In total, December saw 203 new private homes (excluding ECs) sold, representing a 92.1% month-on-month (m-o-m) downtick over November’s performance (2,560 units sold). This contraction in sales was due to a one-two punch of a lack of new project launches and the typical year-end seasonal lull.

Year-on-year (y-o-y), new private home sales were also up 50.4% in December, compared to the 135 units sold over the same period in 2023. This performance also ranks December as the second-lowest month for new private home sales (excluding ECs) for 2024, with February holding the lowest record at 153 units sold.

The Executive Condominium (EC) market delivered a good showing in December, with a total of 170 units sold. Though this marked 49.1% m-o-m decline from November’s sales.

This outcome was largely due to the ongoing success of Novo Place, which made its debut in November. Novo Place’s second round of balloting saw a strong turn-out by second-time buyers (i.e. those who had previously purchased a subsidised flat), which made the development instrumental in propping up December’s EC sales.

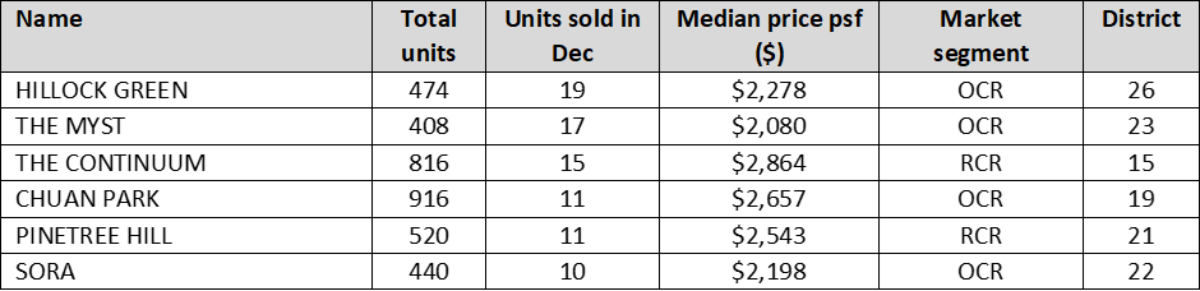

Best-Performing New Launches

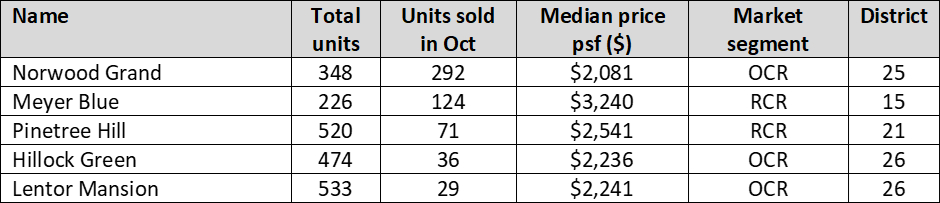

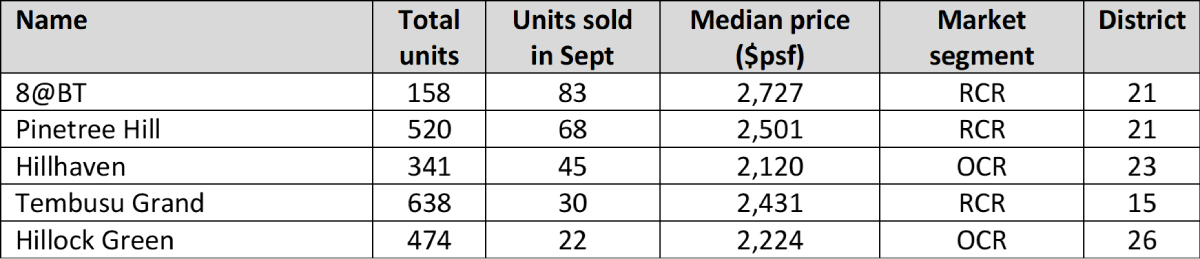

Table 1: Top five performing new launch projects (excluding EC) in November 2024

Source: URA, ERA Research and Market Intelligence

By order of most new private homes sold, December’s best-sellers were respectively Hillock Green (19 units sold), The Myst (17 units sold), The Continuum (15 units sold), Chuan Park (11 units sold), Pinetree Hill (11 units sold), and SORA (10 units sold).

Though modest, sales at Hillock Green were sufficient to secure it the top-selling position for December. It has consistently performed as a best-seller in 2024, for its attractive median pricing at $2,278 psf compared to recent new launches and family friendly layouts. Hillock Green’s continued success can be chalked up to Lentor’s appeal and its growth potential as a family-friendly neighbourhood.

The Continuum, a freehold development and repeat best-seller from November, continued to benefit from spillover demand from the near sold-out Emerald of Katong. In December 2024, new home sales at The Continuum achieved a median price of $2,864 psf, while units at Emerald of Katong were transacted at a median price of $2,626 psf. Buyers who were weighing their options for a condo in D15 might have found the 9% premium for the freehold status of The Continuum palatable, resulting in their eventual purchase.

Similarly, Chuan Park (also a returning top-selling development from November) owes its popularity to its strong locational attributes. Besides marking the first launch in Lorong Chuan since 2010, the development also offers convenient access to Lorong Chuan MRT station and appeals to various buyer profiles (including families) with its 1 to 4-bedder unit mix.

As for The Myst and Pinetree Hill, demand for these developments in December may have been bolstered by recent launches in District 21 in late-2024. These include 8@BT (launched in September) and Nava Grove (launched in November) which share the same locale as Pinetree Hill, while also being sufficiently close to District 23 where The Myst is located. This could have had the effect of drawing buyers who view The Myst and Pinetree Hill as possible alternatives.

Buyers Find Ideal Pricing in New Private Homes Priced Between $1.5M to $2M

As of 14 January 2025, full-year caveat data for 2024 shows that new private homes (excluding ECs) priced between $1.5M and $2M accounted for the largest share (29.9%) of new home transactions, followed by homes priced between $2M and $2.5M (23.4%) and $2.5M and $3M (16.9%).

This is a trend that we have prior witnessed in 2023, and suggests that affordability remains paramount for buyers – a trend likely to persist in 2025 as higher-for-longer interest rates and geopolitical concerns weigh on market sentiment.

Executive Condominium (EC)

In total, there were 170 EC transactions in December. While this was a decline from the 334 units sold in November, fuelled by the launch of Novo Place, it still exceeded the average 40-50 EC sales normally witnessed in months without launches.

These transactions were mainly fuelled by second-timer purchases at Novo Place. The second round of balloting targeted at second-timers yielded 158 transactions, bringing the total sales for the development to 445 units, or about 90% of the project sold.

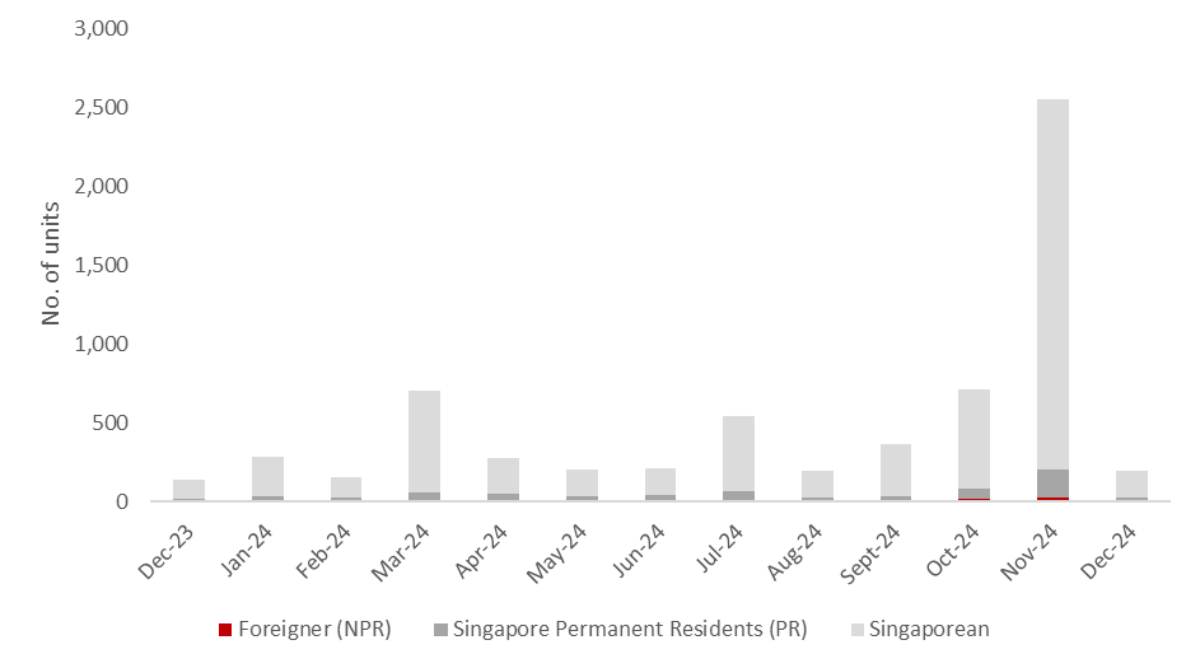

Buyer Profile

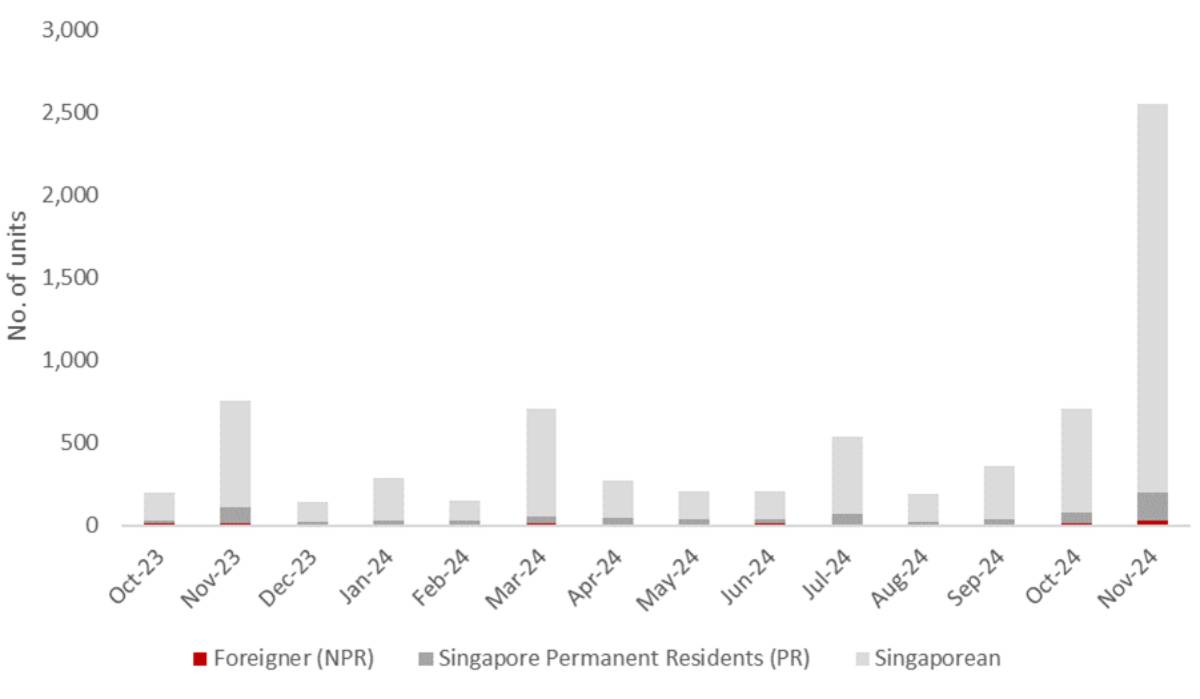

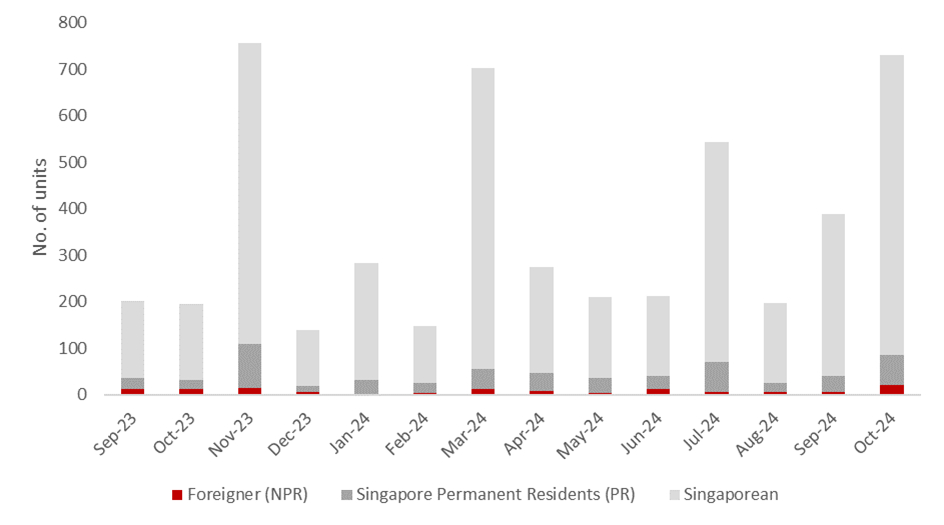

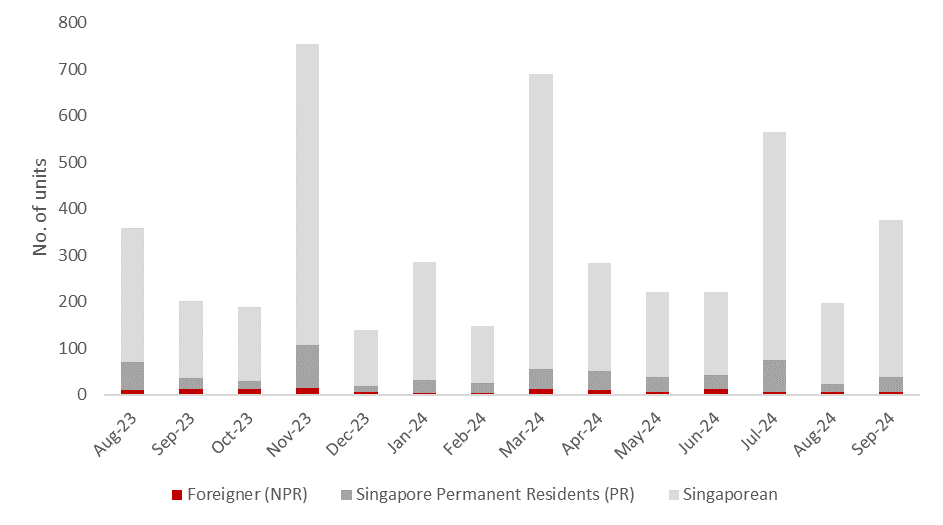

Chart 1: Buyer profile for all new non-landed homes excluding ECs

Source: URA, ERA Research and Market Intelligence

In line with prior months, foreigner demand continued to remain flat largely due to the punitive Additional Buyer’s Stamp Duty. Foreign buyers accounted for only six transactions, or 3.0% of December’s total sales. Meanwhile, Singapore Permanent Resident (PR) buyers recorded 20 transactions in December, making up 10% of total sales amidst the month’s smaller base.

Lastly, Singaporeans continued to dominate the market in December, accounting for 172 transactions or 86.9% of total new private home sales (excluding ECs) for the month. This share aligns closely with the past 12-month average of 87.3%.

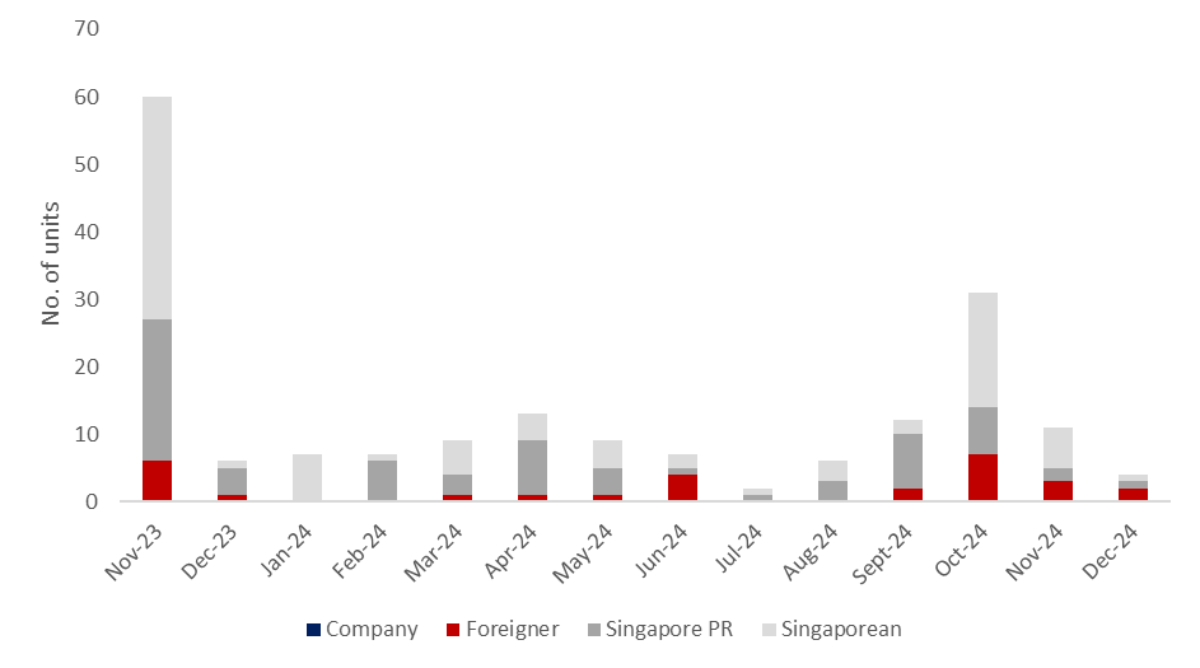

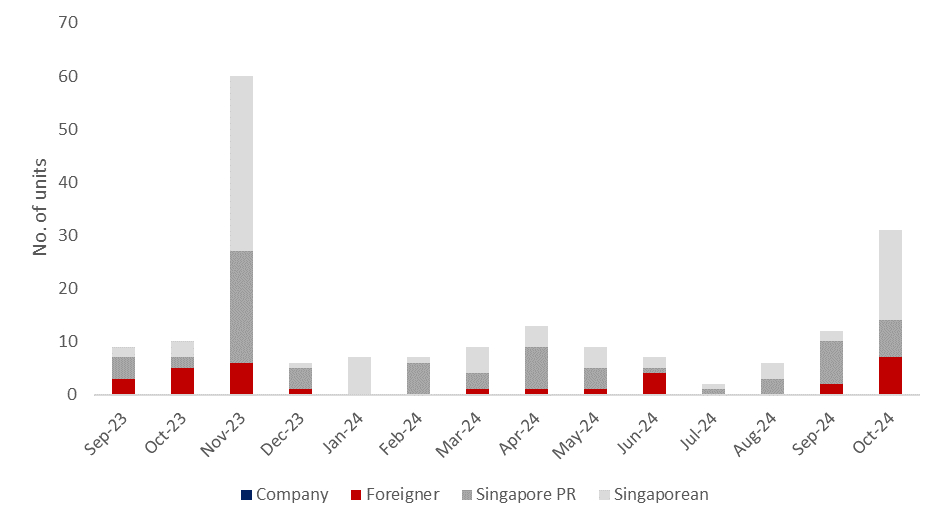

Luxury Properties (Non-Landed Homes $5 Mil and Above)

A total of four luxury homes, priced at $5 mil and above, were transacted in December 2024. Additionally, 50% of the luxury homes transacted in the month fell within the $5 mil – $6 mil price range. The highest-priced transaction was a 4,219 sqft unit at 32 Gilstead, which was purchased for $14.6 mil ($3,455 psf) by a foreign buyer.

