Singapore Residential Market Finishes Strong In 4Q 2024

- By ERA Singapore

- 8 mins read

- Private Residential (Non-Landed)

- 22 Dec 2024

Is recovery on the horizon for the 2025 residential market?

Despite getting off to a slow start in the early 2024, Singapore’s residential property market eventually regained its footing in the last quarter of the year.

In the first half of 2024, the private housing market saw subdued buyer interest and moderated price growth, weighed down by higher interest rates in 1H 2024. More homebuyers opted to stay on the sidelines, amid elevated interest rates and softer economic conditions which sent consumer confidence reeling. Separately, demand from foreign buyers remained curtailed by the punitive 60% Additional Buyer Stamp Duty.

However, hopes of a turnaround emerged in 3Q 2024, spurred by a long-awaited interest rate cut by the U.S. Federal Reserve (Fed) in September. The Fed subsequently delivered a second round of rate cuts in November, bringing the total rate cut to a collective 50 basis points, with a target range of 4.50% – 4.75%.

Following the successive rate cuts, recent project launches like 8@BT, Meyer Blue, Norwood Grand and Chuan Park rallied ahead and reported stronger-than-expected sales performances. More impressively, the Emerald of Katong nearly sold out at its launch weekend, raising the odds of a market resurgence as the year closes.

Meanwhile the resale and sub sale markets remained buoyed by a steady flow of new home completions since 2023. This is attributable to the fact that not all homeowners choose to sell their properties upon completion. Instead, some owners could prefer taking more time before deciding to put their homes on the market, which has contributed to a steady pipeline of resale and sub sale listings in recent years.

The private residential market continues to be driven by HDB upgraders, young buyers who view private homes as investment opportunities, and landed homeowners seeking to downsize in 2024.

2024 Homebuying Activities Underpinned by Firm Economic Fundamentals

Singapore’s economy gained momentum in 3Q 2024, recording a 5.4% year-on-year (y-o-y) expansion compared to a 3.0% growth in 2Q 2024[1]. The growth was primarily driven by robust performances in the manufacturing, wholesale trade, and finance & insurance sectors. With a continued recovery in global electronics demand and stronger-than-expected economic activity, MTI revised its full-year GDP growth forecast to approximately 3.5%, up from the earlier range of 2.0% to 3.0%.

Amid the economic expansion, hiring in the labour market has similarly picked up in 3Q 2024. According to the Labour market report[2], Singapore saw a sharp uptick in employment numbers alongside a decline in retrenchments. Hiring in 3Q 2024 expanded, rising by 22,300 compared to 16,000 in 1H 2024. Retrenchment numbers in the first nine months of 2024 has declined by 15.6% to 9,350, compared to the 11,130 in the same period last year. Overall unemployment rate continued to remain at a low of 1.9% in 3Q 2024.

Singapore continued to see easing inflationary pressures in 3Q 2024, falling to 2.2% which is the lowest seen since 2Q 2021[3]. Among which, accommodation inflation has likewise moderated 2.9% in 3Q 2024, a sharp contrast to the peak of 4.9% in 1Q 2023. As inflation eased, Singapore’s real income rebounded in 2024 compared to 2023.

Despite concerns over growing household debt, local borrowers remained largely capable of handling their mortgage repayments in 2024. According to the Monetary Authority of Singapore, this resilience is largely underpinned by a combination of higher wages and robust financial assets.

Moreover, the recent cuts in the Fed interest rate have benefited homeowners with existing mortgages by easing the cost of monthly repayments. This is evident in the decline of the 3-month compounded Singapore Overnight Rate Average (SORA), a key benchmark for home loan pricing, from 3.70% in January to 3.24% in November.

In short, the better-than-expected economic outlook and firm economic fundamentals had bolstered homebuying activities in the four months of 2024. But as we look ahead, the bigger question remains: Is recovery on the horizon for the Singapore 2025 residential market?

Singapore’s Strong Foothold in The Region Continues to Inspire Confidence Among Homebuyers Even as Uncertainty Looms in 2025

While Singapore’s economy grew better than expected in 2024, uncertainties continue to abound in the global economy; and these could impact the pace of Singapore’s economic growth in 2025.

