Dairy Farm Walk and Tengah Garden Avenue GLS Sites Closing in January 2025: Commentary by ERA

- ERA Singapore

- 4 min read

- PressRelease

- 14 Jan 2025

SINGAPORE, 14 January 2025 – URA has just announced the closing of the tender for two residential land parcels at Dairy Farm Walk and Tengah Garden Avenue today, 14th January 2025.

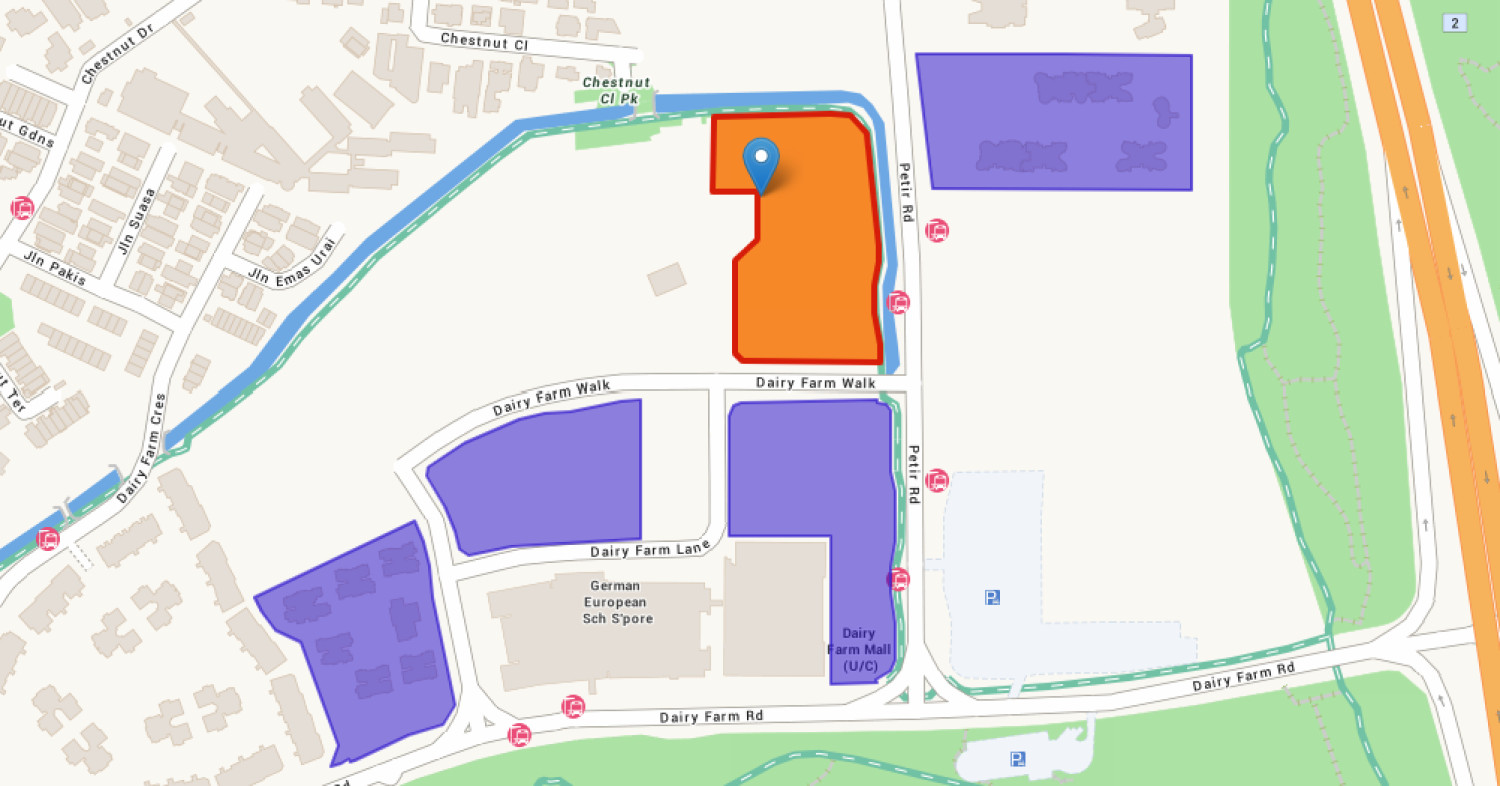

Dairy Farm Walk

The tender for the Government Land Sale (GLS) site at Dairy Farm Walk closed on 14th January 2025. In total, the site drew interest from two bidders, with the top bid of $504.5 million (or $1,020 psf ppr) submitted by a consortium comprising SNC2 Realty, Apex Asia Alpha Investment Two, Soon Li Heng Civil Engineering, and Kay Lim Realty.

The two bids received for the Dairy Farm Walk site highlights the sharp fall in competition as compared to higher interest shown for previous GLS sites in the area. Previous GLS sites at Dairy Farm Walk and Dairy Farm Road received an average of seven bids across three projects, namely The Skywoods, Dairy Farm Residence and The Botany at Dairy Farm. The muted number of bids suggests that developers may now be cautious and concerned that the area’s pent-up demand in Hillview and Dairy Farm might have already been absorbed by the earlier launches.

Nonetheless, bid price for the Dairy Farm Walk site comes 4.1% higher than the last GLS site in the area, now The Botany at Dairy Farm, which was awarded at $347 mil ($980 psf ppr).

However, the wider gap between the two bids where the top bid of is 23.1% higher than the other bidder, reflects the contrasting perspectives of the two developers on the market outlook. This bullish response could come from the developers’ confidence from new home sales performance around Hillview MRT Station. Till date, The Botany at Dairy Farm is 99.8% sold since its launch in March 2023, while Hillhaven has sold 78.0% of units since launching in January 2024. Based on the bid price, we can expect a selling price from $2,250 psf onwards.

Tengah Garden Avenue

The tender for the Government Land Sale (GLS) site at Tengah Garden Avenue closed on 14th January 2025. In total, the site drew interest from three bidders, with the top bid of $675 million (or $821 psf ppr) submitted by a consortium consisting of Intrepid Investments, CSC Land Group and GuocoLand (Singapore). The bids between all three bidders were tight, with difference of just 1% between them.