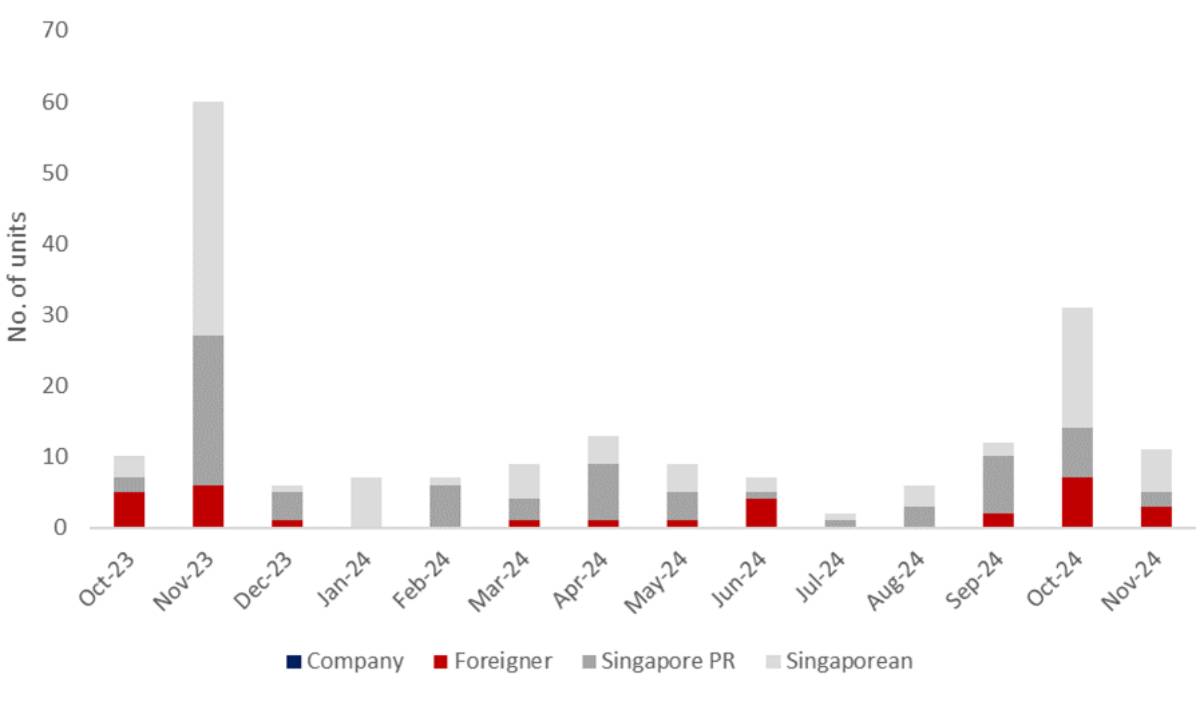

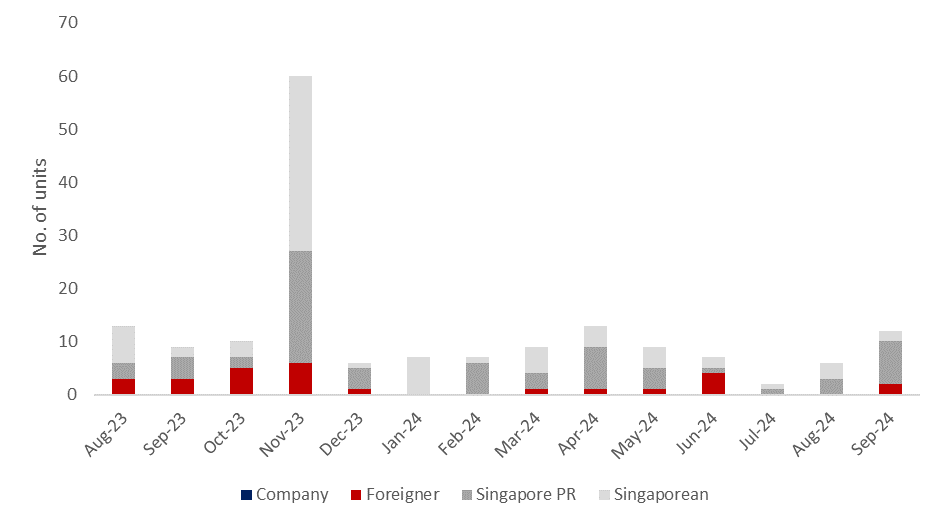

Chart 2: Buyer profile for homes transacted at $5mil and more

Source: URA, ERA Research and Market Intelligence

What Lies Ahead for the New Private Home Market in the Coming Months?

Though recent interest rate cuts and a more positive economic outlook have breathed new life into the new launch market, challenges remain with the possibility of higher-for-longer interest rates, an impending Trump presidency, as well as ongoing trade tensions that could impede Singapore’s economic growth.

Nonetheless, ERA remains cautiously optimistic about Singapore’s residential market in 2025. Supported by strong macroeconomic fundamentals, Singapore is likely to strengthen its position as a ‘safe harbour’ amid potentially stormy conditions. This could, in turn, boost buyer confidence and bolster demand for new private homes even in the face of a challenging global economy.