Worldwide, concerns about global trade have emerged as president-elect Donald Trump prepares to assume his second term in January 2025. Trump’s incoming administration has already signalled an intent to slap tariffs of up to 25% on China, Canada, and Mexico. This has raised fears of inflation and the possibility of interest rates staying higher for longer since Fed has signalled caution and could lean toward fewer rate cuts in 2025.

Consequently, we can expect to see rising protectionism and trade tension, alongside the escalating conflicts in the Middle East and Ukraine. Should all these key themes materialise or worsen, we can certainly expect to see further disruption to global supply chains. This will most definitely drive costs higher and may impede the growth of global trade. Taking these factors into account and barring the materialisation of downside risks, MTI has forecasted Singapore’s economy to grow by 1.0 to 3.0% in 2025.

Even amidst these uncertainties and disruptions, Singapore could still potentially emerge as an early beneficiary of the trade war. Leveraging on our strategic position as a regional safe haven, global companies could be incentivised to relocate their manufacturing supply chains to Singapore.

In brief, ERA remains cautiously optimistic of Singapore’s residential market in 2025. Underpinned by firm macroeconomic fundamentals, Singapore will continue to deepen its status as one of Asia’s leading wealth management hub, thus drawing family offices, high-net-worth individuals and multinational companies to establish a firm foothold in the city.

Barring any unforeseen circumstances and assuming interest rates continue to moderate, the 2025 residential market could outperform 2024, signalling a potential recovery on the horizon. Taken together, the factors mentioned above are expected to boost buyer confidence, driving demand for real estate. Moreover, future price increases are more likely be driven by genuine buying interest, rather than speculative or foreign demand.

Residential home prices

The all-residential property price index registered a modest uptick of just 1.6% since 4Q 2023, largely due to a decline in new launches, which had previously supported price growth.

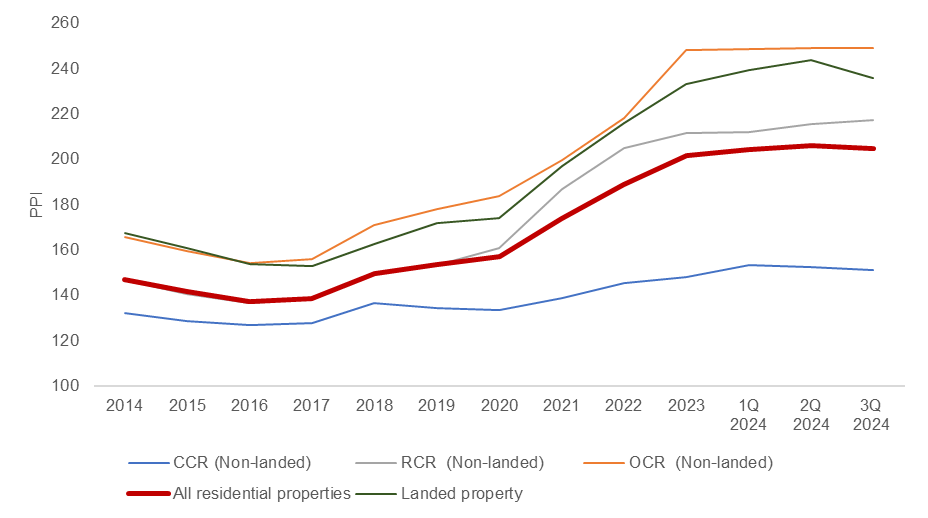

Chart 1: Singapore Private Residential Price Index

Source: URA, ERA Research and Market Intelligence

On the other hand, the price index for non-landed properties rose by 1.7% over the last nine months. By sub-markets, the Rest of Central Region (RCR) clocked in the biggest increase, with non-landed private home prices appreciating 2.7% over the first nine months of 2024. Although the Core Central Region (CCR) has historically lagged in price growth, non-landed home prices there rose by 1.9% over the same period, marking the second-largest increase. In contrast, the Outside Central Region (OCR) saw the smallest growth of just 0.4%.

In the landed residential segment, prices rose by approximately 1.0% since 4Q 2023, reflecting a more modest performance that can be attributed to a higher base price.

