During his first National Day Rally this year, Prime Minister Lawrence Wong cast a spotlight on housing options with improved infrastructure for Singaporean seniors, highlighting that “there are seniors who prefer not to move” who desire to “age in place, where they currently live”.

However, some seniors may not be able to preserve their current living arrangements – primarily those who live in landed homes. Here are three main reasons why we believe Senior homeowners residing in landed properties are considering right-sizing their homes.

- As they age, seniors will face progressively reduced mobility and will eventually require elderly-friendly facilities. This could include extensive renovation such as installing lifts for easy access to upper floors.

- The upkeep and maintenance costs of landed homes could require seniors to part with a significant amount of their savings, especially for those who have already retired and no longer have a steady source of income.

By right-sizing their home, some seniors can unlock some monies from their existing property that could support their retirement.

Recent Tweak to ABSD Rules Could Help More Single Seniors to Right-Size Their Homes

Announced during Budget 2024, Single Singaporeans aged 55 years and above will be eligible for an ABSD concession on their second residential property should they meet certain conditions.

These include disposing their first residential property within six months of purchasing their second completed property, or from the issue date of the Temporary Occupation Permit (TOP)/Certificate of Statutory Completion. For the full list of criteria, see here.

The extension of the Additional Buyer’s Stamp Duty (ABSD) concession to Single senior Singapore citizens, including divorcees and widows/widowers, will provide a greater incentive for single seniors to right-size their homes.

When considering HDB flats, seniors have to keep in mind that there is a wait-out period of 15 months if they aim to move into a 5-room or larger flat. Thus, a more manageable property could be a 4-room or smaller flat. On the other hand, some may prefer living in a condo for its diverse range of facilities as compared to living in HDB estates as a whole.

Landed Properties Being Home to a Higher Proportion of Seniors

A quick study of several landed enclaves across Singapore revealed that nearly all of them had a higher proportion of Seniors. While Seniors make up 37% of the population island-wide, certain subzones, such as Tagore & Sembawang Hills (43%), Lorong Chuan & Serangoon Central (42%), and Hillview (39%), showed a higher concentration of Seniors.

Likewise, results from ERA’s “My Dream Home Survey 2024” reflected a similar trend, revealing that seniors constitute more than half (52%) of the respondents living in landed homes, surpassing residents from other age groups.

Chart 1: Landed enclaves and their estimated proportion of Senior population

Here are some considerations to help Seniors decide if they should right-size to new or resale condos

1. Unlike Resale Leasehold homes, New Leasehold projects come with a fresh 99-year lease

New condominiums have unique advantages of their own too. For most Singaporeans, remaining leasehold tenure is a major buying consideration – this is especially true for anyone interested in creating a legacy asset. This is where newly-launched condos excel, offering fresh leases that translate into longer horizons for price growth.

2. Wide selection of units making it possible for Multi-generation families to buy homes within the same project

Additionally, finding the right condo unit on the resale market might be more challenging than picking one in a newly-launched project. Depending on the pool of available units, right-sizers may have fewer opportunities to find their ideal home in an older development.

In contrast, newly-launched developments offer a wide selection of homes, significantly increasing your chances of finding a dream home that perfectly matches your desired preferences. Moreover, Seniors could consider purchasing new homes alongside their adult children, i.e. buying two properties within the same project. This arrangement enables them to live close enough to easily care for each other while still maintaining personal space.

3. Newer facilities + lower renovation cost required

New projects will see brand new facilities and typically require lower renovation cost compared to resale homes.

4. Resale private homes are affordable

For many buyers, affordability is a crucial factor that influences their decision in making a purchase. Traditionally, new sale private homes command a higher selling price than a resale unit. From 2019 to August 2024, the average price of resale units maintained lower prices than new sale units.

Chart 2: Average Price of New Sale and Resale Condos

Moreover, the premium on new sale units has exponentially increased. In the same period, average prices of new sales pulled away from resale units, boosting the price difference of 27% to 42%.

5. Resale condos have shorter waiting period compared to new condos

In most cases, buyers of resale condos can complete their purchase within three to four months and move in once renovations are finished. However, for new homes, unless the project is nearly completed, buyers generally have to wait between 2 to 4 years for their homes to be ready.

6. Sizeable resale units but many of them may require renovation

One notable expense associated with buying an older condo is renovation cost. The existing structure of resale units may not align with buyers’ preferences or may be in poor condition due to wear and tear. As a result, buyers often need to invest heavily in renovations, which may chalk up unexpected costs along the way.

At some locations, it might mean only finding much older resale condos. For instance, about half of the condo developments around Tagore, Sembawang Hills are more than 20 years old. These older condos may also have maintenance issues in communal areas that cannot be easily rectified.

Resale and new sale: What are the Seniors’ housing options?

While the availability of resale homes largely depends on what is listed on the market, there is a consistent supply of new homes to choose from. According to “Dream Home Survey”, among the Seniors and Boomers looking to buy a private condo as their next home, a significant 61% of them prefer new condos, far surpassing the preferences of the Millennial and Gen Z demographics. This preference likely stems from the appeal of longer leases and greater potential for capital appreciation associated with new condos.

And since familiarity breeds contempt, but in the case of neighbourhoods, it’s more likely that they’ll breed comfort instead. Being well-acquainted with everything – from the nearest supermarket to the cheapest eateries – in an area will allow you to establish a day-to-day routine that ensures daily life stays pleasantly predictable.