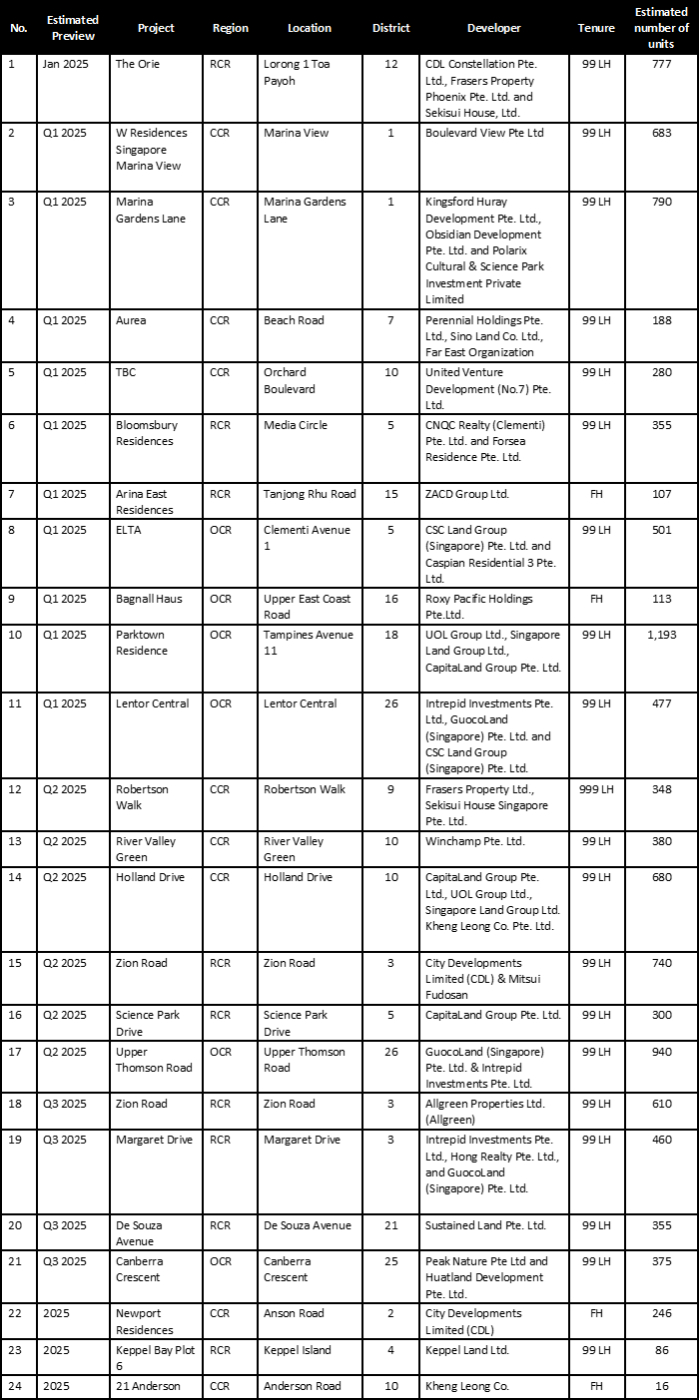

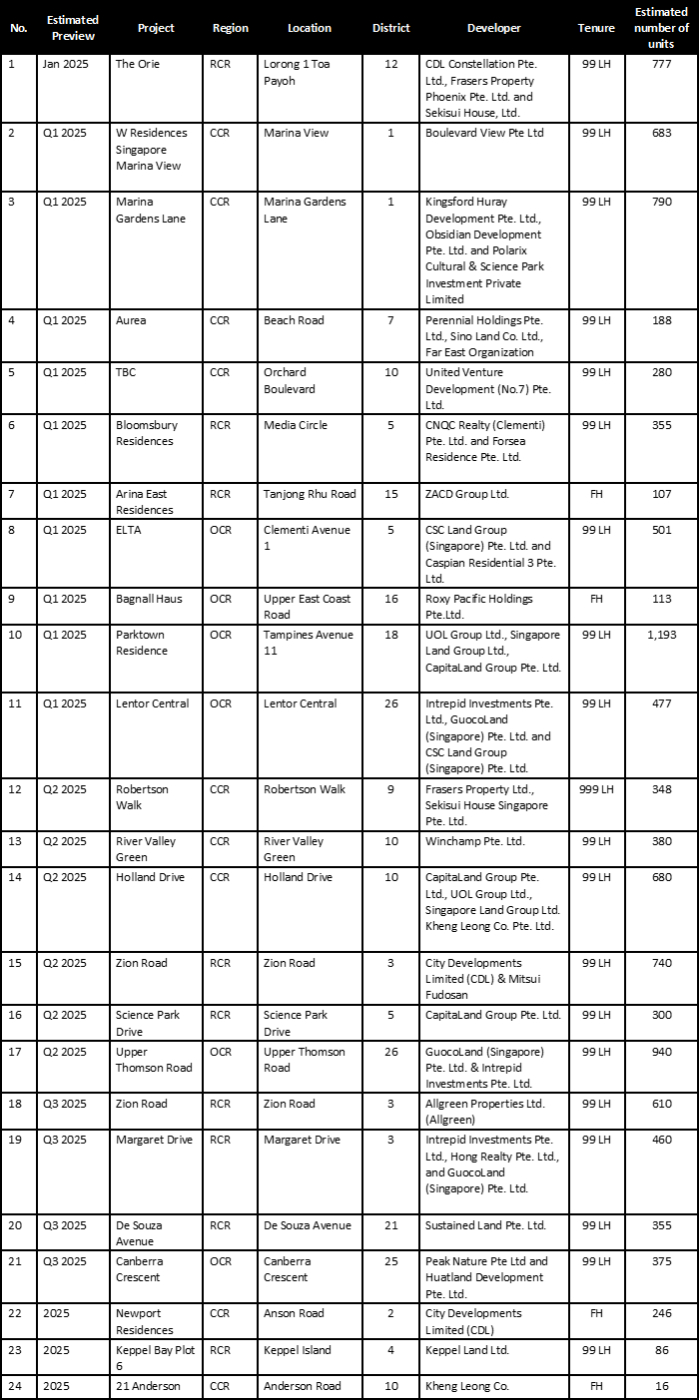

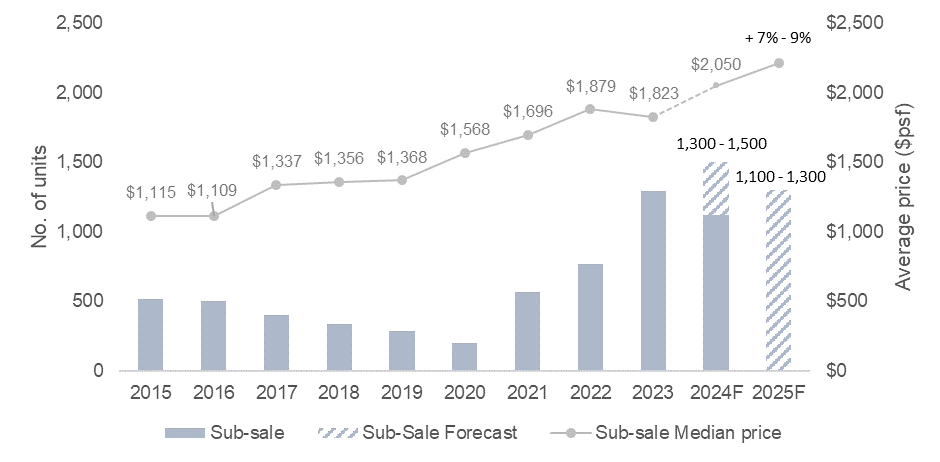

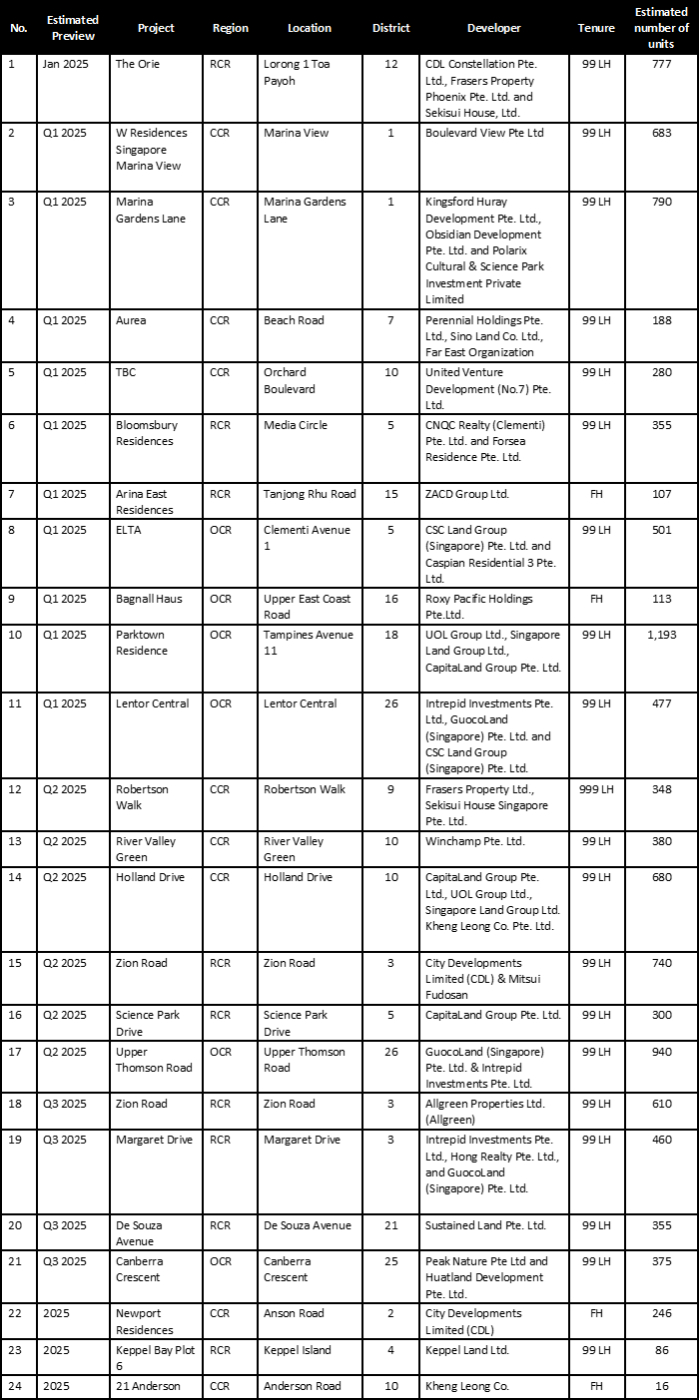

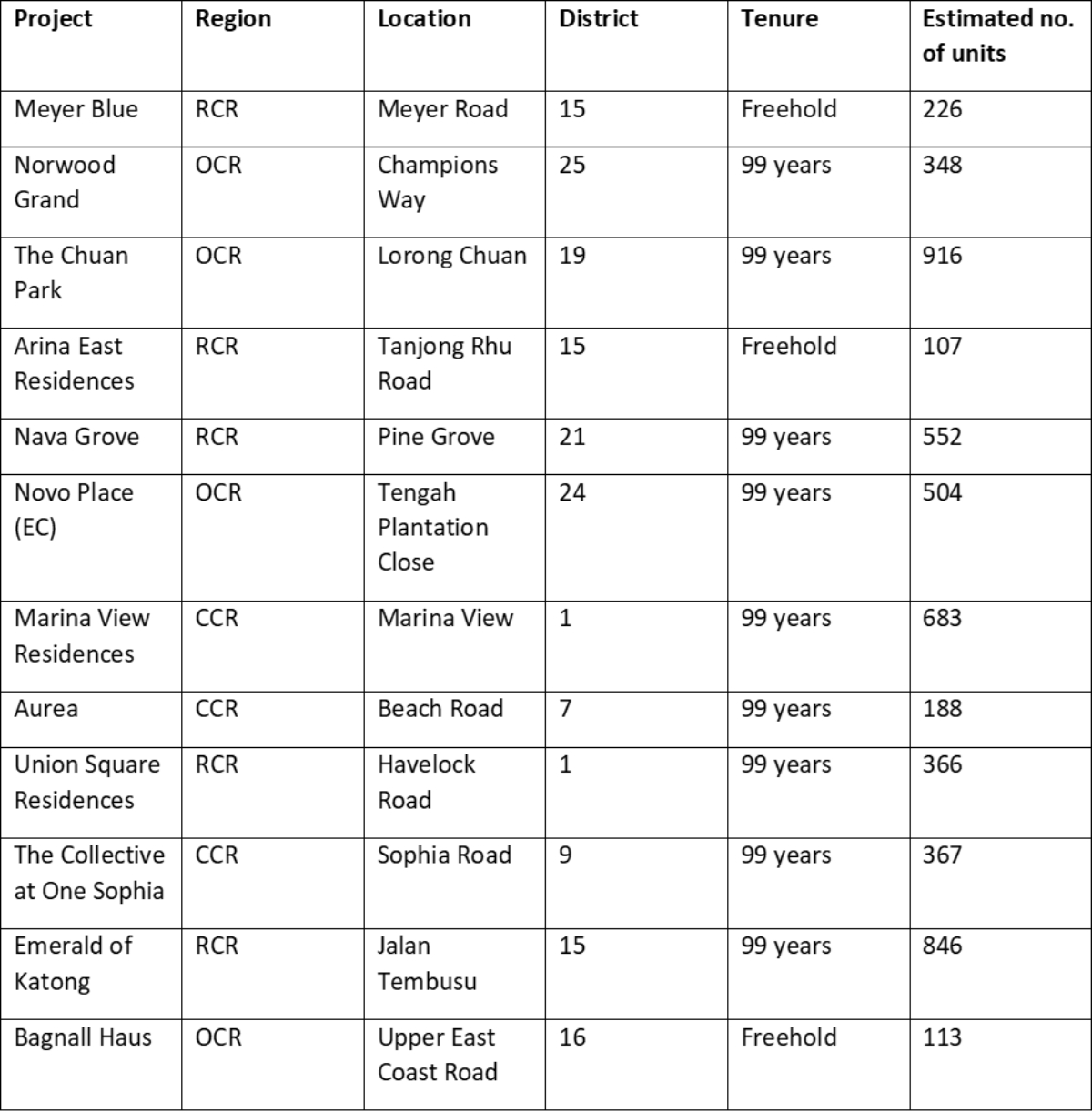

Come January, buyers will have no lack of fresh options with an estimated 24 private home projects and three EC launches slated for 2025.

The Orie, launching in January, will kick off the year as 2025’s first new launch and Toa Payoh’s first new development in nine years, or almost a decade. Located at Toa Payoh Lorong 1, the project is poised to draw considerable interest due to its excellent location, the growing popularity of RCR properties, and intrinsic appeal to HDB upgraders living nearby.

Over in the OCR, Bagnall Haus is likewise scheduled for launch in January, with an indicative average of $2,450. Pent-up demand in the East Coast area, as well as Bagnall Haus’ freehold status (which makes it suitable for legacy planning purposes) are expected to be key drivers for waiting buyers.

On the other hand, in the CCR, One Bernam, a mixed-use development at Tanjong Pagar, approached near-sellout amid fresh developer discounts offered in January. As such, local demand is expected to continue driving buyer activity in the CCR, with competitive pricing being a key motivator.

Apart from the abovementioned developments, upcoming projects at Margaret Drive and Lentor Central, as well as ELTA and Parktown Residence are also expected to captivate buyers in the coming months. The same applies for the three upcoming EC projects of 2025, two of which are in the East (Aurelle of Tampines and Jalan Loyang Besar) and one in the West (Plantation Close).

As such, barring any unforeseen circumstances, the new private residential market could see growth next year, with sales possibly reaching between 7,000 and 8,000 units in 2025.

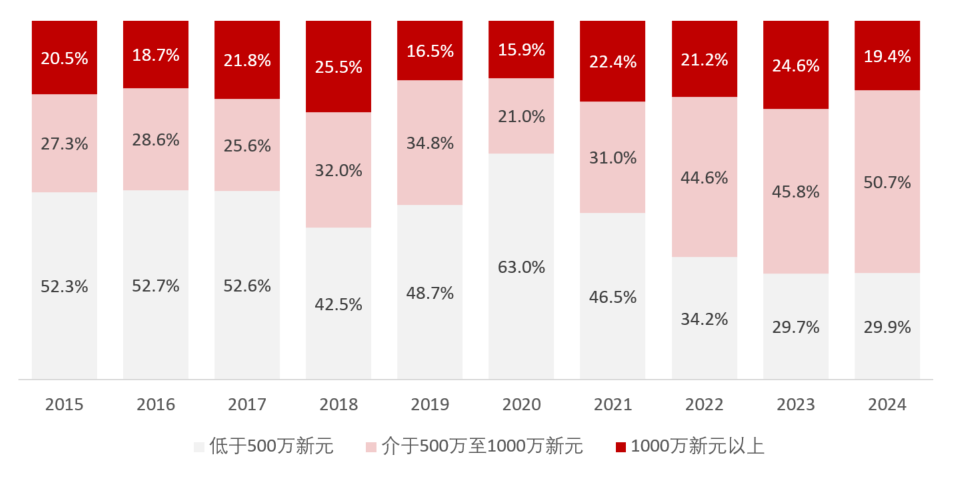

Table 2: Upcoming launches in 2025

Executive Condominium

Source: ERA Project Marketing

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.

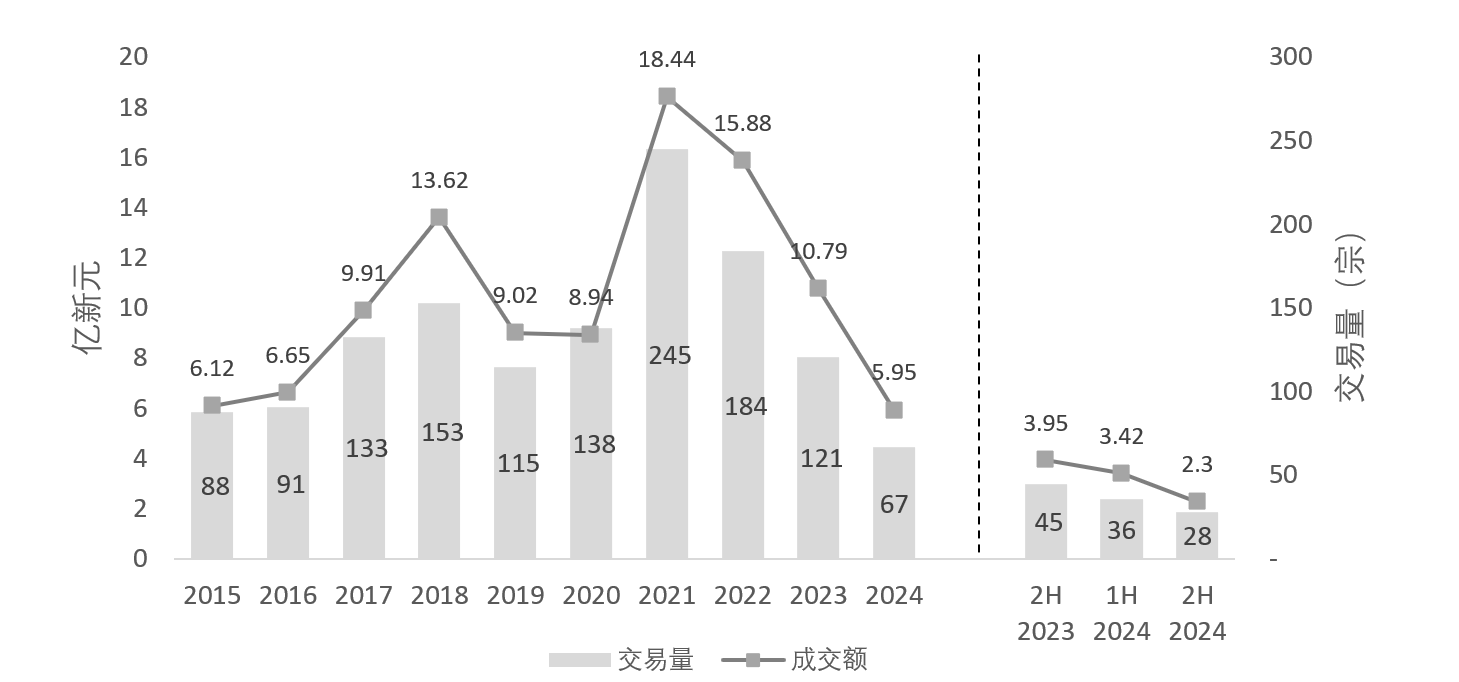

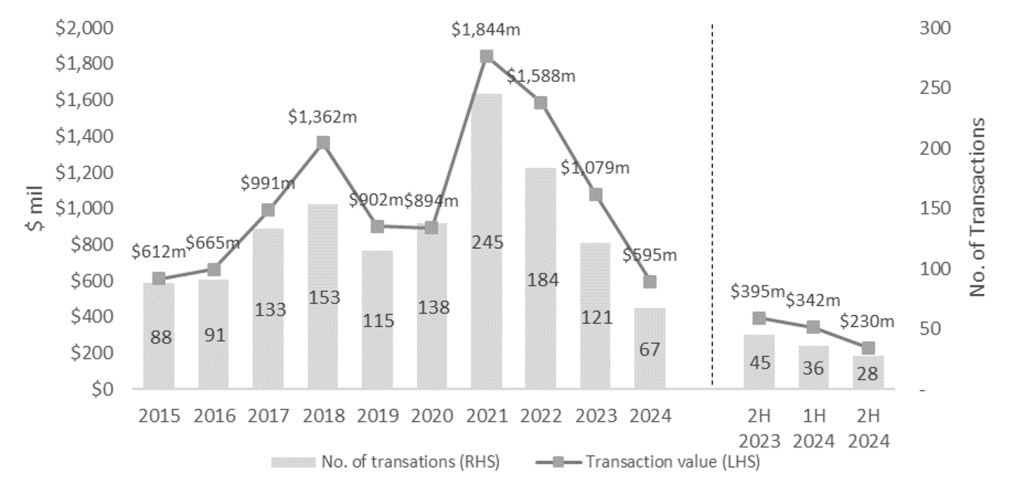

根据新加坡市区重建局(URA)数据,今年下半年店屋仅有28宗交易,较上半年的39宗有所下降。下半年交易总值达2.29亿新元,低于前六个月的3. 65亿新元。全年店屋交易量仅67宗,创下自1998年以来单年交易量的最低记录(当年有48笔店屋成交)。

自2023年洗钱案后,新加坡店屋市场持续低迷,案件抑制了店屋的需求。同时,高利率以及店屋价格的不断攀升,影响了投资收益率。尽管最近降息措施给市场带来了一些乐观情绪,但日益不确定的地缘政治局势使投资者仍保持谨慎。另外,因住宅房地产的额外买方印花税(ABSD)大幅上涨而转向店屋市场的买家热情也有所消退。

值得注意的是,一些买家选择不提交备案,或通过特殊目的公司的股权转让方式完成交易。例如,今年9月,在桥北路(North Bridge Road)和连城街(Liang Seah Street)拐角处一栋四层店屋以4200万新元成交。而桥北路的白沙浮广场(Bugis Junction )对面,三个毗邻的店屋在10月以7200万新元的价格出售。这些交易均未备案。

因此,2024年备案的总交易金额为5.95亿新元,不及去年11亿新元交易额的一半。远低于2021年时的市场峰值。当年约有245宗有地店屋交易,总值达18亿新元。就历年交易记录来看,目前店屋市场似乎已经触底。

图一: 过去十年店屋交易走势

资料来源:新加坡市区重建局和ERA产业

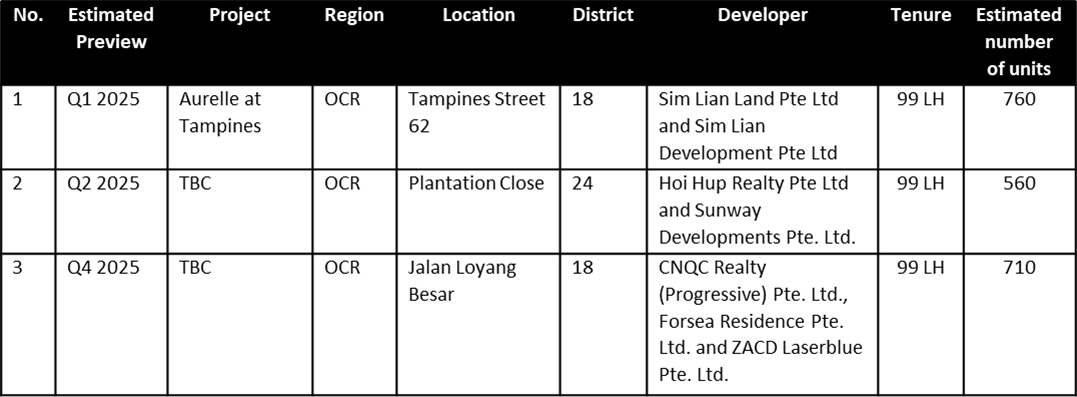

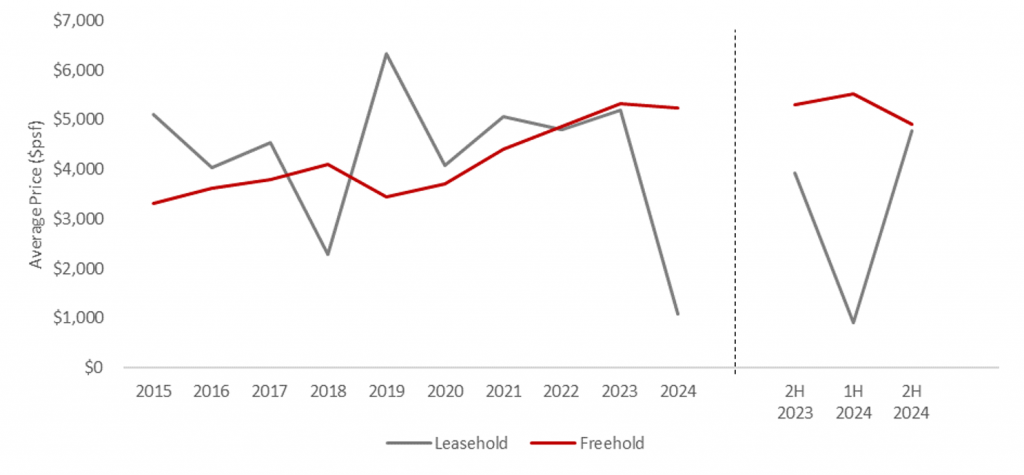

永久地契更受追捧 99年地契价格上涨

今年下半年28宗交易中,85.7%的交易为永久地契或999年地契。在市场波动中,这类型的店屋保值能力强,受到投资者青睐。

然而,与去年下半年相比,永久地契店屋的平均价格却下降了7.7%。而99年地契的店屋价格则上涨21.6%。除因这些成交的店屋位于市区和文化保护区(conservation area)外。它们的剩余年限均在70年以上。