Come 4Q 2024, it is anticipated that the all-residential property index may grow 2% – 4% year-on-year (y-o-y), with a potential range of 3% – 5% y-o-y by the end of 2025.

New Homes Sales Market

In the first nine months of 2024, developers launched a total of 3,222 uncompleted private residential units (excluding ECs), the lowest since 2004. Likewise, only two Executive Condominium (EC) projects were launched in 2024, offering a total of 1,016 units for the year.

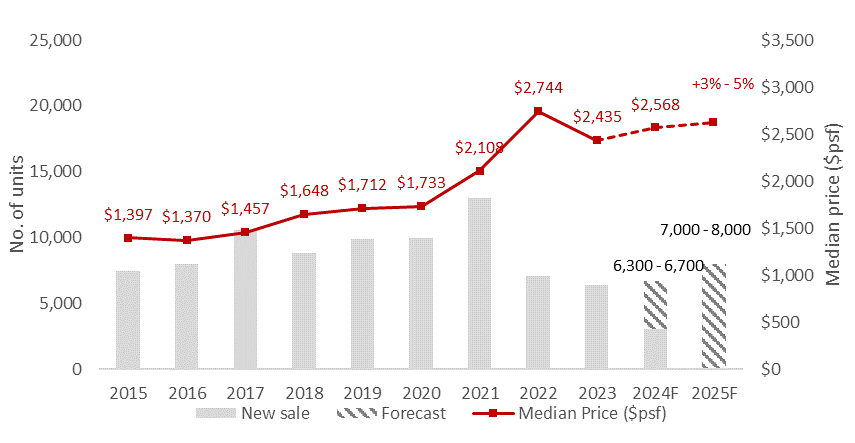

New home sales in Singapore saw a sharp recovery since October after a slow start in 2024. The rebound was largely driven by the launch of eight projects in October and November. Additionally, moderated mortgage rates also played a significant role in boosting home-buying activity. Based on caveats lodged as of 29 Nov, developers had sold 6,095 new private homes and 997 ECs in the first nine months of the year.

Median new home prices also reached new heights on the back of higher benchmark prices at Meyer Blue, Chuan Park, and Emerald of Katong. Caveat data showed that median new home prices reached $2,568 psf in October and November, representing a 5.5% y-o-y increase from the $2,435 psf of 4Q 2023.

Chart 2: New Sale Transactions and Median Price

Source: URA as of 29 Nov 2024, ERA Research and Market Intelligence (Median price as of 4Q each year.)

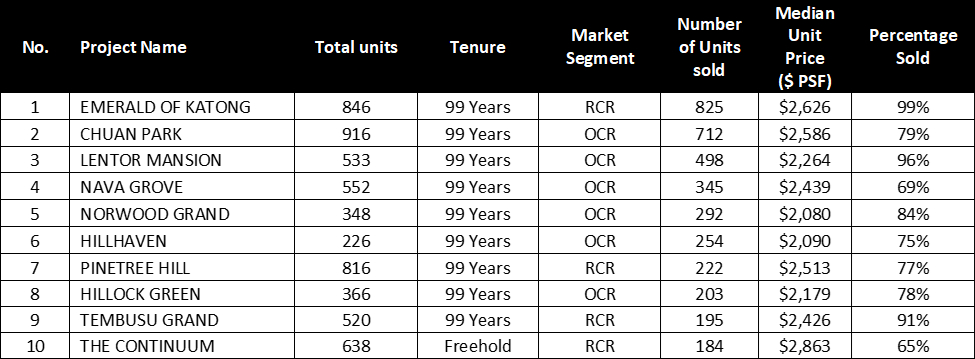

Among the ten best-selling projects, the Emerald of Katong, Chuan Park and Lentor Mansion reported impressive sales, moving more than 70% of their units during their launch weekends. Alongside the new launches, previously launched projects also reported brisk sales. For instance, Pinetree Hill sold an additional 222 units in 2024, following the launch of 8@BT. Similarly, Tembusu Grand and The Continuum recorded increased sales after the launch of Emerald of Katong and Meyer Blue.

