Sentosa Cove – an Exceptional CCR Investment Opportunity at OCR price

- By Egan Mah Jixiang

- 6 mins read

- Private Residential (Non-Landed)

- 26 Mar 2024

Ask any Singaporean what they think of Sentosa Cove and you may hear responses like “posh,” “rich,” or “symbol of status”. Sentosa Cove is all about swanky cars and over-the-top architecture, representing the upmarket community it embodies.

When the Sentosa Cove Masterplan was first conceptualised in 1992, Sentosa Cove was envisioned to be Singapore’s exclusive waterfront resort living, mimicking Port Grimaud in France. The idea was to offer another housing option for wealthy individuals and families seeking respite from the urban hustle and bustle, yearning for the resort lifestyle seen in places like Dubai’s Palm Jumeirah or Florida’s Palm Beach.

Because of this, foreign buyers, who are non-permanent residents, may apply to acquire a piece of landed property at Sentosa Cove, and approvals are generally granted.

Two decades after its first land parcel was sold, Sentosa Cove has seen moderate success but has fallen short of lofty expectations. Home prices in Sentosa Cove continue to languish and have failed to keep pace with Core Central Region (CCR) home price growth. In this piece, we will review Sentosa Cove and unpack its relevance in the Singapore housing market today.

The birth of Sentosa Cove – there are only so many homes here

With the sale of its first land parcel in 2003, Sentosa Cove heralded a new era of luxury waterfront living in Singapore. By 2006, the first development on Sentosa Cove was completed, and by 2008, all land parcels had been sold. Sentosa Cove was paving its way towards becoming a prestigious waterfront community, enticing individuals with deep pockets from around the world to invest in Singapore.

Zoned within the CCR, Sentosa Cove boasts of some 2,160 residential homes; approximately 16% are landed homes. This makes up about 0.5% of islandwide private home stock. Despite all homes at Sentosa Cove being on 99-year leases, the allure of spacious waterfront lifestyles and coveted addresses are compelling reasons for one to aspire to own a piece of Sentosa Cove. According to Squarefoot research, Singaporeans account for close to 50% of the buyers of new homes at Sentosa Cove, with Singapore Permanent Residents and Foreigners accounting for 21% and 23% respectively.

However, apart from non-landed properties, there are some restrictions around buying Sentosa Cove landed properties. For instance, foreigners are only allowed to purchase one detached house for their own use. In the past, the Long-Term Visit Pass scheme granted foreign buyers in Sentosa Cove long-term stays within Singapore, but the scheme was terminated in 2014. In contrast, Singaporeans face no restrictions on the number of detached houses they can buy, and there are also no limitations when leasing these units.

Two decades on, Sentosa Cove has blossomed into a self-sufficient upscale neighbourhood

Today, Sentosa Cove has evolved into a luxurious neighbourhood where living next door to influential and affluent personalities is the norm. It’s a melting pot of local homeowners and expatriate tenants, adding to its cosmopolitan allure.

Beyond its curated selection of restaurants along Quayside Isle and nearby hotels, Sentosa Cove boasts amenities like supermarkets and several preschools, catering to the diverse needs of its residents.

The nearby ONE°15 Marina Sentosa Cove yacht club and the renowned Sentosa South Golf Island offer not just leisure and recreational opportunities but also serve as hubs for socialising among the well-heeled.

Homes in Sentosa Cove are highly coveted for the status symbol and lifestyle they represent. Landed homes, in particular, can be customized to owners’ preferences, with some known for their quirky architecture.

Moreover, the luxury of space allows for ample room to host functions and dinners, enabling residents to showcase their homes to relatives, friends, and, importantly, business partners.

How have home prices at Sentosa Cove fared so far?

We’ve segmented our analysis into three distinct time periods to explore the evolving dynamics and challenges of Sentosa Cove. Each period reflects unique market conditions shaped by factors such as government policies, economic trends, and external events. Given Sentosa Cove’s prestigious status, we’ll be juxtaposing its home prices with those in the CCR.

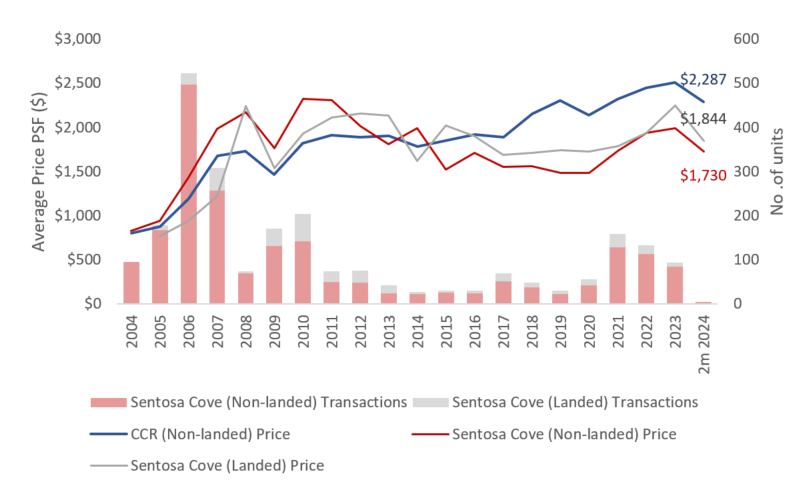

Conception of Sentosa Cove (2004 – 2010)

