September 2024 Developer Sales Report: First Fed Rate Cut in Four Years Boosts Buyer Sentiment and Private Home Sales

- By Stanley Lim

- 4 mins read

- Private Residential (Landed), Private Residential (Non-Landed), Property News

- 15 Oct 2024

In total, September saw 401 new private homes sold, representing a 92.8% month-on-month (m-o-m) uptick over August’s performance (208 units sold). Year-on-year (y-o-y), new private home sales were also up 84.8% in September, compared to the 217 units sold over the same period in 2023.

This surge in transaction volume was primarily driven by new home sales within the Rest of Central Region (RCR), which was the best performing market segment for the month.

In turn, the RCR’s performance was largely due to 8@BT. During its launch weekend, the Bukit Timah development sold 83 units or roughly 53% of its available units. Buyer interest in 8@BT may have also spilled over to other projects, such as Pinetree Hill and Hillhaven – both of which experienced upticks in sales volumes.

Impact of the Fed’s rate cut announcement in September

On 18 September, the U.S. Federal Reserve (Fed) announced that it was finally cutting interest rates after keeping them elevated over the past four years. The cut of 50 basis points lowers the Fed’s target rate range to 4.75% to 5.00%, down from the previous range of 5.25% to 5.50%.

This has largely translated into improved buyer confidence and more activity in the new private home market. Already, we have seen other new launches, aside from 8@BT, delivering strong sales results. For instance, Meyer Blue, which is the second new project to debut after the Fed’s rate cut, sold 50% of its units on launch day.

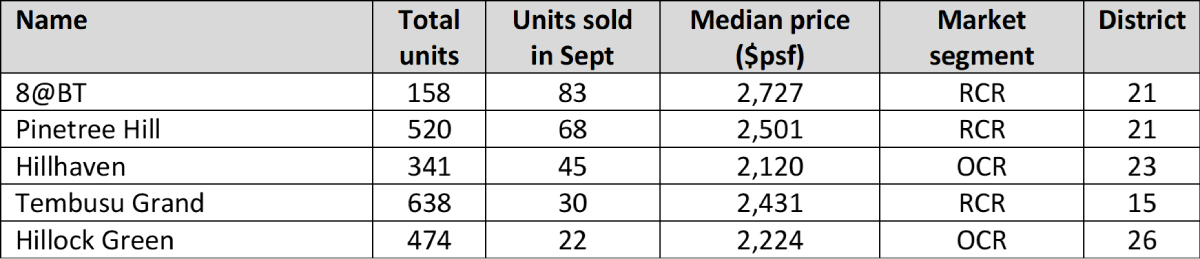

Best-Performing New Launches

Table 1: Top five performing new launch projects (excluding EC) in September 2024

Source: URA, ERA Research and Market Intelligence, ERApro

The top five best-performing projects in September were respectively 8@BT (83 units), Pinetree Hill (68 units), Hillhaven (45 units), Tembusu Grand (30 units), and Hillock Green (22 units).

72% (60 units) of new private home transactions at 8@BT were one- and two-bedders, which sold for between $1.34 mil to $1.59 mil and $1.81 mil to $2.21 mil respectively. Such an outcome aligns with recent buyer trends, where sales at previous top-performing developments like Kassia and Sora were largely driven by smaller units priced at $1.5 million or below.

A mix of favourable factors contributed to brisk sales at 8@BT, including its status as a premium development in a prime location near Beauty World MRT station and upcoming amenities, such as Bukit V shopping centre.

Moreover, at the time of its launch, 8@BT was also the only fully residential project in Bukit Timah with units still on the market.

Other new home options in the vicinity are scarce; the Linq @ Beauty World is fully sold out and is nearing completion, whereas The Reserve Residences is already 97% sold. Consequently, this could have shifted buyer attention towards 8@BT.

In the same vein, interest in 8@BT could have also fuelled fresh demand for other projects in District 21. In September alone, Pinetree Hill sold a total of 72 units, compared to the 80 units sold between January to August this year.

Pinetree Hill (Source: UOL Group Limited. Singapore Land Group)

Additionally, units at Pinetree Hill sold at a median price of $2,501 psf, lower than 8@BT’s $2,727 psf. This mix of more affordable pricing and a quicker completion time may have swayed buyers to opt for a unit at Pinetree Hill over 8@BT.

Hillhaven in District 23 also experienced a similar surge in sales volume with 45 units sold in September, more than triple of the 14 units moved in August. This makes September the second-best month for sales at Hillhaven since January, when developer sales amounted to 64 units.

Executive Condominium

In the Executive Condominium (EC) segment, sales of new homes dipped slightly m-o-m, falling from 36 units sold in August to 29 units in September.

Though the EC market is poised for an injection of fresh stock with the anticipated launch of Novo Place (504 units) in 4Q 2024, sales are likely to remain tepid until then.