图 二: 过去十年店屋每平方英尺交易均价走势

资料来源:新加坡市区重建局和ERA产业

这显示了位置优越的99年地契保留店屋,若维护良好并还有较长剩余地契仍能吸引买家。因此,我们预计这些店屋的价格仍有上涨空间。

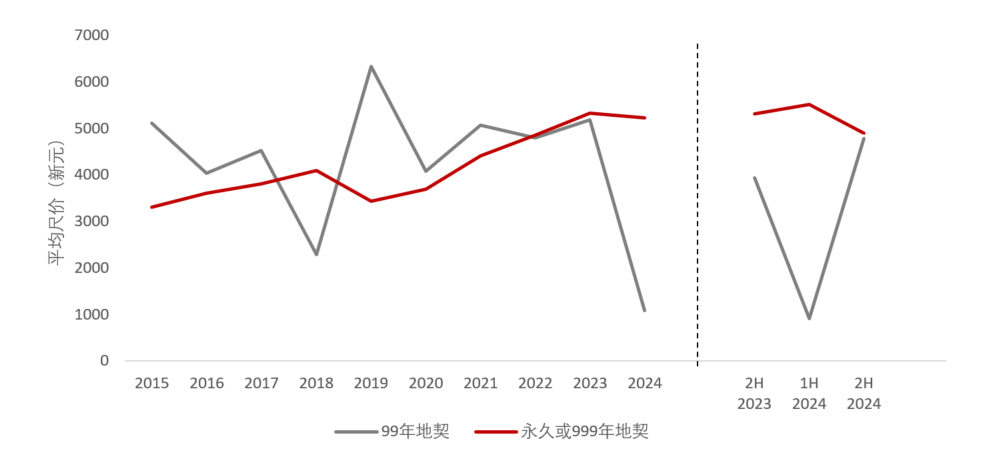

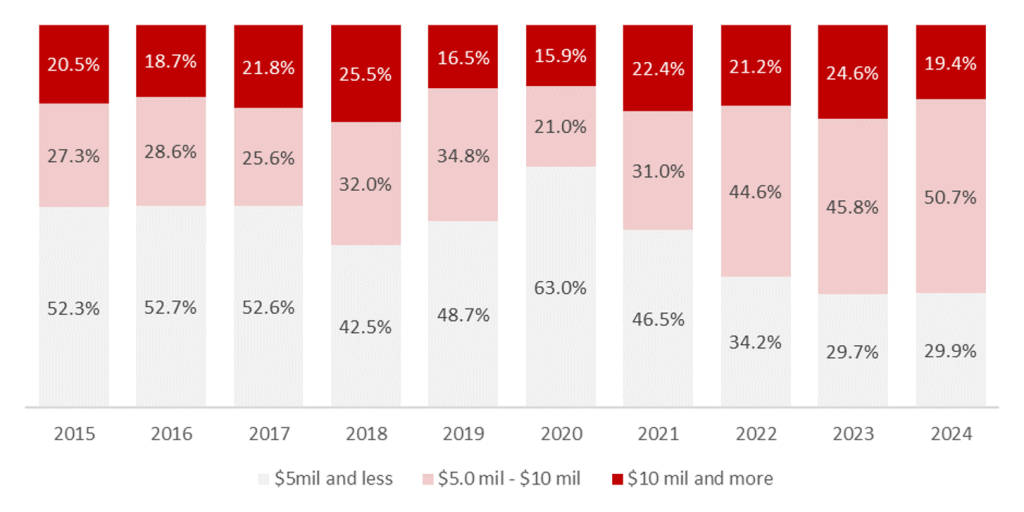

自2020年以来,店屋交易价格持续上涨,带动高额交易比例上升。2024年,超过一半的店屋交易价格介于500万新元至1000万新元之间。而那些价格低于500万新元的店屋,多数不在市区或是99年地契。

图三: 过去十年店屋成交价比例走势

资料来源:新加坡市区重建局和ERA产业

市区店屋较受欢迎

今年成交的67间店屋中,有63间位于市区。这里汇集餐饮、健身房和共居空间等行业,可为屋主带来更高租金。

其中,第八邮区最受买家欢迎,共有31宗交易(占46.3%)。根据交易数据,这个区可能还存在投资机会,其中10宗的成交价低于500万新元。

此外,第14邮区共有七宗交易,而第一区和第二区各有五宗。

Shophouses in Little India

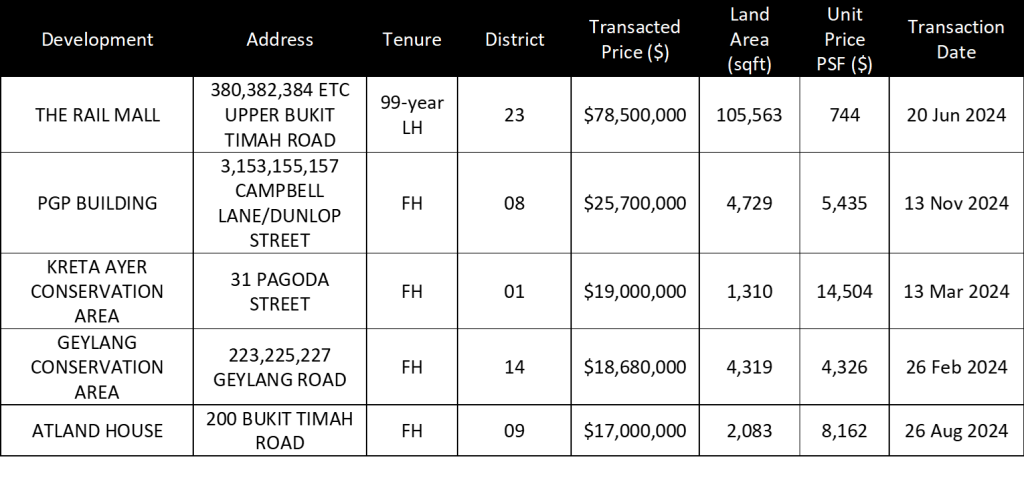

表一: 2024年交易额前五位的店屋交易

资料来源:新加坡市区重建局和ERA产业

新加坡稳定的经济基础支撑房地产市场

在制造业和金融保险等行业带动下,新加坡今年第三季GDP同比增长5.4%,较第二季的3.0%增长有所加快。

半导体产业是新加坡的支柱产业之一。随着全球电子产品需求的持续复苏以及经济活动强于预期,新加坡贸工部将今年全年GDP增长预测从原来的2.0%-3.0%上调至大约3.5%。

经济扩张带动劳动力招聘市场增加。数据显示,新加坡就业人数大幅上升,同时裁员数量有所减少。三季度,招聘人数达2万2300人,远高于今年上半年的1万6000人。此外,今年前九个月的裁员人数为9350人,同比下降15.6%。当季整体失业率维持在1.9%的低位。

同时,新加坡通胀压力持续缓解,降至2.2%,为2021年二季度以来最低水平。其中,住房通胀也在降至2.9%,大幅低于去年一季度4.9%的高峰时期。通胀下降,将使新加坡实际收入回升。

尽管新加坡家庭债务增加,但根据新加坡金融管理局的报告,工资的提高和稳定的金融资产有助于家庭应对抵押贷。此外,美联储的降息举措降低了房主现有抵押贷款的每月还款成本。以新元隔夜利率(SORA)为例,三个月复合新元隔夜利率从1月的3.70%下降至11月的3.24%。

2025年店屋需求将有所改善

展望明年,ERA产业对新加坡房地产市场保持谨慎乐观。首先,利率有望继续下调的利好因素,将有助于明年的房地产市场表现优于今年。这在一定上程度将提振买家信心,推动房地产需求。价格上涨将体现房产价值和潜力,而非投机行为。

另一方面,在稳定的经济基础支撑下,新加坡将继续巩固其作为亚洲领先财富管理中心之一的地位,不断吸引家族办公室、高净值人士和跨国公司来此扎根。其中不乏各类投资者, 他们视新加坡店屋为珍贵稀有资产。

我们认为,当前店屋价格的波动可能是买家寻找潜在优质交易的好时机。尤其是那些位于核心地段且拥有永久地契的店屋可能已被低估。一旦买卖双方的价格预期一致,交易量将有望再次回升。

基于上述因素,我们预计明年店屋交易量将在70到80宗之间,交易金额将在6.5亿新元到7.5亿新元之间。

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.

[1] Ministry of Trade and Industry, Economic Survey of Singapore Third Quarter 2024

[2] Ministry of Manpower, Labour Market Third Quarter 2024

[3] Singstat, Percent Change In Consumer Price Index (CPI) Over Corresponding Period Of Previous Year, 2019 As Base Year

Based on URA’s lodged caveats, landed shophouse transactions fell to 28 deals worth $229.3 million in 2H 2024, down from 39 transactions totalling $365.3 million in 1H 2024. For the whole year, 67 landed shophouses were sold for a total of $594.5 million, marking the lowest number of transactions since 1998, when just 48 shophouses changed hands for $11.3 million.

The landed shophouse market remained in the doldrums after a high-profile money laundering case in 2023 dampened the appetite for shophouses.

Additionally, the high interest rate environment previously coupled with rising price quantum, had resulted in unattractive yields for investors. Even though the recent interest rate cuts might spark some optimism, the increasingly uncertain geopolitical landscape will likely leave investors cautious, with many preferring to stay on the sidelines for now.

Moreover, demand has also eased after the initial euphoria caused by the doubling of Additional Buyers’ Stamp Duty rate for foreign buyers purchasing residential properties. Some of these buyers had turned to the commercial shophouse market then.

Shophouses against Singapore’s CBD backdrop

However, this may not be a full view of the market as there could be deals transacted that may have flown under the radar. This could be due to several reasons, such as the caveats not being lodged, or the deal may have been purchased using Special Purpose Vehicles. Consequently, the total transaction value stands at $595 million, dwarfing the $1.1 billion recorded during the same period last year.

Against the market’s peak in 2021, which witnessed approximately 245 landed shophouses with a cumulative worth of $1.8 billion being sold in a year, the landed shophouse market has seemed to have bottomed out.

In summary, ERA remains cautiously optimistic of Singapore’s property market in 2025. Underpinned by firm macroeconomic fundamentals, Singapore will continue to deepen its status as one of Asia’s leading wealth management hub, thus drawing family offices, high-net-worth individuals and multinational companies to establish a firm foothold in the city.

For such investors, landed shophouses in Singapore are still deemed valuable and coveted assets.

Barring any unforeseen circumstances and assuming interest rates continue to moderate, the 2025 property market could outperform 2024, signalling a potential recovery on the horizon.

Taken together, the factors mentioned above are expected to boost buyer confidence, driving demand for real estate. Moreover, future price increases are more likely be driven by genuine buying interest, rather than speculative or foreign demand.

2024 Property Investments Underpinned by Firm Economic Fundamentals

Singapore’s economy gained momentum in 3Q 2024, recording a 5.4% year-on-year (y-o-y) expansion compared to a 3.0% growth in 2Q 2024[1].

The growth was primarily driven by robust performances in the manufacturing, wholesale trade, and finance & insurance sectors. With a continued recovery in global electronics demand and stronger-than-expected economic activity, MTI revised its full-year GDP growth forecast to approximately 3.5%, up from the earlier range of 2.0% to 3.0%.

Amid the economic expansion, hiring in the labour market has similarly picked up in 3Q 2024. According to the Labour market advance release[2], Singapore saw a sharp uptick in employment numbers alongside a decline in retrenchments. Hiring in 3Q 2024 more than doubled, rising by 24,100 compared to 16,000 in 1H 2024.

Retrenchment numbers in the first nine months of 2024 has declined by 17.3% to 9,200, compared to the 11,130 in the same period last year. Overall unemployment rate continued to remain at a low of 1.8% in 3Q 2024.

Singapore continued to see easing inflationary pressures in 3Q 2024, falling to 2.2% which is the lowest seen since 2Q 2021. Accommodation inflation has likewise moderated 2.9% in 3Q 2024, a sharp contrast to the peak of 4.9% in 1Q 2023. As inflation eased, Singapore’s real income rebounded in 2024 compared to 2023.

Despite concerns over growing household debt, local borrowers remained largely capable of handling their mortgage repayments in 2024. According to the Monetary Authority of Singapore, this resilience is largely underpinned by a combination of higher wages and robust financial assets.

Moreover, the recent cuts in the Fed interest rate have benefited homeowners with existing mortgages by easing the cost of monthly repayments. This is evident in the decline of the 3-month compounded Singapore Overnight Rate Average (SORA), a key benchmark for home loan pricing, from 3.70% in January to 3.24% in November.

In short, the better-than-expected economic outlook and firm economic fundamentals had bolstered shophouse transaction activities in the four months of 2024. But as we look ahead, the bigger question remains: Is recovery on the horizon for the Singapore 2025 property market?

Singapore’s Strong Foothold in The Region Continues to Inspire Confidence Among Investors Even as Uncertainty Looms in 2025

While Singapore’s economy surpassed expectations in 2024, uncertainties continue to abound in the global economy – which could impact the pace of Singapore’s economic growth in 2025.

Worldwide, concerns about global trade have emerged as president-elect Donald Trump prepares to assume his second term in January 2025. Trump’s incoming administration has already signalled an intent to slap tariffs of up to 25% on China, Canada, and Mexico; this has raised fears of inflation and the possibility of interest rates staying higher for longer.

Consequently, we can expect to see rising protectionism and trade tension, alongside the escalating conflicts in the Middle East and Ukraine. Should all these key themes materialise or worsen, we can certainly expect to see further disruption to global supply chains. This will most definitely drive costs higher and may impede the growth of global trade. Taking these factors into account and barring the materialisation of downside risks, MTI has forecasted Singapore’s economy to grow by 1.0 to 3.0% in 2025.

Even amidst these uncertainties and disruptions, Singapore could still potentially emerge as an early beneficiary of the trade war. Leveraging on our strategic position as a regional safe haven, global companies could be incentivised to relocate their manufacturing supply chains to Singapore.

In brief, ERA remains cautiously optimistic of Singapore’s property market in 2025. Underpinned by firm macroeconomic fundamentals, Singapore will continue to deepen its status as one of Asia’s leading wealth management hub, thus drawing family offices, high-net-worth individuals and multinational companies to establish a firm foothold in the city.

Barring any unforeseen circumstances and assuming interest rates continue to moderate, the 2025 property market could outperform 2024, signalling a potential recovery on the horizon. Taken together, the factors mentioned above are expected to boost buyer confidence, driving demand for real estate. Moreover, future price increases are more likely be driven by genuine buying interest, rather than speculative or foreign demand.

Landed Shophouses Transaction Volume

Chart 1: Transaction volume and transaction value of landed shophouses

Source: URA as of 18 Dec 2024, ERA Research and Market Intelligence

Of the 28 shophouses transacted in 2H 2024, 85.7% (24 units) were of Freehold (FH), inclusive of shophouses with 999-year leasehold tenure.

These FH shophouses are immune to lease decay. Hence, these properties are able ride through market volatility, preserving their value if held over the long term. Institutional investors see this as an asset worth having in their portfolio.

In June 2024, The Rail Mall was divested by Paragon REIT to a private investor for $78.5 million ($744 psf). This led to the average price of 99-year leasehold (99-LH) landed shophouse to be significantly lower in that half-year period.

However, comparing 2H 2023 and 2H 2024, the average price of freehold landed shophouse fell by 7.7%. In contrast, their 99-year leasehold counterparts saw a 21.6% increase. The 99-LH shophouses transacted in 2H 2024 were all in the Central Region and in conservation areas. Moreover, they all had at least 70 years of remaining lease, providing a strong reason for buyers.

Despite having a 99-year lease, shophouses with outstanding locational attributes, conservation status, well-maintained façade and interiors and a long remaining lease would still entice buyers. Hence, we will still expect prices to appreciate in future.

Chart 2: Average PSF prices for landed shophouses

Source: URA as of 18 Dec 2024, ERA Research and Market Intelligence

Over the past decade, the price quantum of landed shophouses has generally increased, shown by the proportion of higher valued transactions. In 2024, more than half of the shophouse transactions were between $5 million and $10 million. This could be the sweet spot for a landed shophouse. While there are shophouses transacted under $5 million, they are either not centrally located or have a 99-LH tenure.

Chart 3: Price quantum of landed shophouse in the last ten years

Source: URA as of 18 Dec 2024, ERA Research and Market Intelligence

Singapore shophouse: An asset class that captivates foreign investors

The scarcity of landed shophouses, coupled with Singapore’s status as a wealth hub, have led to these properties being coveted by institutional investors and family offices. Oftentimes, shophouses are used as vehicles to achieve their clients’ goals of capital appreciation and wealth preservation.

In cosmopolitan gateway cities worldwide, investment properties come in the form of modern skyscrapers and trophy assets. Thus, the uniqueness of shophouses can captivate investors seeking something distinct and exceptional.

Hence, with inherently favourable attributes, this slight blip in landed shophouse prices may actually be an opportune time to look out for good deals in the market. Those in prime location and freehold tenures may be undervalued.

Shophouses in Little India

Popularity of Central Region shophouses

Among the 67 shophouses sold in 2024, 63 were located in the Central Region – an area popular for eateries, fitness studios and co-living spaces. As such, owners of Central Region landed shophouses will likely be able to command higher rents on their properties.

District 8 (Little India) was the most popular area for landed shophouse buyers, with 31 transactions in 2024 (46.3%). There could also be opportunities for value buys present in District 8, as ten of these transactions were transacted under $5m.

District 14 (Eunos, Geylang, Paya Lebar) saw seven transactions, while District 01 (Raffles Place, Cecil, Marina, People’s Park) and District 02 (Chinatown, Tanjong Pagar) saw five transactions each in 2024.

Table 1: Top five shophouse transactions in 2024

Source: URA as of 18 Dec 2024, ERA Research and Market Intelligence

Shophouse demand expected to improve going into 2025

While landed shophouse prices have fallen in 2024, it is unlikely that the market in on a downward trend. While institutional investors and funds may look to offload these properties and recycle their capital, it does not mean that they are looking to sell at a discount. These investors have high holding power, making it unlikely for them to be forced into a sale. A slight decline in prices may provide the opportunity to enter the market.

Moreover, underpinned by firm economic fundamentals and with projected Fed rate cuts on the horizon, we should see more buying interest amid higher projected yields and scope for capital appreciation. Hence, once the impasse is resolved between buyers and sellers’ price expectations, transaction volume will pick up once again.

Shophouses will continue to be sought after by local and international buyers owing to their rarity and heterogeneity. Without the additional stamp duties imposed, investors will continue to keep shophouses as a viable option. Family offices and investors are the most probable buyers for shophouses, especially when the properties are located in the Central Region or have a 999-Leasehold or Freehold tenure.

Owing to the abovementioned factors, ERA forecasts a recovery in landed shophouse transaction volume to be between 70 to 80 units, with the transaction value to be between $650m to $750m.

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.

[1] Ministry of Trade and Industry, Economic Survey of Singapore Third Quarter 2024

[2] Ministry of Manpower, Labour Market Third Quarter 2024

[3] Singstat, Percent Change In Consumer Price Index (CPI) Over Corresponding Period Of Previous Year, 2019 As Base Year

Is recovery on the horizon for the 2025 residential market?