With successive new home launches in the area, Sentosa Cove experienced robust home sales and significant price growth. Transaction volume steadily rose, reaching a peak in 2006 with 522 transactions. During this period, both non-landed and landed property prices in Sentosa Cove saw substantial appreciation. Non-landed properties surged from $829 per square foot (psf) in 2004 to $2,325 psf in 2010, while landed properties followed a similar trajectory, climbing from $765 psf to $1,933 psf.

Pre COVID-19 (2011 – 2019)

Between 2011 and 2020, multiple rounds of cooling measures effectively dampened foreign buyer interest in Sentosa Cove. Additionally, global economic headwinds exacerbated the decline in foreign buyer demand, leading to a notable decrease in both home prices and transaction volume in Sentosa Cove. By 2015, the average non-landed home prices had plummeted by 34.4% from their peak in 2010, while landed homes experienced a more gradual price decline.

After 2017, home prices in Sentosa Cove began to gradually decline, in stark contrast to the continued increase in prices observed in the CCR.

COVID-19 and Post-COVID-19 (2020 – 2023)

From 2020 to 2023, a post-COVID housing demand boom characterized the market, fueled by pent-up demand and renewed interest from buyers in Sentosa Cove. During this period, prices for non-landed properties in Sentosa Cove increased by 16.2%, while landed properties saw a growth of 6.8%. Transaction volume in 2021 reached a 10-year peak, reflecting heightened market activity in Sentosa Cove. However, the market’s momentum slowed thereafter due to the April 2023 Additional Buyer Stamp Duty (ABSD) hike, imposing a hefty 60% tax on foreign buyers purchasing residential properties.

Additionally, the slew of money laundering cases in headlines during 2023 led to increased caution among buyers, prompted by more stringent checks and unwanted scrutiny. Despite the recovery in home prices at Sentosa, the home prices remained comparatively lower than homes in the CCR.

Chart 1: Homes at Sentosa Cove

Source: URA as at Feb 2024, ERA Research and Market Intelligence

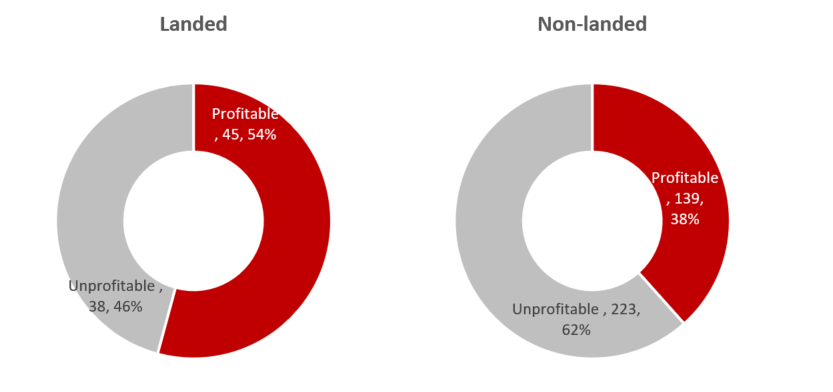

Around 41% of Sentosa Cove transactions were profitable in the last ten years

In the last ten years, about 40% of transactions in Sentosa Cove were profitable. However, it’s noteworthy that landed homes outperformed non-landed ones in terms of profitability. Specifically, 54% of landed home transactions in Sentosa Cove reported an average median gross profit of $3.6 million. In contrast, during the same period, only 38% of non-landed home transactions in Sentosa Cove resulted in a profit, with an average median gross profit of $587,000.