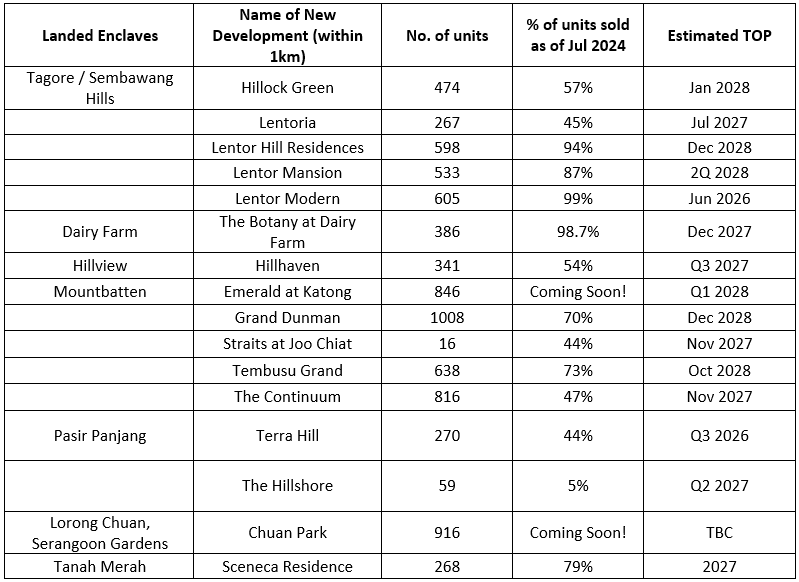

Referencing the locations, we had earlier discussed in Chart 1, here’s a list of new developments found in the vicinity

Table 1: Landed Enclaves & Nearby New Developments

Even at this price point, it is still financially feasible for senior landed homeowners to right-size to a new private condo in 2024

Looking at historical transaction data for landed properties in the various subzones over the past 15 months, it’s evident that current landed homeowners will have sufficient funding to purchase a new condo within a 1km radius after downsizing.

Our survey results also showed that 78% of Boomers and Seniors looking to buy a condo have a budget between $1 million and $3 million, which is a comfortable budget after transacting their previous landed home.

Here are some examples of estimated surplus funds that senior landed homeowners can expect to have after using their sales proceeds to purchase a newly-launched unit within the same subzone:

Case Studies (using median transacted landed home prices within the last 15 months)

| Example 1: Selling a terrace home in Tagore and buying a new 2-bedroom unit at Lentor Hills Estate |

| Value of current property: $3,629,000 Misc. Fees: $82,661 Value of new unit: $1,555,000 BSD: $46,800 Refundable ABSD: $311,000 Surplus: $3,629,000 – $82,661 – $1,555,000 – $46,800 = $1,944,539 |

| Example 2: Selling a semi-detached home in Sembawang Hills and buying a new 4-bedroom unit at Lentor Gardens |

| Value of current property: $5,099,000 Misc. Fees: $114,119 Value of new unit: $2,657,000 BSD: $90,880 Refundable ABSD: $531,400 Surplus: $5,099,000 – $114,119 – $2,657,000 – $90,880 = $2,2237,001 |

| Example 3: Selling a semi-detached home in Dairy Farm and buying a new 3-bedroom unit at Hillview |

| Value of current property: $4,500,000 Misc. Fees: $101,300 Value of new unit: $2,048,000 BSD: $66,520 Refundable ABSD: $531,400 Surplus: $4,500,000 – $101,300 – $2,048,000 – $66,520 = $2,284,180 |

| Example 4: Selling a terrace home in Mountbatten and buying a new 3-bedroom unit at Dakota |

| Value of current property: $4,370,000 Misc. Fees: $95,518 Value of new unit: $3,452,000 BSD: $122,680 Refundable ABSD: $662,200 Surplus: $4,370,000 – $95,518 – $3,452,000 – $122,680 = $696,802 |

*Prices of new units are last updated on 22 August 2024

With their liquidated capital, many seniors should still be able to afford a new condo and have surplus to support their retirement need. Comprehensive planning allows for seniors to overcome the difficulties of living in their landed property while quelling financial concerns – the seemingly impossible is made possible so these seniors’ next properties are no longer out of reach!

For Seniors who have embarked on this journey, some have chosen to rent to rent a unit for two years while waiting for the completion of their new home. Here is what their rental expenditure could look like:

Table 2: Rental Expenditure by District (24-month period)

| District | 2 bedroom* | 3 bedroom* | |

| Tagore / Sembawang Hills | 26 | $3,400 x 24 = $81,600 | $4,300 x 24 = $103,200 |

| Dairy Farm | 23 | $3,500 x 24 = $84,000 | $4,250 x 24 = $102,000 |

| Hillview | |||

| Mountbatten | 15 | $4,300 x 24 = $103,200 | $5,700 x 24 = $136,800 |

| Pasir Panjang | 5 | $4,000 x 24 = $96,000 | $5,300 x 24 = $127,200 |

| Lorong Chuan, Serangoon Central | 19 | $3,500 x 24 = $84,000 | $4,300 x 24 = $103,200 |

*Based on median rental in Jan-Aug 2024.

Even though the rental expense may seem high, it could still be much more affordable than the renovation costs associated with buying resale properties, which can balloon to a similar or significantly higher amount.

So, what now?

Ultimately, don’t close the doors on living a stress-free life! Right-sizing to a smaller home has never been easier for seniors, now that ABSD remissions have provided some financial flexibility. Without the presence of taxes to chip away at your finances, there is some flexibility when it comes to budgeting for your next property.

Given the holding power landed homes have in today’s market, senior landed homeowners can be rest assured that their landed properties can provide them with a competitive exit check to move into their desired right-sized property.

If you are a senior considering downsizing to a new or resale condominium, do not hesitate to consult with an ERA Trusted Adviser today!

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.