Despite getting off to a slow start in the early 2024, Singapore’s residential property market eventually regained its footing in the last quarter of the year.

In the first half of 2024, the private housing market saw subdued buyer interest and moderated price growth, weighed down by higher interest rates in 1H 2024. More homebuyers opted to stay on the sidelines, amid elevated interest rates and softer economic conditions which sent consumer confidence reeling. Separately, demand from foreign buyers remained curtailed by the punitive 60% Additional Buyer Stamp Duty.

However, hopes of a turnaround emerged in 3Q 2024, spurred by a long-awaited interest rate cut by the U.S. Federal Reserve (Fed) in September. The Fed subsequently delivered a second round of rate cuts in November, bringing the total rate cut to a collective 50 basis points, with a target range of 4.50% – 4.75%.

Following the successive rate cuts, recent project launches like 8@BT, Meyer Blue, Norwood Grand and Chuan Park rallied ahead and reported stronger-than-expected sales performances. More impressively, the Emerald of Katong nearly sold out at its launch weekend, raising the odds of a market resurgence as the year closes.

Meanwhile the resale and sub sale markets remained buoyed by a steady flow of new home completions since 2023. This is attributable to the fact that not all homeowners choose to sell their properties upon completion. Instead, some owners could prefer taking more time before deciding to put their homes on the market, which has contributed to a steady pipeline of resale and sub sale listings in recent years.

The private residential market continues to be driven by HDB upgraders, young buyers who view private homes as investment opportunities, and landed homeowners seeking to downsize in 2024.

2024 Homebuying Activities Underpinned by Firm Economic Fundamentals

Singapore’s economy gained momentum in 3Q 2024, recording a 5.4% year-on-year (y-o-y) expansion compared to a 3.0% growth in 2Q 2024[1]. The growth was primarily driven by robust performances in the manufacturing, wholesale trade, and finance & insurance sectors. With a continued recovery in global electronics demand and stronger-than-expected economic activity, MTI revised its full-year GDP growth forecast to approximately 3.5%, up from the earlier range of 2.0% to 3.0%.

Amid the economic expansion, hiring in the labour market has similarly picked up in 3Q 2024. According to the Labour market report[2], Singapore saw a sharp uptick in employment numbers alongside a decline in retrenchments. Hiring in 3Q 2024 expanded, rising by 22,300 compared to 16,000 in 1H 2024. Retrenchment numbers in the first nine months of 2024 has declined by 15.6% to 9,350, compared to the 11,130 in the same period last year. Overall unemployment rate continued to remain at a low of 1.9% in 3Q 2024.

Singapore continued to see easing inflationary pressures in 3Q 2024, falling to 2.2% which is the lowest seen since 2Q 2021[3]. Among which, accommodation inflation has likewise moderated 2.9% in 3Q 2024, a sharp contrast to the peak of 4.9% in 1Q 2023. As inflation eased, Singapore’s real income rebounded in 2024 compared to 2023.

Despite concerns over growing household debt, local borrowers remained largely capable of handling their mortgage repayments in 2024. According to the Monetary Authority of Singapore, this resilience is largely underpinned by a combination of higher wages and robust financial assets.

Moreover, the recent cuts in the Fed interest rate have benefited homeowners with existing mortgages by easing the cost of monthly repayments. This is evident in the decline of the 3-month compounded Singapore Overnight Rate Average (SORA), a key benchmark for home loan pricing, from 3.70% in January to 3.24% in November.

In short, the better-than-expected economic outlook and firm economic fundamentals had bolstered homebuying activities in the four months of 2024. But as we look ahead, the bigger question remains: Is recovery on the horizon for the Singapore 2025 residential market?

Singapore’s Strong Foothold in The Region Continues to Inspire Confidence Among Homebuyers Even as Uncertainty Looms in 2025

While Singapore’s economy grew better than expected in 2024, uncertainties continue to abound in the global economy; and these could impact the pace of Singapore’s economic growth in 2025.

Worldwide, concerns about global trade have emerged as president-elect Donald Trump prepares to assume his second term in January 2025. Trump’s incoming administration has already signalled an intent to slap tariffs of up to 25% on China, Canada, and Mexico. This has raised fears of inflation and the possibility of interest rates staying higher for longer since Fed has signalled caution and could lean toward fewer rate cuts in 2025.

Consequently, we can expect to see rising protectionism and trade tension, alongside the escalating conflicts in the Middle East and Ukraine. Should all these key themes materialise or worsen, we can certainly expect to see further disruption to global supply chains. This will most definitely drive costs higher and may impede the growth of global trade. Taking these factors into account and barring the materialisation of downside risks, MTI has forecasted Singapore’s economy to grow by 1.0 to 3.0% in 2025.

Even amidst these uncertainties and disruptions, Singapore could still potentially emerge as an early beneficiary of the trade war. Leveraging on our strategic position as a regional safe haven, global companies could be incentivised to relocate their manufacturing supply chains to Singapore.

In brief, ERA remains cautiously optimistic of Singapore’s residential market in 2025. Underpinned by firm macroeconomic fundamentals, Singapore will continue to deepen its status as one of Asia’s leading wealth management hub, thus drawing family offices, high-net-worth individuals and multinational companies to establish a firm foothold in the city.

Barring any unforeseen circumstances and assuming interest rates continue to moderate, the 2025 residential market could outperform 2024, signalling a potential recovery on the horizon. Taken together, the factors mentioned above are expected to boost buyer confidence, driving demand for real estate. Moreover, future price increases are more likely be driven by genuine buying interest, rather than speculative or foreign demand.

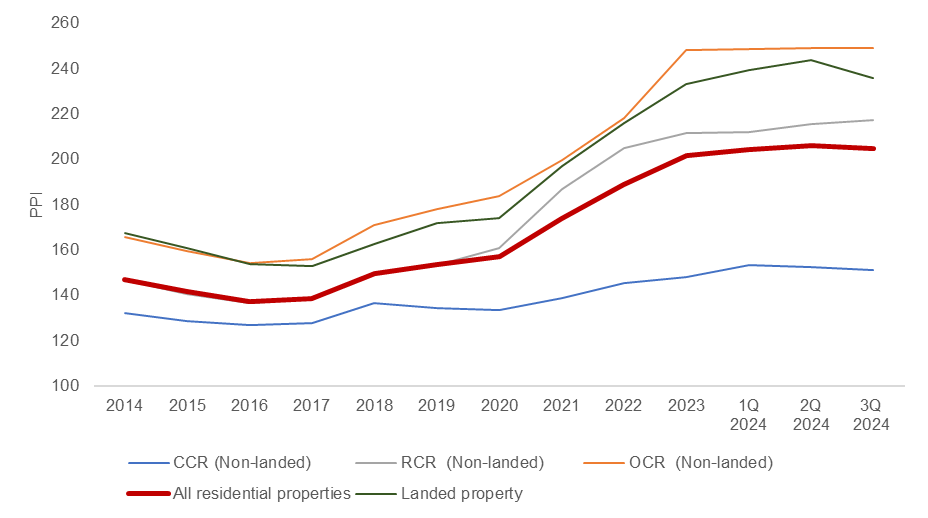

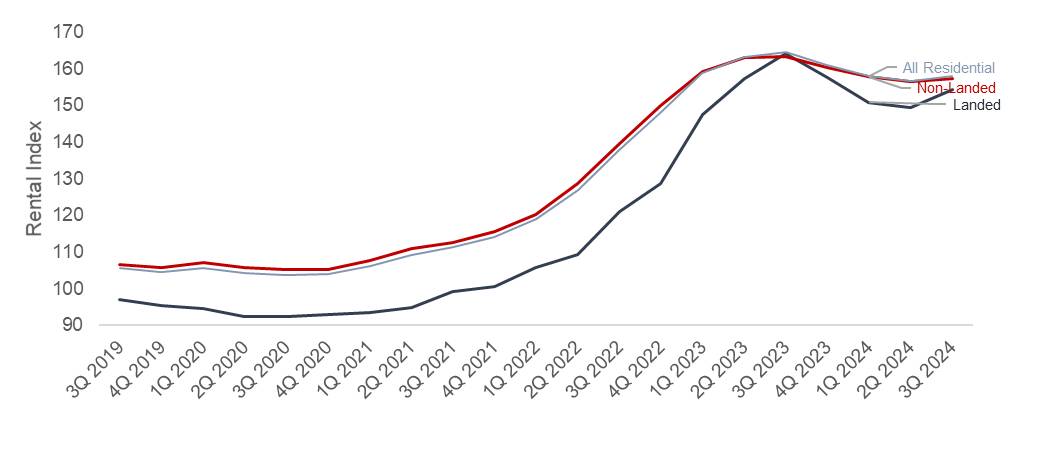

Residential home prices

The all-residential property price index registered a modest uptick of just 1.6% since 4Q 2023, largely due to a decline in new launches, which had previously supported price growth.

Chart 1: Singapore Private Residential Price Index

Source: URA, ERA Research and Market Intelligence

On the other hand, the price index for non-landed properties rose by 1.7% over the last nine months. By sub-markets, the Rest of Central Region (RCR) clocked in the biggest increase, with non-landed private home prices appreciating 2.7% over the first nine months of 2024. Although the Core Central Region (CCR) has historically lagged in price growth, non-landed home prices there rose by 1.9% over the same period, marking the second-largest increase. In contrast, the Outside Central Region (OCR) saw the smallest growth of just 0.4%.

In the landed residential segment, prices rose by approximately 1.0% since 4Q 2023, reflecting a more modest performance that can be attributed to a higher base price.

Come 4Q 2024, it is anticipated that the all-residential property index may grow 2% – 4% year-on-year (y-o-y), with a potential range of 3% – 5% y-o-y by the end of 2025.

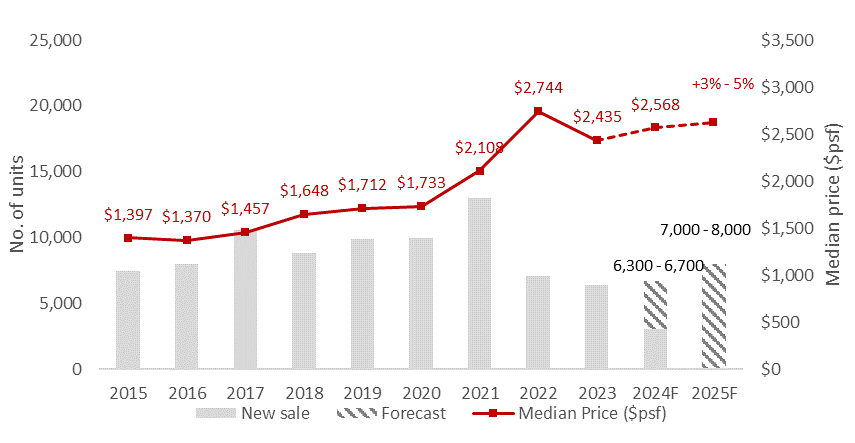

New Homes Sales Market

In the first nine months of 2024, developers launched a total of 3,222 uncompleted private residential units (excluding ECs), the lowest since 2004. Likewise, only two Executive Condominium (EC) projects were launched in 2024, offering a total of 1,016 units for the year.

New home sales in Singapore saw a sharp recovery since October after a slow start in 2024. The rebound was largely driven by the launch of eight projects in October and November. Additionally, moderated mortgage rates also played a significant role in boosting home-buying activity. Based on caveats lodged as of 29 Nov, developers had sold 6,095 new private homes and 997 ECs in the first nine months of the year.

Median new home prices also reached new heights on the back of higher benchmark prices at Meyer Blue, Chuan Park, and Emerald of Katong. Caveat data showed that median new home prices reached $2,568 psf in October and November, representing a 5.5% y-o-y increase from the $2,435 psf of 4Q 2023.

Chart 2: New Sale Transactions and Median Price

Source: URA as of 29 Nov 2024, ERA Research and Market Intelligence (Median price as of 4Q each year.)

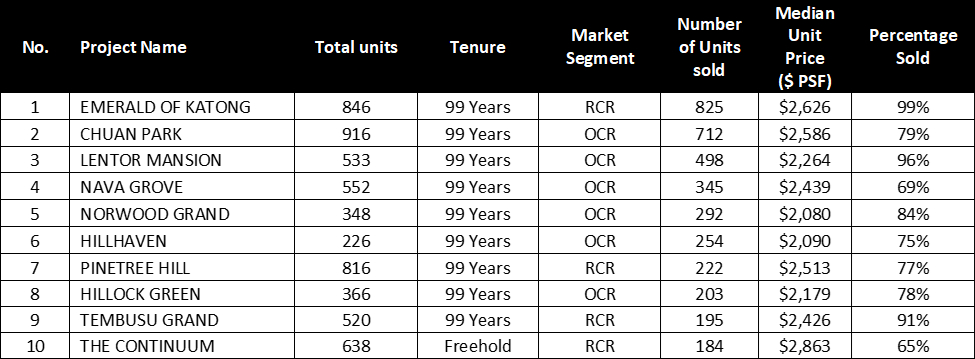

Among the ten best-selling projects, the Emerald of Katong, Chuan Park and Lentor Mansion reported impressive sales, moving more than 70% of their units during their launch weekends. Alongside the new launches, previously launched projects also reported brisk sales. For instance, Pinetree Hill sold an additional 222 units in 2024, following the launch of 8@BT. Similarly, Tembusu Grand and The Continuum recorded increased sales after the launch of Emerald of Katong and Meyer Blue.

However, with December’s seasonal lull in sight, we can expect new home sales to reach between 6,300 to 6,700 units by the year’s end.

Table 1: Top 10 Best-Selling Projects in 2024

Source: URA, ERApro as of 29 Nov 2024

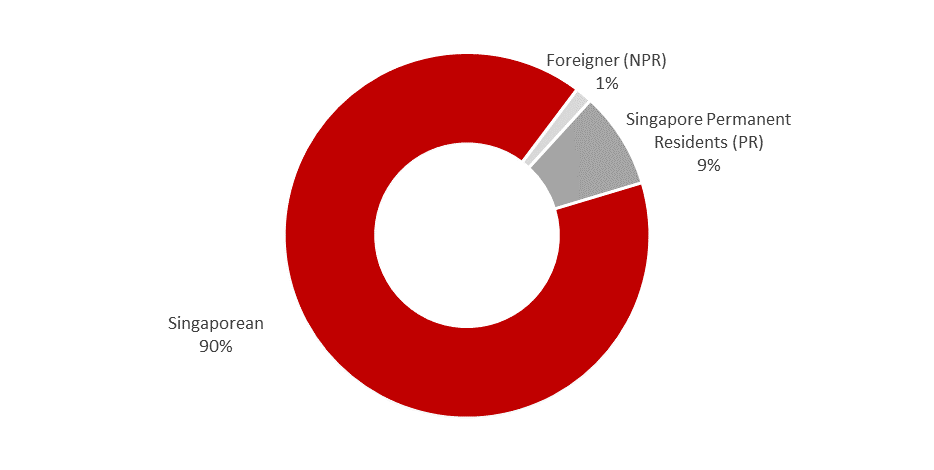

New home demand from foreigners remained subdued in 2024, largely due to the punitive 60% Additional Buyer’s Stamp Duty. Approximately 90% of new home buyers were Singaporeans, with another 9% comprising Singapore Permanent Residents.

Chart 3: Buyer Profile for New Home – Islandwide

Source: URA, ERA Research and Market Intelligence

Upcoming Launches In 2025

Based on estimations, 2025 could see up to 24 new private home launches and three EC launches. In total, new private home launches will yield 11,000 new homes, while the EC launches will see some 2,030 units added to the market.

In 2025, the CCR and RCR are anticipated to see up to nine launches each, while the OCR is expected to see six. These new homes will be evenly distributed across all three regions, giving buyers a wider range of options to choose from.

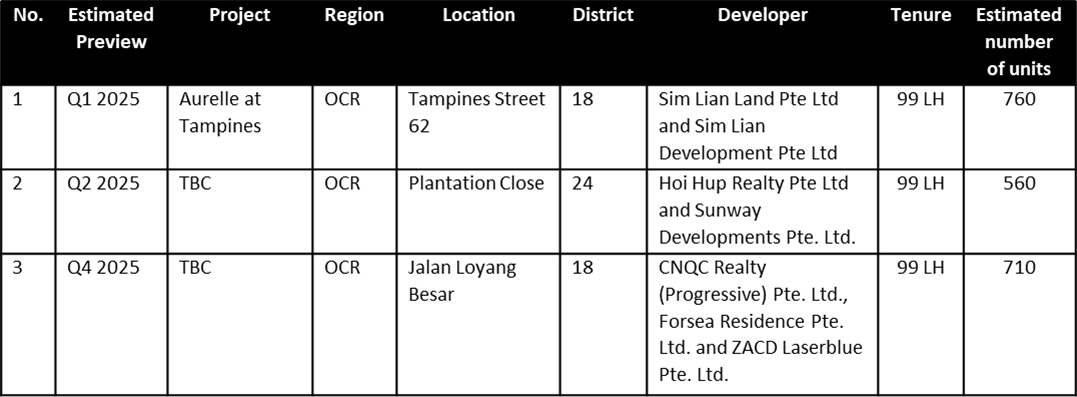

In the EC segment, three ECs will be launch in Tampines, Pasir Ris and Plantation Close.

Over two thirds of the upcoming new home launches will be in the CCR and RCR regions, which are known to command higher prices. Said launches include highly anticipated projects like The Orie at Toa Payoh, a site at Margaret Drive, as well as OCR projects such as Elta (Clementi), Parktown Residence (Tampines) and Lentor Central. Given these factors, we can expect new home prices to maintain their upwards trajectory, growing by 3%-5% y-o-y in 2025.