Chart 2: Transactions in Sentosa Cove (2013-2023)

Source: URA as at Feb 2024, ERA Research and Market Intelligence

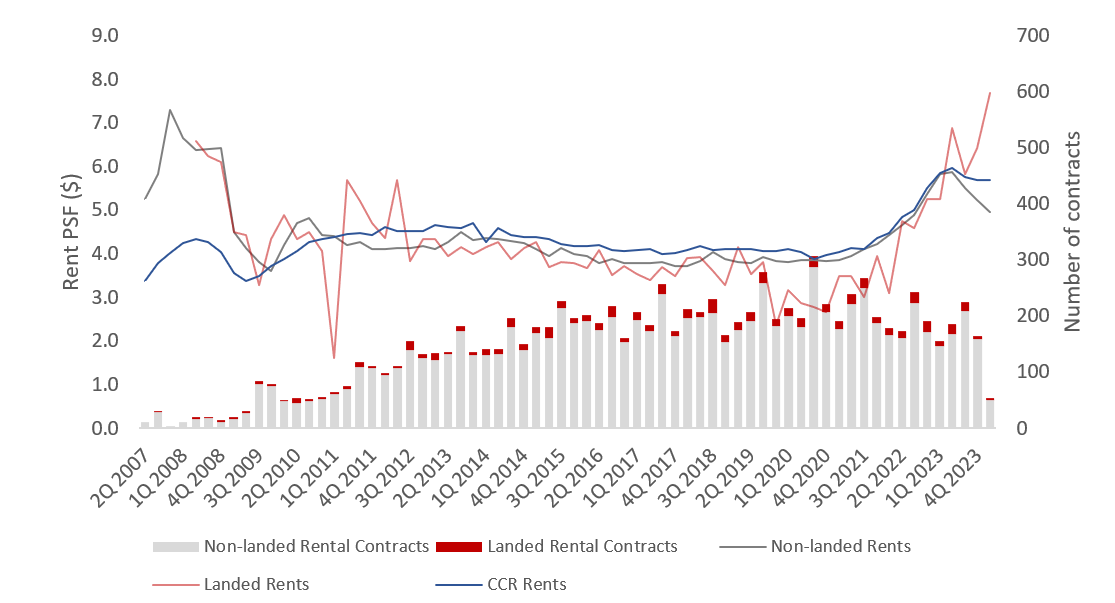

Sentosa’s rental market

Between 2015 and 2023, Sentosa Cove saw an average of 764 non-landed units and 57 landed homes being rented out yearly. This accounted for almost 38% of the total homes at Sentosa Cove. Non-landed rents at Sentosa Cove are comparable to those in the Core Central Region (CCR), while landed rents at Sentosa have been rising and are now at their all-time peak. High-net-worth tenants looking for waterfront homes are willing to pay higher rents for these rare units.

Chart 3: Median Rents and Rental Contracts in Sentosa Cove

Source: URA as at Feb 2024, ERA Research and Market Intelligence

Sentosa Cove – the comeback kid

Sentosa Cove to benefit from the Sentosa-Brani Masterplan development

Announced in 2019, the Sentosa-Brani Masterplan had a vision to transform the island into a game-changing leisure and tourism destination. There will be five zones across the island that will see new indoor and outdoor attractions for families, nature lovers, and adventure seekers. In addition, the opening of the 30,000 square meter (sqm) multisensory two-tiered walkway will integrate and connect Resorts World Sentosa in the north with Sentosa’s beaches in the south. Redevelopment works at Sentosa are part of the plans for the Greater Southern Waterfront, which includes Keppel, Sentosa, and Gardens by the Bay.

Since there are no plans to increase the number of residential units in Sentosa, the redevelopment is expected to yield positive effects on Sentosa Cove, as it will be minutes away from aspiring world-famous attractions.

Future of work

In a post-pandemic world where hybrid or remote work is becoming more prevalent, Sentosa Cove emerged as choice place of residence. It’s serene and idyllic environment, along with its luxurious amenities, make it attractive for those pursuing sophistication, leisure and a refined lifestyle even as they are working from home. Even though Sentosa Cove is pretty self-sufficient, enhanced last mile delivery options have further elevated convenience for residents in recent years.

Singapore’s reputation as a safe haven beckons High Net Worth Individuals (HNWIs)

Singapore’s reputation for safety, political stability, and economic resilience continues to attract foreign investors. The government has been relentlessly pursuing High Net Worth Individuals (HNWIs) and talents to Singapore through various schemes, enticing them to invest here, including in residential properties.

The Global Investor Programme allows HNWIs who generate economic spin-offs and create employment to attain Permanent Residency status. To do so, they can choose to invest at least S$10 million in a business or S$25 million in an approved fund.

Other long-term programmes for high-income skilled foreign talents include the Overseas Networks & Expertise Pass and the Tech.Pass.

Being recognised as a wealth hub in Asia, Singapore attracted some $2,619 billion in foreign direct investment and has close to 1,100 family offices established in Singapore as at 2022. Moreover, the KPMG Private Enterprise and family office consultancy Agreus estimated as at 2023, 59% of all family offices in Asia are located in Singapore.

But the government could potentially sweeten the deal for foreigners through Sentosa Cove.

Is it time to reduce ABSD for foreign buyers purchasing properties Sentosa Cove?