In the meantime, EC buyers have the option to choose from available units across North Gaia (62 units), Altura (19 units) and Lumina Grand (101 units).

Buyer Profile

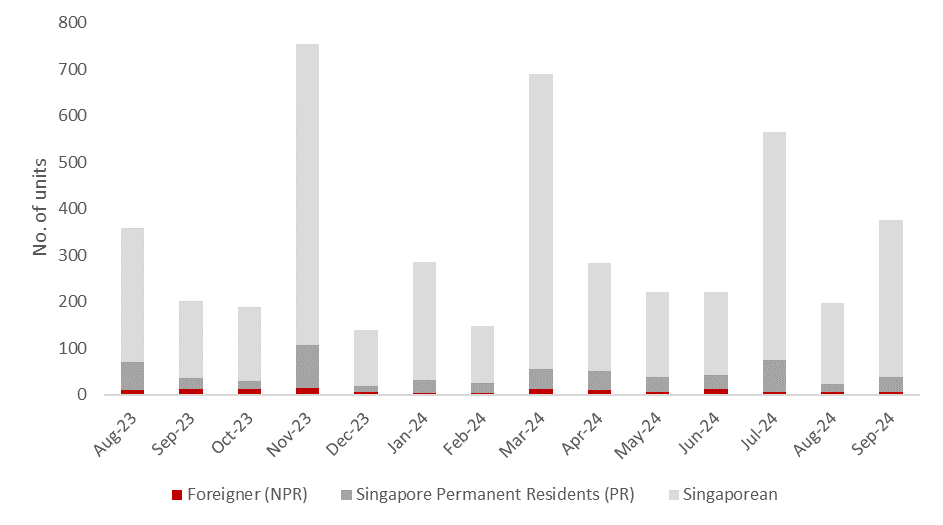

Chart 1: Buyer profile for all new non-landed homes excluding ECs

Source: URA as of 15 Sep 2024, ERA Research and Market Intelligence

Foreigner demand for new non-landed homes (excluding ECs) continued to stay flat in September as 2023’s cooling measures continue to exert their influence on buyer appetite.

In contrast, the number of Singapore Permanent Resident (SPR) buyers rebounded from last month’s low. Based on caveat data from URA Realis, SPR buyers purchased a total of 31 new non-landed homes in September, marking a reversal from the 17 units purchased in August.

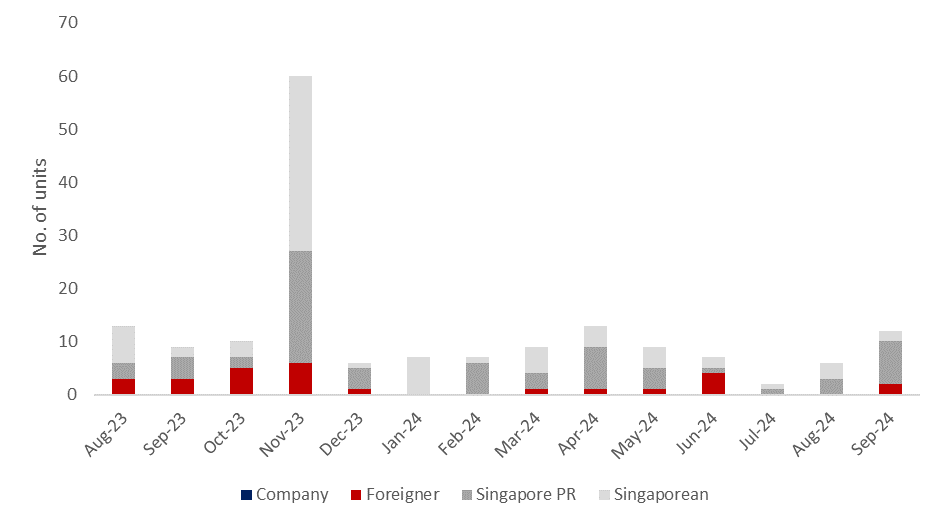

Luxury Properties (Non-Landed Homes $5 Mil and Above)

A total of 12 luxury homes, priced at $5 mil and above, were transacted in September 2024. The highest-priced transaction was a 4,209 sq ft unit at 32 Gilstead, which was purchased for $14.6 mil ($3,408 psf) by a SPR.

Chart 2: Buyer profile for homes transacted at $5mil and more

Source: URA, ERA Research and Market Intelligence

What Lies Ahead for the New Private Home Market in Coming Months?

September’s strong performance could carry into the closing months of 2024, buoyed by improved buyer sentiment and the introduction of new projects that could sustain the current momentum.

Any additional Fed rate cuts could bolster market sentiment down the line as well, while paving the way for increased private housing market activity – though likely not a large scale. Likewise, new private home demand could also be tempered by the approaching holiday season as well as existing cooling measures.