Table 2: Upcoming launches in 2025

Executive Condominium

Source: ERA Project Marketing

Government Land Sales exercise

In 2024, the government launched some 20 sites in the Government Land Sales Confirmed List. This includes 17 private residential sites, two EC sites, and one long-stay serviced apartment site. Two sites at Chuan Grove and Holland Link are also slated for launch in December 2024.

As of Nov 2024, a total of 12 private residential sites and three EC sites have been awarded. However, three sites were unawarded as a result of low bids submitted by developers; these include the white site at Marina Gardens Crescent, the master developer site at Jurong Lake District and the long-term serviced apartment site at Media Circle.

Look ahead, the 1H 2025 Government Land Sales (GLS) program saw an increase in the overall private home supply to 8,505 units, up from 8,140 units in 2H 2024. A total of ten sites were placed on the Confirmed List, comprising six private residential sites, one Commercial & Residential site, and three EC sites.

Collectively, the 1H 2025 GLS Confirmed List includes 5,030 private homes, comprising 980 Executive Condominium (EC) units, while the Reserve List will offer an additional 3,475 residential units. Overall, the private home supply slated for 1H 2025 fell marginally by 0.4% compared to 2H 2024 but remains 7.7% lower than the supply in 1H 2024.

Resale and Sub-Sale markets

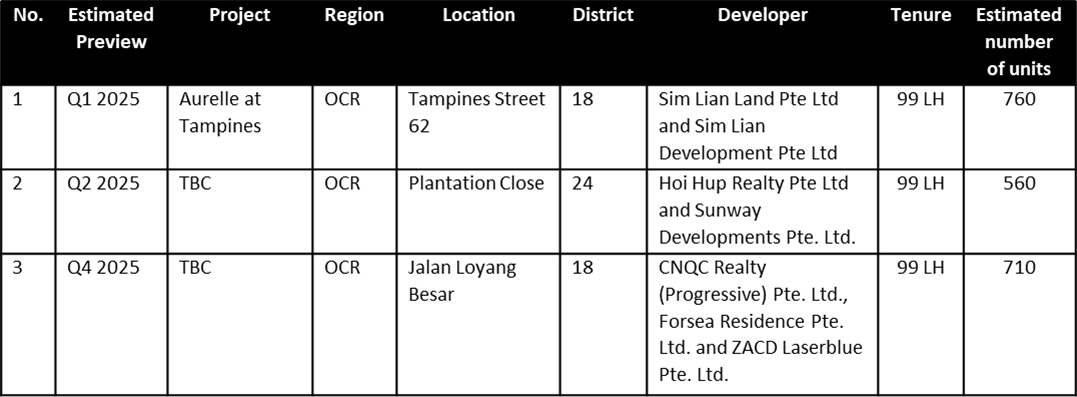

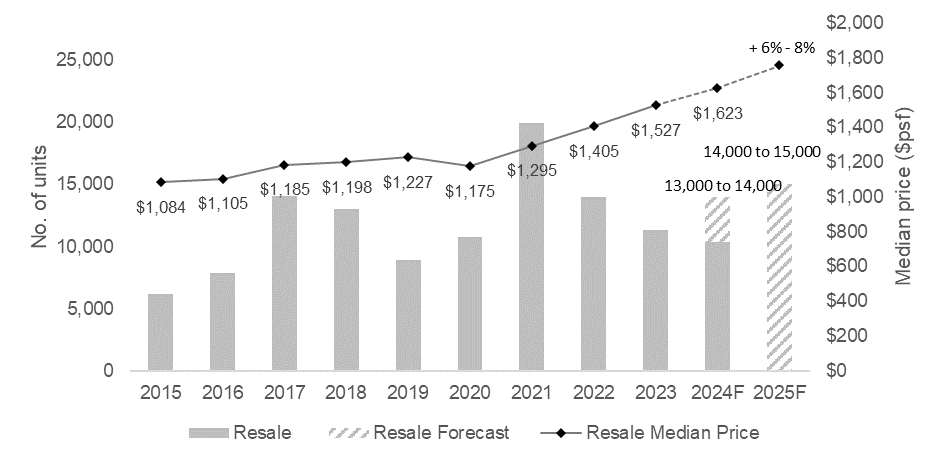

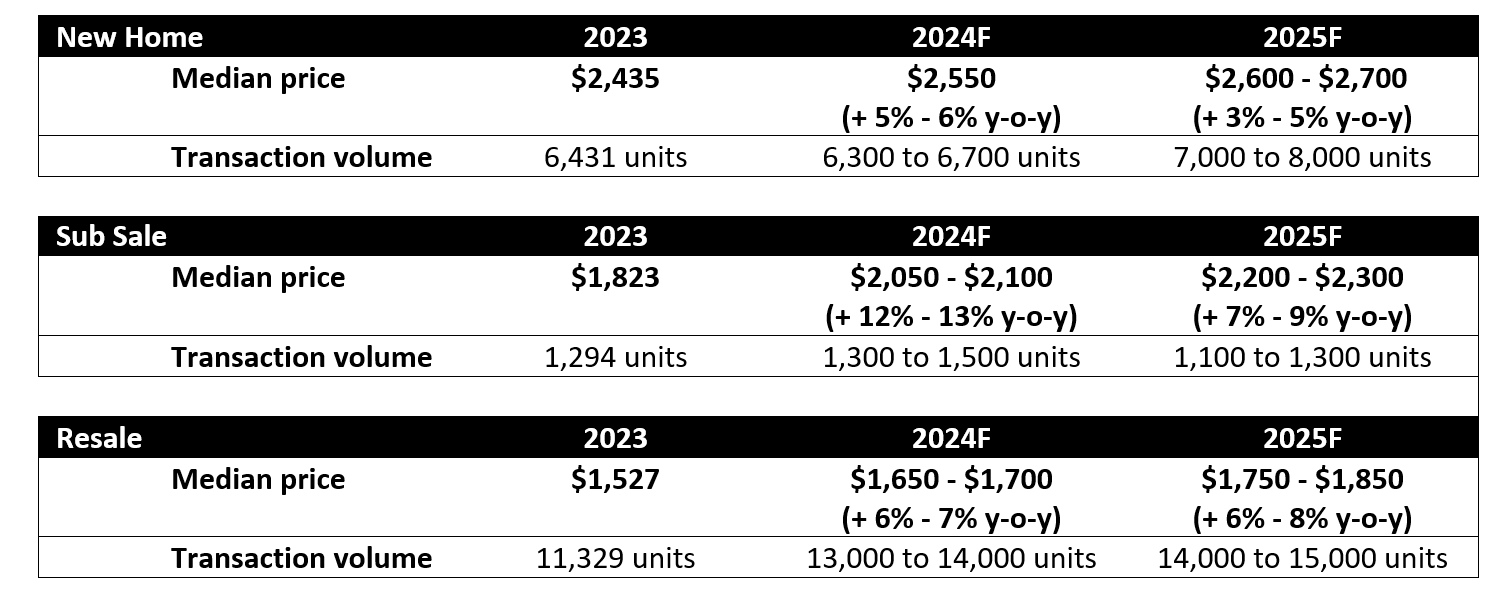

Compared to a year ago, the resale and sub-sale market reported a significant uptick in transaction volume, along with a continued surge in resale and sub-sale prices.

Based on URA caveats lodged as of 29 Nov, some 12,381 resale private homes were transacted in first 11 months of 2024. Median resale prices also reached $1,623 psf in October and November 2024. Compared to a year ago, resale prices have risen by 6.3%, largely boosted by recent completions of new projects.

By end-2024, ERA forecasts resale transaction numbers to reach between 13,000 and 14,000 units, which is notably higher than the 11,329 resale transactions recorded in 2023. Resale prices are also expected to rise by 6% and 8% by end-2024.

Additionally, some 1,250 sub-sale units were transacted in the first 11 months of 2024, taking median sub-sale prices to $2,050 psf in October and November 2024. Over the year, sub-sale prices experienced steeper growth, rising by 12.5%. These prices were driven by an increase in completions in the CCR and RCR.

By end-2024, ERA estimates that sub-sale transactions could reach 1,300 and 1,400 units, potentially marking it as the highest recorded number in the last decade. Sub-sale prices are also expected to rise between 12% and 13% by end-2024.

Chart 4: Resale Transactions and Median Price

Source: URA as of 29 Nov 2024, ERA Research and Market Intelligence

Chart 5: Sub-Sale Transactions and Median Price

Source: URA as of 29 Nov 2024, ERA Research and Market Intelligence

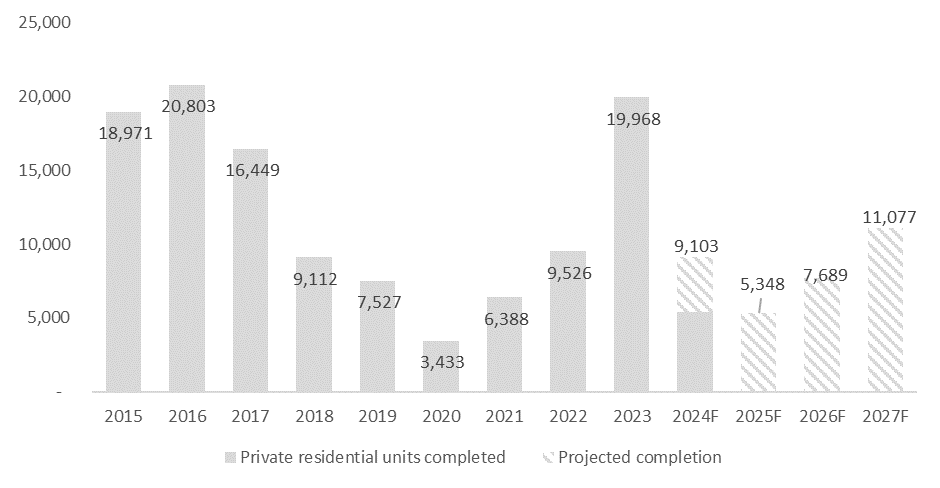

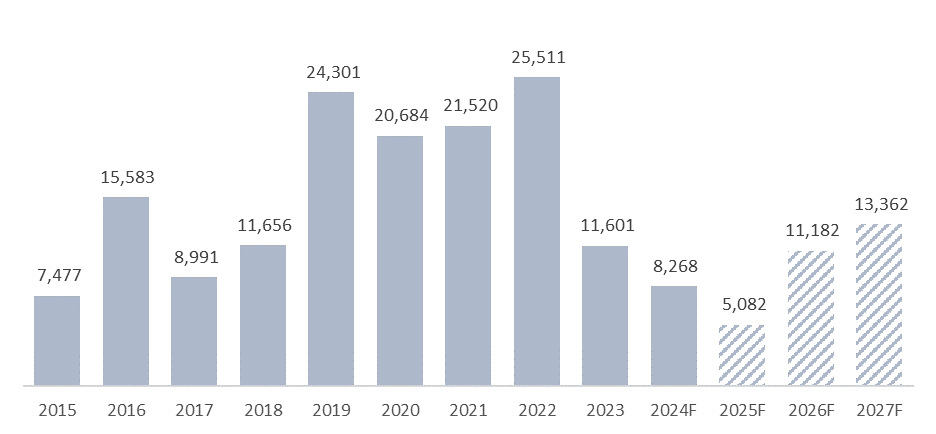

New Home Completions

In 2023, nearly 20,000 private residential units were completed, but this figure is projected to drop by half to approximately 9,100 by end-2024. Come 2025, this number is expected to decline further to just about 5,300 units.

Despite the substantial reduction in new home completions in 2024, the resale and sub-sale markets have remained active, largely driven by the overflow of new home completions from 2023. The surge in completed units in 2023 created a ripple effect, contributing significantly to the inventory of homes available for sale throughout 2024.

Chart 6: Private residential completions

Source: URA, ERA Research and Market Intelligence

Resale and sub-sale outlook

Come 2025, ERA anticipates that the resale and sub-sale markets will remain active despite declining new home completions.

This resilience is largely due to the spillover of new home completions from 2023, which will continue feeding into the secondary market. Additionally, as some homeowners may choose to delay selling their properties, either to lease them out or to take more time to find their next home, this will further contribute to a steady pipeline of resale and sub-sale listings.

Moreover, the slew of recent completions in the RCR and CCR could support future sub-sale price growth. This includes projects such as The Avenir (376 units), One Pearl Bank (774 units), One Holland Village Residences (551 units), and Forett at Bukit Timah (633 units).

Considering these factors, ERA estimates that sub-sale transactions will range between 1,100 to 1,300 units in 2025, with a projected 7% to 9% growth in median prices. Meanwhile, resale transactions are also expected to reach 14,000 to 15,000, and may register a median price growth of 6% to 8% by the end of 2025.

In closing

Recent interest rate cuts and a more positive economic outlook have breathed new life into Singapore’s residential property market. However, it remains to be seen if this momentum will continue into 2025, given the potential impact of emerging global events.

Despite this uncertainty, 2025 will see the launch of several highly-anticipated projects, including The Orie (Toa Payoh), Elta (Clementi), Parktown Residences (Tampines), as well as two yet-to-be-named projects at Margaret Drive and Lentor Central. These upcoming launches, located within established housing estates, are expected to attract strong demand.

Assuming stable macroeconomic conditions and the absence of unforeseen negative factors, new home price are expected to continue their upward trajectory – potentially achieving 3-5% y-o-y growth in 2025. New home transaction volume is also projected to reach between 7,000 to 8,000 units next year, dependent on a favourable economic outlook.

Finally, ERA estimates that sub-sale transactions will range between 1,100 to 1,300 units, with median prices possibly growing by 7% to 9%. Resale transactions are also expected to reach between 14,000 to 15,000 units, accompanied by a median price growth of 6% to 8% by the close of 2025.

Table 3: ERA forecast of Private Home Market

Source: URA, ERA Research and Market Intelligence

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.

[1] Ministry of Trade and Industry, Economic Survey of Singapore Third Quarter 2024

[2] Ministry of Manpower, Labour Market Third Quarter 2024

[3] Singstat, Percent Change In Consumer Price Index (CPI) Over Corresponding Period Of Previous Year, 2019 As Base Year

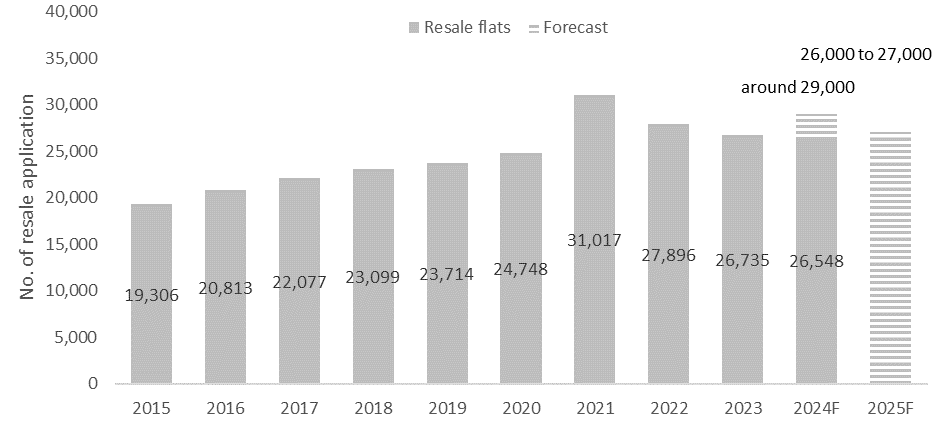

2024 was a bumper year for the HDB resale market

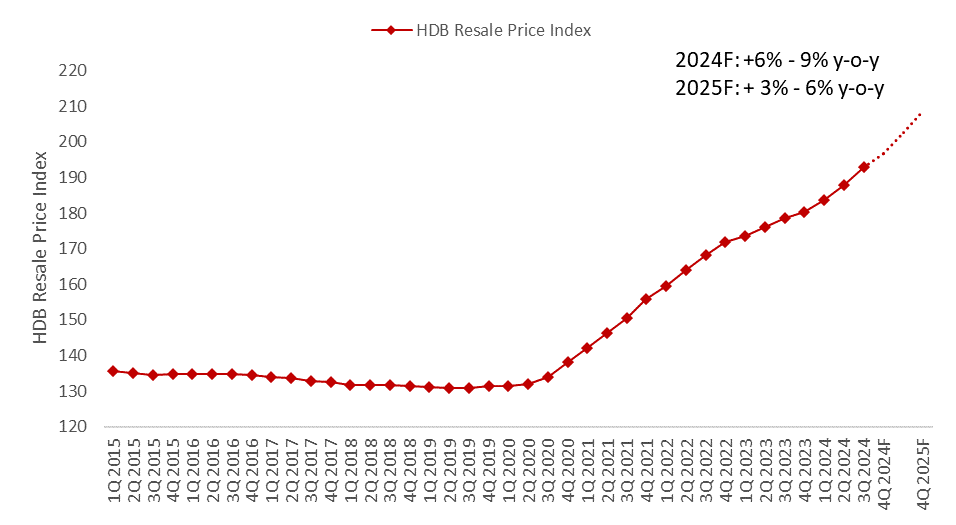

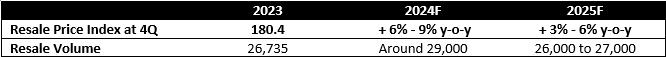

The Housing and Development Board (HDB) resale market saw continued price growth, reaching an all-time high, driven by a healthy resale volume. Over the first nine months of 2024, the HDB Resale Price Index (RPI) rose by 6.9% and is projected to follow a similar growth trajectory, potentially bringing the full-year increase to between 6% and 9%.

In the first 11 months of 2024, resale applications totalled 26,548 and are projected to reach between 28,500 and 29,000 units by year-end—a significant increase from the 26,735 units for the full year 2023.