The initial vision for Sentosa Cove was conceived with the aim of positioning Singapore as a premier waterfront living destination for the affluent.

However, along the way, multiple rounds of cooling measures have taken a toll on the Sentosa Cove housing market. Sentosa home price growth has not kept pace with homes on the main island. In 2023, the CCR average home prices reached around $2,510 psf compared to the average of $1,992 psf at Sentosa Cove.

One potential solution is to reduce the ABSD payable by foreign buyers purchasing homes at Sentosa Cove from 60% to 20%. This would align with what a Singaporean would pay when buying a second property. By implementing this change, this may redirect more foreign buyer interest towards Sentosa Cove.

Sentosa Cove is on track to becoming a choice waterfront living enclave in the region

Singapore will continue to be a magnet for global investors due to its reputation for safety, political stability, and ease of doing business. This, in turn, will help support the Singapore property market over the long term.

Sentosa Cove offers a differentiated product and presents an opportunity for those aspiring to immerse themselves in the epitome of luxury waterfront living. One can revel in its unparalleled luxury and exclusivity by indulging in oceanfront villas, tranquil waterway bungalows, and an array of upscale condominiums at Sentosa Cove.

Beyond its stunning architecture and picturesque landscapes, Sentosa Cove is still priced below homes in the CCR, and that presents a value buy for investors. Going forward, with the anticipated rising home prices across the island, coupled with redevelopment in Sentosa and the Greater Southern Waterfront, home prices in Sentosa Cove could see further appreciation in the future.

Have we piqued your interest in Sentosa Cove? Here are some exciting home options.

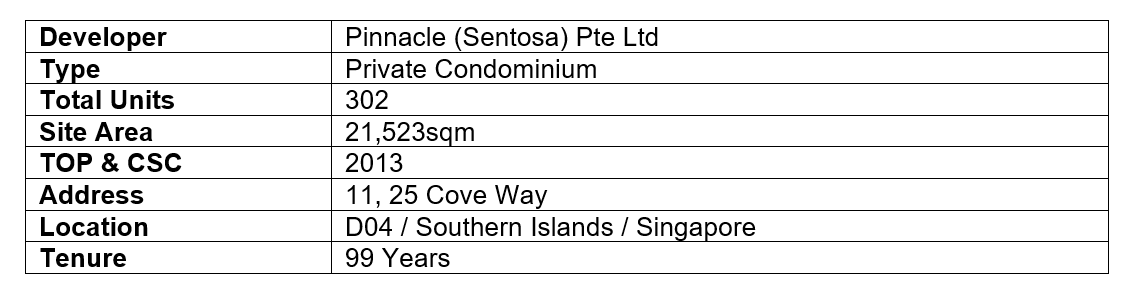

Cape Royale

DESCRIPTION

Cape Royale Sentosa Cove is the tallest residential condo. Situated just at the entrance of the marina leading into Sentosa Cove Singapore. Sentosa Cove condo residents will be enjoying the breathtaking views of the South China Sea and Tanjong Golf Course.

Cape Royale condo is developed by Pinnacle (Sentosa) Pte Ltd. This iconic tower will offer 302 luxurious residential units in Sentosa Cove. Residents will have easy access to an integrated marina, One°15 Marina Club and Resort World Sentosa. All other Sentosa Island entertainments are with minutes reach. On top of the Sentosa Island attractions, Cape Royale Singapore is easily accessible to and from the main island of Singapore. Travel time to Singapore Changi International Airport is within half an hour drive away.

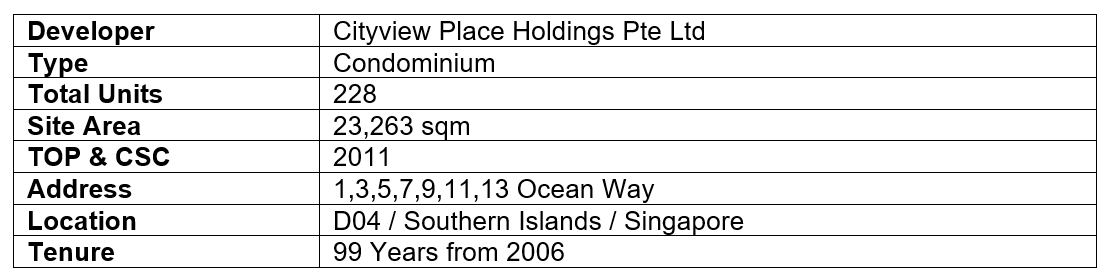

The Residences At W Singapore Sentosa Cove

The Residences is a luxury leasehold condominium project comprising 228 exclusive apartment suites situated amongst a wave of six-storey condominium blocks.

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.