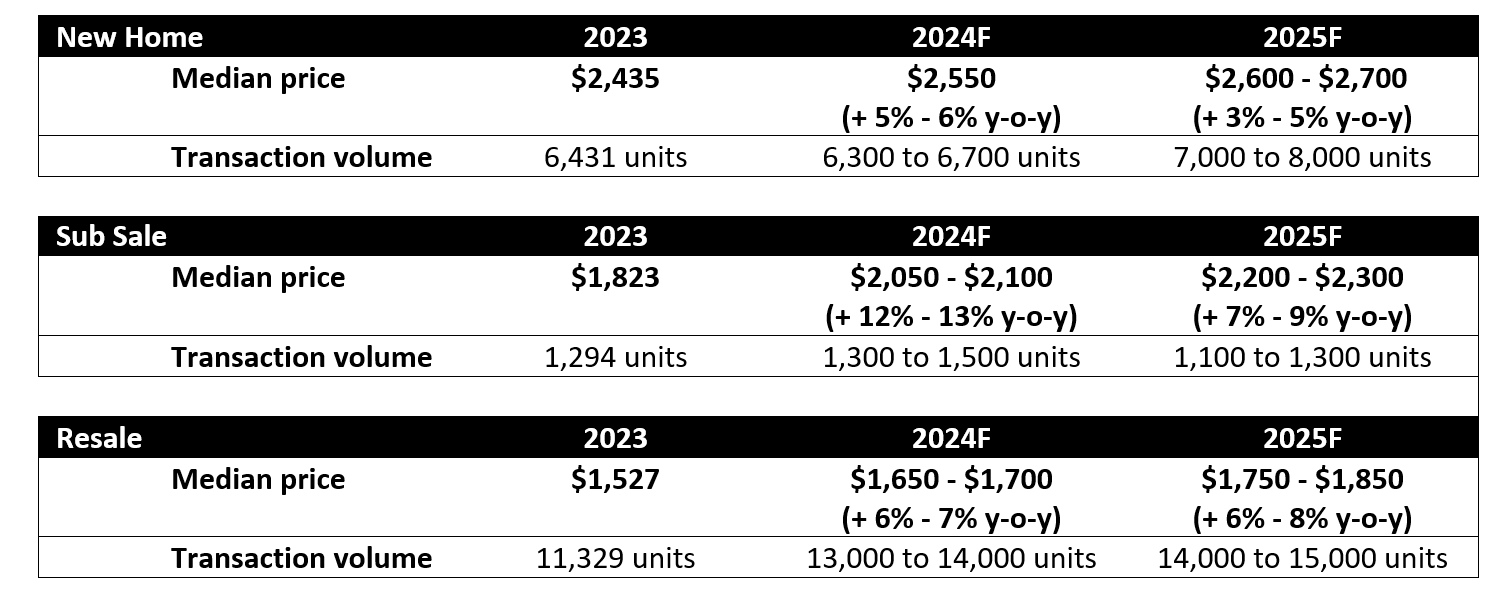

However, with December’s seasonal lull in sight, we can expect new home sales to reach between 6,300 to 6,700 units by the year’s end.

Table 1: Top 10 Best-Selling Projects in 2024

Source: URA, ERApro as of 29 Nov 2024

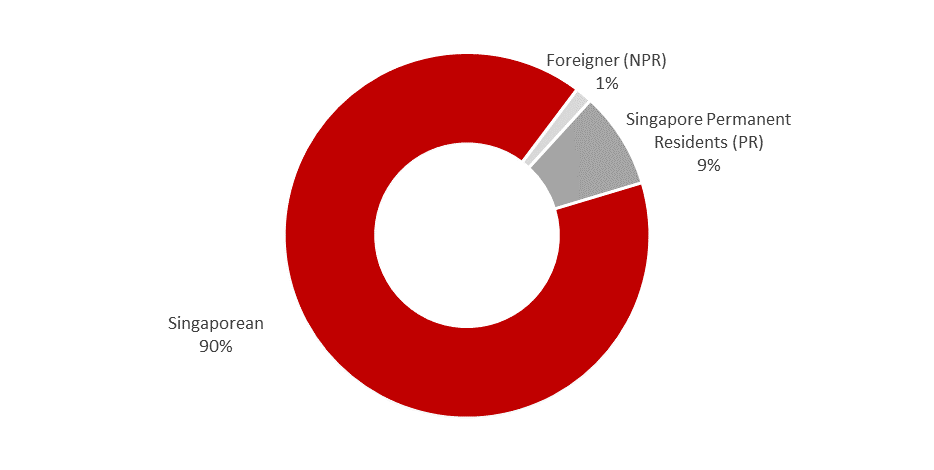

New home demand from foreigners remained subdued in 2024, largely due to the punitive 60% Additional Buyer’s Stamp Duty. Approximately 90% of new home buyers were Singaporeans, with another 9% comprising Singapore Permanent Residents.