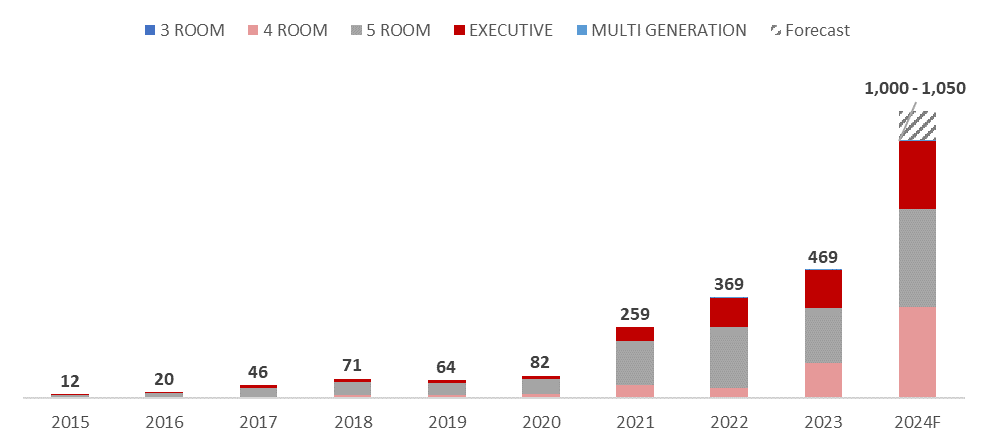

This robust demand has also led to a surge in million-dollar flats, with more than double the number of such sales recorded compared to 2023, with 944 of such transactions as of 3rd December, projected to exceed 1000 by year end.

In the Build-to-Order (BTO) segment, the reclassification of flats rolled out 2H 2024, introducing the new “Standard,” “Plus,” and “Prime” flats in the October BTO sales launch. While the “Standard” flats saw the same resale criteria as before, “Plus” and “Prime” flats came with stricter requirements, including a 10-year Minimum Occupation Period (MOP) and subsidy clawback conditions among other conditions. Collective, HDB had launched 21,225 new flats, comprising 19,637 BTO flats and 1,588 flats under the Sale of Balance Flats exercise in 2024 to meet the housing demand.

2024 Homebuying Activities Underpinned by Firm Economic Fundamentals

Singapore’s economy gained momentum in 3Q 2024, recording a 5.4% year-on-year (y-o-y) expansion compared to a 3.0% growth in 2Q 2024[1]. The growth was primarily driven by robust performances in the manufacturing, wholesale trade, and finance & insurance sectors. With a continued recovery in global electronics demand and stronger-than-expected economic activity, MTI revised its full-year GDP growth forecast to approximately 3.5%, up from the earlier range of 2.0% to 3.0%.

Amid the economic expansion, hiring in the labour market has similarly picked up in 3Q 2024. According to the Labour market report[2], Singapore saw a sharp uptick in employment numbers alongside a decline in retrenchments. Hiring in 3Q 2024 expanded, rising by 22,300 compared to 16,000 in 1H 2024. Retrenchment numbers in the first nine months of 2024 has declined by 15.6% to 9,350, compared to the 11,130 in the same period last year. Overall unemployment rate continued to remain at a low of 1.9% in 3Q 2024.

Singapore continued to see easing inflationary pressures in 3Q 2024, falling to 2.2% which is the lowest seen since 2Q 2021[3]. Among which, accommodation inflation has likewise moderated 2.9% in 3Q 2024,

a sharp contrast to the peak of 4.9% in 1Q 2023. As inflation eased, Singapore’s real income rebounded in 2024 compared to 2023.

Singapore households remained financially resilient despite concerns over growing household debt. The Monetary Authority of Singapore remains confident in households’ financial resilience, citing higher wages and robust financial assets that will continue to support households in meeting their loan obligations. Furthermore, the recent Fed interest rate cuts have offered additional relief to home owners. The 3-month compounded SORA fell from 3.70% in January to 3.24% in November, easing pressure on mortgage payments.

The number of Resident Population increased by some 31,600 which helped to fuel demand for HDB flats in 2024. In short, the better-than-expected economic outlook, firm economic fundamentals and grown resident population had bolstered stronger HDB resale activities in the second half of 2024.

HDB Resale Price Index Growth to Moderate In 2025

The HDB RPI has shown consistent growth throughout the year, reaching 192.9 in 3Q 2024, registering 6.9% increase over the last nine months, with a projected 6% – 9% increase by end 2024.

By 2025, the HDB RPI is expected to grow at a measured pace, reflecting the higher price base in 2024 and a reduced supply of MOP flats in 2025, which have been a key driver of price growth in recent years.

Chart 1: HDB Resale Price Index (RPI) Time Series

Source: data.gov.sg, ERA Research and Market Intelligence

HDB resale transactions soared in 2024, highest seen since 2021

In the first 11 months of 2024, resale applications totalled 26,548 and are projected to reach around 29,000 units by year-end—a significant increase from the 26,735 units for the full year 2023. What could have contributed to this surge? Firstly, some HDB upgraders are being priced out of the private home market, leading them to opt for larger or more centrally located flats instead. Next, with the reclassification of BTO flats since Oct 2024, some buyers saw better value in centrally located resale flats. These flats are exempt from the extended 10-year MOP and other restrictive resale restrictions, making them more appealing to these buyers.

ERA estimates HDB resale transactions to moderate to between 26,000 and 27,000 in 2025 on the back of fewer MOP units and higher cost of replacement homes which may lead existing owners to reconsider selling their flats.

Chart 2: HDB Resale Applications

Source: HDB, data.gov.sg as of 3 Dec 2024, ERA Research and Market Intelligence

2024 Saw A Record Number of Million-Dollar Flats

As at 3 December 2024, some 944 million-dollar flats were transacted, and the number of million-dollar flats is projected to cross 1,000 units by end-2024. This is more than double the 469 million-dollar flats minted in 2023. Nearly 91% of the million-dollar flats in 2024 were from mature estate, with 49% of these were flats that are 15 years and below. The number of million-dollar flats remains represent 3.6% of the resale application.

The highest recorded transactions came from a trio of 5-room flats in Bukit Merah, which all sold for $1.58m.

Chart 3: Million-Dollar Flat Transactions (by year)

Source: data.gov.sg as at 3 Dec 2024, ERA Research and Market Intelligence

Diminished supply of Minimum Occupation Period (MOP) Flats in 2025

This year, 8,268 flats (3-room and larger) fulfilled their 5-year MOP in 2024, marking a 28.7% decrease from the 11,601 flats recorded in 2023. By 2025, the number of MOP flats is expected to decline further, falling 38.5% year-on-year to 5,082.

Chart 4: HDB flats (3-room and larger) that reach the 5-year MOP by year

Source: data.gov.sg, ERA Research and Market Intelligence

Looking at 2025, there is expected to be about 5,082 flats completing their MOP, which could lead to a corresponding decline in supply of flats being put up for sale. Notably, in 2025, we will see nearly 1,700 flats in centralised locations like Bidadari and Dawson fulfil their MOP status, which will likely contribute to more million-dollar flats.

Changes to the Build-To-Order (BTO) flat system turned buyers to resale market

Collective, HDB had launched 21,225 new flats, comprising 19,637 BTO flats and 1,588 flats under the Sale of Balance Flats exercise in 2024 to meet the housing demand.

2024 marked significant changes to the BTO system. By far, the largest change was the abolishment of the mature and non-mature classification of HDB towns. Taking its place were the new “Standard”, “Plus”, and “Prime” housing models.

While the “Standard” flats saw the same resale criteria as before, the “Plus” and “Prime” flats featured more stringent resale restrictions, such as a longer 10-year MOP, subsidy clawback and a buyer resale monthly income ceiling of $14,000. These stringent resale restrictions could deter some homebuyers, driving more to turn to existing centrally located resale flats, which remain unaffected by these changes.

What can we expect in 2025?

For 2025, ERA expects resale prices to grow at a more measured pace due to the higher price base in 2024 and a reduced supply of MOP flats in 2025, which have been a key driver of price growth in recent years. We can expect an overall 3% – 6% price growth, with 26,000 – 27,000 resale HDB units expect to move by end-2025.

Table 1: ERA forecast of HDB Resale Market

Source: URA, ERA Research and Market Intelligence

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.

[1] Ministry of Trade and Industry, Economic Survey of Singapore Third Quarter 2024

[2] Ministry of Manpower, Labour Market Third Quarter 2024

[3] Singstat, Percent Change In Consumer Price Index (CPI) Over Corresponding Period Of Previous Year, 2019 As Base Year

In total, November saw 2,557 new private homes (excluding ECs) sold, representing a 246.5% month-on-month (m-o-m) uptick over October’s performance (738 units sold). Year-on-year (y-o-y), new private home sales were also up 226.1% in November, compared to the 784 units sold over the same period in 2023. This is the highest new home sales in a month since September 2012 which saw 2,621 new homes sold.

The substantial spike in developer sales was fuelled by six new projects (of which, includes one EC), striking a strong contrast to the first ten months of 2024, which were characterised by a relative lack of new launches.

Notable projects that made their debut in November include Chuan Park (OCR, 916 units), Union Square Residences (RCR, 366 units), The Collective at One Sophia (CCR, 367 units), Emerald of Katong (RCR, 846 units), Nava Grove (RCR, 552 units) and Novo Place (EC, 504 units).

This year’s strong showing is also noteworthy, with even more projects launched to capture buyer interest before the festive season. For instance, in November last year, developers had only launched three new projects – namely J’den, Hillock Green, and Watten House.

The flurry of the new home launches can be attributed to several factors. Developers were rushing to launch their projects as soon as they have their sales licenses ahead of the Dec-Jan festivities. At the same time, we have seen buyer sentiment has also improved following the Federal Reserve’s interest rate cut in September and November which have eased mortgage rates and borrowing costs.

In total, developers had launched 2,871 new private homes (excluding ECs) in November, marking a 437.6%, or four-fold from the 534 units in October. On the year, this figure represents a 196% increase over the 970 units launched for sale in November 2023.

Meanwhile, the EC market too witnessed a sharp pick-up in sales volume following Novo Place’s debut, with transaction numbers of new units increasing twelve-fold on a m-o-m basis. Of the 334 new EC transactions recorded, approximately 85.8% can be attributed to Novo Place, thus showcasing its role in boosting market activity.

Best-Performing New Launches

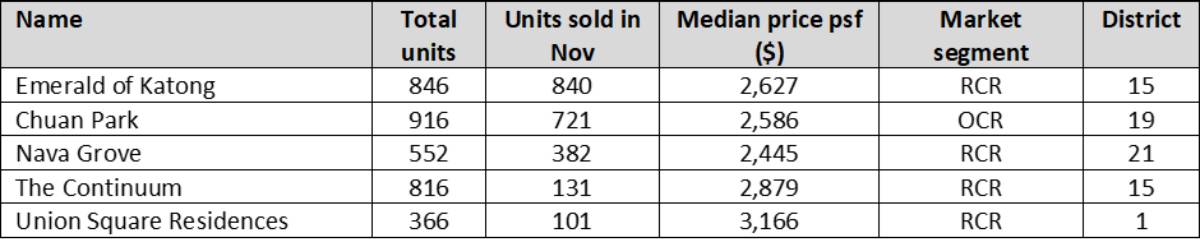

Table 1: Top five performing new launch projects (excluding EC) in November 2024

Source: URA, ERA Research and Market Intelligence

By order of most units sold, November’s best-sellers were respectively Emerald of Katong (840 units sold), Chuan Park (721 units sold), Nava Grove (382 units sold), The Continuum (131 units sold), and Union Square Residences (101 units sold).

Emerald of Katong had set a new benchmark for new private homes in the area, with a median price of $2,627 psf. Helmed by developer Sim Lian Group, the project had a take-up rate of 99% during its launch weekend, making it by far the best-selling project of the year with 840 out of 846 units sold. Factors contributing to the launch’s success include its location within the desirable District 15, as well as its proximity to key commercial and recreational nodes, such as Paya Lebar Central and East Coast. The success of the Emerald of Katong could be attributed to the sweet spot in the price quantum of its units, despite its higher median price of $2,626 compared to other new launches in the vicinity. Notably, approximately 59% of the transactions were below $2.5 million.

Similarly, Chuan Park had set a new benchmark price of $2,586 psf in Lorong Chuan, following its successful launch in mid-November. Occupying the same site as the former Chuan Park Residences, the development is just a stone’s throw away from Lorong Chuan MRT station, thus giving future residents easy access to the Circle Line. Additionally, Chuan Park is the first new launch in the neighbourhood since 2010, enabling it to capitalise on years of pent-up demand from potential upgraders living nearby.

Nava Grove, which likewise made its debut on the same weekend, provides future residents with the opportunity to live within a natural enclave nestled between Clementi and Dover Forests. Despite the harmonisation rule, which tend to see higher psf pricing, Nava Grove was offered at a very attractive price point for an RCR project. 67% of the units sold were transacted at $2,500 psf and below.

The Continuum climbed the charts to become the fourth best-performing development in November 2024, benefitting from the spilt-over demand from Emerald of Katong. Several units were sold at a price psf similar to or just marginally higher than that of the Emerald of Katong, despite its freehold status.

Meanwhile, new private homes at Union Square Residences achieved a median price of $3,166 psf, following an encouraging launch weekend that saw 75 units sold. The development is conveniently located near key destinations along Singapore River’s vibrant dining and entertainment scene, including Clarke Quay and Boat Quay. Moreover, its proximity to the downtown area also offers live-work-play opportunities for future owners.

Emerald of Katong Revives New Private Home Sales in RCR and District 15

Leading the three regions by far, the Rest of Central Region (RCR) recorded the highest number of new home sales in November, with 1,570 units sold. On the other hand, the Core Central Region (CCR) and Outside Central Region (OCR) saw 98 and 885 units sold.

Compared to October (247 units sold), November’s new private home sales in the RCR represent a dramatic 535.6% increase, or a five-fold jump over the previous month.

This dramatic rise in new private home sales in the RCR is largely attributable to the revitalising effect of Emerald of Katong on earlier launches in District 15. Examples include Tembusu Grand and The Continuum – both of which saw a rebound in sales numbers as Emerald of Katong renewed consumer interest in the area.

Tembusu Grand, which launched in April 2023, sold 53 units in November—doubling the 26 units sold in October. Similarly, sales at The Continuum skyrocketed to 131 units in November, a significant rise from the 8 units sold in October.

This outcome was also likely driven by oversubscription at Emerald of Katong. Buyers who were unable to secure favourable ballot numbers or desired units may have ended up shifting their attention to other developments in District 15.

Executive Condominium

In the Executive Condominium (EC) segment, sales of EC likewise soared to 334 units in November up from 28 units in October, with the launch of Novo Place, which provided EC buyers with a fresh option since the launch of Lumina Grand in January this year.

On its launch weekend, Novo Place achieved a take-up rate of 57%, selling 291 units out of a total of 504. This strong performance is partly attributable to Novo Place’s convenience. Unlike other EC launches with remaining stock, Novo Place will be within walking distance from the future Tengah Park MRT station – a rare convenience for EC developments, which are often located in more outlying areas. The second-timer quota was met at launch and will reopen for ballot in December which is expected to boost sales at Novo Place.

Additionally, Novo Place’s strong showing also drummed up interest in similar offerings, leading to a boost in sales at earlier EC projects. For example, Lumina Grand and North Gaia both recorded 19 units sold respectively in November compared to the 11 and 13 units sold in October.

Buyer Profile

Chart 1: Buyer profile for all new non-landed homes excluding ECs

Source: URA, ERA Research and Market Intelligence

Despite the significant jump in overall new non-landed private home sales (excluding ECs), foreigner demand continued to remain flat largely due to the punitive Additional Buyer’s Stamp Duty. Foreign buyers accounted for only 25 transactions.

On the other hand, Singapore Permanent Residents (PR) exhibited significantly higher buyer activity. The number of PR buyers surged from 62 in October to 175 in November, representing a more than twofold increase in absolute terms.

Meanwhile, Singapore residents continued to dominate the market in November, accounting for 2,353 buyers, or 92.2% of all transactions for the month.

Luxury Properties (Non-Landed Homes $5 Mil and Above)

A total of 11 luxury homes, priced at $5 mil and above, were transacted in November 2024. Additionally, 63% of the luxury homes transacted in the month fell within the $5 mil – $6 mil price range. The highest-priced transaction was a 4,209 sqft unit at 32 Gilstead, which was purchased for $14.4 mil ($3,431 psf) by a Singapore PR.

Chart 2: Buyer profile for homes transacted at $5mil and more

Source: URA, ERA Research and Market Intelligence

What Lies Ahead for the New Private Home Market in the Coming Months?

Though recent interest rate cuts and a more positive economic outlook have breathed new life into the new launch market, challenges remain with an impending Trump presidency and ongoing trade tensions that could impede Singapore’s economic growth.

Nonetheless, ERA remains cautiously optimistic about Singapore’s residential market in 2025. Supported by strong macroeconomic fundamentals, Singapore is likely to strengthen its position as a ‘safe harbour’ amid potentially stormy conditions. This could, in turn, boost buyer confidence and bolster demand for new private homes even in the face of a challenging global economy.

With no more new launches planned for this year, buyers will have to wait till January for more projects to enter the market. That said, there will be no lack of fresh options in 2025, with an estimated 24 private home projects and three EC launches coming next year.

The Orie, launching in January, will kick off the year as 2025’s first new launch and Toa Payoh’s first new development in almost a decade. Located at Toa Payoh Lorong 1, the project is poised to draw considerable interest due to its excellent location, the growing popularity of RCR properties, and intrinsic appeal to HDB upgraders living nearby.

Aside from The Orie, upcoming projects at Margaret Drive and Lentor Central, as well as ELTA and Parktown Residence are also expected to captivate buyers in the coming months.

However, with December’s seasonal lull in sight, we can expect new home sales to reach between 6,300 to 6,700 units by the year’s end.