This GLS site at Tengah Garden Avenue will be the first private condominium launch in Tengah estate – with all four previous projects launched in the areas being Executive Condominiums (ECs).

Guocoland’s expertise lie in township planning of new estates through mixed-developments. Having made the foray into sites at Lentor, Upper Thomson and Bugis, they see this as an opportunity to do the same in Tengah with the first private development there.

The most recent piece of land tendered in Tengah was the Tengah Plantation Close EC (Parcel B) in February 2024. The land went for a rate of $423.4m, or $701 psf ppr. The highest bid for this site at Tengah Garden Avenue is only 17.1% higher than that of the nearby EC site.

Coupled with a relatively tepid three bids for the site, could be a result of the saturated number of OCR GLS sites made available to developers in the past year.

While there have been five EC sites tendered in the Tengah/Bukit Batok area previously, this is the first private condominium development. Therefore, the developers can tap into the first movers’ advantage, especially as the site is near a future MRT station and ACS Primary. The project could be priced attractively and competitively given the tender price, enhancing future demand from upgraders in nearby HDB estates.

This could attract a wider pool of buyers compared to previous EC developments in Tengah, who were limited to those with a monthly household income ceiling of $16,000. Private developments are also less restrictions, such as having no minimum occupation period, and follows the TDSR of 55% of their monthly income. This would help buyers achieve a higher loan quantum for their property purchase.

If the site is awarded at the land rate of $821 psf ppr, we believe the consortium may position this as a more upmarket development, a differentiated product from the ECs, potentially pricing it from the upwards of $2,000 psf. EC buyers may be swayed to this project if the price gap is only 15% to 20%, does not come with restrictions like the $16k income cap and 5-year MOP.

For media enquiries, please contact:

Yue Kai Xin, Press Relations, ERA Singapore

Email: [email protected]

I confirm that I have read theprivacy policy and allow my information to be shared with this agent who may contact me later.