Chart 3: Buyer Profile for New Home – Islandwide

Source: URA, ERA Research and Market Intelligence

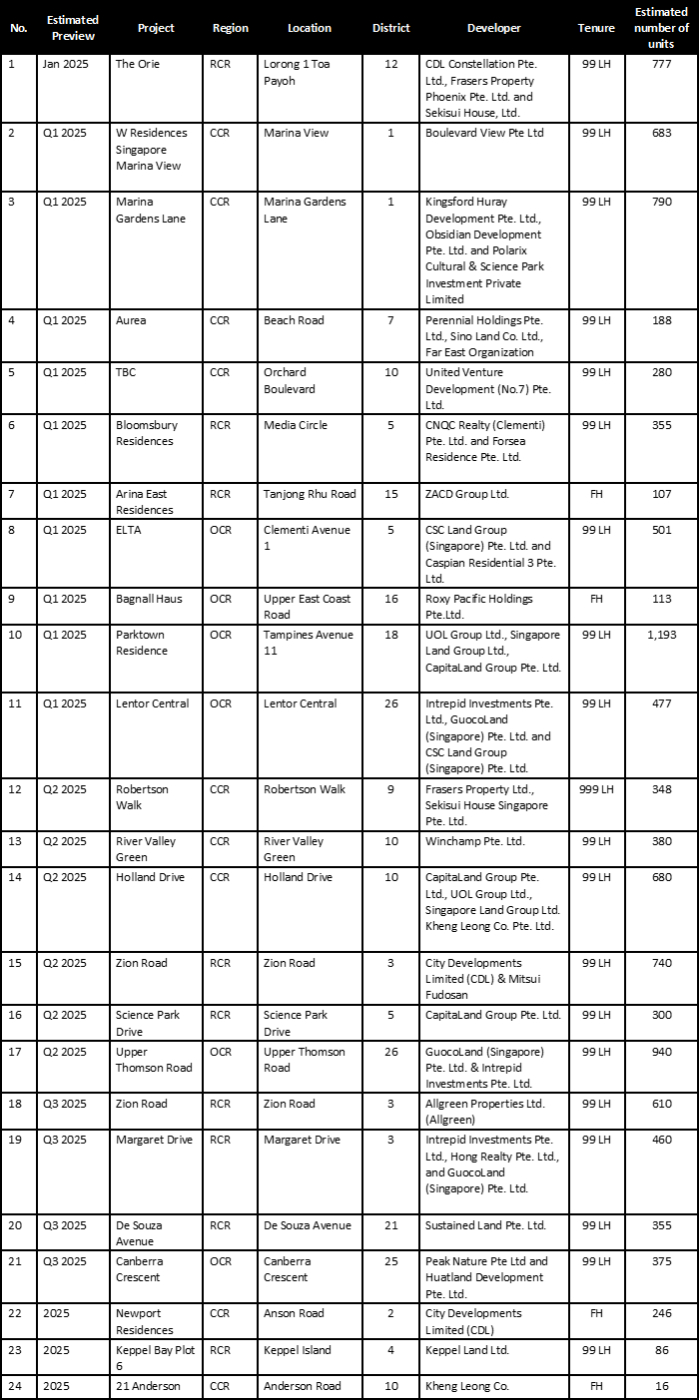

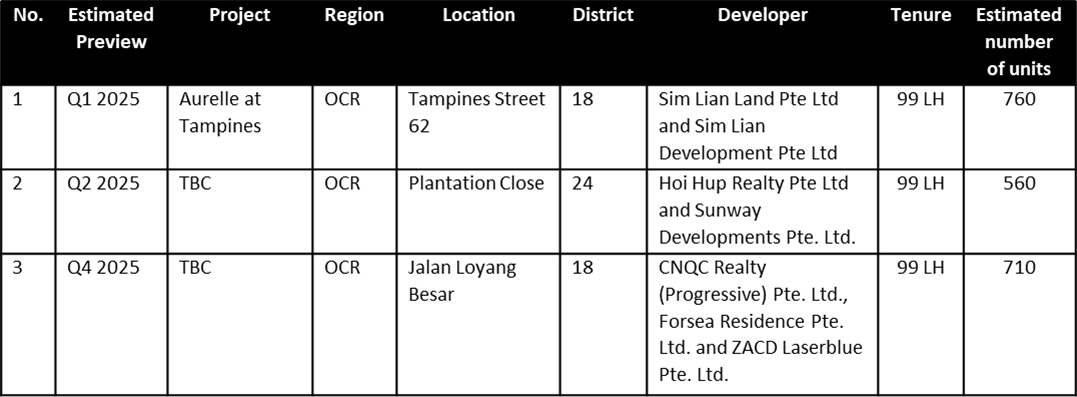

Upcoming Launches In 2025

Based on estimations, 2025 could see up to 24 new private home launches and three EC launches. In total, new private home launches will yield 11,000 new homes, while the EC launches will see some 2,030 units added to the market.

In 2025, the CCR and RCR are anticipated to see up to nine launches each, while the OCR is expected to see six. These new homes will be evenly distributed across all three regions, giving buyers a wider range of options to choose from.

In the EC segment, three ECs will be launch in Tampines, Pasir Ris and Plantation Close.

Over two thirds of the upcoming new home launches will be in the CCR and RCR regions, which are known to command higher prices. Said launches include highly anticipated projects like The Orie at Toa Payoh, a site at Margaret Drive, as well as OCR projects such as Elta (Clementi), Parktown Residence (Tampines) and Lentor Central. Given these factors, we can expect new home prices to maintain their upwards trajectory, growing by 3%-5% y-o-y in 2025.

Table 2: Upcoming launches in 2025

Executive Condominium

Source: ERA Project Marketing

Government Land Sales exercise