Assuming stable macroeconomic conditions and the absence of unforeseen negative factors, new home price are expected to continue their upward trajectory – potentially achieving 3-5% y-o-y growth in 2025. The private residential market could see growth next year, with sales possibly reaching between 7,000 and 8,000 units in 2025

Table 2: Upcoming launches in 2025

Executive Condo

Source: ERA Project Marketing

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.

Economic Overview

Based on advance estimates, the Ministry of Trade and Industry (MTI) announced that the Singapore economy grew by 4.1% year-on-year (y-o-y) in 3Q 2024. The growth is led by the manufacturing sector which expanded 7.5% y-o-y. All manufacturing sectors recorded expansions apart from the biomedical manufacturing cluster. On a quarter-on-quarter (q-o-q) seasonally-adjusted basis, the sector grew by 9.9 per cent, a sharp turnaround from the 1.2 per cent contraction in the second quarter.

The Economic Development Board (EDB) also expects that business sentiments in the manufacturing sector remain positive, despite continuing geopolitical and macroeconomic headwinds. Similarly, all clusters barring biomedical manufacturing, anticipates improved business prospects till March 2025. The transport engineering (including aerospace and marine & offshore engineering segments) expects the most favourable business environment. This is followed by the general manufacturing cluster.

The Singapore Manufacturing PMI decreased slightly month-on-month (m-o-m) by 0.4% to 50.80 points from 51.00 points in October 2024. However, despite this small blip, manufacturing is still in an expansion mode.

However, there may be potential headwinds in the longer run. US under President-elect Donald Trump may impose higher import tariffs that will disrupt China, and the larger global arena. This may have a knock-on impact on the manufacturing supply chains in Asia and Singapore.

Price and Sales Transaction Volume

On 18 September, the U.S. Federal Reserve (Fed) announced that it was finally cutting interest rates after keeping them elevated over the past four years. The cut of 50 basis points lowers the Fed’s target rate range to 4.75% to 5.00%, down from the previous range of 5.25% to 5.50%. The rate was cut by a further 25 basis points to between 4.50% – 4.75% on 7 November 2024.

This cut gave buyers the confidence to enter the market. For investors, the higher rental yield of industrial properties are also more attractive than those of residential leasehold properties. Moreover, industrial properties also comes without the punitive Additional Buyers’ Stamp Duty (ABSD). These factors may have provided both local and foreign investors the impetus to enter the market now.

Moreover, improved market sentiments and business environment brought about by the Fed rate cuts have led to higher manufacturing output. Industrialists, being more optimistic with the market conditions, are ramping up production when demand for goods and services are driven up. The manufacturing sector has picked up steam and businesses are moving forward ahead in business expansion. The lower financing cost could translate to lower operating costs.

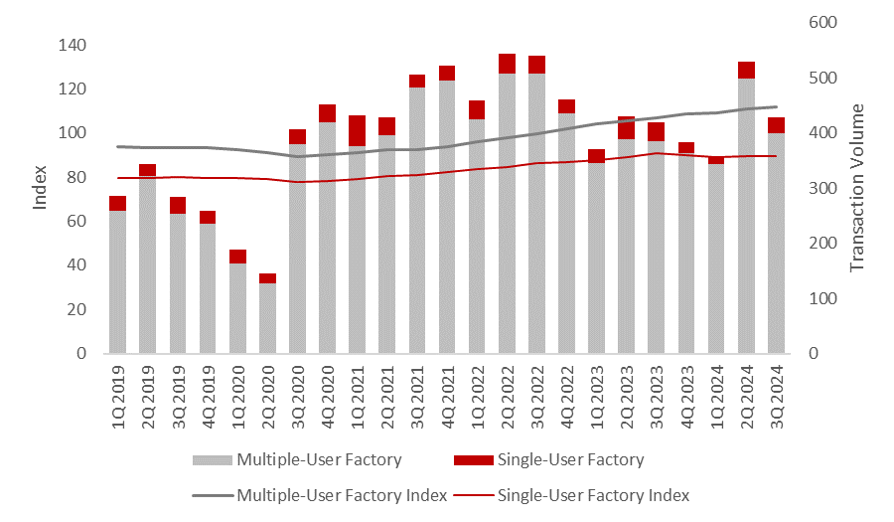

Chart 1: Price Index and Transaction Volume

Source: URA, ERA Research and Market Intelligence

Prices of multiple-user factories and single-user factories rose 0.7% and 0.2% quarter-on-quarter despite fewer transactions. This is despite transactions falling for both sub-markets. While multi-user factory space saw 19.9% q-o-q fewer transactions, it was still 3.6% higher y-o-y. There was still strong demand for these units by both investors and end-users.

The most notable transaction in 3Q 2024 was in August. Lendlease and US private equity firm Warburg Pincus acquired $1.6 billion portfolio of assets from a Real Estate Investment Trust (REIT) portfolio owned by Blackstone and Soilbuild.

Separately, ESR-Logos REIT also purchased 51% stake in a manufacturing facility cum logistics warehouse at 20 Tuas South Avenue 14. This was part of the $772.6 million acquisition that also includes a 100% interest in a modern logistics facility in Nagoya, Japan.

More recently, Mercedes-Benz Singapore is selling the balance lease term of 16 years and 5 months of its property at 301 Jalan Ahmad Ibrahim back to JTC Corporation for $46.2 million.

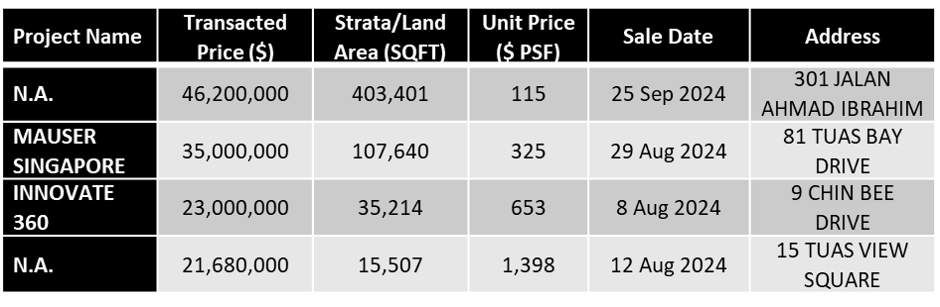

Table 1: Top five sales transactions in 3Q 2024, based on caveats lodged

Source: URA, ERA Research and Market Intelligence

As Food and Beverage (F&B) businesses attempt to keep costs low with higher commercial rents, some have opted to centralise their kitchen operations at food factories. In particular, those with multiple outlets would use this cost-effective strategy. Hence, there are more interest among end-users for such food factories. In 3Q 2024, Food Xchange @ Admiralty moved three units, while Food Vision @ Mandai moved six units and Food Ascent in Tuas South moved another 16 units respectively.

Leasing and Leasing Volume

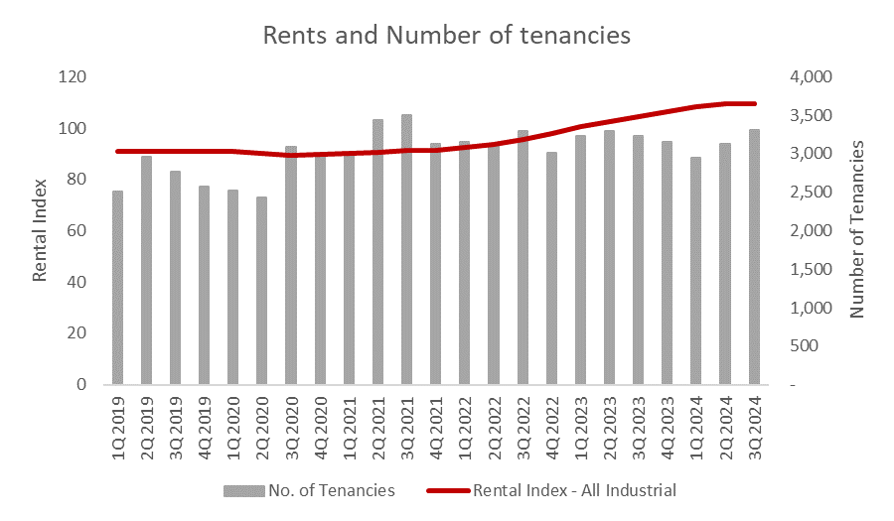

On the back of higher manufacturing output, the JTC All Industrial rental index continued its upward trend, rising for the sixteenth consecutive quarter in 3Q 2024. It climbed a further 0.3% q-o-q to 109.6, marking the highest point since 2Q 1996. However, growth has been slowing, falling from the 1.0% growth in 2Q 2024. This growth was led by Multiple-User Factory, where rents grew by 0.6% q-o-q.

While rental index has climbed marginally q-o-q, leasing volume have continued to rise for the second consecutive quarter as well. There were 3,304 tenancies signed in 3Q 2024, a 5.9% increase from the previous quarter. This follows the 5.8% growth in 2Q 2024.

Chart 2: Rental Index and Number of tenancies for industrial properties

Source: JTC JSpace, ERA Research and Market Intelligence

In conclusion

With better market sentiments and another 25-basis points of interest rate cuts forecasted, we will likely continue to see more growth in rents and prices. However, the growth would be more muted in light of firms still being cautious about the global geo-political outlook and higher supply of industrial stock coming in. Moreover, Fed rate cuts forecasts may not be as bullish as initially predicted. We are likely to see more transactions in the coming quarters. Investors would look to capitalise on lower financing cost add to their portfolio, while businesses may be bullish to expand their operations. Prices and rents are still looking to increase steadily, but at a sustainable rate of between 0.5% and 1.0% in the coming quarters.

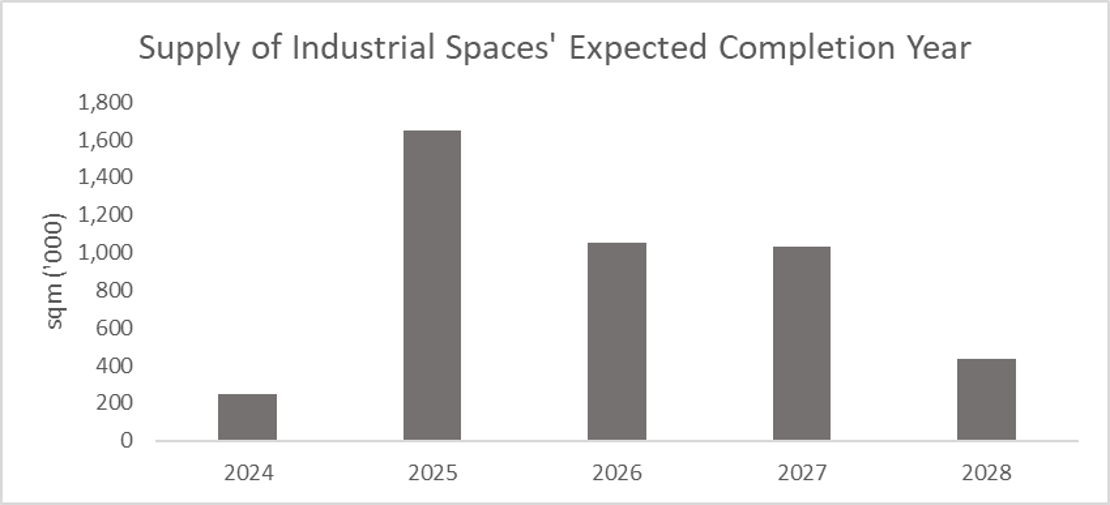

By end-2024, we do expect seven new industrial developments to attain their Temporary Occupation Permit (TOP). This will inject another 193,000 sqm of industrial spaces into the market. 2025 will see a further 1.2 million sqm of industrial space attaining TOP. Some notable developments are Bulim Square 1 and 2, a business park in Punggol Way and JTC Space @ AMK. All three developments are developed by JTC Corporation.

Industrial buildings developed by JTC Corporation are not sold. Moreover, they have started leasing out the space even before completion. Hence, the surge in supply may not have as great an impact on prices and rents even upon completion.

Chart 3: Supply of Industrial Spaces’ Expected Completion Year

Source: JTC JSpace, ERA Research and Market Intelligence

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.

In total, October saw 738 new private homes sold, representing a 84.0% month-on-month (m-o-m) uptick over September’s performance (401 units sold). Year-on-year (y-o-y), new private home sales were also up 263.5% in October, compared to the 203 units sold over the same period in 2023.

This surge in transaction volume was primarily driven by the two new launches – Norwood Grand in Woodlands (OCR) and Meyer Blue along Meyer Road (RCR).

Norwood Grand, the first new launch in Woodlands in 12 years, sold 292 of its 348 units (83.9%) during its launch. The stellar launch day performance was due to the strong pent-up demand, coupled with the lack of supply for new private homes in the vicinity, leading to all 1 to 3-bedroom units being snapped up on its launch day.

Despite new benchmark prices for Woodlands, it was still an attractive opportunity for new home buyers today. At a median of just $2,081 psf, it presented a value buy for new homes, particularly one located near an MRT station. In the first nine months of 2024, new homes in the OCR sold at a median price of $2,145 psf.

Meyer Blue, on the other hand, moved 114 of its 226 units (50.4%) on its launch. The rarity of new freehold units along the prestigious Meyer Road made them highly sought after, particularly units with sea views. Being a freehold project, it captivates homeowners and investors buying for legacy purposes. In October 2024, a total of 124 units were sold at a median price of $3,240.

In October, 534 non-landed private homes were launched. This is was a 22.2% and 888.9% increase m-o-m and y-o-y respectively. Developers are rushing to launch new projects before the year end festive period when many potential buyers are away.

Impact of the Fed’s rate cut announcement in September

On 18 September, the U.S. Federal Reserve (Fed) announced that it was finally cutting interest rates after keeping them elevated over the past four years. The cut of 50 basis points lowers the Fed’s target rate range to 4.75% to 5.00%, down from the previous range of 5.25% to 5.50%.

This has largely translated into improved buyer confidence and more activity in the new private home market. Already, we have seen strong homebuyers’ interest in the upcoming launches. In total, Nava Grove, Emerald of Katong and Chuan Park drew more than 29,000 visitors to their respectively show flats over the weekend over the prior weekend. Beyond the strong take up rates at Norwood Grand and Meyer Blue, Chuan Park also sold 696 of its 916 units (76.4%) when it launched on 10 November 2024.

Best-Performing New Launches

Table 1: Top five performing new launch projects (excluding EC) in October 2024

Source: URA, ERA Research and Market Intelligence, ERApro

The top five best-performing projects in October were respectively Norwood Grand (292 units), Meyer Blue (124 units), Pinetree Hill (71 units), Hillock Green (36 units), and Lentor Mansion (29 units).

While Norwood Grand had set new benchmark prices for homes in Woodlands, they were still within the affordable price range for homebuyers today. 1-bedroom units were mostly under $1.1 million, while 2-bedroom units were priced under $1.6 million. Investors see them as value buys in today’s market. On the other hand, 3-bedroom units were all priced under $2 million which sat well for HDB upgraders.

For Meyer Blue, units with sea view are mostly sold out as buyers are willing to pay a premium for such views. The development also has a prestigious address and located within an 8-minute walk to Katong Park MRT Station. Being at the city-fringe, residents have easy and quick access to the Central Business District (CBD). A shortage of new homes in this location, and a lack of future residential sites nearby provided buyers the impetus required to secure a unit at Mayer Blue.

Pinetree Hill sold a total of 71 units in October, similar to the 72 sold in September. This comes after the second phase of launch, where higher-floor units were released for sale. In contrast, just 80 units were sold between January to August this year. Fresh demand could also have been fuelled by the interest in 8@BT, launched in September, and the upcoming Nava Grove in November.

Hillock Green (36 units) and Lentor Mansion (29 units), both located at the Lentor Hills estate, also saw renewed interest. This could be attributed to the spill over effects from Norwood Grand, located just two MRT stops away at Woodlands South.

Executive Condominium

In the Executive Condominiums (EC) segment, sales of new homes dipped slightly m-o-m, falling from 32 units sold in September to 28 units in October. This comes on the back of no new EC launch since January 2024 when Lumina Grand was launched.

EC sales are likely to pick up when the 504-unit Novo Place in Tengah is launched in November. This injection of fresh stock will also capture buyers’ interest for ECs in the west. They can choose from the remaining units at the nearby Altura (15 units) and Lumina Grand (85 units). In Yishun, North Gaia have another 44 units remaining.

Buyer Profile

Chart 1: Buyer profile for all new non-landed homes excluding ECs

Source: URA as of 15 Nov 2024, ERA Research and Market Intelligence

Foreigner demand for new non-landed homes (excluding ECs) continued to stay flat in September as 2023’s cooling measures continue to exert their influence on buyer appetite. Despite this, there were 20 new home transactions made by foreign buyers, the highest since May 2023 when there were 29 transactions.

However, the proportion of new non-landed homes have been relatively similar over the past 12 months. Singaporean citizen buyers accounted for 89.7% of total new home non-landed transactions. The past 12-month average stands at 85.9%.

Luxury Properties (Non-Landed Homes $5 Mil and Above)

A total of 31 luxury homes, priced at $5 mil and above, were transacted in October 2024. The highest-priced transaction was a 4,219 sqft unit at 32 Gilstead, which was purchased for $14.5 mil ($3,434 psf) by a foreigner.

Chart 2: Buyer profile for homes transacted at $5mil and more

Source: URA as of 15 Nov 2024, ERA Research and Market Intelligence

What Lies Ahead for the New Private Home Market in Coming Months?

Following September’s recovery, October’s strong performance could also carry onwards into November. Buoyed by improved buyer sentiment and the excitement from the introduction of new highly anticipated projects, current momentum in the market will likely continue.

While Fed rate cuts forecasts may not be as bullish as initially predicted, any additional cuts will bolster market sentiment down the line. However, after the flurry of new launches in November, we do anticipate that the demand in the private home market could taper into December 2024 and January 2025 with the approaching holiday seasons.