been absorbed by the earlier launches.

Nonetheless, bid price for the Dairy Farm Walk site comes 4.1% higher than the last GLS site in the area, now The Botany at Dairy Farm, which was awarded at $347 mil ($980 psf ppr).

However, the wider gap between the two bids where the top bid of is 23.1% higher than the other bidder, reflects the contrasting perspectives of the two developers on the market outlook. This bullish response could come from the developers’ confidence from new home sales performance around Hillview MRT Station. Till date, The Botany at Dairy Farm is 99.8% sold since its launch in March 2023, while Hillhaven has sold 78.0% of units since launching in January 2024. Based on the bid price, we can expect a selling price from $2,250 psf onwards.

Tengah Garden Avenue

The tender for the Government Land Sale (GLS) site at Tengah Garden Avenue closed on 14th January 2025. In total, the site drew interest from three bidders, with the top bid of $675 million (or $821 psf ppr) submitted by a consortium consisting of Intrepid Investments, CSC Land Group and GuocoLand (Singapore). The bids between all three bidders were tight, with difference of just 1% between them.

This GLS site at Tengah Garden Avenue will be the first private condominium launch in Tengah estate – with all four previous projects launched in the areas being Executive Condominiums (ECs).

Guocoland’s expertise lie in township planning of new estates through mixed-developments. Having made the foray into sites at Lentor, Upper Thomson and Bugis, they see this as an opportunity to do the same in Tengah with the first private development there.

The most recent piece of land tendered in Tengah was the Tengah Plantation Close EC (Parcel B) in February 2024. The land went for a rate of $423.4m, or $701 psf ppr. The highest bid for this site at Tengah Garden Avenue is only 17.1% higher than that of the nearby EC site.

Coupled with a relatively tepid three bids for the site, could be a result of the saturated number of OCR GLS sites made available to developers in the past year.

While there have been five EC sites tendered in the Tengah/Bukit Batok area previously, this is the first private condominium development. Therefore, the developers can tap into the first movers’ advantage, especially as the site is near a future MRT station and ACS Primary. The project could be priced attractively and competitively given the tender price, enhancing future demand from upgraders in nearby HDB estates.

This could attract a wider pool of buyers compared to previous EC developments in Tengah, who were limited to those with a monthly household income ceiling of $16,000. Private developments are also less restrictions, such as having no minimum occupation period, and follows the TDSR of 55% of their monthly income. This would help buyers achieve a higher loan quantum for their property purchase.

If the site is awarded at the land rate of $821 psf ppr, we believe the consortium may position this as a more upmarket development, a differentiated product from the ECs, potentially pricing it from the upwards of $2,000 psf. EC buyers may be swayed to this project if the price gap is only 15% to 20%, does not come with restrictions like the $16k income cap and 5-year MOP.

For media enquiries, please contact:

Yue Kai Xin, Press Relations, ERA Singapore

Email: [email protected]

SINGAPORE, 02 January 2025 – According to URA flash estimates, the all-residential property price index registered a faster pace of growth of 2.3% quarter-on-quarter (q-o-q) in 4Q 2024, reversing the 0.7% q-o-q decline in 3Q 2024. For the whole of 2024, the all-residential property price index rose at a slower pace of 3.9% y-o-y, compared to 6.8% y-o-y growth in 2023 and 8.6% in 2022.

The faster pace of growth was largely led by the non-landed property segment, which grew by 3.2% q-o-q in 4Q 2024. Prices of non-landed properties in RCR and OCR grew by 3.4% q-o-q, supported by projects like Emerald of Katong, Chuan Park and Nava Grove which saw overwhelming demand. Meanwhile, prices of non-landed properties in CCR grew 2.4% q-o-q in 4Q 2024, reversing the 1.1% decline in 3Q 2024. Landed property prices fell at a slower pace of 0.9% q-o-q in 4Q 2024, compared to 3.4% q-o-q in 3Q 2024.

According to URA, private home sales transaction volume reached 6,715 in 4Q 2024 (as of mid-December), up from 5,372 in 3Q2024. In total, transactions reached 21,232 across 2024 (as of mid-December), an 11.5% increase y-o-y from 19,044 total transactions in 2023. However, transaction volume in 2024 is still 14% lower than the annual average of 24,830 across 2021-2023.

Based on caveats lodged, some 3,398 new homes were sold in 4Q 2024. This brings the total for 2024 to 6,447 new homes, closely mirroring the 6,421 new homes sold in 2023.

In the secondary market, some 3,313 resale and sub-sale units were transacted in 4Q 2024 compared to 4,212 in 3Q 2024. For the whole of 2024, 14,781 resale and sub-sale units were transacted compared to 12,623 units in 2023.

Comments from ERA

“The price increase in 4Q 2024 was primarily driven by the strong new home demand, some of which had achieved benchmark pricing.” said Marcus Chu, CEO, ERA Singapore.

The Singapore residential market showed some early signs of recovery as the overall transactions increased after two consecutive years of decline. Demand for private homes remained healthy underpinned by sanguine economic sentiment while the moderation of interest rates has instilled the confidence of local homebuyers.

The secondary market remained buoyed by a steady flow of new completions since 2023. Since not all homeowners choose to sell their properties upon completion, this has formed a steady pipeline of resale and sub-sale listings in 2024.

These new completions played a key role in driving resale price growth and transactions in 2024, since buyers who have an immediate need for homes appreciate ready-to-move-in options, which also come at a more attractive price point.

Separately, the new home housing segment regained its footing in the 4Q 2024, after a lacklustre nine months performance. Buyers’ confidence was reinvigorated following the successive interest rate cuts since September and the more positive economic sentiment. As a result, we have seen impressive new home sales for projects such as Emerald of Katong, Chuan Park and Norwood Grand, in 4Q 2024. The optimism may extend to January with the launch of The Orie, the first launch in Toa Payoh since 2016.

Based on estimations, 2025 could see up to 24 new private home launches and three EC launches. In total, new private home launches will yield 11,000 new homes, while the EC launches will see some 2,030 units added to the market.

Assuming stable macroeconomic conditions and the absence of unforeseen negative factors, new home prices are expected to continue their upward trajectory, potentially achieving 3-5% y-o-y growth in 2025. The ample new home launches will support new home transaction volume which is projected to reach between 7,000 to 8,000 units in 2025, dependent on a favourable economic outlook.

ERA estimates that sub-sale transactions will range between 1,100 to 1,300 units, with median prices possibly growing by 7% to 9%. Resale transactions are also expected to reach between 14,000 to 15,000 units, accompanied by a median price growth of 6% to 8% by the close of 2025.

Table 1: URA Private Residential Property Price Index

Source: HDB, ERA Research and Market Intelligence

Chart 3: New Sale and Resale/Sub-sale Transactions

*4Q2024 figures based on flash estimates Source: URA as of 01 Jan 2025, ERA Research and Market Intelligence

Table 2: Upcoming launches in 2025

Source: ERA Project Marketing

Executive Condominium

Source: ERA Project Marketing

For media enquiries, please contact:

Yue Kai Xin, Press Relations, ERA Singapore

Email: [email protected]