In 2024, the government launched some 20 sites in the Government Land Sales Confirmed List. This includes 17 private residential sites, two EC sites, and one long-stay serviced apartment site. Two sites at Chuan Grove and Holland Link are also slated for launch in December 2024.

As of Nov 2024, a total of 12 private residential sites and three EC sites have been awarded. However, three sites were unawarded as a result of low bids submitted by developers; these include the white site at Marina Gardens Crescent, the master developer site at Jurong Lake District and the long-term serviced apartment site at Media Circle.

Look ahead, the 1H 2025 Government Land Sales (GLS) program saw an increase in the overall private home supply to 8,505 units, up from 8,140 units in 2H 2024. A total of ten sites were placed on the Confirmed List, comprising six private residential sites, one Commercial & Residential site, and three EC sites.

Collectively, the 1H 2025 GLS Confirmed List includes 5,030 private homes, comprising 980 Executive Condominium (EC) units, while the Reserve List will offer an additional 3,475 residential units. Overall, the private home supply slated for 1H 2025 fell marginally by 0.4% compared to 2H 2024 but remains 7.7% lower than the supply in 1H 2024.

Resale and Sub-Sale markets

Compared to a year ago, the resale and sub-sale market reported a significant uptick in transaction volume, along with a continued surge in resale and sub-sale prices.