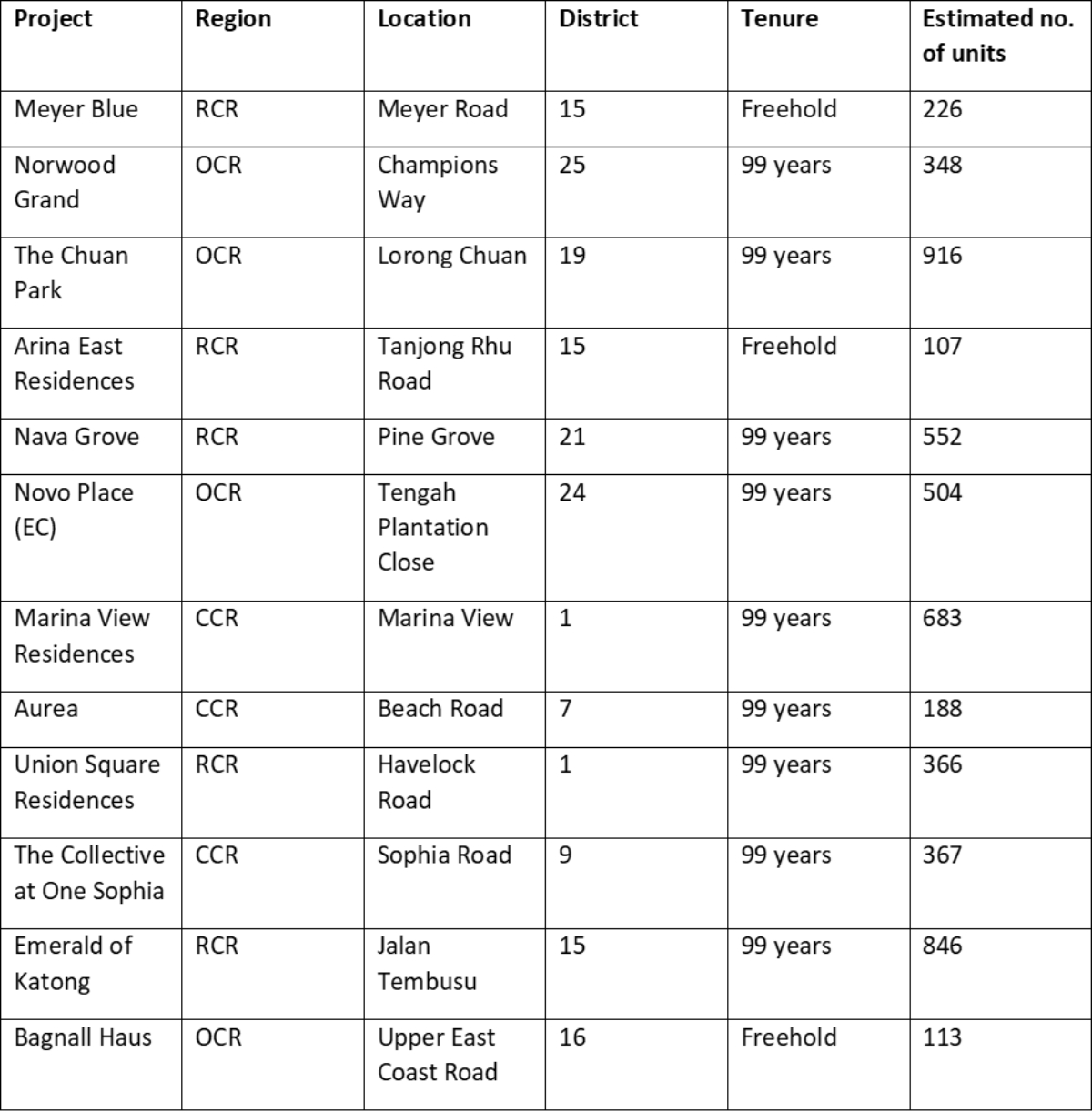

At present, there are at least 13 new private developments in the pipeline, potentially yielding a total of 6,204 units. This includes several mega-developments in popular heartland areas such as Parktown Residence (1,195 units) in Tampines, The Chuan Park (916 units) in Serangoon, Emerald of Katong (846 units) in the East Coast area.

Table 2: Potential new launches in 4Q 2024

Source: ERApro, ERA Project Marketing, ERA Research and Market Intelligence

Among the upcoming projects, Norwood Grand is expected to perform well, driven by its attractive pricing and pent-up demand in Woodlands.

As the first new launch in Woodlands in over a decade, Norwood Grand is poised to attract strong interest. Furthermore, with prices for its three-bedroom units projected to range between $1.6 mil and $1.7 mil, Norwood Grand presents an appealing option for HDB upgraders.

Accounting for current market conditions, ERA projects approximately 5,500 to 6,500 new private homes to be sold by the end of 2024.

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.