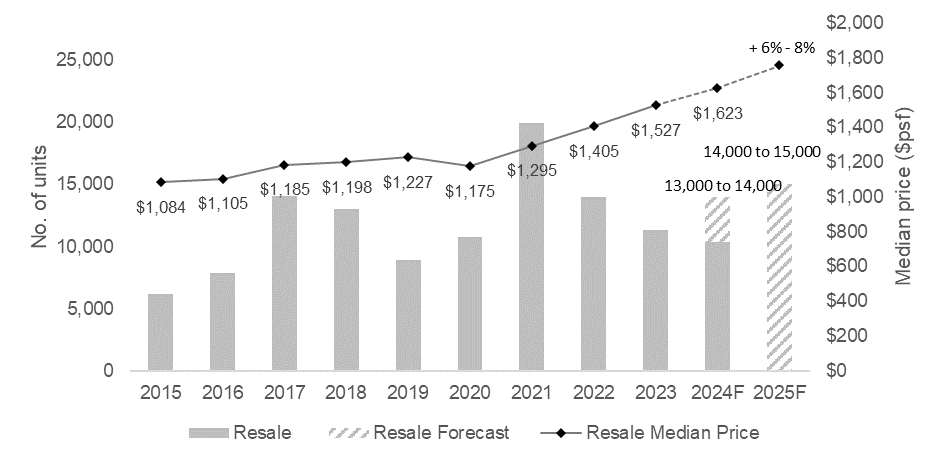

Based on URA caveats lodged as of 29 Nov, some 12,381 resale private homes were transacted in first 11 months of 2024. Median resale prices also reached $1,623 psf in October and November 2024. Compared to a year ago, resale prices have risen by 6.3%, largely boosted by recent completions of new projects.

By end-2024, ERA forecasts resale transaction numbers to reach between 13,000 and 14,000 units, which is notably higher than the 11,329 resale transactions recorded in 2023. Resale prices are also expected to rise by 6% and 8% by end-2024.

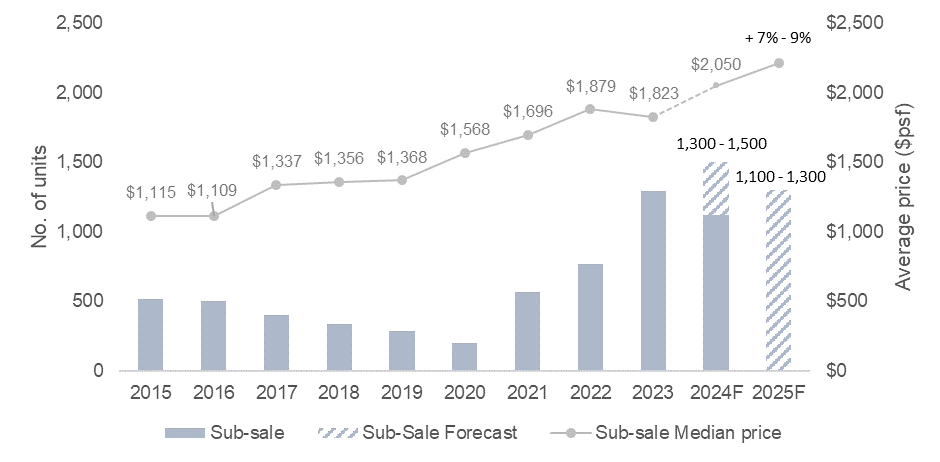

Additionally, some 1,250 sub-sale units were transacted in the first 11 months of 2024, taking median sub-sale prices to $2,050 psf in October and November 2024. Over the year, sub-sale prices experienced steeper growth, rising by 12.5%. These prices were driven by an increase in completions in the CCR and RCR.

By end-2024, ERA estimates that sub-sale transactions could reach 1,300 and 1,400 units, potentially marking it as the highest recorded number in the last decade. Sub-sale prices are also expected to rise between 12% and 13% by end-2024.

Chart 4: Resale Transactions and Median Price

Source: URA as of 29 Nov 2024, ERA Research and Market Intelligence

Chart 5: Sub-Sale Transactions and Median Price

Source: URA as of 29 Nov 2024, ERA Research and Market Intelligence

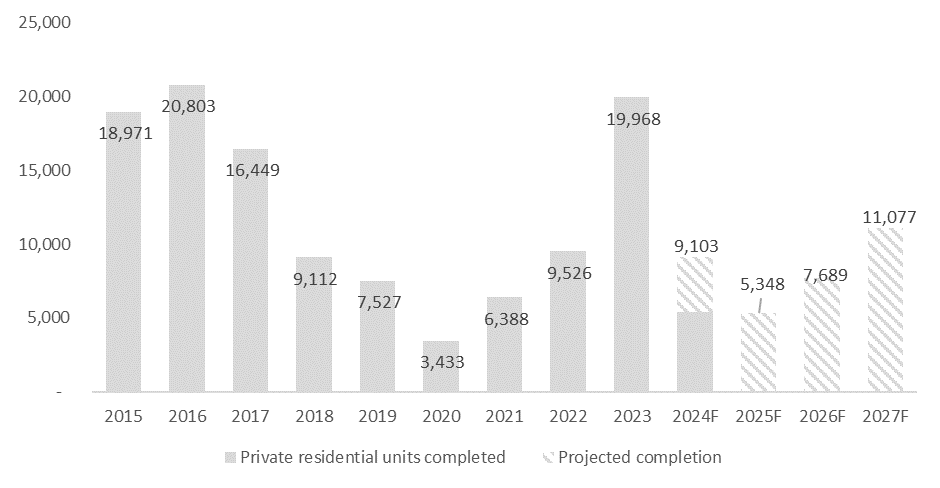

New Home Completions

In 2023, nearly 20,000 private residential units were completed, but this figure is projected to drop by half to approximately 9,100 by end-2024. Come 2025, this number is expected to decline further to just about 5,300 units.

Despite the substantial reduction in new home completions in 2024, the resale and sub-sale markets have remained active, largely driven by the overflow of new home completions from 2023. The surge in completed units in 2023 created a ripple effect, contributing significantly to the inventory of homes available for sale throughout 2024.

Chart 6: Private residential completions

Source: URA, ERA Research and Market Intelligence

Resale and sub-sale outlook

Come 2025, ERA anticipates that the resale and sub-sale markets will remain active despite declining new home completions.

This resilience is largely due to the spillover of new home completions from 2023, which will continue feeding into the secondary market. Additionally, as some homeowners may choose to delay selling their properties, either to lease them out or to take more time to find their next home, this will further contribute to a steady pipeline of resale and sub-sale listings.

Moreover, the slew of recent completions in the RCR and CCR could support future sub-sale price growth. This includes projects such as The Avenir (376 units), One Pearl Bank (774 units), One Holland Village Residences (551 units), and Forett at Bukit Timah (633 units).

Considering these factors, ERA estimates that sub-sale transactions will range between 1,100 to 1,300 units in 2025, with a projected 7% to 9% growth in median prices. Meanwhile, resale transactions are also expected to reach 14,000 to 15,000, and may register a median price growth of 6% to 8% by the end of 2025.

In closing

Recent interest rate cuts and a more positive economic outlook have breathed new life into Singapore’s residential property market. However, it remains to be seen if this momentum will continue into 2025, given the potential impact of emerging global events.

Despite this uncertainty, 2025 will see the launch of several highly-anticipated projects, including The Orie (Toa Payoh), Elta (Clementi), Parktown Residences (Tampines), as well as two yet-to-be-named projects at Margaret Drive and Lentor Central. These upcoming launches, located within established housing estates, are expected to attract strong demand.

Assuming stable macroeconomic conditions and the absence of unforeseen negative factors, new home price are expected to continue their upward trajectory – potentially achieving 3-5% y-o-y growth in 2025. New home transaction volume is also projected to reach between 7,000 to 8,000 units next year, dependent on a favourable economic outlook.

Finally, ERA estimates that sub-sale transactions will range between 1,100 to 1,300 units, with median prices possibly growing by 7% to 9%. Resale transactions are also expected to reach between 14,000 to 15,000 units, accompanied by a median price growth of 6% to 8% by the close of 2025.

Table 3: ERA forecast of Private Home Market

Source: URA, ERA Research and Market Intelligence

Disclaimer

This information is provided solely on a goodwill basis and does not relieve parties of their responsibility to verify the information from the relevant sources and/or seek appropriate advice from relevant professionals such as valuers, financial advisers, bankers and lawyers. For avoidance of doubt, ERA Realty Network and its salesperson accepts no responsibility for the accuracy, reliability and/or completeness of the information provided. Copyright in this publication is owned by ERA and this publication may not be reproduced or transmitted in any form or by any means, in whole or in part, without prior written approval.

[1] Ministry of Trade and Industry, Economic Survey of Singapore Third Quarter 2024

[2] Ministry of Manpower, Labour Market Third Quarter 2024

[3] Singstat, Percent Change In Consumer Price Index (CPI) Over Corresponding Period Of Previous Year, 2019 As Base Year